Many individuals face the financial burden of having a limited or nonexistent credit history. Recent statistics from Experian show that 1 out of 10 people has no credit score. Accessing loans and credit with competitive rates without any form of credit record is challenging.

Applying for a credit-builder loan is an effective solution that offers unique benefits to help build healthy credit profiles over time. The concept behind such a type of loan is straightforward. Borrowers establish a positive payment history and begin to build their credit score over time by taking out the loan and paying off the debt within a set timeframe (12 months). Making these payments provides access to better financing options in the future. It instills confidence in managing money effectively, especially as part of larger personal financial goals such as saving for retirement or buying a home.

The following sections explain how credit builder loans work and provide step-by-step instructions on applying for one.

Summary

- Credit-builder loans are secured or non-secured loans designed to help people with limited or poor credit history improve their credit scores over time.

- Secured loans require collateral and offer lower interest rates, while non-secured loans don’t require collateral but have higher interest rates.

- The maximum number of credit-builder loans an individual can take out at a time is usually determined by the lender and depends on several factors.

- Lenders generally look for evidence of stable income, reasonable debt levels, and good financial responsibility. The benefits of credit-builder loans include opportunities to build a credit score, affordable interest rates, access to funds, establishment of long-term financial habits, and low repayment amounts.

- The impact of interest rates on the overall cost of a loan is significant, and credit-builder loans generally have the most affordable interest rates compared to personal loans and credit cards.

Research Your Options

It’s necessary to thoroughly research available options before obtaining a credit-builder loan. The right choice depends on several factors, including the desired loan type, required amount, and repayment terms that fit the borrower’s financial situation. Credit builder loan applicants must evaluate different lenders and associated rates or fees.

Borrowers must take the time to comprehend all available information before proceeding. Take advantage of resources such as online calculators or customer service representatives who can answer questions about credit-builder loans. After gathering enough data, individuals can decide based on their needs and preferences.

Confidently proceed towards obtaining a credit-builder loan by checking the current credit score to guarantee that it meets the lender’s criteria and qualifies for the desired loan amount.

Check the Credit Report

Americans have seen their credit scores fall 5.4 points since January 2020 due to the financial crisis caused by the COVID-19 pandemic. Anyone interested in getting a credit-builder loan should check their credit score before applying. Knowing the credit score helps in making sound financial decisions.

Understanding one’s current finances and situation is beneficial when deciding if a credit-builder loan is right for them. Individuals must review their credit reports from the three major credit bureaus: Experian, Equifax, and TransUnion.

Checking the credit report makes it easier for borrowers to make informed decisions about taking out a loan that works best for them. Many financial solutions are structured based on the borrower’s credit score or financial status. The borrower’s credit score determines the repayment length, interest rate, and monthly payment. Knowing the credit score before applying for a loan help borrowers avoid hidden charges or being stuck in a financial situation they can’t afford. One option to consider is getting a secured credit card, which can help rebuild credit and provide a way to establish a relationship with credit bureaus.

Consider Collateral

Collateral refers to any asset or item with monetary value used as security to repay a loan. Examples of collaterals include various things, such as real estate, automobiles, stocks, bonds, jewelry, art pieces, and electronics. Using a secured credit card might be a useful option to improve your credit score before applying for a loan that requires collateral, as it reports your payment history to the credit bureaus, potentially increasing your credit rating.

Using collateral when applying for a loan makes it easier to obtain the funds needed. Using collateral helps an individual secure more favorable loan terms, such as a lower interest rate or a longer repayment period. Lenders view an individual with collateral as less of a risk, as there is a tangible asset that is free to seize in the event of nonpayment.

Lenders require borrowers to purchase insurance for their collateral. The insurance helps protect borrowers from losses related to nonpayment issues or damages resulting from unforeseen circumstances.

Applying For A Loan

Before applying, knowing the process and being ready with all the necessary information is vital. The application process varies from lender to lender, but generally, borrowers need to provide various documents and information. Online lenders have made it more convenient to apply for various types of loans, including installment loans.

Listed below are the steps on how to apply for a loan.

- The first step is determining the lender best suits the borrower’s needs. The borrower can choose a financial institution or an online platform to apply for a traditional loan.

- The borrower must carefully research the terms and conditions of the lender, focusing on loan payments and other financial aspects, to guarantee that they meet their requirements and budget.

- The next step is for the borrowers to familiarize themselves with the application form and any documents required before submission. Each lender has its criteria and documents that must be provided.

- The borrower must read through everything thoroughly and double-check that all the data entered into the form is accurate to avoid delays or rejection of the loan request.

- Submit the loan application after double-checking all the provided information, including loan payment details.

- The outcome of the loan application depends on factors such as providing adequate evidence of income and assets, along with other requirements from the lender offering the traditional loan.

- Borrowers must spend extra time researching and becoming fully aware of what lies ahead when applying for a credit-builder loan.

Understanding Credit-Builder Loans

Credit-builder loans are designed to help borrowers build credit. These loans provide borrowers with low or no credit history the opportunity to improve their credit score and create more financial opportunities in the future. Borrowers must comprehend the details of these loans before deciding to apply for them, especially when building credit is their main goal.

Here are four key points borrowers must consider when considering a credit-builder loan.

- Borrowers must know how much they can afford to borrow. Lenders usually assess the borrower’s income and expenses to determine the maximum amount they can borrow.

- Interest rates on credit-builder loans are generally higher than other types of personal loans due to their higher risk. Therefore, borrowers must only take them out as short-term solutions.

- Most lenders require collateral, such as a vehicle title or valuable item, which they hold until the loan is fully paid off. The collateral guarantees that the lender possesses something if the borrower fails to make payments. One option for borrowers to consider is a Secured card, which can help them build credit while providing collateral to the lender.

- Some lenders must report payments to all three major bureaus (TransUnion, Equifax, and Experian). However, many lenders do, so it is worth checking before agreeing to the loan terms.

Borrowers can make informed decisions based on their circumstances by understanding credit-builder loans. It is vital to know the difference between secured and non-secured loans and assess them carefully before signing any agreements.

Difference Between Secured And Non-Secured Loans

Two main loan types in credit-building, namely secured and non-secured loans. Secured loans require collateral as a form of assurance that borrowers repay their debt, while non-secured loans do not need collateral.

Borrowers must note the following points to understand these loan categories’ differences better.

- A secured loan is one in which an individual pledges some asset (such as a car or house) as collateral for the loan. The lender can take away this asset if they fail to make timely payments.

- Non-secured loans do not require any security deposit from borrowers; instead, they rely on factors such as your income level and credit score to determine your eligibility for the loan.

- Interest rates tend to be lower with secured loans because lenders have more confidence in receiving repayment since they have something tangible if borrowers fail to pay. However, interest rates for unsecured loans are higher due to the risks involved for lenders without having any assets pledged against them.

- Secured loans take longer to process than unsecured ones due to more paperwork to secure the collateral.

Understanding how each type of loan works helps individuals make informed decisions about building their credit through borrowing money. It is necessary to research thoroughly before committing to find out what best suits their financial needs and goals, including exploring various credit accounts and financial products.

How To Get A Secured Loan To Build Credit

A secured loan is any borrowing in which an asset or collateral serves as security against defaulting on repayment. The lender has legal recourse to seize their assets and recoup their losses if the borrower cannot keep up with payments. Secured loans are beneficial because they give lenders added confidence due to the collateral backing them. Borrowers generally enjoy lower interest rates when compared to unsecured loans, making it easier for those with less-than-perfect credit scores to acquire financing. A secured loan helps individuals improve their credit rating by establishing positive payment history, managing credit accounts responsibly, and providing solid financial management of various financial products.

There are many options available when seeking out a secured loan. Borrowers can choose from banks and credit unions to online lending companies. However, it’s necessary to understand all terms associated with the process before applying, such as interest rates, repayment terms, fees charged by the lender, etc.

Potential borrowers must have adequate collateral, such as real estate or vehicles, to secure the needed debt. Good communication skills are essential in negotiating favorable terms from lenders who require more documentation or proof of income/assets before any application is approved.

How To Get A Non-Secured Loan To Build Credit

Non-secured loans do not require any form of collateral from the borrower. Lenders are taking on a greater risk but potentially offering better terms. The loans come with lower interest rates and fees than other financing arrangements. It often features lenient repayment plans, giving individuals more time to manage their debt without further penalties.

Here’s how to get a non-secured loan.

The application process includes:

Filling Out an Online Form

The first step in the process is filling out an online form. This form usually requires basic information to assess your loan eligibility and understand your financial needs.

Submitting Documentation

After completing the online form, you need to submit the necessary documentation. These documents may include proof of income, identification, and other relevant financial records to support your application.

Speaking with a Loan Officer

Finally, you’ll likely have a discussion with a loan officer. This conversation allows you to ask questions, clarify doubts, and understand the terms and conditions of the loan you are applying for.

- Borrowers must provide documentation such as proof of income, employment verification, and bank statements. Having these documents ready speeds up the application process.

- Review the terms before accepting the loan to understand the interest rate, repayment terms, and any fees charged. Ask the lender for clarification if there are confusing or ambiguous terms.

- Accept the loan to finalize the agreement. The funds are usually transferred to the borrower’s bank account within a few hours or days.

Qualifying Criteria For A Credit-Builder Loan

Lenders generally look for evidence of stable income and reasonable debt levels relative to the borrower’s income. They want to see if their applicants are employed over a certain period. There are four key qualifications to be eligible for a credit-builder loan.

- Having steady employment with an acceptable level of income.

- Having satisfactory debt levels relative to your salary or wages.

- Being able to verify previous employment history.

- Demonstrating good financial responsibility through past behavior, such as building credit from scratch.

Borrowers must show that they adhere to these qualifications in their finances and demonstrate continuing stability regarding both job security and reliable repayment habits. The qualities help build trust between both parties and guarantee that any agreements made are mutually beneficial. Utilizing credit monitoring services can aid in achieving a better financial overview for borrowers and lenders alike.

Maximum Number Of Allowed Credit-Builder Loans At A Time

The lender usually determines the maximum number of credit-builder loans an individual can take out. Credit-builder loan limits vary from one lending institution to another and depend on several factors, such as income, credit score, and repayment history. Some lenders offer more than one type of credit-builder loan with different terms and conditions attached, which can be helpful for those starting with credit from scratch.

The five key points borrowers need to know are listed below when taking out multiple credit-builder loans.

- A borrower’s financial stability and ability to repay determine how much they can borrow. The number of funds required for each loan must be considered.

- The interest rate associated with each loan must be taken into account.

- Different types of credit scores should be understood to know how each loan will affect them.

- Different types of credit-builder loans have different eligibility criteria.

- Lenders impose their restrictions when offering multiple loans.

Benefits Of Credit-Builder Loans

Credit-builder loans are not only helpful for improving credit scores. They provide numerous benefits that give individuals an edge in their financial future. Listed below are some of them:

Opportunity to build a credit score and understand the types of credit scores

The structure of credit-builder loans is designed to make it easy for borrowers to repay their loans on time while also providing an incentive to be responsible with their credit limits. The overall process helps build a positive credit history and improve access to other types of credit.

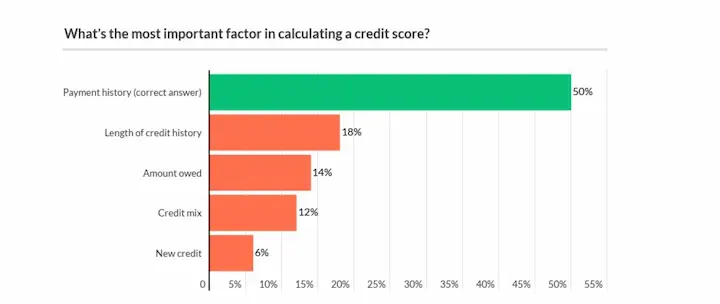

- Affordable interest rates: Credit-builder loans are generally more affordable than other financing types. This can be particularly helpful when compared to the rates offered by some credit card companies. For example, the average interest rate for a credit-builder loan is 9.8%, compared to 12% for personal loans and 17% for credit cards.

- Access to funds: Individuals can access funds when needed by taking out a credit-builder loan. The loans are easy to apply for online or over the phone. Lenders have minimal requirements for borrowers, and most people qualify for a loan. This includes those who struggle with time payments and want to improve their performance.

- Establishment of long-term financial habits: Using a credit-builder loan helps people establish better long-term financial habits, such as making timely payments, which leads to improved access to other forms of financing at lower interest rates in the future. Establishing time payments and managing debt responsibly can also improve relationships with credit card companies.

- Low repayment amounts: Credit-builder loans tend to have relatively low monthly repayment amounts, making them easier for borrowers with little disposable income at any given time. This can be especially beneficial compared to the higher payment demands from some credit card companies, allowing borrowers to maintain their time payments more effectively.

The Impact of Interest Rates on the Overall Cost of the Loan

| Loan Type | Average Interest Rate |

|---|---|

| Credit-Builder Loan | 9.8% |

| Personal Loan | 12% |

| Auto Loans | 4-7% |

| Credit Card | 17% |

The table shows that credit-builder loans have the most affordable interest rates, with an average interest rate of 9.8%. Personal loans have an average interest rate of 12%, and credit cards have the highest average interest rate of 17% in comparison. In the middle of the range, auto loans have an average interest rate between 4-7%.

Interest rates are crucial in determining the overall cost of borrowing money. For instance, assume two persons want to borrow $10,000 for five years. The first borrower takes out a personal loan with an interest rate of 12%. The second one takes out a credit-builder loan with an interest rate of 9.8%. These two loans’ differences can be further explained by comparing their annual percentage rates.

The person who takes out a personal loan has to pay a total of $12,975 throughout the loan, which includes the original $10,000 borrowed with $2,975 in interest. The other individual who takes out a credit-builder loan only needs to pay a total of $11,030, which includes the original $10,000 borrowed and $1,030 in interest.

The difference in the interest rates between the loans results in significant savings for the borrower. The person who chose a credit-builder loan saves $1,945 in interest payments over the person who decided on a personal loan.

It’s vital to note the interest rate when choosing a loan to get the most affordable option. The example demonstrates how a small interest rate difference adds to significant savings over time. Additionally, considering other alternatives like lines of credit can help you make an informed decision.

We are pleased to present a comprehensive table showcasing the reach and availability of our company’s credit-builder loan across the United States. At PaydayChampion, we understand the importance of financial stability and its vital role in achieving one’s goals. Our credit-builder loan program aims to empower individuals to strengthen their credit history, paving the way for a brighter financial future. As we expand our services nationwide, we proudly provide this overview of the American states where our credit-builder loan is actively available. Please refer to the table below for a detailed breakdown of the states where you can access our credit-building services and embark on your journey toward greater financial success.

| Alabama / AL | Alaska / AK | Arizona / AZ | Arkansas / AR |

| California / CA | Colorado / CO | Connecticut / CT | Delaware / DE |

| District Of Columbia / DC | Florida / FL | Georgia / GA | Hawaii / HI |

| Idaho / ID | Illinois / IL | Indiana / IN | Iowa / IA |

| Kansas / KS | Kentucky / KY | Louisiana / LA | Maine / ME |

| Maryland / MD | Massachusetts / MA | Michigan / MI | Minnesota / MN |

| Mississippi / MS | Missouri / MO | Montana / MT | Nebraska / NE |

| Nevada / NV | New Hampshire / NH | New Jersey / NJ | New Mexico / NM |

| New York / NY | North Carolina / NC | North Dakota / ND | Ohio / OH |

| Oklahoma / OK | Oregon / OR | Pennsylvania / PA | Rhode Island / RI |

| South Carolina / SC | South Dakota / SD | Tennessee / TN | Texas / TX |

| Utah / UT | Vermont / VT | Virginia / VA | Washington / WA |

| West Virginia / WV | Wisconsin / WI | Wyoming / WY |

Tips For Improving Your Credit Score

A good credit score is essential for accomplishing financial goals, such as obtaining an affordable loan or renting an apartment. Improving one’s credit score is achieved through careful planning and consistent effort. Here are some tips to help you get started:

- Take the time to understand the current credit report, including any errors made by reporting agencies. Knowing what affects the credit score makes it easier to identify areas of improvement and create a plan accordingly. One important factor is your credit utilization ratio.

- Paying off existing debts on time and in full each month is necessary for improving one’s credit score. Keeping a low credit utilization ratio by paying down debt shows lenders that the borrower can manage money responsibly.

- Stay away from taking out new loans unless necessary. Doing so decreases the debt owed and increases the likelihood of getting approved for future loans, keeping the credit utilization ratio in a favorable range.

These steps provide only a starting point for improving one’s credit score. However, implementing them consistently over several months helps build positive momentum toward reaching higher levels of success with personal finance management, even for those with a bad credit score.

Conclusion

Credit-builder loans are an effective way to improve credit scores and strengthen financial futures, especially for those with a bad credit scores. The benefits of these loans are clear, but some risk is involved. Individuals must understand the pros and cons before deciding whether to pursue such loans.

Careful research and understanding lead to a successful experience with credit-building loans. They offer the potential to make positive changes toward building better credit histories in the future, giving hope to those struggling with a bad credit score.

Frequently Asked Questions

What is a credit-builder loan, and how does it work to improve your credit score?

A credit-builder loan is a loan structured to help build credit history. The lender places loan funds into a savings account as collateral, and borrowers make fixed payments over a set term to “pay off” the loan and build good payment history.

What are the typical eligibility requirements for obtaining a credit-builder loan?

Typical credit-builder loan requirements include steady income, direct deposit capabilities, a checking or savings account in your name, government-issued ID, and a Social Security number. Minimum credit scores may apply.

What are the key benefits of using a credit-builder loan to improve your credit score compared to other methods?

Key benefits are the ability to demonstrate responsible use of credit, establish on-time payment history, improve credit mix by adding an installment loan, and receive the savings account balance after successful repayment.

How do you choose the right financial institution or lender for a credit-builder loan?

Choose an established, reputable institution; compare interest rates and fees; review lending requirements; and evaluate borrower resources like credit monitoring and financial counseling to select the best credit-builder loan option for your needs.

Can you provide some practical tips for successfully managing and paying off a credit-builder loan to maximize its impact on your credit score?

Tips include setting up automatic payments, paying on time each month, keeping loan utilization low, avoiding applying for additional new credit during the term, and monitoring your credit reports regularly to ensure on-time payments are reported.