Need A Loan For Christmas & Black Friday in 2023?

The holiday season is a time for families to come together, celebrate, and enjoy the joys of giving. Holiday loans for bad credit with no credit check in 2023 are becoming increasingly popular as they give individuals access to extra cash that helps make a special time even more enjoyable. The following article discusses the characteristics of Christmas loans, their advantages and disadvantages, and how to find one that meets a borrower’s needs, including bad credit loan approval.

Summary

- Christmas loans are personal loans designed to help borrowers finance holiday expenses, such as gifts, travel, food, decorations, and other festive costs.

- The benefits of getting a Christmas loan include helping to manage expenses, lower interest rates, extended repayment periods, and improving credit scores.

- Christmas loans are available in secured, unsecured, and payday.

- Secured loans require collateral to secure the loan and offer lower interest rates and more favorable repayment terms.

- Unsecured loans do not require collateral but have higher interest rates and strict eligibility criteria.

- Payday loans have high-interest rates and short repayment periods, making them risky for borrowers, but they are accessible to people with bad credit.

What Is A Christmas Loan?

A Christmas loan is a type of personal installment loans used by borrowers to cover expenses related to the holiday season. It is designed to help borrowers finance holiday purchase expenses, such as gifts, travel, food, decorations, and other festive costs. Christmas loans have special terms and conditions, such as lower interest rates or repayment periods that extend beyond the holiday season. But borrowers must note that a Christmas loan is still a form of debt that needs to be repaid, so they only need to borrow what they afford to repay. It’s best to carefully review the terms and conditions of any loan before applying to guarantee that the borrower understands the repayment obligations and any associated fees or charges.

Benefits Of Getting A Christmas Loan

Christmas is a time of giving, joy, and love. It’s a time when people come together to celebrate with their loved ones and exchange gifts as a symbol of affection and appreciation. But only some have the financial means to spend on gifts during the holiday season. Many families and individuals struggle to make ends meet, and the added expenses of Christmas are a significant burden. The holiday season is a source of stress and anxiety instead of joy for certain people. But cash loans for Christmas can help people by providing them with the funds they need to cover their holiday expenses and participate in the holiday traditions without worrying about the financial strain. With different loan options, you can surely find one that fits your needs. Listed below are the benefits of getting Christmas loans.

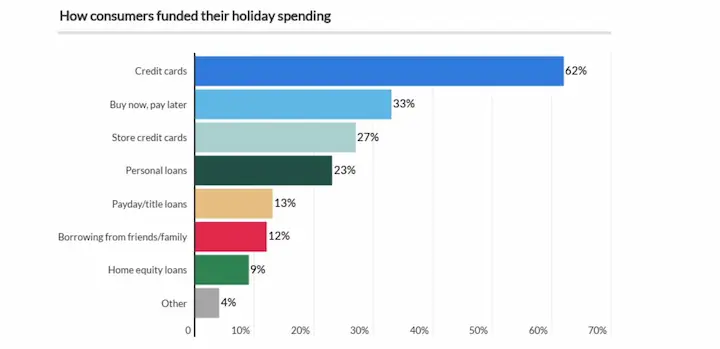

- Helps Manage Expenses – The holiday season is stressful for certain people, especially when managing finances. A Christmas loan helps borrowers manage their holiday expenses by providing the necessary funds. It helps borrowers avoid overspending or relying on credit cards with high-interest rates, which leads to credit card debt accumulation and financial stress. Joining a credit union can further help borrowers manage their finances efficiently.

- Lower Interest Rates – Many lenders, including credit unions, offer lower interest rates on Christmas loans than credit cards, saving borrowers money on interest charges. It is especially beneficial for borrowers who plan to carry a balance on their loan for an extended period.

- Extended Repayment Period – Christmas loans have an extended repayment period that allows borrowers to repay the loan over a more extended period than a personal loan. It helps ease the financial burden during the holiday season and gives borrowers more flexibility in managing their finances. But it’s necessary to note that a longer repayment period increases interest charges.

- Improve Credit Score – Making timely payments on a Christmas loan help improve a borrower’s credit score. Timely payments show lenders that the borrower manages debt responsibly, which increases their creditworthiness. A higher credit score helps borrowers access better loan terms and interest rates in the future, making it easier to borrow money if needed.

Types Of Christmas Loans For Bad Credit

Christmas loans are versatile in that they are used to cover a wide range of holiday expenses. Borrowers can use the loan to purchase gifts for loved ones, travel expenses, decorations, food, and other holiday-related costs. Lenders offer different types of Christmas loans to assure borrowers that they can help them in any situation during the holiday season, even those with poor credit. The versatility benefits borrowers who want to enjoy the holiday season without worrying about financial constraints. Various loan amounts are available to suit individual needs.

Secured Loans

Secured personal loans are a viable option for borrowers with bad credit looking for a Christmas loan. Since they are less risky, lenders offer lower interest rates and more favorable repayment terms than unsecured loans. To secure the loan, the borrower must pledge collateral, such as a car or property. The collateral gives the lender a sense of security, knowing they can recoup their losses if the borrower defaults. But it’s necessary to note that securing the loan with collateral comes with risks. The lender can repossess the collateral to recover losses if the borrower cannot repay the loan. It results in the loss of the borrower’s property or vehicle, which have long-term financial consequences.

One of the best ways to obtain a Christmas loan with bad credit is to go through a loan agreement with one of the many personal loan providers specializing in these types of loans. They often have more flexible eligibility criteria, making their services accessible to borrowers who may struggle to secure loans from traditional lenders. In addition, some personal loan providers operate specifically as a bad credit loan platform, catering to individuals with low credit scores or past financial hiccups.

Unsecured Loans

Unsecured loans are another Christmas loan available to borrowers with bad credit. They do not require collateral to secure the loan, unlike secured loans. Lenders rely on the borrower’s creditworthiness and financial history to determine the loan decision. Unsecured loans are riskier for lenders, charging higher interest rates and fees than secured ones. But unsecured loans are more accessible for borrowers with bad credit who do not have assets to pledge as collateral. Below are the pros and cons of unsecured Christmas loans, which you can look further into on a bad credit loan website.

Pros

- No collateral required –Unsecured loans do not require collateral to secure the loan, which is beneficial for borrowers who do not have assets to pledge.

- Faster approval –Lenders approve unsecured approval loans faster than secured ones since the lender does not need to assess the collateral’s value.

- More flexibility – Borrowers are free to use unsecured installment loans for various purposes, including holiday expenses, without specifying the intended use of the loan. These loans often come with flexible terms that allow borrowers to adapt their repayment schedules to meet their financial needs.

Cons

- Higher interest rates – Lenders deem unsecured loans riskier and charge higher interest rates and fees to offset the risk.

- Strict eligibility criteria – Lenders have strict eligibility criteria for unsecured loans, including a minimum credit score, income requirements, and other factors that disqualify other borrowers.

- Limited borrowing capacity – Lenders limit the amount borrowers can obtain with an unsecured loan.

Payday Loans

Payday loans are Christmas loans accessible to borrowers with bad credit but with significant risks. They are short-term and require repayment within a few weeks or the borrower’s next payday. Payday lenders charge high-interest rates and fees, making them an expensive option for borrowers. Borrowers who cannot repay the loan on time are charged extra fees or interest, which quickly add up and lead to a cycle of debt.

Payday loans are known for their ease of access and convenience, as they often provide credit check loans. They have a simpler application process than traditional loans and less strict requirements, making them more accessible to borrowers with bad credit. The application process for a payday loan involves filling out a short online form or in person, providing proof of income, and providing a post-dated check or access to the borrower’s bank account. Lenders do not require a credit check, which makes the application process faster and allows for credit check loans.

Online Loans

Online loans are a popular option for borrowers with bad credit looking for a Christmas loan. Online lenders specialize in providing loans to borrowers with less-than-perfect credit and offer more flexible repayment terms and competitive interest rates compared to traditional lenders. The primary advantage of online loans is that borrowers are free to apply for a loan from the comfort of their home or office, making the online applications process more convenient and accessible.

One option is to approach an online bank for loans, as they may have tailored loan products for borrowers with bad credit. Online lenders offer faster approval times and funding, essential for borrowers who need cash quickly. But borrowers must know that online loans have risks, such as high-interest rates, fees, and the potential for scams or fraudulent lenders. It is best to research and compare multiple lenders, read reviews and check their reputation, and review the terms and conditions of any loan carefully before applying.

How To Get A Christmas Loan With Bad Credit And No Credit Check In 2023

A bad credit score makes it challenging for borrowers to get approved for loans. Most personal loan lenders use credit scores to evaluate the creditworthiness of borrowers and determine if they are eligible for a loan. These scores are typically reported by the major credit bureaus. Lenders view borrowers with low credit scores as high-risk borrowers and are less likely to approve their loan applications. But there are ways to get a Christmas loan with bad credit, even when dealing with the major credit bureaus. Listed below are the steps on how to get bad credit Christmas loans.

- Check the credit score. The borrower must check their credit score to evaluate their creditworthiness. Free credit reports are obtained from major credit reporting agencies such as Equifax, Experian, or TransUnion.

- Research direct lenders. It is necessary to look for lenders that specialize in providing loans to borrowers with bad credit. Several online lenders offer bad credit loans, so the borrower must research and compare direct lenders to find the best rates and terms.

- Gather necessary documents for loan requests. The borrower must prepare to provide documentation such as pay stubs, bank statements, and proof of identity when applying for a loan. Other lenders require proof of residence or employment.

- Submit loan request. Borrowers must complete the loan application and submit any necessary documentation after choosing their lender. It’s best to read the terms and conditions carefully, including the interest rate and repayment terms.

Below are some statistics about Christmas loans:

| Statistic | Value |

|---|---|

| Average loan amount | $500 |

| Average APR | 391% |

| Average repayment period | 14 days |

| Percentage of Christmas loan borrowers who roll over their loans | Approximately 70% |

| Percentage of Christmas loan borrowers who default on their loans | Approximately 10% |

Required Documents Needed When Applying

Borrowers must provide certain documents to the lender to verify their identity, income, and creditworthiness when applying for a Christmas loan. The specific requirements vary depending on the lender. Listed below are the common requirements for a Christmas loan, which often include proof of direct deposits.

- Government-issued photo ID – Lenders accept a driver’s license, passport, or state ID to confirm the borrower’s identity.

- Proof of income – Borrowers must submit proof of income, such as pay stubs, W-2 forms, or bank statements, to demonstrate their ability to repay the loan.

- Credit report – Lenders request a credit report from one or more credit bureaus to assess the borrower’s creditworthiness.

- Employment verification – Lenders require employment verification to confirm the borrower’s job status and income.

- Bank statements – Borrowers must provide statements demonstrating their financial stability and repayment ability.

- References – Certain lenders ask for personal or professional references to verify the borrower’s character and reputation.

Borrowers should have the documents ready before applying for a Christmas loan to speed up the process and increase their chances of approval. By seeking quick funding options and partnering with a network of lenders, you have a better chance to negotiate favorable loan conditions.

Factors To Consider When Choosing A Financial Institution

Choosing the right lender for a bad credit Christmas loan is necessary for borrowers. The right lender offers borrowers competitive interest rates, flexible repayment terms, and transparent fees and charges. Working with a reputable lender allows borrowers to ensure they are getting a fair deal and are not subject to any hidden costs or fraudulent activity. Choosing the right lender helps borrowers improve their credit scores by making payments on time and demonstrating their ability to manage debt responsibly, avoiding any additional hidden costs.

- Eligibility Requirements – Borrowers must check each lender’s eligibility requirements to ensure they qualify for the loan before applying. Each lender has different criteria, such as minimum credit score or income level, so borrowers must verify that they meet the requirements before applying. Loan forms play a crucial role in this process, providing insight into the lender’s requirements.

- Customer Service – It’s necessary for borrowers to look for a lender with good customer service so they get assistance when they need it. Access to helpful and responsive customer service representatives makes borrowing smoother, especially when needing help filling out loan forms.

- Transparency – Borrowers must check if the lender is transparent about all fees, charges, and loan terms. It includes the interest rate and any origination fees, prepayment penalties, or other charges associated with the loan. A clear understanding of all costs helps borrowers make informed decisions and avoid surprises in the long run. Lenders should include this information on their loan forms to maintain transparency.

- Flexibility – Borrowers benefit from choosing a lender that offers flexibility with repayment terms and allows them to make early repayments without penalties. It gives borrowers more control over their loans and helps them save money by paying off the loan earlier than the agreed-upon term. Make sure to check the loan forms for flexibility options.

- Security – Borrowers must ensure the lender has proper security measures to protect their personal and financial information. Borrowers must verify that the lender uses encryption technology to safeguard their data and has established policies and procedures to prevent fraud or identity theft, especially when handling sensitive information on loan forms.

At PaydayChampion, we take pride in providing financial solutions that make the holiday season a little brighter for individuals facing credit challenges. With our commitment to inclusivity and accessibility, we have expanded our operations to several states across the United States. Our mission is to offer Christmas loans for bad credit with no credit check, ensuring everyone can celebrate the festive season without worrying about their financial past. We are excited to share the states where our services are available, enabling more people to enjoy the joy and magic of Christmas. Please refer to the table below to find out if your state is among those where we are active and discover how we can assist you in making this holiday season a truly special one.

| AL (Alabama) | AK (Alaska) | AZ (Arizona) |

| AR (Arkansas) | CA (California) | CO (Colorado) |

| CT (Connecticut) | DE (Delaware) | DC (District Of Columbia) |

| FL (Florida) | GA (Georgia) | HI (Hawaii) |

| ID (Idaho) | IL (Illinois) | IN (Indiana) |

| IA (Iowa) | KS (Kansas) | KY (Kentucky) |

| LA (Louisiana) | ME (Maine) | MD (Maryland) |

| MA (Massachusetts) | MI (Michigan) | MN (Minnesota) |

| MS (Mississippi) | MO (Missouri) | MT (Montana) |

| NE (Nebraska) | NV (Nevada) | NH (New Hampshire) |

| NJ (New Jersey) | NM (New Mexico) | NY (New York) |

| NC (North Carolina) | ND (North Dakota) | OH (Ohio) |

| OK (Oklahoma) | OR (Oregon) | PA (Pennsylvania) |

| RI (Rhode Island) | SC (South Carolina) | SD (South Dakota) |

| TN (Tennessee) | TX (Texas) | UT (Utah) |

| VT (Vermont) | VA (Virginia) | WA (Washington) |

| WV (West Virginia) | WI (Wisconsin) | WY (Wyoming) |

Interest Rates, Payment Schedules, And Late Fees

Interest rates, payment schedules, and late fees vary depending on the type of loan chosen by borrowers for their Christmas loans. For example, payday loans, designed for short-term borrowing needs, have higher interest rates than other types of loans, such as instant loans. The interest rates for payday loans range from 300% to 500% APR, according to incharge.org. Payday loan payment schedules usually require a lump-sum payment on the borrower’s next payday. In contrast, instant loans may offer more flexible repayment options. But certain lenders offer extended payment plans that allow borrowers to make smaller payments over a more extended period. But it comes with extra fees and interest charges.

Late fees for payday and instant loans are steep and quickly add up if the borrower misses a payment or fails to pay the loan on time. Lenders charge fees for bounced checks or insufficient funds in the borrower’s account, further exacerbating the borrower’s financial situation.

| Loan Type | Interest Rates (APR) | Payment Schedule | Late Fees |

|---|---|---|---|

| Payday Loans | 300% – 500% | Lump-sum payment on next payday or extended payment plan with extra fees | Steep fees for missed payments, bounced checks, or insufficient funds |

| Personal Loans | 6% – 36% | Monthly installments over several years | Vary depending on the lender |

| Secured Loans | 3% – 6% | Monthly installments over several years | May result in loss of collateral |

| Credit Cards | 15% – 25% | Monthly minimum payment or full payment to avoid interest | Vary depending on the lender |

Secured loans, such as home equity or auto loans, have even lower interest rates than personal loans, ranging from 3% to 6%. But borrowers risk losing their collateral if they fail to pay the loan on time. Credit card companies often provide credit cards with similar interest rates to credit personal loans, ranging from 15% to 25%, and require monthly minimum payments. Late fees and added interest charges apply if the borrower fails to make at least the minimum payment. Additionally, having an active loan could also impact your credit score.

Conclusion

Christmas loans for bad credit with no credit check in 2023 help individuals and families cover expenses related to the holiday season, such as gifts, travel, food, decorations, and other festive costs. Christmas loans have special terms and conditions, such as lower interest rates or extended repayment periods. But borrowers must only borrow what they can repay and carefully review the terms and conditions of any loan before applying.

The benefits of getting a Christmas loan include helping manage expenses, lower interest rates, extended repayment periods, and the potential to improve credit scores. Lenders offer different types of Christmas loans, including secured, unsecured, and payday loans. Some of these loans may even include an introductory period with special terms. It is best to weigh the pros and cons of each type of loan and choose one that meets the borrower’s needs and financial situation.

Frequently Asked Questions

Can I get a Christmas loan with bad credit and no credit check in 2023?

Yes, some lenders offer Christmas loans to borrowers with bad credit and without a credit check in 2023, but interest rates are typically very high.

What are the requirements for obtaining a Christmas loan for bad credit this year without a credit check?

Basic requirements are being 18+, having regular income, and a valid bank account. Proof of income may be required. Credit score is generally not checked. Loan amounts and terms vary by lender.

Where can I find reputable lenders offering Christmas loans for people with bad credit and no credit check in 2023?

Look for Community Development Financial Institutions (CDFIs) or review lenders on trusted industry websites. Avoid offers that seem too good to be true or guarantee approval.

Are there any tips or strategies to improve my chances of approval for a Christmas loan despite having bad credit?

Apply with a lender you have an existing relationship with, provide proof of steady income, minimize loan request, opt for shorter terms, use collateral if possible, and avoid applying multiple places.

What interest rates and repayment terms can I expect when applying for a Christmas loan with no credit check and poor credit in 2023?

Expect interest rates from 200-500% APR. Repayment terms are often 3-12 months. Be prepared for very high costs.