The cost of a college education is daunting and overwhelming. As the burden of tuition fees continues to increase, students need to explore all their options when looking for student loans. Unsubsidized student loans like Direct Unsubsidized Loans are one option that helps lighten the financial load and pave the way toward achieving a degree. Students have an opportunity to find comfort in knowing they do not need to bear the brunt of educational expenses alone by understanding how these loans work. Additionally, students should be aware of their financial aid package and how it can assist in covering the costs associated with higher education.

Direct Unsubsidized Loans provide a stable platform for eligible students to build their future dreams. The loans offer relief from rising costs associated with higher learning institutions and equip borrowers with the necessary financial and academic planning tools. The availability of the loan program allows eligible students without access to other forms of credit or financial assistance, including those who lack parental support or income, an equal chance at pursuing post-secondary studies. It is necessary to understand how they differ from other types of loans available and what criteria must be met before being eligible to apply for those looking into taking out Direct Unsubsidized Loans.

Key Takeaways

- Direct Unsubsidized Loans are federal student loans that do not require the borrower to demonstrate financial need.

- These loans are available to undergraduate and graduate students with access to other credit or financial assistance.

- Interest on these loans accrues from loan disbursement until repayment begins, meaning borrowers owe additional money when all payments have been made due to accumulated interest.

- Direct Unsubsidized Loans are administered directly by the U.S. Department of Education and have lower interest rates than private student loans.

- Direct Unsubsidized Loans do not offer benefits such as the U.S. Department of Education paying the interest on the loan. At the same time, the borrower is enrolled in school, as they are based solely on the borrower’s creditworthiness and require that interest payments begin immediately upon loan disbursement.

What Is A Direct Unsubsidized Loan?

The U.S. Department of Education offers a direct unsubsidized loan as part of the William D Ford Federal Direct Loan Program. Interest accrues from the time of disbursement until repayment begins – meaning borrowers owe additional money when all payments have been made due to accumulated interest over time. Direct unsubsidized loans are available to undergraduate and graduate students who demonstrate financial need; however, unlike undergraduate loans like subsidized loans, applicants are not required to prove such neediness to qualify.

Understanding what a direct unsubsidized loan entails is necessary before applying for one. The direct unsubsidized loan does not require evidence of financial need like other undergraduate loans and federal student aid programs; awareness of how these loans accumulate interest must inform any decisions about borrowing funds.

How do Direct Unsubsidized Loans Work?

Direct Unsubsidized Loans are federal student loans that do not require the borrower to demonstrate financial need. The direct unsubsidized loans are administered directly by the U.S. Department of Education and have lower interest rates than private student loans. The government pays the accumulated interest on behalf of borrowers during periods of deferment or forbearance with Unsubsidized Loans. The borrower is then responsible for repaying the principal and any accrued interest upon completing their studies.

Examples Of Subsidized And Unsubsidized Loans

Subsidized and unsubsidized loans are the two main federal student loans available to undergraduate students. A subsidized loan is a type with an interest rate set by Congress. The U.S. Department of Education pays the interest on these loans.

Borrowers are enrolled in school at least half-time and for six-month grace period after leaving or dropping below half-time enrollment during their undergraduate study. This means payments are made after graduation, which benefits students with little disposable income during college. An unsubsidized loan does not offer the benefit as it’s based solely on the borrower’s creditworthiness and requires that interest payments begin immediately upon disbursement.

Unsubsidized Loans

Listed below are examples of subsidized loans.

- 1Federal Student Loans (Subsidized Student Loan): One example of subsidized student loans is federal student loans, funded through the U.S. Department of Education. The loans are especially for students attending or planning to attend college and need assistance paying tuition and other related costs such as books, housing, etc. The federal government pays part of the interest on these loans while the student attends school.

- Small Business Administration Loan Programs: The Small Business Administration offers various loan programs to be used by companies to help them start their business or expand their existing operations. Eligible small businesses can receive favorable loan terms with a federally-funded guaranty on loan repayment if borrowers meet certain requirements set by the SBA and it’s participating lenders.

- State-Sponsored Subsidized Loans (Subsidized Student Loan): Some states offer subsidized student loans to help low-income individuals purchase homes that otherwise have access to conventional mortgage products due to a lack of funds or credit history issues. States have specific lending criteria that must be met to qualify for these special mortgage programs and other requirements such as homeownership counseling and sweat equity payment from buyers towards closing costs of home purchase in place before the lending institution gives final approval.

- Housing Assistance Program (HAP): HAP provides subsidization for those wanting to purchase a house but cannot afford a mortgage with standard rates available on the market due to low income or credit issues and offers deferred payment plans geared towards assisting individual households contain an overall affordability range based upon established HUD guidelines that offer lower initial down payments for first-time buyers or those seeking a new residence in particular areas.

Unsubsidized Loans

Below are examples of unsubsidized loans, including details on the loan balance and how it may affect the overall loan balance during the repayment period.

- Private loans: Private lenders such as banks and other financial institutions offer private loans, which are often more expensive than subsidized ones due to a lack of assurance from public entities.

- Student loans: Most student loan types are unsubsidized, meaning they come with higher interest rates and less repayment flexibility than a subsidized loan. There are issued through private companies and government-sponsored organizations such as Sallie Mae, Great Lakes, and Wells Fargo.

- Credit card debt is an unsubsidized loan since it needs more assurance from the government or any other entity. Interest rates on credit cards tend to be very high, so it’s incredibly necessary to pay off your balance in full every month and avoid going into debt for unnecessary purchases.

- Small business loans: Loans associated with starting or developing a small business are supplied by private lenders rather than government sources; therefore, they are not classified as subsidized loans. Given their relatively high-interest rates, shopping around for the best terms is advisable before signing up for a small business loan.

- Auto Loans: Most car loans tend to be unsubsidized due to the lack of an insured asset in the form of collateral the borrower offers (the car owner). However, auto manufacturers have financing partnerships with banks offering discounted prices on cars with certain features.

Benefits Of an Unsubsidized Direct Loan

A direct unsubsidized loan has several benefits, including financial flexibility, reduced interest rates, and favorable repayment terms. It allows students to be financially independent without relying on grants or scholarships.

Listed below are the benefits of a direct unsubsidized loan.

- Lower Interest Rate: One of the primary benefits of a direct unsubsidized loan is the lower interest rate compared to other financing options, such as credit cards and private loans. The government sets the interest rate on these loans, so borrowers know they’re getting a fair deal when they take out one of these types of loans. This also means that the current interest rates on direct unsubsidized loans are generally more favorable for borrowers.

- Fixed Rates: Another benefit of direct unsubsidized loans is that the rates are fixed, meaning you won’t have to worry about your payments increasing if market conditions change. So, even if current interest rates in the market increase, your loan rate stays the same.

- Deferred Payment Options: You defer payment until you graduate or become employed full-time. This lets you focus on school work or job training without worrying about making loan payments immediately. During the deferment period, no payments are required, providing you with some financial flexibility.

- Flexible Repayment Plans: A direct unsubsidized loan offers flexible repayment plans for borrowers that don’t require a down payment or collateral as security for the loan, making it easier to qualify for than other financing types them more attractive for borrowers.

- Longer Repayment Periods: Direct unsubsidized loans come with longer repayment periods than many other financing options, allowing borrowers more time to pay off their debt without incurring too much interest due to high monthly payments. The extended time frame takes into account the deferment period before repayment begins.

- No Credit Check: One unique advantage of most direct unsubsidized loans is that no credit check is needed to qualify for a direct unsubsidized type of loan because they are based on something other than your credit score or history, like other loan products.

Drawbacks Of an Unsubsidized Direct Loan

A direct unsubsidized loan is a type of financial aid that students can use to fund their education. Direct unsubsidized loan offers significant benefits, but drawbacks are associated with them. Students must consult their college or university’s financial aid office before deciding on this type of loan.

Listed below are the drawbacks of a direct unsubsidized loan.

- Interest Rate: Interest makes it difficult to pay off the loan quickly, as extra money increases interest rates with each payment.

- Origination Fee: The origination fee must be paid before you receive your disbursement. This means that not all the borrowed amount is toward tuition, but others are toward administrative costs.

- No Deferment/Forbearance Option: There is no option for a temporary moratorium or forbearance period in which you get a temporary break from payments in case of any financial struggles or difficulties with an unsubsidized loan.

- Negative Credit Score Impact: Missing or getting behind on payments negatively impacts your credit score and delays any financial goals you have set firmly into motion, such as purchasing a car or house, among other things.

- No Flexibility in Payment Plans: Unsubsidized direct loans have set payment plan options with limited flexibility and no outside options. It includes extending specific due dates when money is unavailable during tough times or allowing variable monthly amounts depending on income fluctuations, as seen with other loan programs like IBR (Income-Based Repayment).

What are the Eligibility Requirements For Direct Unsubsidized Loans?

Achieving eligibility for a direct unsubsidized loan provides the financial support to fund one’s education, especially in the face of student loan debt. But what exactly are the requirements?

Listed below are the eligibility requirements for direct unsubsidized loans, which can help manage your student loan debt.

- Citizenship: You must be a U.S. citizen or an eligible non-citizen with a valid Social Security Number (SSN) to qualify for direct unsubsidized loans.

- Financial Need: You are not required to demonstrate financial need to receive the loan.

- Credit History: You must have a satisfactory credit history to qualify for the loan, including having no delinquencies on past debt, especially that which result in default or bankruptcy.

- Academic Progress: You must maintain satisfactory academic progress in your degree program to be approved for direct unsubsidized loans.

- Education Requirements: You must be enrolled at least half-time in a degree or certificate program at an accredited college or university to receive the loan. You must possess a high school diploma or its equivalent if applying for a consolidation loan to receive it. Make sure to maintain your academic progress throughout your enrollment.

- Defaulted Loans: You must make satisfactory arrangements to repay them before being eligible for direct unsubsidized loans; otherwise, your application is only allowed once those obligations are fully met and cleared from your credit report.

Application Process For Unsubsidized Direct Loans

Applying for a direct unsubsidized loan is intimidating and complicated. However, with the proper guidance, it is manageable. Several steps must be followed to begin the application process.

- First, gather your financial information, including income statements and tax returns, to provide accurate details about yourself.

- Second, fill out the Free Application for Federal Student Aid (FAFSA) form accurately and completely, as many lenders require it before giving you a loan.

- Third, contact potential lenders or schools that offer these loans to compare rates and terms from multiple sources.

Prospective borrowers must review their credit scores and credit report to know the accuracy and up-to-date information before formally applying for a loan once these tasks have been completed. Take steps to improve one’s credit rating before submitting applications. Research repayment options carefully since different loans have different payment structures, such as variable rate options. Submit all requested documents and the original loan request to complete the application process, considering both fixed and variable rate loans. Taking these steps seriously helps applicants obtain favorable terms when taking out a direct unsubsidized loan.

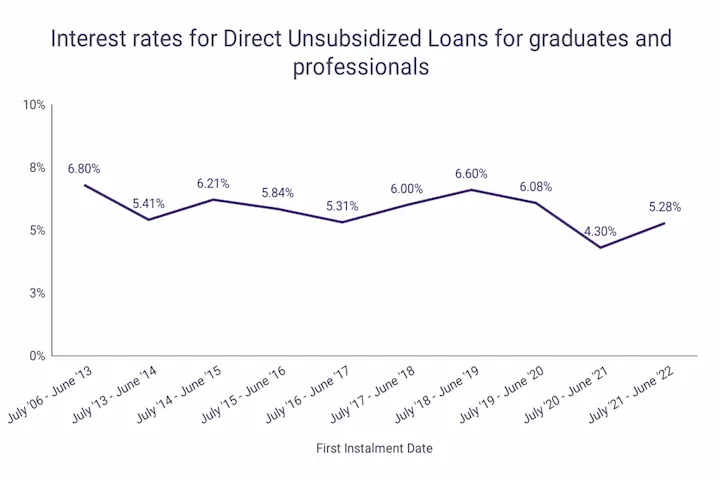

What are the Maximum Interest Rates For Subsidized Direct Loans, Direct Unsubsidized Loans, and Direct Plus Loans?

According to fsapartners.ed.gov, the calculated interest rate for each loan type is at the maximum rate specified in the HEA. The maximum interest rates are 8.25% for Direct Subsidized Loans and Direct Unsubsidized Loans made to undergraduate students and 9.50% for Direct Unsubsidized Loans made to graduate, and 10.50% for Direct PLUS Loans made to parents of dependent undergraduate students or to graduate or professional students.

| Loan Type | Maximum Interest Rate |

| Direct Subsidized Loan | 8.25% |

| Direct Unsubsidized Loan – Undergraduate | 8.25% |

| Direct Unsubsidized Loan – Graduate | 9.50% |

| Direct PLUS Loan – Parents of Dependent Undergraduate Students | 10.50% |

| Direct PLUS Loan – Graduate or Professional Students | 10.50% |

The table displays the maximum interest rates allowed for different types of loans as specified in the Higher Education Act (HEA). The HEA sets a maximum interest rate for each loan type, which lenders cannot exceed.

Conclusion

Direct Unsubsidized Loans are federal student loans that do not require the borrower to demonstrate financial need. Borrowers are responsible for repaying the principal and any accrued interest upon completion of their studies for both dependent students and non-dependent students. Interest accrues from the time of disbursement until repayment begins.

Direct Unsubsidized Loans offer much-needed relief from rising costs associated with higher learning institutions and equip borrowers with the necessary financial and academic planning tools. The availability of direct unsubsidized loan programs allows independent students who have access to other forms of credit or financial assistance, including those who lack parental support or income, an equal chance at pursuing post-secondary studies.

Frequently Asked Questions

What is a Direct Unsubsidized Loan, and how does it differ from other types of student loans?

A Direct Unsubsidized Loan is a federal student loan that accrues interest while the student is in school. Unlike subsidized loans, the government does not pay the interest on unsubsidized loans during school. Students can opt to make interest payments or allow interest to capitalize. Direct Unsubsidized Loans have higher loan limits than subsidized loans.

What are the advantages (pros) of taking out a Direct Unsubsidized Loan for education?

Advantages of Direct Unsubsidized Loans include higher loan limits, eligibility for students regardless of financial need, and flexibility in allowing interest to accrue during school or making interest payments. They provide an option for students who do not qualify for need-based aid to still receive federal student loans.

What are the disadvantages (cons) of opting for a Direct Unsubsidized Loan for financing education?

Disadvantages include accruing interest charges while enrolled, potentially higher long-term costs if interest is capitalized, variable interest rates, and losing eligibility for interest subsidies that subsidized loans provide. Students must be diligent about repayment to avoid negative consequences.

How can I apply for a Direct Unsubsidized Loan, and what are the eligibility criteria I need to meet?

To apply, complete the FAFSA form and accept the loan amount offered by your school’s financial aid office. Eligibility criteria include: enrolled at least half-time in an eligible program, not in default on previous federal loans, completed a FAFSA, and maintaining satisfactory academic progress.

What are the key differences between a Direct Subsidized Loan and a Direct Unsubsidized Loan, and how do these differences affect the borrowing experience?

The key differences are that the government pays interest on subsidized loans while enrolled but not on unsubsidized loans. This means unsubsidized loans accrue interest during school, increasing costs. Eligibility for subsidized loans is based on financial need while unsubsidized loans are available to all.