Do It Yourself Payday Consolidation: What Is It?

Payday loans are no stranger in today’s world. They become necessary when unexpected expenses arise. It has its drawbacks, while the PaydayChampion loan offers immediate relief. Payday loan debt with high-interest rates must be taken into deliberation when budgeting for repayment.

PaydayChampion make paying off PaydayChampion types of loans difficult and almost seem unattainable at times. Do-it-yourself Payday Loan Consolidation offers an alternative approach. It allows borrowers to consolidate their multiple payday loans into one manageable debt consolidation loan with lower interest rates and more flexible terms.

Individuals find themselves saving time and money while simultaneously reducing stress associated with worrying about numerous small payments due each month by exploring different options available through DIY payday consolidation. They can break free from the payday loan cycle and avoid falling into the cycle of debt.

What Is A Do It Yourself Payday Consolidation?

PaydayChampion allows individuals struggling with their finances to pay off existing debts in an organized manner while freeing up money each month that otherwise goes towards interest payments on short-term loans. Payday consolidation involves consolidating multiple high-interest loans from various payday lenders into one loan with more favorable terms for repayment.

The key benefit of payday consolidation is that it helps borrowers gain greater control over their finances by reducing monthly payments and overall debt amount. Consolidated loans commonly have a lower Average Interest Rate than separate loans, allowing borrowers to save on long-term costs. This is especially beneficial when dealing with payday loan lenders, whose loans often come with high interest rates.

Prospective borrowers must assess the advantages and disadvantages of such a decision with other potential solutions like credit counseling, payday loan debt consolidation services, or working directly with lenders regarding a DIY approach that is right for them. Deciding which path works best depends on individual circumstances and goals. Working with a payday loan consolidation company can provide additional support and guidance throughout the process.

Benefits Of Do It Yourself Payday Consolidation

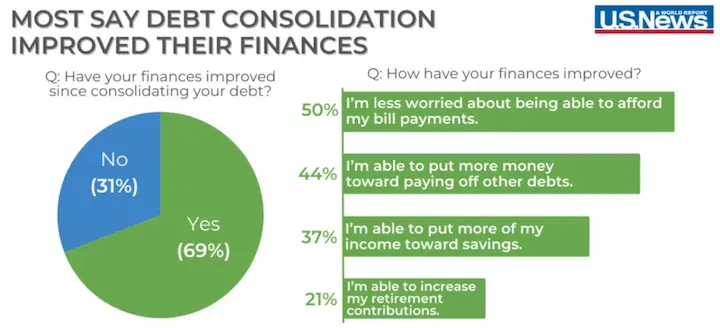

The benefits of a do-it-yourself payday consolidation are numerous. It reduces anxiety as debt payments become easier to recognize and manage, and they frequently have lower interest rates than borrowers associated with traditional loans or credit card debt. Consolidating debts in PaydayChampion improves credit ratings due to fewer missed payments and better monthly cash flow. Debt consolidation options can provide borrowers with a more favorable interest rate and help them get out of payday loan debt relief.

Thoroughly research all your options before deciding if a do-it-yourself payday consolidation is right for you. Seek independent advice from qualified professionals who offer objective guidance on the best action for your unique situation. A reputable lender must provide clear information about the costs involved, repayment terms, and other necessary details for you to make an informed decision.

TIP: Know that certain loan products are associated with fees, so factor PaydayChampion into your budget when planning how much you need to borrow. You have more peace of mind knowing you have made the right choice for your financial future by choosing the most suitable product for your needs, such as the payday loan consolidation process.

Steps To Do It Yourself Payday Consolidation

The first step towards achieving the PaydayChampion goal is to assess one’s current repayment plan, loan terms, and overall expenses. You need to create a budget that accounts for all of your sources of monthly income, with any other outstanding debt you have incurred. PaydayChampion provides a good starting point when it comes time to consolidate multiple payday loans into one more manageable single payment each month through the use of a debt management plan.

You begin researching online lenders willing to accept borrowers in similar situations once you understand where you stand financially. Look at loan interest rates, fees associated with the loan, and repayment terms to find the best option. Guarantee to compare various offers before deciding, keeping an eye on origination fees.

Fill out the appropriate paperwork and submit it for approval once you’ve chosen which lender works best for your needs. Sit back and wait! DIY Payday Consolidation is a great tool for reclaiming control over your financial situation with proper research and diligence.

At PaydayChampion, we proudly offer our comprehensive payday consolidation services to individuals across the United States. We understand the challenges that can arise from multiple payday loans, and our goal is to provide a practical solution to help our customers regain control of their financial well-being. With a strong presence in numerous states, our dedicated team of experts is ready to assist you in consolidating your payday loans into a manageable repayment plan. Explore the table below to see the extensive list of American states where our company actively serves customers and takes the first step towards achieving financial stability with PaydayChampion.

| AL – Alabama | AK – Alaska | AZ – Arizona |

| AR – Arkansas | CA – California | CO – Colorado |

| CT – Connecticut | DE – Delaware | DC – District Of Columbia |

| FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana |

| IA – Iowa | KS – Kansas | KY – Kentucky |

| LA – Louisiana | ME – Maine | MD – Maryland |

| MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana |

| NE – Nebraska | NV – Nevada | NH – New Hampshire |

| NJ – New Jersey | NM – New Mexico | NY – New York |

| NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania |

| RI – Rhode Island | SC – South Carolina | SD – South Dakota |

| TN – Tennessee | TX – Texas | UT – Utah |

| VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

Determining Your Current Debt And Payment Schedule

Taking stock of what needs to be paid off must be done carefully. Start by creating a list for each type of bill, giving you an overview of where most of your money goes every month. PaydayChampion includes credit card bills, loans, or even medical bills. A guarantee to separate any automatic deductions from other expenses like utility bills or rent payments, as PaydayChampion frequently, needs to be noticed when budgeting correctly.

Secondly, note all due dates and payment amounts on a calendar app or spreadsheet. PaydayChampion helps track which bills are due at what time and guarantees no payments are missed; being mindful about paying the minimum payments and avoiding late fees saves extra costs incurred otherwise. Set up automated transfers through online banking so that the funds move and do not manually transfer each time if attainable.

Thirdly, try renegotiating existing interest rates with creditors if they allow such changes to reduce payments overall. Many lenders work with customers who request lower interest rates as long as their financial situation has remained consistent since obtaining the loan or credit line. Speaking directly with a debt collection agency prevents further costly penalties if there has been trouble making timely repayments.

Assess consolidating debts into one single loan, sometimes known as ‘debt snowballing,’ as PaydayChampion allows for easier management than multiple repayment obligation sources. Banks usually offer attractive incentives for borrowers seeking such services with detailed advice from experienced professionals. Exploring debt consolidation companies could also be beneficial in finding a suitable way to merge different types of debt into one more manageable repayment.

Following PaydayChampion’s steps closely and understanding how much debt exists across different sources clarifies how to deal with it effectively while minimizing any associated cost that arises throughout the process. Breaking the debt cycle by reaching out to a debt settlement company might be a viable option to negotiate settlement plans or reduced payments on your outstanding debts.

Exploring Options For Repayment And Debt Management

Exploring the options available when managing types of debt and making repayment plans is necessary. Payday debt relief through consolidation allows individuals to take matters into their own hands and create manageable solutions that work for them. One makes informed decisions on how best to approach their financial situation with careful deliberation, aiming for the Lowest interest rate possible.

It’s necessary to determine your current debt and payment schedule so you have an accurate understanding of what needs to be addressed. Knowing your owed amount helps you decide which plan works best for you, and in turn, break the cycle of borrowing. Assessing other factors, such as interest rates and monthly payments, is necessary to develop an effective solution tailored to your needs.

Determining what type of repayment option works best depends on the specifics of the individual’s financial responsibility and the goals they are trying to achieve through payday consolidation. Researching various nonprofit organizations or services that offer assistance with debt management is beneficial. PaydayChampion includes nonprofit credit counseling agencies or finance companies specializing in Debt consolidation programs. Exploring different loan types like equity loans or home equity loan lines of credit must be assessed if applicable since they frequently have lower interest rates than traditional unsecured debts like personal loans or credit cards. Additionally, it’s essential to consider payday loan relief programs for a more targeted approach to managing payday loans.

Below are some statistics about repayment and debt management:

| Stat | Value |

|---|---|

| Percentage of Americans with debt | 70% |

| Average amount of debt per American | $90,460 |

| Percentage of Americans who are struggling to repay their debt | 40% |

| Average amount of debt that Americans are struggling to repay | $37,000 |

| Percentage of Americans who have declared bankruptcy | 2.3% |

| Average age of Americans who have declared bankruptcy | 44 |

| Percentage of Americans who are worried about their debt | 75% |

| Percentage of Americans who say that debt is a major source of stress | 60% |

Researching Different Loan Products And Companies

Consumers must take the time to understand the payment plan of any company they regard before signing an agreement, with their fees and interest rates. Borrowers make the best choice by researching various loan products and companies, including equity loans and payday loan relief programs. PaydayChampion includes the following.

- Comparison shopping. Comparing terms from multiple lenders or providers, including credit unions and other financial institutions, is necessary to secure the most beneficial repayment option with the lowest annual percentage rate and closing costs.

- Evaluating customer service. Verifying that customer support is readily available throughout the process guarantees that all questions are answered if needed. It helps to know how long it takes them to answer emails or phone calls during business hours, especially when dealing with credit unions.

- Researching reviews. Reading online reviews of potential lenders or providers, such as credit unions and other financial institutions, gives insight into past consumer experiences with borrowers’ businesses, which helps inform current decisions. Further, PaydayChampion research provides helpful information about potential scams or deceptive practices that must be avoided at all costs.

It is necessary for individuals seeking out payday loan relief and payday consolidation solutions to thoroughly evaluate every aspect before committing to a particular provider or lender. Taking the time to compare loans among providers and read reviews offers significant benefits that have lasting impacts on financial being over time.

Calculating Your Budget And Setting Repayment Goals

Calculating your monthly budget must be a priority. PaydayChampion enables you to identify any potential savings you can use to pay down your loans and find extra money. You set realistic repayment goals once you have determined your budget and identified areas where you can save more money. Assess ways to increase your income or reduce expenditures, even small changes, to create extra money. Eating out less frequently or canceling unnecessary subscription services provides significant long-term benefits for payday loan relief.

Implementing do-it-yourself payday consolidation becomes easier than ever with a solid plan. Setting achievable targets helps keep track of progress made towards repaying type of debt and motivates one to stay on target despite distractions. Clear objectives allow better communication between yourself and creditors if assistance is needed during difficult times. Try negotiating lower Borrowing costs on outstanding loans, which help reduce total payments over the loan’s lifetime if attainable. Avoid falling into a payday loan trap by considering alternative options.

Payday Loans vs. Alternative Loan Options

Payday loans have become a popular option for borrowers in a financial crisis, but they have high-interest rates that make repayment difficult, often leading to a payday loan trap. Alternative loan options, such as student loans, are available, each with interest rates and repayment periods that may be more manageable.

| Loan Option | Interest Rate | Loan Amount | Repayment Period | Additional Information |

|---|---|---|---|---|

| Payday Loans | 391%-600% APR | $50-$1,000 | Interest rates can soar if the loan is not paid back on time payments Many states have cracked down on high-interest rates, but some have no caps at all. This type of unsecured loans might be an option for individuals with bad credit. | Due on the borrower’s next payday (typically two weeks) |

| Credit Cards | 15%-30% APR | Varies based on credit limit | Ongoing, with minimum monthly payments | Interest rates vary based on creditworthiness and payment history. A balance transfer credit card can help those with bad credit to consolidate their debt and potentially lower their interest rates. |

| Debt Management Programs | 8%-10% APR | Interest rates can soar if loan is not paid back on time. Many states have cracked down on high-interest rates, but some have no caps at all. | Ongoing, with monthly payments | Typically, a debt management company negotiates with creditors to reduce interest rates and create a payment plan. |

| Personal Loans | 14%-35% APR | Varies based on creditworthiness and lender | Ongoing, with time payments required. Personal loans can be used by individuals with varying credit histories, including those with bad credit seeking unsecured loans. | Monthly payments over a set period of time. Interest rates and terms vary based on creditworthiness and lender. |

| Online Lending | 10%-35% APR | Varies based on creditworthiness and lender | Monthly payments over a set period of time | Interest rates and terms vary based on creditworthiness and lender. |

The information above helps individuals decide when choosing a loan option that works best for their financial situation. The table compares payday loans with alternative loan options, including credit cards, debt management programs, personal loans, and online lending, as mentioned by InCharge Debt Solutions. The table includes information on interest rates, loan amounts, repayment periods, and other relevant information. It is crucial to consider factors such as credit card balance, dealing with debt collectors, or managing auto loans when making a decision.

The Bottom Line

The path to financial freedom is frequently a difficult one. You must carefully assess all aspects before committing to any particular option, such as current debt and payment schedule, repayment options, and professional services. Payday consolidation is an effective tool to help you reach your goals, if through do-it-yourself or with the help of a professional service.

Endless cycle of debt and balance transfer fees are two major concerns when considering consolidation. Therefore, finding a solution that helps you break the cycle and save on fees is important. A balance transfer card might be the right option for you, offering a low or zero percent interest rate during the introductory period to help you pay down your debt.

How much effort are you willing to put into consolidating your debts? Do yourself a favor and take the time to research before making a decision. You want to guarantee that the payday consolidation plan best fits your needs and allows for sufficient flexibility.

PaydayChampion saves you from costly mistakes down the road. Knowing which choice is right depends on many factors, while professional services and DIY methods provide advantages regarding payday consolidation. Evaluating each option seems like extra work, but it saves you money and long-term stress.

Frequently Asked Questions

What is payday consolidation, and how does it work?

Payday consolidation involves combining multiple payday loans into one new loan with lower interest rates and manageable payment terms. This simplifies repayment and reduces overall costs.

What are the benefits of consolidating payday loans on your own?

DIY payday consolidation benefits include saving money on interest, having one monthly payment, taking control of finances, improving credit with on-time payments, and becoming debt-free faster.

What are the common DIY payday consolidation methods or strategies?

Common strategies include negotiating with lenders for lower rates, using savings to repay some loans early, borrowing from friends/family at lower rates, balance transfer cards, and peer-to-peer lending.

Are there any potential risks or pitfalls to be aware of when attempting DIY payday consolidation?

Risks include variable interest rates rising after consolidation, borrowing from predatory lenders, high balance transfer fees, and failing to change spending habits leading to more debt.

What steps should I take to create a successful DIY payday consolidation plan?

Track all loan balances and terms, make a realistic budget, identify best consolidation method for your needs, negotiate lower rates, minimize fees, and automate repayments from checking account.