Does Bankruptcy Eliminate Payday Loans

Payday loans may seem tempting if your monthly income needs to be increased to cover all your expenses. But because payday loans are so expensive, many get more loans the following month. If you frequently rely on payday loans, declaring Bankruptcy can assist you in eliminating the debt and ending the cycle.

You may already know Chapter 7 bankruptcy can wipe off any outstanding medical and credit card debt. What about payday loans, though? Can you get relief from this kind of debt by submitting a claim?

The short answer is yes. Filing bankruptcy may help you escape the obligation to repay a payday lender. However, you might want a knowledgeable bankruptcy attorney on your side, given your difficulties in getting a payday loan erased.

Going through the bankruptcy process can help in offering debt relief for various types of debts, including payday loan debt. During a bankruptcy filing, your assets and income will be assessed, and the court may discharge your payday loan debt, freeing you from the burden of dealing with payday loan lenders.

Key Takeaways

- Bankruptcy can help eliminate payday loans, offering much-needed debt relief.

- The bankruptcy process can be complex, and hiring an attorney may be helpful.

- Filing bankruptcy can stop payday loan lenders from seeking repayment.

- Payday advances can be discharged in both Types Of Bankruptcy: Chapter 7 and Chapter 13 Bankruptcies.

- Filing for Bankruptcy can provide an automatic stay that stops lenders from attempting to collect on the debt.

- An experienced bankruptcy law attorney can help ensure a smooth process of discharging payday loans.

What Can I Do If I Am Unable To Repay My Payday Loan?

Refinance

The payday loan company can let you refinance or extend a check advance loan if you have one that you can’t pay back. But this frequently has a very high cost. Refinancing with payday loan firms frequently entails paying high fees, which could raise the interest rate.

Bankruptcy

Payday advances are dischargeable in Chapter 7 bankruptcy cases. Even if the business states that the debt cannot be discharged or erased through Bankruptcy, this is frequently untrue.

Is It Possible to Discharge Payday Loans in Chapter 13 Bankruptcy?

Yes, discharging payday loans in Chapter 13 Bankruptcy is possible. Through a payment plan established in Chapter 13, borrowers can gradually pay off their payday loan debt over time, alongside other unsecured debts. The Types Of Bankruptcy will determine the most appropriate option for discharging payday loans. An experienced bankruptcy attorney can guide you through the process and help you achieve the best possible outcome based on your circumstances.

Yes, payday loans can be included in the repayment plan established by the court in Chapter 13 bankruptcy and handled similarly to other unsecured debts. If the borrower cannot fulfill the repayment plan, a hardship provision may allow them to discharge a portion of the payday loan. This is one of the debt relief options available to bankruptcy filers.

Is It Possible to Discharge Payday Loans in Chapter 7 Bankruptcy?

Yes, payday loans can be discharged in Chapter 7 bankruptcy since they are unsecured and not considered priority debts. All unsecured debts are typically discharged in Chapter 7 bankruptcy, allowing debtors to eliminate their types of debts without repayment. The debtor must disclose the payday loan as unsecured in the bankruptcy petition, just like other unsecured loans and secured debts.

Potential Obstacles

Your payday lender may challenge the discharge of your debt. They can contend that the loan was obtained late (within 60 to 90 days of your filing for Bankruptcy) and that recent debts, such as a post-dated check, aren’t dischargeable under the law. Additionally, they may argue that there was fraudulent intent in obtaining the loan, which could also impact the dischargeability of the debt.

This is technically accurate because payday loans are frequently programmed to renew if not repaid, trapping you in a payday loan cycle. Furthermore, even though the Utah bankruptcy courts typically rule in favor of debtors in this circumstance by referring to the initial loan date rather than the most recent renewal, nothing can be taken for granted. Understanding the type of debt and your financial situation is crucial, and a bankruptcy expert can provide guidance.

Another issue? Your payday lender likely asked for a post-dated personal check to approve you for the loan; they might try to cash it before your bankruptcy hearing. Once they know your bankruptcy case, debt collectors cannot take any money. The money could therefore be required to be returned by the courts. However, you might have to pay overdraft fees and run out of money for other expenses.

When You File for Bankruptcy, Can You Get an Automatic Stay?

It can be tremendously distressing to have mounting debt and no way to pay it off. You need help right away. Fortunately, if you file for Bankruptcy, you may be granted an automatic stay that includes payday loans. This court-structured repayment plan can provide relief and it’s advisable to consult a law firm to ensure your case is handled correctly.

When bankruptcy is filed, an automatic stay halts any debt collection activities. Any payments and attempts by the lender to collect any outstanding debt must be made through the bankruptcy case, overseen by a bankruptcy trustee. It may be more complicated than that, especially when dealing with predatory payday lenders. A post-dated cheque you used to secure the loan may be in doubt, and your credit score may be impacted.

Attorneys can help you understand your rights and what to anticipate with an automatic stay of collections. You must list the payday loans as a debt when declaring bankruptcy to get an automatic stay and include them in your bankruptcy discharge. This process can help you break free from the cycle of debt while taking your disposable income into account.

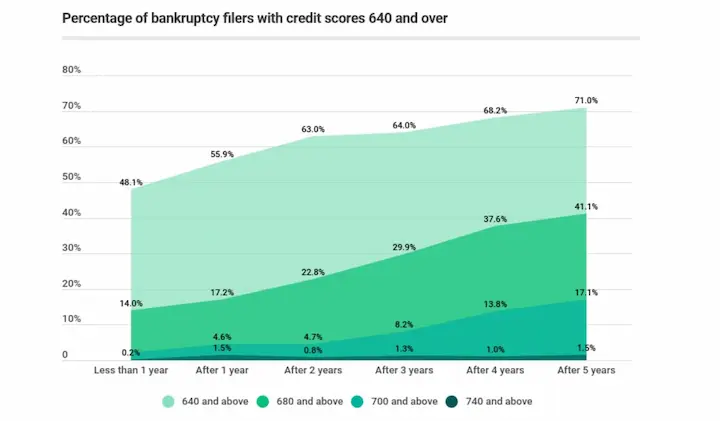

Below are some statistics about filing bankruptcy and loans repayment:

| Stat | Value |

|---|---|

| Number of bankruptcy filings in 2022 | 387,721 |

| Most common type of bankruptcy | Chapter 7 |

| Second most common type of bankruptcy | Chapter 13 |

| Average amount of debt discharged in bankruptcy | $100,000 |

| Impact of bankruptcy on credit score | Negative |

| Importance of talking to a bankruptcy attorney | High |

| Average American debt | $90,460 |

| Average American debt payment | $1,200 per month |

| Average American debt repayment time | 20 years |

Is It Recommended to Discuss Payday Loans With a Chapter 7 Bankruptcy Attorney?

Absolutely, it’s highly recommended to seek legal advice from a Chapter 7 bankruptcy attorney when dealing with payday loans in the context of a bankruptcy filing. They can help ensure that you’re fully informed of your rights and options, including protections afforded to you by the bankruptcy process and the role of a bankruptcy trustee.

Seeking expert advice before declaring bankruptcy can help you make informed decisions and avoid mistakes, especially when considering the days of filing bankruptcy. It is advisable to consult with a local Chapter 7 bankruptcy lawyer before filing for bankruptcy to repay payday loans, which often have high-interest rates. Each state has different regulations regarding payday loans, so having an experienced bankruptcy attorney review your situation can provide valuable insights and guidance.

You receive detailed instructions from your attorney on eliminating PayDay loans during the bankruptcy procedure, taking into account the presumptive fraud rule. If your loan does not renew, you might only need to wait a few months after the due date to file your Chapter 7 case if your loan does not renew. In such circumstances, the lawyer might suggest you shut the bank account and hold off on filing a Chapter 7 case for three months.

You might have further alternatives for eliminating PayDay loans through Bankruptcy. Consulting with a credit counselor can help you manage collection calls and devise a plan for making your monthly payments more manageable. Remember to keep track of the days of filing bankruptcy and stay informed about your options throughout the process.

But because every circumstance is different, it is impossible to say whether or not a PayDay debt is dischargeable in Chapter 7 before the case has been filed. It is essential to consider factors such as payment fees, condition of service, and annual interest rates.

Will Chapter 7 Be Troubled If I Just Took Out a Payday Loan?

Taking out a PayDay loan after declaring Bankruptcy won’t put you in “trouble” with your Chapter 7 case. However, as we covered above, a recent debt might not be canceled in Bankruptcy. Even though you filed for bankruptcy protection, you can still repay the PayDay loan if the lender objects to the discharge. Important details to keep in mind are the annual percentage rate and ensuring you have sufficient funds.

Debts Accrued Recently Before Filing for Bankruptcy

When declaring bankruptcy, remember that debts with high annual interest rates and a substantial annual percentage rate may affect the outcome of your application.

Debts accrued between 60 and 90 days before applying for bankruptcy relief may not be discharged. Loans obtained in advance of declaring Bankruptcy are not dischargeable. Because you accumulated the debt to file for Bankruptcy rather than paying it back, the court assumes that these obligations are fraudulent. Many PayDay loans automatically renew every 30 to 60 days, which is an issue. Lenders contend they are not dischargeable because you incurred the debts within 60 to 90 days of the Chapter 7 petition.

Credit card balances, medical bills, and other forms of financial troubles can add up quickly and become overwhelming. If you’ve found yourself struggling with multiple credit card balances and are considering bankruptcy, it’s important to be aware of the timing of your debt accumulation.

Accumulated debt that might not be discharged under bankruptcy relief may include credit card balances and medical bills. Incurring debts, such as obtaining loans or writing a bad check shortly before declaring bankruptcy, can be seen as fraudulent by the court. This is especially true if you experience financial troubles within 60 to 90 days of the Chapter 7 petition.

Frequently Asked Questions

Can declaring bankruptcy completely eliminate payday loan debt?

Declaring bankruptcy can eliminate payday loan debt, but the ability to discharge payday loans depends on the type of bankruptcy filed. Chapter 7 bankruptcy allows for fully discharging payday loan debt, while Chapter 13 bankruptcy allows for repaying these loans over time under a payment plan.

What happens to payday loans when someone files for bankruptcy?

When filing for bankruptcy, payday loans are treated as unsecured debt. In Chapter 7 bankruptcy they can potentially be fully discharged, while under Chapter 13 the loans can be repaid over 3-5 years through the bankruptcy payment plan. However, recent loans may be considered non-dischargeable.

Is it possible to discharge payday loan debt through Chapter 7 bankruptcy?

Yes, it is possible to fully discharge payday loan debt through Chapter 7 bankruptcy, which liquidates assets to pay creditors and discharges remaining unsecured debts. However, payday loans obtained right before filing bankruptcy may be ruled non-dischargeable by the court.

How does Chapter 13 bankruptcy affect payday loans and repayment?

Chapter 13 bankruptcy allows borrowers to repay payday loans over 3-5 years through a court-approved repayment plan based on income level. The repayment plan allows paying only a portion of the debt over time. However, recent payday loans may still be considered non-dischargeable.

Are there any alternatives to bankruptcy for dealing with payday loan debt?

Alternatives to bankruptcy include payday loan consolidation to combine debts into one payment, payment plans offered by some lenders, credit counseling services to negotiate lower interest rates, taking out a personal loan to pay off the debt, or contacting lenders directly to explain financial hardship and request more time.