What Are Emergency Cash Loans for Single Mothers?

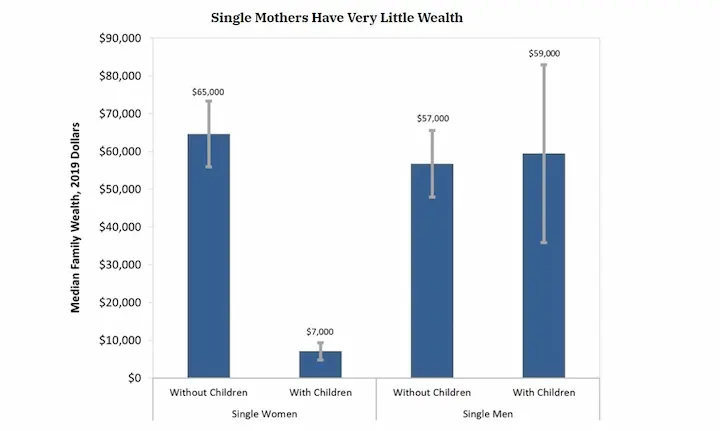

Single motherhood carries many responsibilities and poses numerous economic pressures that other parents don’t experience. For example, they are more likely to have lower incomes than in two-parent households or be unemployed entirely. Often, single mothers may face financial hardship. Childcare costs take up a large portion of the family budget.

Emergency cash loans, sometimes called emergency loans, help individuals when unexpected expenses arise. It is a short-term emergency financial loan that offers quick access to funds for urgent needs like medical bills, rent payments, or car repairs. These loans can provide much-needed financial assistance to single mothers in need. However, borrowers need to understand the potential advantages and downsides before applying for one of these types of loans to prepare them for any issues.

Key Takeaways

- Single mothers face economic pressures that other parents don’t, such as lower incomes and childcare costs that make it difficult to manage unexpected expenses.

- Emergency cash loans for single mothers provide an immediate influx of funds without requiring collateral or credit checks to cover urgent expenses like medical bills or rent payments. They can consider Pell Grant, emergency payday loans, and hardship loans.

- Single mothers must carefully research their options and understand the potential advantages and downsides before applying for emergency cash loans.

- Emergency cash loans are available to meet the needs of single mothers in difficult financial situations, including short-term loans, student loans, bad credit loans, and Pell Grants.

- The advantages of emergency cash loans for single mothers include quick access to funds, no collateral requirements, flexible repayment terms, improved credit scores, and grants like Pell Grant that don’t require repayment.

- Emergency cash loans have a simplified application process and provide fast and efficient access to funds, especially when dealing with urgent expenses like medical bills or car repairs.

What Is An Emergency Cash Loan For Single Mothers?

Emergency cash loans for single mothers are a form of financial aid used by those in need to meet urgent expenses. It provides immediate funds without the requirement of collateral or credit checks and helps bridge the gap between income and expenses during an emergency situation.

The terms and eligibility requirements for such loans vary from lender to lender. Most lenders require applicants to prove their employment status and ability to repay the loan. Some lenders impose more restrictions on the eligible recipient of such a loan, especially during a financial crisis. Borrowers need to research their options carefully before applying for financial emergencies assistance.

Emergency funds through emergency cash loans for single mothers provide relief when unexpected costs arise. However, potential borrowers need to understand the financial product well to make informed decisions.

Types Of Emergency Cash Loans For Single Mothers

Emergency bank loans exist in various forms to meet the needs of single mothers facing difficult economic circumstances.

Private lenders, credit unions, banks, and other organizations that provide short-term solutions offer emergency cash loans. Emergency cash loans for single mothers are often offered more flexible repayment terms than those with conventional loan provider products.

However, potential borrowers need to know the different types of emergency cash loans. Having a background in the different types of loan products helps them pick the right choice.

Short Term Loans

Short-term loans are a popular option for single mothers needing emergency cash. Short-term types of loans provide an immediate influx of cash and cover short-term financial needs, such as medical expenses or bills that must be paid quickly. They often have low-interest rates than other loan products, making them more attractive and affordable, as well as manageable monthly payments.

The repayment terms on these loans range from two weeks to six months, allowing borrowers the flexibility needed when taking out a loan. Some lenders offer same-day approval, meaning borrowers receive their money within hours of applying. Online loans are available even for those with a bad credit score.

Student Loans

The United States Department of Education offers several types of student loans, such as Direct Subsidized Loans and Direct Unsubsidized Loans, both available for undergraduate students who demonstrate financial need. The amount borrowed depends on other factors such as the school attendance cost, expected family contribution (EFC), and if they’re pursuing a degree in certain areas of study. Federal Parent PLUS Loans allow parents to borrow money for their dependent children attending college.

Bad Credit Loans

For borrowers with a bad credit score, options are available to secure the required funds. Lenders offer loans designed specifically for individuals with low credit scores or loan amount credit restrictions. These loans might have higher interest rates or require a co-signer but can help those needing financial assistance who might not qualify for traditional loans.

Bad credit loans offer an alternative to individuals with a poor financial history. They are designed for those whose credit scores prevent them from accessing traditional financing options, such as student loans or other personal finance products.

Many borrowers take out bad credit loans because they give them access to funds without having a good credit report. Repaying such loans helps improve credit scores if payments are made on time.

Loan options provided by bad credit personal loan lenders offer repayment terms that are adjustable according to individual circumstances. Bad credit loans are secured or unsecured, depending on the borrower’s preference and requirements.

Education Grants

Education grants like Pell Grants are a form of financial aid to help single mothers pay for college. Pell grants, issued by the US Department of Education, are available to undergraduate students who demonstrate financial need. The amount awarded is based on several factors, including the cost of attendance at an accredited school and the student’s family income.

Pell Grants funds provide an invaluable resource for those with limited means to further their education. Pell Grants do not require repayment as long as recipients remain enrolled in college full-time and make satisfactory academic progress, unlike payday lender and bad credit loans. Any unused funds roll over into future years until they have been exhausted or graduated from their program.

Advantages Of Emergency Cash Loans For Single Mothers

Single mothers often face difficult financial situations due to lacking resources and support. Emergency cash loans provide an invaluable lifeline for moms, offering the necessary funds to cover urgent needs such as food, rent, medical bills, or childcare. Emergency cash loans have five major advantages for single mothers, including quick cash loans, no collateral required, competitive interest rates, and no credit check required.

Quick Access to Funds

Emergency cash loans, such as payday lender loans, offer quick cash loans to single mothers who need immediate financial assistance. However, these loans come with a high-interest rate, so it’s crucial to explore other options and only use them as a last resort.

Emergency cash loans are designed to provide fast and efficient access to funds when needed most. Quick access to funds is a vital benefit of emergency cash loans. There are more viable options loans for people than waiting for traditional loan agreement approval processes when faced with unexpected expenses or a temporary loss of income.

Quick access types of loans have a simplified application process, and in some cases, the funds are made available on the same day or within a few days of approval. The quick turnaround time is especially helpful when dealing with urgent expenses such as medical bills or car repairs.

Emergency cash loans come in different forms, including personal, payday, or cash advances. The loan amount, interest rates, and repayment terms vary depending on the lender.

No Collateral is Required

Collateral is an asset pledged as security for a loan, and if the borrower defaults on the loan, the lender seizes the asset to recover the outstanding balance.

No collateral loans make it easier for single mothers to access the funds they need, as they may need valuable assets to pledge as security. The loan structure is especially beneficial for those facing unexpected expenses or a temporary loss of monthly income, as they don’t have the luxury of waiting for a traditional loan that requires collateral.

Emergency cash loans that do not require collateral rely on other factors to assess the borrower’s ability to repay the loan, such as credit history and income. Direct lenders look at the borrower’s credit score to determine the risk of default, and they consider the borrower’s income and employment status to assess their ability to make payments.

Competitive Interest Rates

Many lenders offer competitive annual percentage rates. Competitive interest rates make a significant difference in the cost of the loan over time, as even a slightly lower interest rate results in significant savings in the long run. The application process for these loans can often be completed in a matter of minutes, making it a convenient option for those needing quick financial assistance.

The average interest rate for personal loans in the United States was 9.46% in Q2 of 2021, according to a report by the Federal Reserve. However, interest rates for emergency cash loans vary significantly based on the lender, the borrower’s credit score, income, and other factors. Borrowers with good credit scores and income are qualified for lower interest rates than those with lower credit scores. The federal government plays a crucial role in providing various loans to borrowers to address their financial needs.

| Borrower’s Credit Score | Lender A Interest Rate | Lender B Interest Rate | Lender C Interest Rate |

|---|---|---|---|

| Excellent (750-850) | 4.25% | 4.75% | 4.50% |

| Good (700-749) | 6.00% | 6.50% | 6.25% |

| Fair (650-699) | 10.00% | 11.50% | 10.75% |

| Poor (600-649) | 15.00% | 17.50% | 16.25% |

In addition to banks and credit unions, the federal government offers various loans to borrowers through specific programs to help with different financial needs such as education, housing, and business expansion. Borrowers must research and compare interest rates, terms, and conditions offered by different lenders before deciding.

16.00%Comparison of Interest Rates for Emergency Cash Loans

Explanation of Scenarios:

- The borrower’s Credit Score column shows different credit score ranges of borrowers, ranging from excellent to poor. The borrower’s credit score is one of the primary factors lenders consider while determining the interest rate for emergency cash loans. The higher the credit score, the lower the interest rate charged.

- Lenders A, B, and C Interest Rates columns show the interest rates for emergency cash loans offered by different lenders, labeled as A, B, and C. The interest rates are hypothetical and used for illustrative purposes only. The table shows that the interest rates offered by different lenders vary significantly for borrowers with different credit scores. For example, Lender A offers a lower interest rate for borrowers with excellent credit scores than Lenders B and C.

No Credit Check Required

Sometimes, Private loans may be an option for borrowers who don’t want to go through a credit check. A Loan Program that does not require a credit check can benefit those with less-than-perfect credit scores. However, it’s important to note that these loans might have higher interest rates and additional closing costs. So, always compare options, including Private loans and other loan programs, to determine the best choice for your needs.

The phrase “no credit check required” refers to a type of financial transaction or loan where the lender does not perform a traditional credit check on the borrower before approving the loan. The borrower’s credit score or credit history does not play a role in determining their eligibility for the loan. Instead, lenders use other factors such as income, employment history, and other financial information to assess the borrower’s ability to repay the loan.

Finding a lender who offers no credit check loans is a helpful solution for single mothers with poor credit or limited financial resources. No credit check loans are easier to obtain and provide quick access to funds when needed without needing a credit check. Low-income families can also benefit from government assistance programs and online application processes, which can help cover urgent expenses.

Introducing the table below, we proudly present a comprehensive list of American states where our company actively supports single mothers through emergency cash loans. Recognizing the unique challenges single mothers face in times of financial distress, our mission is to extend a helping hand when needed. Our commitment to empowering single mothers has established a presence in various states nationwide. Please refer to the table to find your state and the range of assistance available to single mothers in your area. We are dedicated to making a positive impact in the lives of single mothers, and we are honored to serve these communities in their times of need.

| AL – Alabama | AK – Alaska | AZ – Arizona | AR – Arkansas |

| CA – California | CO – Colorado | CT – Connecticut | DE – Delaware |

| DC – District Of Columbia | FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana | IA – Iowa |

| KS – Kansas | KY – Kentucky | LA – Louisiana | ME – Maine |

| MD – Maryland | MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana | NE – Nebraska |

| NV – Nevada | NH – New Hampshire | NJ – New Jersey | NM – New Mexico |

| NY – New York | NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania | RI – Rhode Island |

| SC – South Carolina | SD – South Dakota | TN – Tennessee | TX – Texas |

| UT – Utah | VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

Here are some statistics about emergency cash loans for single mothers:

| Stat | Value |

|---|---|

| Single mothers who take out emergency cash loans are more likely to experience financial hardship and stress. | $500 |

| The average amount of emergency cash loan for single mothers | 300% |

| The average repayment period for emergency cash loans for single mothers | 30 days |

| Percentage of single mothers who take out an emergency cash loan and default on the loan | 25% |

| Single mothers who take out emergency cash loans are more likely to experience financial hardship and stress | Yes |

Different Forms of Emergency Cash Loans

Emergency cash loans come in various forms, each with unique features, eligibility criteria, and application processes. Here are some of the most common types of emergency cash loans, including options with online application methods and sources for government assistance programs designed for low-income families:

- Payday loans – Payday loans are a type of short-term loan designed to provide borrowers with quick access to the cash they repay on their next payday. These loans are generally easy to qualify for, with lenders requiring little more than proof of income and a valid checking account. The interest rates on payday loans reach 400% APR, making them one of the most expensive forms of borrowing, according to Consumer Financial Protection Bureau.

- Personal loans – Personal loans come with fixed interest rates and terms, which means that the borrower makes the same payment every month for the duration of the loan. Loan terms range from a few months to several years, and loan amounts range from a few hundred to several thousand dollars, depending on the lender and the borrower’s creditworthiness. Personal loans have lower interest rates than other unsecured loans, such as credit cards, making them a more affordable option over time.

- Credit card cash advances – They are a type of borrowing that allows credit card holders to withdraw cash from an ATM or bank, using their credit card as collateral. Credit card cash advances are convenient for borrowers who need cash quickly. However, the cash advance amount is generally limited to a percentage of the available credit limit and subject to a higher interest rate than other credit card purchases.

- Auto title loans – Title loans are secured loans that use the borrower’s vehicle as collateral. The borrower must own a vehicle outright and provide the lender with the title as collateral. The lender holds the title until the loan is repaid in full. The primary risk associated with title loans is the potential for the borrower to lose their vehicle. The lender can repossess the vehicle and sell it to recoup their losses if the borrower cannot repay the loan on time.

- Installment Loans – Installment loans are loans that borrowers repay in fixed installments over a specific period. The terms of installment loans vary depending on the lender and the borrower’s credit score. Some installment loans require collateral, such as a car or house, while others are unsecured. The interest rates on installment loans vary but are generally lower than those on payday or title loans.

Conclusion

Single motherhood poses several economic pressures that other parents do not experience. Emergency cash loans provide a financial solution for borrowers in need, with no collateral or credit check requirement. Short-term loans, student loans, bad credit loans, and Pell Grants are emergency cash loans available to single mothers. Emergency cash loans offer several benefits, including quick access to funds, no requirement for collateral, and flexible repayment terms. However, potential borrowers need to understand the various types of loans, as each has advantages and disadvantages, making it essential to research their options carefully before applying.

Frequently Asked Questions

What are the eligibility criteria for single mothers to qualify for online emergency cash loans with no credit check?

Being a single mother with dependents, steady income of at least $800 per month, active checking account, proof of identity, and minimum age of 18 years old.

What is the typical interest rate and repayment terms associated with emergency cash loans for single mothers with no credit check?

Interest rates range from 70-400% APR typically. Repayment terms are usually 3-12 months. Borrow only what you can afford to repay.

Are there any government programs or nonprofit organizations that provide financial assistance or emergency cash grants to single mothers in need?

Yes, options include TANF, WIC, SNAP, subsidized housing, Medicaid, United Way, Salvation Army, Catholic Charities, and local churches.

What alternative options exist for single mothers who may not qualify for traditional loans but still need emergency financial assistance?

Alternatives like crowdfunding sites, borrowing from friends/family, credit cards, part-time work, payment plans on bills, and reducing expenses.