The Loan-to-Value (LTV) ratio is a measure lenders use to assess the risk of lending against a property. The ratio is determined by dividing the full loan amount by the property’s estimated market value. The lender takes on a lot of risks because the collateral is completely exhausted in the event of default when the LTV ratio is very high. Lenders prefer loan-to-value (LTV) ratios below 80% because they lower the lender’s risk and yield better underwriting outcomes. Lenders are more generous with the offers to borrowers with a lower LTV.

Lenders and borrowers utilize the Loan-to-Value (LTV) ratio to establish the maximum amount of a loan that is acceptable in relation to the value of the collateral. To illustrate, a 60% LTV would indicate that a borrower has put down 40% of the total purchase price of a $500,000 home by taking out a $300,000 loan. The ratio helps banks and other financial organizations assess the danger of making loans, which informs decisions about whether to make loans and, if so, at what interest rate.

The Loan-to-Value (LTV) ratio is an important factor in determining eligibility for a loan. The loan-to-value ratio assesses how much of a loan is secured by what is being borrowed. A lower LTV signifies smaller cash expenditure and riskier loans, whereas a higher LTV indicates more loan funds are being used for financing. Financial institutions use the ratio to gauge whether or not a borrower has sufficient resources to make monthly debt payments and repayments in the event of a default, which banks often set a maximum loan-to-value (LTV) ratio and impose other restrictions on loan products to compensate for the increased risks associated with certain borrowers.

What is Loan-to-Value Ratio?

Loan-to-value (LTV) ratio is a value lenders use to assess the risk of lending money. LTV is the proportion of a loan’s principal to the asset’s value, as determined by an appraiser. Lenders favor a low LTV ratio since it signals lower risk. The value or purchase price of the asset is used as one number, while the loan amount serves as the other. A higher LTV indicates that the borrower has taken on more financial risk, which poses a larger threat to the lender’s collateral in the long run. Loan-to-Value Ratio is a financial tool commonly used in lending, real estate, and other business transaction choices.

The loan-to-value is useful for determining a company’s debt capacity and the level of investment risk it tolerates. Financial institutions commonly utilize loan-to-value since it helps lenders assess the risk involved with the loan and calculate how much money financial institutions afford to offer when deciding whether or not to provide a mortgage or loan. Owners used the loan-to-value ratio to assess the company’s capital liquidity by comparing it to the present assets, liabilities, and cash flow. The Loan-to-Value (LTV) ratio establishes the maximum loan amount extended to a borrower in mortgages and real estate financing. Lenders assess a borrower’s risk level and make lending decisions by comparing the requested loan amount to the available collateral.

What is Loan-to-Value in a Mortgage?

Loan-to-Value (LTV) in a Mortgage is a ratio between the loan amount and the value of the mortgaged property. Lenders heavily consider the LTV ratio when making risk assessments, and a higher LTV ratio indicates a larger risk to the lender. Mortgage lenders use loan-to-value (LTV) ratios to determine whether or not to provide a borrower with a loan. Most financial institutions prefer loan-to-value (LTV) ratios of no more than 80%, which means that the loan amount does not exceed the property’s worth by more than 20%. Borrowers must refrain from approving such a loan because of the increased default risk associated with loans with a high LTV ratio.

Loan-to-Value a Mortgage helps consumers by allowing borrowers to pay much lower down payments and monthly payments than they normally do when purchasing a home. Lenders offer loans with an LTV of up to 97%, allowing homebuyers to put down as little as 3%. Paying fewer results in smaller monthly payments and cheaper interest rates over the loan term.

What is Loan-to-Value in a Business?

Loan-to-Value in a Business or LTV is a financial ratio used to measure the debt financing ratio to a business’s total value. The ratio of the outstanding principal to the total value of the assets is displayed. To illustrate, let’s say a company has borrowed $50,000 against a value of $100,000. The Loan-to-Value ratio would be 50%. LTV is crucial for lenders to evaluate risk and set the appropriate interest rate. Larger loans, as a percentage of the total value, typically have more risks and, thus, higher costs over time.

Loan-to-Value (LTV) is an essential metric in business because it allows lenders to measure the risk associated with a loan. LTV is a way for lenders to gauge how much debt would be repaid in case of a borrower default or bankruptcy, which is critical for estimating long-term cash flow and minimizing losses for investors and lenders. That’s why banks and other lenders rely heavily on LTV when deciding whether or not to make a loan and what terms and conditions to attach to that loan.

What is LTV in Customer Acquisition?

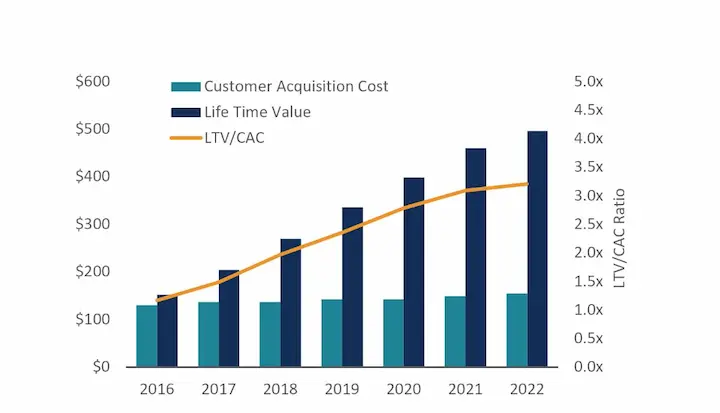

Loan-to-Value (LTV) in customer acquisition is a metric used to measure the expected return on investment of acquiring customers. It assesses the return on investment (ROI) relative to the customer acquisition cost. Customer LTV is often determined by multiplying the average revenue per user by the gross margin percentage and the customer’s lifetime value. Businesses benefit from a deeper comprehension of LTV when selecting how much and where to spend on customer acquisition methods.

What is the Example of a Loan-to-Value Ratio?

Lenders typically express a loan amount as a percentage of the asset’s value, a ratio known as the loan-to-value (LTV) ratio. A higher LTV ratio indicates a larger chance of default on a loan. Hence it is commonly employed for that purpose. For instance, a loan-to-value (LTV) ratio of 80% would apply to a home purchase of $200,000 for which a loan of $160,000 was obtained. Percentages are determined by dividing the loan amount ($160,000) by the purchase price ($200,000) and multiplying the result by 100. The Loan-to-Value Ratio (LTV) = Loan Amount / Sales Price X 100%.

Loan-to-value (LTV) ratios are used for many different kinds of loans, including but not limited to mortgages, equity loans on the home, and money for cars and boats. Lenders’ minimum acceptable LTV ratios vary by loan type and borrower creditworthiness. The loan-to-value (LTV) ratio for a conventional mortgage typically must be 80% or lower, while the LTV ratio for an FHA loan is as high as 90%, but these standards are not written in stone and vary from lender to lender. It’s worth noting that the loan-to-value (LTV) ratio varies with the amount of the down payment, with a larger down payment resulting in a lower LTV; however, some lenders require an LTV of 80% or lower before approving the loan, in which case the borrower would need to make a larger down payment.

What is the Importance of Calculating Loan to Value Ratio?

LTV is an important metric for both borrowers and lenders, as it helps to determine the risk involved in a loan. To lenders, a low LTV ratio is preferable since it suggests that the borrower has a substantial amount of equity in the property and is thus less likely to fail on the loan. As a result of the reduced perceived risk associated with a loan with a low LTV, the borrower is offered a more favorable interest rate. Lenders often use the loan-to-value (LTV) ratio as a proxy for the riskiness of a certain loan. Since the borrower has less equity in the property, a high LTV ratio signal that the borrower is more likely to fail on the loan if unable to make the payments. High LTV ratios prompt banks to impose additional restrictions on borrowers through higher interest rates or less lenient repayment conditions.

Real estate investors make use of the LTV ratio; it’s a crucial indicator of the return that is made by analyzing the relationship between the loan amount and the value of the property, which allows the investor to quickly assess the risk of an investment and the potential return that is made. It’s worth noting that loan-to-value (LTV) ratios change depending on the nature and use of the financing. The LTV of a refinance or home equity loan is based on the difference between the loan amount and the home’s appraised value. The loan-to-value (LTV) ratio is an important indicator of the safety and profitability of a financial commitment. Real estate investors, homebuyers, and financial organizations all use it frequently.

How to Calculate Loan-to-Value Ratio?

It is determined by dividing the loan amount (L) by the collateral value (V) (V).

To illustrate how to compute LTV, let’s say a borrower needs a loan of $150,000 to buy a home valued at $200,000.

The formula for the LTV is as follows: LTV = (Loan Amount) / (Property Value)

LTV = ($150,000) / ($200,000) = 0.75 or 75%

The percentage is the proportion of the collateral’s value utilized to secure the loan. As the lender’s risk decreases with a lower LTV ratio, lenders are willing to offer more lenient terms and conditions, such as a lower interest rate.

To calculate the loan-to-value (LTV) ratio for a loan of $150,000 to purchase a home valued at $200,000, follow these steps:

- Determine the loan amount: The loan amount is $150,000.

- Determine the property’s value: The property is valued at $200,000.

- Divide the loan amount by the property value: $150,000 ÷ $200,000 = 0.75 or 75%. So the LTV ratio of the loan is 75%.

In deciding whether to grant a loan and on what terms, a lender looks at the loan-to-value ratio (LTV). Mortgage insurance is necessary if the LTV ratio is above 80%. A higher interest rate is necessary if the LTV exceeds 90%.

Why Calculating Loan-to-Value Ratio Matters?

Calculating the loan-to-value ratio is important when considering a loan. A measure of how much discount is expected to receive between the amount being borrowed and the value of the collateral has been put up as security. A higher debt-to-value ratio increases the likelihood of default on loan payments if there is a significant decline in the value of the collateral. That’s why it’s useful for borrowers and lenders alike to grasp how the debt-to-income ratio affects the decision to fund a project and how it is used to choose the most appropriate loan product.

Calculating a loan-to-value ratio is important for consumers because it indicates the amount of equity in borrowers’ homes. It is useful for figuring out how much is borrowed for things like house improvements and expansions. Lenders use the LTV ratio to gauge the risk of extending credit to a borrower and set appropriate interest rates and repayment terms to prevent borrowers from loaning more money. Fewer people are likely to overspend or rack up excessive debt, hence avoiding financial hardship.

What is a Good Loan-to-Value Ratio?

A good loan-to-value (LTV) ratio is 80%. However, certain lenders go higher or lower depending on the borrower’s situation. A good loan-to-value (LTV) ratio is the amount of money a borrower borrows against the value of a property. While a low LTV ratio is preferable so that a borrower doesn’t overextend financially, a high LTV ratio makes lenders more confident in giving a loan.

A better rate is possible if a borrower has a high credit score. A good loan-to-value ratio is 80%, meaning the loan amount cannot exceed 80% of the property’s worth. The percentage guarantees that borrowers have adequate “skin in the game,” While it varies from lender to lender, it often equates to a decreased chance of default. Borrowers must have enough money for the down payment, interest, taxes, and insurance. Most want borrowers to have a loan-to-value ratio below 80% before offering more lenient terms.

Is 70% a Good Loan-to-Value Ratio?

A 70% loan-to-value ratio is considered a good ratio in many cases because it shows lenders that a borrower can pay off 20% of the loan amount as a down payment, which protects the lender’s investment and guarantees repayment in the event of inability to make payments. Investors like a loan-to-value ratio of 70% because it gives a better return on money invested. Smaller down payments help potential homeowners get approved for mortgages.

Does Increasing the Downpayment Lower the Loan-to-Value Ratio?

Yes, increasing the downpayment does lower the loan-to-value (LTV) ratio. The downpayment is usually a fixed percentage of the property’s purchase price. Increasing the downpayment percentage reduces the amount of money requested for financing. It reduces the borrower’s LTV ratio, which benefits borrowers by reducing the interest rate and helps applicants qualify for certain loan products or better terms from a lender.

Does LTV Affect Interest Rate?

Yes, loan-to-value affects interest rates in several different ways. First, a higher loan-to-value ratio is associated with a higher perceived risk; thus, lenders would likely demand a higher interest rate to compensate for the increased risk. The interest rate offered by a lender is affected by the risk the lender perceives in lending money to a borrower with a high loan-to-value ratio. Credit-to-value ratios that are too high result in higher interest rates due to penalties imposed by government-backed loan programs (like FHA and VA loans).

What is the Difference between LTV and CLTV?

Loan-to-Value (LTV) is a ratio of the loan amount to the current appraised value or purchase price of the property, whichever is lower. It helps lenders evaluate credit risk when processing mortgages or other loans. CLTV stands for Combined Loan-To-Value, and it is a combination of two types of financing. CLTV is always larger than LTV because it adds any prior mortgages against the property with the new loan. Generally, lenders prefer lower LTV/CLTV ratios to have less risk than higher ratios.

Frequently Asked Questions

What is the loan-to-value (LTV) ratio, and how is it calculated?

The loan-to-value ratio compares the amount of a loan to the total value of the asset purchased. It is calculated by dividing the loan amount by the appraised value of the asset.

Could you provide an example of how to calculate the loan-to-value ratio for a home mortgage?

If you purchase a $200,000 home with a $160,000 mortgage, the loan amount is $160,000 and the home’s value is $200,000. The LTV ratio is $160,000 divided by $200,000, or 80%.

Why is the loan-to-value ratio important for lenders and borrowers in the context of loans?

The LTV ratio helps assess risk for lenders and determines how much equity the borrower has. Higher LTV means higher risk for lenders and less equity for borrowers if values decline.

How does the loan-to-value ratio affect the terms and conditions of a loan, such as interest rates and down payment requirements?

Higher LTV ratios often mean higher interest rates, mortgage insurance requirements, and larger down payments for borrowers. Lenders mitigate risk with stricter terms when lending at higher LTV levels.

What strategies can borrowers use to improve their loan-to-value ratio and secure better loan terms?

Make a larger down payment if possible, buy a less expensive property, have co-signers or guarantors, and improve credit scores to qualify for lower interest rates and better loan terms.