The concept of borrowing money from friends or family conjures up many emotions. On the one hand, it is a safe and secure way to access funds when needed. However, it is seen as an uncomfortable situation that leads to awkwardness or resentment. Borrowers must understand how such arrangements must be handled for both the lender and the borrower to get the best outcome, while there are benefits and drawbacks associated with this type of loan. PaydayChampion explores the potential advantages, risks, and considerations of taking out a loan from friends or family.

All involved parties must carefully contemplate their motivations before entering into any financial arrangement with people they know. The involved parties must enter an agreement outlining all aspects of the arrangement before taking out the loan. It includes repayment terms and repercussions if either party fails to abide by them. The need for clear communication between both sides must be balanced. Failure to communicate effectively has serious financial and emotional consequences, ending relationships permanently.

Many individuals who take loans from friends or family do so because traditional lenders won’t provide capital due to poor credit history or lack of collateral. However, it is still practical for borrowers to find alternative funding sources. Considering all available options, making informed decisions about taking out such a loan makes sense given individual cases and being mindful of potential pitfalls.

What Are Loans From Friends And Family?

Loans from friends and family are financial assistance for people with close relationships. Such loans do not involve the same strict legal requirements as other loan types, such as those taken out with banks or credit unions, nor do they charge interest rates or fees for processing. Family and friends loans are often referred to as informal loans. They are beneficial in certain circumstances due to their flexible terms and lack of paperwork.

Various factors must be weighed when deciding to take a loan from a friend or family member. On the one hand, it’s vital to understand how this arrangement potentially affects the relationship. However, borrowers must realize their ability to repay the loan within an agreed period. All parties must carefully evaluate the potential benefits and drawbacks associated with the arrangement before making decisions.

Is Borrowing Money From Family Or Friends A Good Decision?

Borrowing money from family or friends is a great way to improve your financial situation. Borrowers must learn about the potential consequences of doing so. The decision to take out a loan must not be taken lightly and requires careful thought and consideration before jumping in. Both positives and negatives are associated with such loans that must be weighed carefully against each other before taking action.

On the one hand, borrowing from family or friends provides more lenient terms than traditional lenders. Repayments do not likely involve interest payments or fees for late payments.

Flexibility exists within the agreement, allowing alternative payment arrangements without punitive measures if repayment becomes difficult due to unforeseen circumstances. It normally has long-term implications beyond just monetary losses. However, there is a risk of damaging relationships between borrowers and lenders in case of default on a loan. It is vital to understand all aspects before opting into any loan arrangement with somebody close.

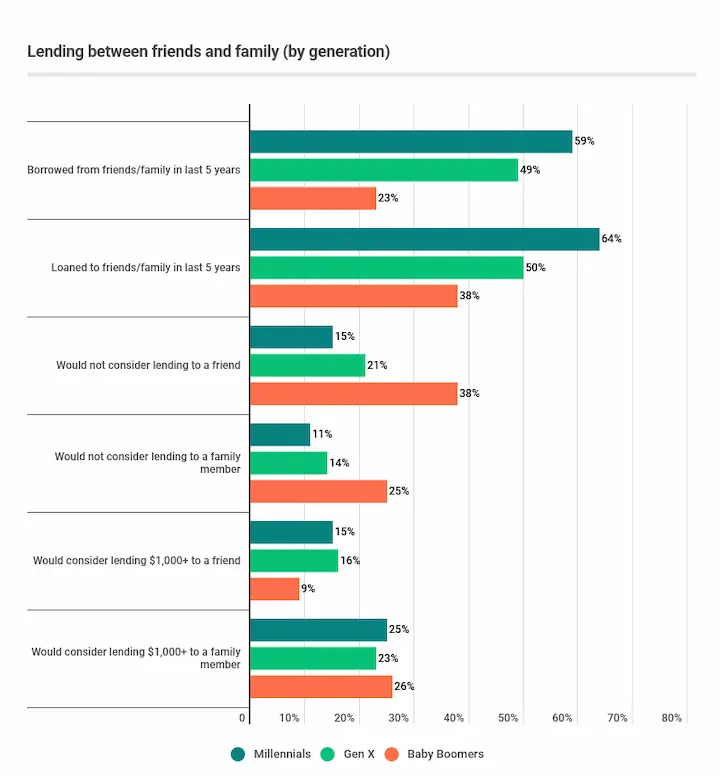

10% of American adults, or approximately 25.6 million people, rely on borrowing from friends and family for financial support, According to China Daily. The table below shows different scenarios of borrowing from friends and family in the US.

| Number of American Adults Percentage | Different scenarios of borrowing from friends and family in the US |

| Total US Adult Population 255 million (approximate) 100% | Total US Adult Population: The estimated total number of American adults. |

| Adults who rely on borrowing from family 25.6 million 10.0% | Adults who rely on borrowing from family: The number of American adults who rely on borrowing from family and friends to meet their spending needs. |

| Adults who relied on borrowing last year 19.1 million 7.5% | Adults who relied on borrowing last year: The number of American adults who borrowed from family and friends to meet their spending needs last year. |

| Adults who started borrowing this year 6.5 million 2.5% | Adults who started borrowing this year: The number of American adults who began relying on borrowing from family and friends to meet their spending needs this year. |

| Adults who borrowed due to rising prices 15.2 million 5.9% | Adults who borrowed due to rising prices: The number of American adults who had to borrow from family and friends due to the rising costs of goods and services. |

| Adults who borrowed for emergency expenses 10.3 million 4.0% | Adults who borrowed for emergency expenses: The number of American adults who had to borrow from family and friends to pay for emergency expenses such as medical bills, car repairs, etc. |

When Should You Consider A Family Loan?

Taking a loan from family and friends is analogous to walking a tightrope. Sometimes it provides you with the extra financial support needed in times of need or opportunity. Other times, when not handled properly, it negatively affects personal relationships.

The time to start taking such a step depends upon your unique situation. A family loan is beneficial since it helps secure future success without paying high-interest rates associated with commercial banks if funds are necessary for something that has potential for growth (such as starting a business). However, it must be chosen after carefully weighing all outcomes and discussing the matter openly and honestly with those involved. There must be clear expectations concerning repayment terms and consequences for any defaults.

Additionally, considering the loan-to-value (LTV) ratio is crucial when contemplating a family loan. Evaluating the collateral or value of the investment against the borrowed amount provides a measure of risk and helps establish fair terms. Maintaining a balanced LTV ratio ensures a level of security for both parties involved, fostering transparency and trust in the familial financial arrangement.

Advantages Of Borrowing Money From Friends And Family

Borrowing money from friends and family is a lifeline, connecting us to financial stability in times of need. The following are the advantages of taking a loan from family and friends.

- Individuals enjoy greater flexibility with repayment terms when borrowing from close ties instead of banks or other institutions.

- Loan applicants benefit from more lenient arrangements that suit their budgets with no interest rates or credit checks needed.

- Friends and family have fewer restrictions on what types of loans are offered since many private lenders are not regulated by government agencies like banks.

- Borrowers get access to larger sums with bad credit than through traditional methods while being able to negotiate fair payment plans based on their earnings.

- Loved ones understand your situation better than anyone else when borrowing from them. Borrowers are likely to receive compassion suppose there is a problem making repayments.

Flexibility

Its flexibility is the most attractive aspect of borrowing money from friends and family. It provides much more options with repayment, interest rates, and timeframe than a conventional lender offers. The loan is structured to work around any budget or lifestyle changes that occur along the way. There are ways it stands out. It includes flexible payment arrangements.

The loan lets borrowers negotiate their repayment plan with friends or family, allowing flexible payments. Next is the customizable interest rate. You have complete control over the agreed-upon interest rate since no formal banking institution is involved. Another benefit is the longer lending period.

Unlike traditional banks, which require shorter repayment periods, friends and family members are often ready to lend money for longer periods so that borrowers don’t feel rushed into repaying their debt quickly. Lastly, no credit check: They don’t require stringent credit checks since the loans aren’t tied to a financial institution. It makes them ideal for those who need quick access to cash but do not qualify based on their credit score alone.

Quick Approval

Borrowing from friends and family is often convenient because it is resolved quickly. Besides speed, such loans come with flexibility. Approval for the loan comes almost instantaneously because no banks or other financial institutions whose rules must be adhered to are involved. The parties involved must agree on how the money is repaid, if interest charges apply, and when payments need to be made.

The quick approval process associated with the loans makes them an attractive option for those needing funds without going through a lengthy application process. It depends entirely upon the terms agreed between borrowers and lenders though a few need a form of collateral as security against defaulted repayment. Friends or family members sometimes do not charge any interest at all.

A further benefit of obtaining a loan from friends or family is the absence of paperwork. Most agreements are verbal rather than written, significantly reducing time-consuming documentation processes. The processes usually delay access to finances by weeks or even months.

Borrowers have greater control over their repayment schedules without being bound by rigid bank regulations based on credit scores and income levels since each deal is bespoke and tailored around individual circumstances. It allows them to negotiate affordable monthly payments which suit their budget while simultaneously saving face with their loved ones.

No Collateral Required

The lack of collateral requirement is one of the major attractions of a family loan since it removes the burden of providing security for borrowers. It is especially beneficial for someone who does not have assets or property to provide in exchange for a loan. Involved parties negotiate terms directly, which often results in more favorable repayment conditions, given that no intermediaries are involved.

No collateral makes it easier for borrowers to access additional capital if needed without going through another process with an alternative lender. All the mentioned factors make family loans an attractive choice for many individuals looking for quick financing solutions without dealing with complex legal formalities associated with other forms of borrowing. The transactions benefit both sides since the interest earned on such loans supplements the income received by lenders while allowing borrowers greater flexibility when repaying the amount owed over time.

Less Paperwork

The paperwork associated with a loan from family and friends is less involved or intimidating than a traditional bank loan. However, some paperwork is required to borrow money from someone close to them, even if no collateral is needed. It likely involves fewer documents than you experience when applying for a bank loan despite the extra work on both sides. All that’s necessary is an agreement outlining how much has been borrowed and when it needs to be repaid rather than needing multiple forms of financial information, like your income and assets.

A simplified process makes sense, given the level of trust between borrowers and lenders. Having less paperwork involved helps make things easier. It clarifies expectations while saving time in getting everything set up correctly, which means more time spent enjoying whatever was purchased with the funds!

No Credit Check

Borrowing money from friends or family provides numerous advantages, one of which is that it does not involve a credit check. Individuals who have experienced difficulty obtaining loans from traditional sources benefit. Borrowers’ credit history must be considered when assessing their loan application. The process is much simpler and involves less paperwork than a standard loan application. Borrowers seeking funds can skip filling out extensive forms and providing detailed personal information.

The lack of credit assessment means borrowers are not scrutinized and experience greater peace of mind when requesting financial assistance.

The freedom lends itself to more relaxed requirements for repayment terms, making the entire agreement easier for both parties involved. Therefore, borrowing money from friends or family provides an efficient way for individuals to obtain funds without going through long-winded processes and intrusive questioning about their finances. On top of that, it opens up new opportunities for people otherwise excluded from accessing funds due to their circumstances.

Potential Disadvantages Of Borrowing Money From Friends And Family

Borrowing money from friends and family only partially ends positively if expectations are clearly defined and both parties adhere strictly to their agreement. All parties involved must take any loan agreements seriously; failure to comply with the results damages personal relationships and causes financial losses if emotions become involved. It complicates matters further and leads to disputes over repayment terms or interest rates.

Risking Personal Relationships

Borrowing money from friends and family is a slippery slope. It often puts personal relationships at risk. The reality of potentially ruining bonds with those closest to you must be understood. The fear of disappointing beloved ones causes guilt and shame. Failure to repay leads to both parties’ resentment, anger, and bitterness. The situations linger even after they’ve been resolved due to the social nature of borrowing money between family members or friends.

Lack Of Legal Protection

Taking out a loan from friends and family is often considered a gamble. There are unseen dangers when borrowing money from people close to you. One such risk is the need for legal protection with loans from family and friends.

There is usually an assumption that both understand the terms without formalizing them in writing. It leads to understanding and clarity when it comes time for repayment or additional terms are added. Both parties have real recourse if things go wrong without any legally-binding contract. They cannot seek compensation due to their non-existent contractual obligations if either party breaches the agreement.

Taking out a loan from friends and family sometimes quickly becomes complicated unless all involved take extra precautions beforehand, even though it appears convenient at first glance. The potential consequences of not having clear terms and conditions make the loans dangerous. If issues arise, it takes away both parties’ rights, leaving them vulnerable and exposed to financial losses.

No Clear Terms And Contract

The major issue with obtaining a loan from family and friends is clear terms and contracts. The absence of any formal arrangement leads to disputes over matters such as the loan period or what penalties apply if payments are not made on schedule.

Borrowers looking into borrowing money from friends or family must draft a contractual agreement outlining all relevant information. Lack of clarity around financial expectations makes it difficult to establish an understanding between both parties and leaves borrowers feeling uncertain about their obligations toward repaying their debt. Any verbal commitment made by either party lacks enforcement resulting in potential disagreements which damage relationships permanently without a legally binding document.

Lack Of Professional Advice

Professional advice is needed when borrowing money from friends or family. Borrowers need to understand what terms and conditions they agreed to with the guidance of someone experienced in financial matters. Borrowers need help to comprehend any legal repercussions if repayment goes awry. The borrowers need more knowledge about managing their debt responsibly after receiving the loan without an expert’s help.

What Happens When You Default?

First, its impact on the relationship between borrowers and lenders must be acknowledged. Defaulting such a loan leads to broken trust, strained emotions, and damaged relationships. The next consequence of defaulting on a loan from friends or family is the financial implications. There are potentially severe penalties for not making payments in full and on time, depending on how much money was borrowed and what terms were agreed upon in advance.

Legal action is sometimes taken if the debt is not settled. Therefore, defaulting on loans from friends or family must be examined carefully before taking a loan. With proper communication about expectations and potential outcomes before signing any documents, both parties fully know their rights and obligations throughout the repayment process.

Conclusion

Taking out loans and borrowing money is often seen as desperation due to needing more other options, but it presents certain advantages. There is flexibility not found elsewhere, which is useful for those who need financial assistance. At the same time, few risks are associated with the loans, such as a lack of legal protection and no clear terms and contracts.

Loans from friends or family are beneficial when used responsibly. Borrowers must review the pros and cons when deciding if or not such type of loan is right for them. A loan from family or friends provides the help needed while avoiding many potential drawbacks with proper consideration and care taken.

Frequently Asked Questions

What are the advantages of borrowing money from friends and family instead of traditional lenders?

Advantages include more flexible repayment terms, lower or no interest, no credit check, quicker access to funds, and strengthening personal relationships through the act of lending support. Loved ones may be willing to help when banks will not.

What are the potential drawbacks of taking a loan from loved ones, and how can they impact relationships?

Drawbacks include straining relationships if repayment issues arise, lack of legal loan protections, and discomfort discussing finances openly with friends or family. Defaulting on a personal loan can ruin relationships. Clear terms and boundaries are critical.

How can one establish clear terms and boundaries when borrowing money from friends or family to avoid conflicts?

Have a written agreement outlining repayment amounts and timelines. Discuss expectations upfront and decide on consequences for late payments. Agree to discuss any issues openly. Maintain privacy otherwise. Treat it like a business transaction despite the relationship.

What are some alternative options to consider before asking friends or family for a loan?

Alternatives to explore first include bank/credit union loans, credit cards with promotional rates, employer assistance programs, payment plans with service providers, crowdfunding, scholarships, and government aid. These provide financing while avoiding risks to personal relationships.

What are the best practices for repaying a loan from friends or family to maintain a healthy relationship?

The best practices are making repayment a priority, sticking to the agreed terms, keeping in contact about any issues before they escalate, showing appreciation, following up after it’s repaid, and preserving the relationship by avoiding money topics going forward.