Installment loans in Ohio for bad credit installment loans are a viable option for individuals unable to qualify for traditional bank loans. Ohio Installment loans allow borrowers to borrow a fixed amount of money and repay it in regular installments over several months to a few years, making it more manageable for other individuals. Borrowers must know bad credit score loans have higher interest rates and fees than traditional loans. Read and understand the terms and conditions of the loan. Must have the ability to repay the loan. Compare rates and terms from multiple lenders to find the best deal, and be aware of the approval process for each lender.

What Are the Types of Installment Loans In Ohio?

The installment loans available in Ohio include personal installment, payday, title, student, mortgage, and installment loans for bad credit. Personal installment loans are unsecured and are useful for various purposes. Payday loans are short-term and flexible but lead to a cycle of debt. Title loans use a vehicle as collateral. The government offers student loans and private lenders to pay for education expenses. Mortgage loans are useful for purchasing real estate, and installment loans for bad credit provide a viable option for individuals with bad credit history who need financial assistance.

Personal Installment Loans

Online installment loans are also available in Ohio, providing individuals with a convenient way to apply for loans without the need to visit a physical location. This option allows people to get their loan approvals faster, which can be beneficial in dealing with financial emergencies.

Personal installment loans in Ohio are unsecured loans that provide the borrower with a lump sum. They must repay the loan in equal monthly installments over a set period. They have fixed interest rates determined by the borrower’s credit score, income, and other factors. Personal installment loans are versatile and are useful for various purposes like home improvements, medical expenses, or debt consolidation. Banks, credit unions, and online lenders offer them, and applicants need to provide documentation, like proof of income and identification, to apply.

Payday Loans

Payday Loans are short-term lending with repayment scheduled for the borrower’s next paycheck. They are helpful in emergencies or when other financing options are unavailable. Payday loans are more flexible than traditional bank loans, allowing borrowers to choose their loan amount and repayment plan. They are unsecured loans between one and a thousand dollars that people borrow to deal with financial emergencies or make ends meet between payments. One option for payday loans is a cash advance loan, which can be applied using an online application form. Payday loans can sometimes spiral into a never-ending circle of debt.

Title Loans

A title loan is a type of secured loan that provides quick access to cash for borrowers who own a vehicle outright. Its loan allows borrowers to use their vehicle as collateral in exchange for a loan. The lender places a lien on the vehicle’s title, meaning they have the legal right to repossess the vehicle if the borrower fails to repay the loan. Title loans are helpful for individuals who need quick access to cash.

Student Loans

Student loans are financial aid provided to students to help them pay for their college or university education. The loans are obtained from the federal government, private lenders, or through the college or university itself. Federal student loans are the most common type of student loan issued by the U.S. Department of Education.

On the other hand, private student loans are issued by banks, credit unions, and other financial institutions. Students only have to begin repaying their loans after they graduate or leave school, unlike other types of loans, and repayment plans vary depending on the type of loan. Student loans cover tuition fees, room and board, textbooks, and other educational expenses. Students must check the amount of money they borrow and explore other financial aid options before obtaining a loan, as the repayment of student loans significantly impacts their financial situation after graduation.

Mortgage Loans

A mortgage loan is a popular loan used to finance a real estate purchase. The borrower uses the purchased property as collateral and pays back the loan over a period of time with fixed or adjustable interest rates. To qualify for a mortgage loan, borrowers need a good credit history, a stable income source, and a down payment. Mortgage loans are useful for purchasing primary residences, vacation homes, and investment properties. They are used to refinance an existing mortgage for better interest rates or lower monthly payments when someone has a poor credit history.

Installment Loan for Bad Credit

Installment loans for bad credit offer a viable option for individuals with poor credit scores who need financial assistance. Short-term loans enable borrowers to repay the borrowed amount over a set period through fixed monthly payments, providing a steady income. They do not require collateral, providing borrowers more flexibility than traditional bank loans. Installment loans for poor credit are a viable choice for borrowers who do not qualify for conventional loans owing to low credit ratings or a lack of collateral, despite their higher interest rates and the need for a steady income.

In addition to installment loans, payday loans are another short-term lending option for Ohio residents needing quick access to cash. While installment loans allow borrowers to pay back the amount borrowed in fixed installments over several months, payday loans provide funds that must be repaid in full by the borrower’s next paycheck. To learn more about payday loans and how they work in Ohio, check out our informative article on Payday Loans Ohio.

What Are Installment Loans Qualifications?

The qualifications for installment loans vary depending on the lender, loan type, and the borrower’s financial situation. Borrowers need to be at least 18 years old, have a steady source of income, pass a credit check, have a favorable debt-to-income ratio, provide valid identification, proof of residency, and provide collateral. Listed below are the qualifications for Installment Loans.

- Borrowers must be 18 years old to apply for a loan.

- Lenders require borrowers to have a steady source of income, like employment, self-employment, or social security benefits.

- Lenders check the borrower’s credit score to determine their creditworthiness and the interest rate they offer. Borrowers with higher credit scores are more likely to qualify for lower interest rates and better loan terms.

- Credit check installment loans are an option for borrowers with bad credit. These loans can be repaid over a fixed period, and as long as borrowers meet the repayment schedule, they can help rebuild their credit.

- Lenders must check the borrower’s debt-to-income ratio, which compares their monthly debt payments to their monthly income. A lower debt-to-income ratio indicates a better ability to repay the loan.

- Borrowers must have valid government-issued identification and proof of residency in the state where they apply for credit check installment loans.

- A loan agreement is a legal document between the borrower and the lender outlining the loan details, including interest rate, repayment terms, and any additional fees.

- Other loans require collateral, like a car or property, to secure the loan.

Here are some statistics about installment loans in Ohio:

| Statistic | Value |

|---|---|

| Average interest rate | 25% |

| Average repayment term | 3 years |

| Average amount borrowed | $5,000 |

| Most common use | Unexpected expenses |

| Most common lenders | Banks, credit unions, and online lenders |

| Payday loans | Banned |

| Short-term installment loans | Capped at $600, maximum APR of 28% |

| Consumer Installment Loan (CIL) | Up to $5,000, maximum APR of 25% |

How To Find The Best Loan For Bad Credit?

Check one’s credit score and report, shop around, read reviews, examine getting a co-signer, and review the loan terms carefully before accepting any offer to find the best loan for bad credit. Considering a no-credit-check loan might be an option, but it’s essential to understand that these loans typically have higher interest rates. Checking one’s credit score gives consumers an idea of what to expect regarding interest rates while shopping around, and reading reviews help individuals compare rates, terms, and fees from different lenders. Checking your credit score involves the major credit bureaus, which can impact your score. Having a co-signer improves the chances of approval and lowers their interest rate. It’s essential to explore various loan products and choose the best-suited option.

- Check the credit score. Start by checking one’s credit score and understanding the credit report. It gives applicants an idea of what lenders are looking for and what interest rates borrowers expect to pay during their loan request.

- Shop around. Look for lenders specializing in bad credit loans and compare their rates, terms, and fees. Check traditional lenders, like banks and credit unions, and online loans providers.

- Read reviews. Check online reviews from other borrowers to get an idea of the lender’s reputation and customer service. Ensure also to consider how well they are known for providing reasonable interest rates.

- Get a co-signer. Ask a trustworthy friend or family member with excellent credit to co-sign the loan with borrowers if one needs strong credit. Get a lower interest rate and a higher approval likelihood if a co-signer exists.

- Review the terms. Understand the interest rate, payback duration, and any costs associated with a loan offer before accepting it. Please find out the interest rate and the monthly payment amount, ensuring to look for reasonable interest rates.

What Are The Advantages And Disadvantages Of Installment Loans?

Borrowers must examine factors before deciding to get an installment loan. The advantages of installment loans include fixed interest rates, flexible repayment terms, and wide availability. In contrast, disadvantages include higher interest rates, more fees, potential harm to credit scores, and the temptation to borrow more than needed.

Advantages of Installment Loans

- One advantage of installment loans is that they have fixed interest rates and a set repayment schedule, making it easier for borrowers to plan and budget their payments.

- Installment loans offer a variety of repayment terms, ranging from a few months to several years, depending on the loan type and amount. It allows borrowers to choose a term that fits their financial situation and repayment ability.

- Installment loans are widely available, and borrowers find a lender that fits their needs and credit score, making it easier to obtain funds when needed.

Disadvantages of Installment Loans

- Installment loans are relatively easy for other borrowers to borrow more than they need, leading to more debt and financial strain. Installment loans have higher interest rates, especially for borrowers with bad credit, than secured loans, like mortgages or car loans. This is even more common when seeking a no-credit-check installment loan where the lender doesn’t verify the borrower’s creditworthiness.

- Installment loans have other fees, like origination fees, prepayment penalties, or late fees, which increase the total cost of borrowing. Also, alternative borrowing options like credit cards may come with lower fees.

- A borrower’s credit score and ability to get future loans take a hit if they fail. Meeting the specific eligibility criteria is crucial to avoid such consequences.

What Are The Factors To Check In Obtaining Installment Loans For Bad Credit?

When obtaining installment loans for bad credit, the factors to know include interest rates, repayment terms, fees, loan amount, and lender reputation. Borrowers must compare interest rates, choose a repayment term that fits their budget, understand any fees associated with the loan, determine the amount of money they need, and research the lender’s reputation to know reliability and trustworthiness.

- Interest rates – A borrower with poor credit is charged more than a borrower with excellent credit. Compare the interest rates different lenders offer and choose the one that offers the lowest rate.

- Repayment terms – The repayment terms of installment loans vary depending on the lender, loan type, and amount. Choose a repayment term that is comfortable for the budget and allows borrowers to make timely payments.

- Fees – Other lenders charge fees and penalties for late payments, prepayments, or loan origination. Understand the fees associated with the loan and factor them into the overall cost of borrowing.

- Loan amount – The loan amount a person qualifies for with bad credit is lower than what one receives with good credit. Determine how much money a person needs and know that the lender provides the necessary funds.

- Lender reputation – Research the lender’s reputation and read reviews from other borrowers to know they are reliable and trustworthy.

Installment Loans Interest Rate and Credit Score

The table below compares the interest rates, minimum credit score necessary to apply, and several forms of poor credit installment loans. The table highlights that interest rates vary greatly depending on the lender and the type of loan, according to U.S.News. The data in the table show that a wide variety of loans are available to borrowers with less-than-perfect credit, but they have high-interest rates and other costs. More than 20%, compared with 10% for very good credit

| Type of Loan | Credit Score Required | Interest Rate |

| Mortgages | 620 or higher | Varies depending on the lender |

| Personal Loans | Less-than-perfect credit | Up to 36%, few rise into the triple digits |

| Auto Loans | Less-than-perfect credit | |

| Student Loans | Less-than-perfect credit | Varies depending on the lender |

As a leading provider of installment loans in Ohio, we are proud to serve numerous cities across the state. Our commitment to financial accessibility and exceptional customer service has allowed us to establish a strong presence in key urban centers. Below is a comprehensive list of the most important cities where our company is active, providing reliable and flexible installment loan solutions to meet your financial needs. Whether you reside in a bustling metropolis or a charming town, we are dedicated to helping you navigate your financial journey with ease and peace of mind. Explore the table below to discover if our services are available in your city and take the first step toward securing the funds you require.

| Columbus | Cleveland | Cincinnati |

| Toledo | Akron | Dayton |

| Parma | Canton | Lorain |

| Hamilton | Youngstown | Springfield |

| Kettering | Elyria | Newark |

Bottom Line

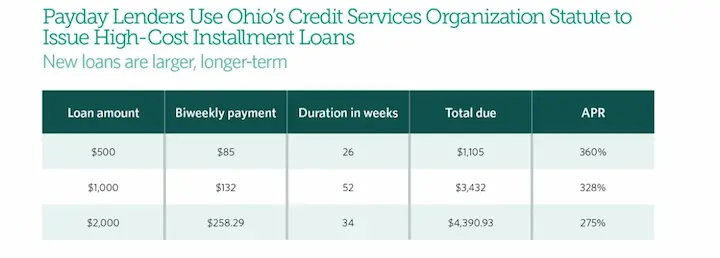

Standing apart from its counterparts like Indiana, Michigan, Kentucky, West Virginia, and Pennsylvania that have robust consumer credit frameworks, Ohio charts its own course. The state laws here are generous, allowing interest rates to stretch up to 28% APR and fees that are not tightly regulated. Consequently, it’s not uncommon to find loans less than $500 bearing APRs of anywhere between 200-600%, a fact underscored by industry analysts. But winds of change are blowing with bipartisan lawmakers rallying for a standardized 28% APR cap. While some debate the potential pitfalls of such a change, many are optimistic about the positive impact it could have on Ohio’s populace.

Credit Check Loans in Ohio for bad credit provide a practical solution for individuals unable to qualify for traditional bank loans. Borrowers must know installment loans have higher interest rates and fees than traditional ones. Read and understand the terms and conditions of the loan, can repay the loan, and compare low-interest rates and terms from multiple lenders to find the best deal.

The installment loans available in Ohio include personal installment, payday, title, student, mortgage, and installment loans for bad credit. The qualifications for installment loans vary depending on the lender, loan type, and the borrower’s financial situation. Borrowers must meet the minimum qualifications, like having a steady source of income and passing a credit check, to be eligible for installment loans in Ohio.

Frequently Asked Questions

What are the requirements to qualify for an installment loan in Ohio if I have bad credit and don’t want a credit check?

Typical requirements are Ohio residency, age over 18 years, income verification through paystubs or bank statements, active checking account, valid contact info, and regular employment. Without a credit check, income and ability to repay are the main qualifications.

How much money can I borrow with an Ohio installment loan for bad credit without a credit check?

Loan amounts for Ohio installment loans without a credit check for bad credit borrowers generally range from $100 up to a maximum of around $2,500 – $5,000 depending on the lender. Loan amounts are lower than with credit checks.

What loan terms are available for installment loans for bad credit in Ohio without doing a credit check?

Typical terms for Ohio no credit check installment loans for bad credit range from 3 months up to 24 month installment loans. Specific repayment term options depend on factors like the lender, loan amount, and income verification.

Will not having a credit check impact the interest rates and fees for an installment loan in Ohio if I have bad credit?

Yes, not having a credit check will result in higher interest rates and fees due to the increased risk assumed by lenders. APRs can range from 60% up to over 200% without a credit check.

Which lenders in Ohio offer installment loans for bad credit borrowers without checking their credit history?

Some Ohio lenders offering installment loans for bad credit without credit checks.