What Is A $255 Payday Loan Online In California For Bad Credit With No Credit Check?

A $255 payday loan online for bad credit with no credit check is a type of loan ideal for borrowers in California who are short of money and urgently need a loan until their next paycheck. The maximum finance charge is 15%. After the $45 loan charge is paid, you may get a payday loan online for up to $255. Payday loans in California are legal and regulated by the Department of Business Oversight, which oversees the lenders (DBO).

At PaydayChampion, you can learn what a payday loan is and how our application process works. Our direct network of lenders will deposit the money into your bank account in as little as one business day. If you apply early enough, you could receive the cash the same day.

Our online platform aims to provide a seamless experience, making applying for a loan easier. Furthermore, our same-day funding option ensures that you receive the much-needed cash in the shortest possible time. Remember that qualifying for our same-day funding service depends on the timely submission of your application.

Main Points

- A $255 payday loan is a type of loan for borrowers in California who urgently need money until their next paycheck, with a maximum finance charge of 15%. This loan can be helpful in financial emergencies and is a temporary solution for cash flow issues.

- PaydayChampion is a matching service for borrowers and lenders specializing in short-term financing solutions, such as emergency loans. It offers $255 loans with no credit checks, direct lenders, and no hidden fees. They also offer options from various online lenders to provide the ideal loan solution for your unique financial needs.

- You don’t need a credit score to apply, be approved, and receive a $255 loan from PaydayChampion. However, you need to meet some eligibility requirements, such as being a U.S. citizen or a permanent resident, over 18 years old, having an active bank account, earning at least $800-$1000 a month, and living in a state where the loans are legal.

- If you apply early enough, you could receive the cash on the same day, and if you can’t repay the loan on time, you can extend the due date for a fee. However, it’s important to be aware of the high-interest rates and potential risks of payday loans, such as the cycle of debt.

Can I get $255 Near Me On The Same Day From Direct Lenders Only?

Yes, getting an instant $255 loan near me from direct lenders only on the same business day is possible, with same-day approval. Our AI-driven, lightning-fast verification process pairs you with a suitable lender even with a bad credit score. Ensure your loan application contains accurate and comprehensive information to prevent delays and speed up loan approval. If you apply before the cut-off time, approximately midday, and qualify for credit check loans, you have a better chance of getting a loan.

If we don’t deposit your loan by the end of every business day, it will be sent out the following day. Please note on weekends, you will also have to wait until Monday.

Why Choose PaydayChampion for My $100 to $300 Payday Loans With Low Credit in CA?

Our Direct lenders offer no credit check loans of $100 to $300 with low credit in California and are also good for borrowers with bad credit. There are no hidden fees, and Payday Champion’s network of direct lenders will be transparent about interest charges, rollover fees, and due dates, ensuring a smooth loan approval process and same-day approval when possible.

Payday Champion is a premium matching service for borrowers and lenders that prioritizes the needs of its customers because of these three aspects. They offer an online application process, streamlining the experience for users searching for financial assistance through their vast network of loan websites.

- No Credit Checks: Our valued customers can borrow without damaging their credit scores. As our lenders do not do a hard pull of your credit score, you can rest assured that your credit rating will not be harmed further. As a result, regardless of your credit history, we can supply you with the same top loan offers, including credit check payday loans. Soft credit checks are the best choice when you have a poor credit score.

- Direct Lenders: Our direct payday lenders have been vetted for transparency. You may rest easy knowing that your lender will do everything possible to meet your financial obligations, respecting the loan terms. Also, our lenders specialize in short-term financing solutions and have a streamlined lending process. They know that getting funds to you in an emergency is important.

- There are no additional fees or prepayments: Hidden fees can rob you of your hard-earned cash when you make repayments. The only expense is the interest rate offered to you by the lender. You should always check your loan application for terms and conditions. You are liable to repay the loan; only you know if you can afford it. As $255 is the maximum allowed in California. The repayments are much more manageable than in other states where you can borrow $1000.

As a leading financial solutions provider, our company proudly serves customers across the vibrant state of California. We understand that unexpected expenses can arise anytime, and our mission is to offer reliable payday loan services to help bridge those financial gaps. With an extensive network of branches strategically located throughout the state, we ensure accessibility and convenience for our valued customers. Whether you need immediate funds in bustling urban centers or seek assistance in smaller communities, our company is active in several key cities across California. The table below highlights the most important cities where our services are available, illustrating our commitment to supporting individuals and families in their financial journeys.

| Los Angeles | San Diego | San Jose |

| San Francisco | Fresno | Sacramento |

| Long Beach | Oakland | Bakersfield |

| Anaheim | Stockton | Riverside |

| Irvine | Santa Ana | Chula Vista |

For California residents looking for more flexible repayment options, installment loans can be a great alternative to traditional payday loans. Installment loans allow you to borrow a larger amount and repay it over multiple scheduled payments. To learn more about the benefits of installment loans and how they work in California, check out our informative guide on Installment Loans California.

Do You Offer $255 Direct Lender Loans in California For Bad Credit With Guaranteed Approval?

You can get legit short-term loans for bad credit with guaranteed approval from our lenders if your credit improves. They can give you a loan agreement for unexpected expenses and emergency cash needs, such as emergency expenses even with bad credit. As mentioned above, because there are no hard credit checks and by considering your emergency expenses, you have a high chance of being approved, even if you have poor credit.

We will help you locate a state-licensed lender specializing in quick cash loans for people with bad credit. Complete our online loan application form to locate your cash advance options, such as a credit union, to start the process of receiving your loan. You can see we are comparing the best $255 Instant payday loans. Once we’ve discovered a match and the lender approves you, we’ll provide you with guaranteed and secure instant approval for Instant payday loans.

Do I need a Minimum Credit Score For A $255 Payday Loan Wirth Same Day Deposit & No Denial?

You don’t need a credit score to apply, be approved for, and receive a $255 or $100 loan near me from Paydaychampion with same-day approval and no denial. Your credit score is not a factor for a $255 loan. Due to the small loan amount you are borrowing, our online payday loan providers avoid assessing your credit to approve you quickly. This makes your loan request more accessible regardless of your credit situation, giving you more options to choose from the types of loans available.

We won’t inquire about your credit score or contact any major credit bureaus to do so. That a result, we will handle your loan request in the same manner as we do for borrowers with excellent credit, even if you have terrible credit. When understanding the debt relief choices available to California residents, debt management programs may be beneficial.

What Are the Eligibility Requirements for The Best $255 Loans With Instant Funding?

If you apply for the best loan with instant funding from any of our direct lenders, here are the main requirements you need to meet;

- You must be a citizen of the United States or a permanent resident.

- Be over 18 years of age.

- Have an active bank account

- Earn at least $800-$1000 monthly, also considering your monthly income.

- Live in a state where the loans are legal.

- Have a valid email address and working phone number

- A social security number

- Provide proof of income.

You will need a source of income to apply for any loan. That income could also be unemployment benefits.

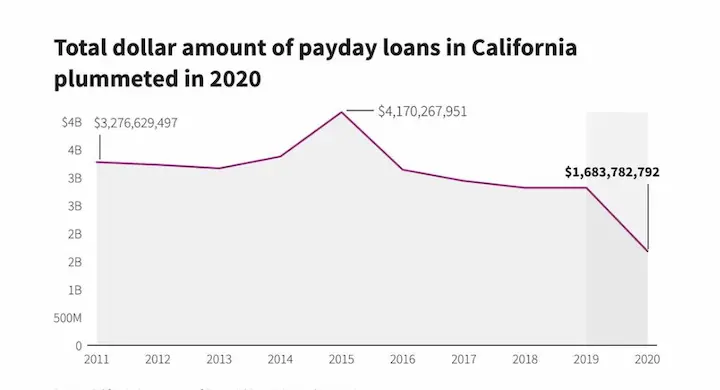

Here are statistics about a $255 payday loan in California:

| Statistic | Value |

|---|---|

| Maximum amount | $255 |

| Annual percentage rate (APR) | 460% |

| Maximum term | 31 days |

| Average origination fee | $15 |

| Average monthly payment | $25 |

| Total cost of borrowing | $305 |

Frequently Asked Questions

The following information explains your loan’s approval, due date, available repayment terms, and other loan parameters. Beyond the ones listed below, you can contact us with further inquiries.

When Will the $200 Loans Approved in 1 Hour Be Deposited Into My Account?

You will receive your 1-hour $200 emergency same-day payday or installment loan within 24 hours or the following day after acceptance. Applying during the weekday hours will increase your odds of receiving your day payday loans quickly.

How Do Small Loan Lenders Determine My Repayment Date For The Loan Amount & Interest Rates?

Your following payday is when your small payday loan repayment is due, plus interest. Check the date of your due date against the source of money you will use for repayment to the loan company. Regular payday loan repayment dates range from 2 to 4 weeks, based on your source of income.

The repayment period for day payday loans is a maximum loan duration of 31 Days. Monthly payments are possible with personal installment loans, not payday loans.

Can I Extend My Legal Payday Loan’s Due Date?

Yes, lenders can extend your due date for final payment on your legal payday loan with same day deposit. Communicate with your lender and determine the specifics of your request as soon as you suspect you won’t make it by the due date. Share your justifications for extending the loan principal and your future intentions. Make a new deal with the lender and make a concerted effort to stick to your new payment plan. Many lenders reorganize the repayments into daily or weekly payments to lessen the load. Understanding the factors influencing your loan decision is crucial when considering your options.

Let’s politely inquire how lenders may forgive you for your missed payments. It is always better to communicate with lenders than miss payments. Be prepared to discuss any unexpected costs that may have contributed to your inability to make timely payments.

Should I get A $500 Installment Loan Instead Insread Of a Fast Payday Loan?

Different loan types should be considered depending on your financial situation when you need a $500 loan. Personal or installment loans with fast funding to debit card may be better with a good credit score. This is a better choice if you want to repay a larger monthly amount instead of one loan payment. Please be aware that requesting higher amounts may involve a hard credit check and an origination fee. The approval process is the same, and you can find an online application form on our site.

What Will Happen If I Immediately Fail to Repay My Payday Loan With Instant Funding to Debit Card?

If you immediately fail to repay your weekend payday loan with instant funding to debit card, your creditor will contact you by email and phone to find out what is happening and if you can pay. Lenders can write you an official letter at your home address if you ignore them. If you don’t reply, they can try to contact you at your place of employment. Considering the annual percentage rate before taking a loan is important to avoid such situations.

In the worst cases, your lender might transfer your loan to a collection company. A collection agency will keep contacting you to negotiate a settlement. If you avoid them, your lender or debt collector may bring a lawsuit against you.

What Are The Benefits Of Working Directly With A Direct Lender That Approves Weekend Payday Loans?

There are numerous reasons to consider a direct lender for weekend payday loans when you need a loan. The following are some of the most important advantages of working with this particular sort of lender:

- Better borrowing rates and more advantageous terms and conditions are typically available, especially compared to the rates on payday loans offered by traditional lenders.

- Faster and more flexible conditions

- People with bad credit can get loans from a reliable source.

- If you get a loan, spend it on anything you want.

- Direct lenders mean direct contact and no third-party involvement.

The advantages of private money lending make it a good choice for those needing emergency funds. With instant funding available, it becomes an even more attractive option. That said, you should shop for the best interest rates before considering taking out a loan, as a Wide network of direct lenders sometimes has better loans.

Which States Does PaydayChampion Offer Online Payday Loans Per The Laws?

Various U.S. states have distinct laws governing payday loans with instant approval. Note that by 2023, not all states will have legalized payday lending. Continue reading if you need clarification on whether your state permits payday loans and how they operate where you live. For more information, you can also research your local laws online.

The specifics of legalization differ between states. The way that payday loans operate varies between California and Texas.

There are restrictions on lending and a cap on the overall number of payday loans you can take out in California. With the benefit of instant funding, it becomes essential to understand your state’s rules and regulations.

To guarantee that you only engage with reputable lenders who adhere to the rules in your state, find out what they are. It’s particularly important when considering traditional loans and bank loans, as these traditional loans often have more strict regulations.

Conclusion

Arizona, Nevada, and New Mexico have a more open view when it comes to high-cost loans, a contrast to California’s firm consumer protection laws that eschew payday lending. Some feel that Californians might be nudged towards exploring other financial options because of this. The abundance of lenders in surrounding states, however, seems to be a magnetic pull for many of California’s borrowers.