Indiana residents with bad credit find it difficult to obtain traditional loans from banks or credit unions. It leaves them in a tough spot to cover unexpected expenses like car repairs or medical bills. Many borrowers turn to payday loans to access quick cash as a result. But payday loans get high-interest rates and fees in certain cases, making it difficult for borrowers to repay the loan on time and avoid falling into a debt trap. The following article discusses payday loans in Indiana and how borrowers can avoid defaulting.

Summary Of IN Online Payday Loans For Bad Credit With No Credit Check

- Online payday loans in IN for bad credit with no credit check are short-term loans designed to provide quick access to cash for unexpected expenses or to bridge the gap between paychecks.

- Borrowers with bad credit turn to payday loans as they find it difficult to obtain traditional loans from banks or credit unions.

- Payday loans in Indiana have been criticized for their high-interest rates and fees, which make them an expensive form of borrowing and trap borrowers in a cycle of debt.

- Payday lenders in Indiana must be licensed and regulated by the Indiana Department of Financial Institutions and comply with legal requirements, including limits on loan amounts, interest rates, and fees.

- Eligibility requirements for payday loans with bad credit vary depending on the lender. Still, lenders examine a borrower’s income, employment history, and banking activity aside from their credit score when evaluating their eligibility.

What Are Payday Loans With Guaranteed Approval & Same Day Deposit?

Payday loans with guaranteed approval and same-day deposit are short-term loans due on the borrower’s next payday. They are designed to provide quick access to cash to cover unexpected expenses or to bridge the gap between paychecks. Payday loans are usually small amounts, ranging from a few hundred dollars, and are accompanied by high-interest rates and fees. Certain payday loans are available online through direct lenders, making them more convenient for borrowers who need quick access to cash. But payday loans are risky for borrowers who have difficulty paying the loan on time.

Who Are Direct Lenders Only Offering Payday Advance Loans With Instant Approval?

Online bad credit direct lenders only offering payday advance loans with instant approval are financial institutions offering payday loans and other short-term loans to borrowers with poor credit. Unlike traditional banks or credit unions, online bad credit direct lenders do not require borrowers to have good credit to be approved for a loan. They use other factors such as employment history, income, and banking activity to determine a borrower’s eligibility. Online bad credit direct lenders are a convenient option for borrowers who need quick access to cash and have been denied loans by traditional lenders due to their poor credit history.

Overview Of Good Payday Loans Near Me With No Denial

Payday loans near me for good and bad credit with no denial have been criticized for their high-interest rates and fees, which make them an expensive form of borrowing. Certain consumer advocates argue that payday loans trap borrowers in a cycle of debt, as they cannot repay the loan on time and end up getting more loans to cover the original loan. Many states have enacted laws restricting or banning payday lending in response to the issues. For example, payday loans are illegal in 18 states and the District of Columbia, while other states have limited the interest rates and fees lenders can charge.

Payday loans remain legal in the state of Indiana, but borrowers in the state must know the laws regarding the financial solution. Doing so helps them avoid potential risks and costs associated with payday loans.

Below are some statistics about Payday Loans In Indiana:

| Statistic | Value |

|---|---|

| Maximum loan amount | $500 |

| Maximum APR | 215% |

| Number of payday loan storefronts | 300 |

| Annual payday loan debt per borrower | $1,300 |

| Percentage of borrowers who roll over their loans | 65% |

| Percentage of borrowers who default on their loans | 10% |

| State law on payday loans | Indiana has a cap on the number of payday loans that a borrower can take out in a year. Borrowers can only take out three payday loans in a 12-month period. |

| State law on interest rates | The maximum APR on payday loans in Indiana is 215%. |

Legal Requirements For A $100-$500 Cash Advance Direct Lender Loan In The State Of Indiana

Payday lenders in Indiana for $100-$500 cash advance loans must be licensed and regulated by the Indiana Department of Financial Institutions. A direct lender must comply with many legal requirements to operate in the state, including limits on loan amounts, interest rates, and fees.

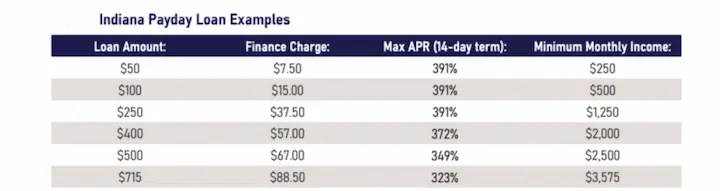

The maximum loan amount for a payday loan in Indiana is $550, and the loan term cannot exceed 14 days. Lenders charge a $20 administrative fee for each loan. Lenders can charge a finance charge of up to 15% for loans up to $250, 13% for loans between $251 and $400, and 10% for loans between $401 and $550, according to UStatesloans.org.

Payday lenders in Indiana must provide borrowers with a written agreement outlining the terms and conditions of the loan, including the total amount borrowed, the interest rate and fees charged, and the loan due date. Lenders must disclose the loan’s annual percentage rate (APR), which helps borrowers understand the true cost of borrowing. The maximum APR is 391%.

Indiana law prohibits payday lenders from engaging in abusive or unfair practices, such as threatening or harassing borrowers who cannot repay their loans. Borrowers can file a complaint with the Indiana Department of Financial Institutions if they believe a lender has violated the legal requirements.

| Loan Amount | Loan Term | APR | Total Repayment |

|---|---|---|---|

| $200 | 14 days | 391% | $278 |

| $300 | 14 days | 391% | $417 |

| $400 | 14 days | 391% | $556 |

| $500 | 14 days | 391% | $695 |

| $550 | 14 days | 391% | $760.50 |

| $550 | 7 days | 391% | $385.25 |

| $550 | 21 days | 391% | $1,135.75 |

The above table represents different scenarios for payday loans with a maximum loan amount of $550 and a loan term of 14 days. The table shows the loan amounts ranging from $200 to $550 with corresponding APR and total repayment amounts for the loan term of 14 days. The lenders are allowed to charge an APR of up to 391%. For example, a borrower who takes out a $200 payday loan has to pay an APR of 391%, resulting in a total repayment of $278.

The table includes different loan term scenarios for a $550 loan amount, i.e., seven days and 21 days. The total repayment amount for a 7-day loan is $385.25, whereas it is $1,135.75 for a 21-day loan term.

Eligibility Requirements To Qualify For $200 Payday Loans Approved Within 1 Hour

Eligibility requirements to qualify for $200 loans approved within 1 hour vary depending on the lender; borrowers with bad credit can still qualify for a payday loan in Indiana. Lenders examine a borrower’s income, employment history, and banking activity aside from their credit score when evaluating their eligibility for a loan. Borrowers must provide proof of income, such as pay stubs or bank statements, to be eligible for a payday loan with bad credit.

They must provide proof of employment, such as a letter from their employer, and a valid form of identification, such as a driver’s license or state ID. It’s best to note that payday lenders still check a borrower’s credit history when evaluating their eligibility for a loan. Still, more than bad credit is needed to disqualify a borrower from being approved. But borrowers with a history of missed payments, defaults, or bankruptcy face more difficulty obtaining a loan.

Listed below are the requirements for a payday loan in Indiana.

- Age – The borrower must be at least 18 to qualify for a payday loan in Indiana. The borrower must provide proof of their age, such as a driver’s license or birth certificate, to the lender when applying for the loan. The age requirement is in place to guarantee that the borrower is legally capable of entering into a contract.

- Residency – The borrower must be a state resident to apply for a payday loan in Indiana. The lender requires proof of residency, such as a utility bill or lease agreement, to verify that the borrower lives in Indiana. When applying for the loan, the borrower must provide their current address to the lender.

- Income – To qualify for a payday loan, the borrower must have a steady source of income. Lenders require proof of income, such as pay stubs or bank statements, to verify that the borrower can repay the loan. Lenders verify the borrower’s income by contacting their employer or other means.

- Bank account – The borrower must have an active checking account to receive a payday loan in Indiana. Lenders use the account to deposit loan funds and to withdraw a repayment from the borrower. Lenders require a bank statement or voided check to prove the borrower’s account. The borrower must provide their bank account information to the lender when applying for the loan.

- Identification – Borrowers must provide a valid form of identification, such as a driver’s license or state ID, to verify their identity when applying for a payday loan in Indiana. The requirement is necessary to prevent fraud and to guarantee that the borrower is who they claim to be. Lenders make a copy of the borrower’s ID and keep it on file for their records.

Applying For A $300 Small Payday Loan In Indiana To Get Approval Immediately

$300 small payday loans are easier to get than traditional bank loans, as the eligibility requirements for payday loans are less strict. Payday lenders immediately approve borrowers with bad credit or no credit history, requiring only basic documentation such as proof of income and a valid checking account. The ease of approval for payday loans is appealing to borrowers who need help to qualify for a traditional bank loan due to their credit history or other factors. But borrowers must know or familiarize themselves with the process to guarantee that their application process has no delays. Below are the general steps for applying for a payday loan in Indiana.

- Find a lender. Research and compare different payday lenders in Indiana to find one that suits your needs. Borrowers must search online or ask for recommendations from friends or family.

- Check eligibility. Review the lender’s eligibility requirements to make certain they meet the criteria. Requirements vary by lender but usually include age, residency, income, and a valid checking account.

- Gather documentation. Gather the necessary documentation to support the application, such as pay stubs or bank statements to verify your income and a government-issued ID to verify the borrower’s identity.

- Apply online or in person. Most payday lenders in Indiana allow borrowers to apply for loans online or in person at a physical location. Borrowers must follow the lender’s instructions for submitting their application and supporting documentation.

- Receive approval. Approved borrowers receive a loan agreement outlining the terms and conditions of the loan, including the amount borrowed, interest rate, fees, and repayment terms.

- Review the agreement. Carefully review the loan agreement before signing it to understand the terms and conditions. Borrowers with questions or concerns must ask the lender for clarification before signing.

- Receive funds. Lenders deposit the funds directly into the approved borrower’s checking account. The process is usually completed within one business day.

How Does Credit Score Affect The Cost Of Online Payday Loans?

Online payday lenders in Indiana do not require a credit check for borrowers to qualify for a loan. Payday loans are short-term loans with high-interest rates, meaning borrowers with lower credit scores are viewed as a higher risk. But borrowers with lower credit scores are charged higher interest rates and fees than applicants with higher credit scores. Payday lenders in Indiana charge borrowers higher interest rates and fees to offset the lender’s risk. It leads to higher overall costs for the loan, including higher interest rates and fees.

Benefits Of Applying For Indiana Online Payday Loan With a Cooling Off Period

Lenders market payday loans as a convenient way to get quick cash when people need it, but they offer other benefits. For example, due to poor credit history, Indiana payday loans with a cooling off period are a valuable resource for people who need access to traditional bank loans or credit cards. Payday lenders don’t require a credit check and use other factors like employment and income to make loan decisions. Here are the benefits of using payday loans.

- Quick and convenient – Payday loans are known for their convenience and quick access to cash. They are an ideal option for borrowers who need cash urgently, as they have fast approval times and direct deposit into their bank account within one business day.

- Accessible to borrowers with bad credit – Payday lenders are more open to lending to borrowers with bad credit or no credit history, as they don’t require a credit check. Payday lenders examine other factors, such as employment and income, when making loan decisions. It makes payday loans an accessible option for people who traditional lenders have turned down due to their credit history.

- Short-term borrowing – Payday loans are designed to be a short-term solution to a financial problem. They are meant to help people bridge the gap until their next paycheck. Payday loans have a term of two weeks to a month and are expected to be paid back in full at that time.

- Flexible loan amounts – Payday lenders offer a range of loan amounts, which are helpful if borrowers only need a small amount of cash. The flexibility allows borrowers to choose a loan amount that meets their immediate financial needs. The loan amount range from a few hundred dollars up to a few thousand dollars, depending on the lender and the borrower’s income and other factors.

- Easy application process – Many payday lenders allow borrowers to apply for loans online or over the phone, making the application process quick and easy. The application process involves filling out a simple form and providing basic personal and financial information. It is helpful for people who do not have the time or ability to visit a physical location to apply for a loan.

- No collateral required – Payday loans are unsecured, meaning borrowers don’t need to put up collateral such as their car or home to get approved. The structure contrasts traditional loans, which require collateral to secure the loan. The lack of collateral requirements makes payday loans more accessible to borrowers who do not have assets to put up as collateral.

As a leading provider of payday loans in Indiana, we take pride in our widespread presence across the state, ensuring convenient access to financial assistance when it matters most. With a steadfast commitment to serving our customers, we have established a strong foothold in several significant cities, enabling us to extend our support to individuals and families in need. Below, we present a comprehensive table highlighting the key cities where our company is actively engaged, allowing you to easily identify the nearest location for seamless assistance. We are dedicated to delivering reliable and transparent lending solutions, and we look forward to serving you in the cities we call home.

| Indianapolis | Fort Wayne | Evansville |

| Fishers | South Bend | Carmel |

| Bloomington | Hammond | Noblesville |

| Lafayette | Gary | Greenwood |

| Muncie | Kokomo | Westfield |

Indiana residents looking for alternatives to payday loans may want to consider installment loans. Installment loans allow borrowers to repay the loan in multiple scheduled payments over time. This structured repayment schedule can make installment loans more manageable for borrowers. To learn more about installment loans and how they compare to payday loans in Indiana, check out our article on Installment Loans Indiana.

The best way To Avoid Defaulting On An Online Payday Loan Per The Indiana :Laws

By communicating with the lender, borrowers can avoid defaulting on an online payday loan with bad credit in Indiana. Borrowers who cannot pay on time must tell the lender about it. Many lenders are open to working with borrowers to develop a repayment plan that fits their budget. Certain lenders even offer extensions or rollovers per the law, which give borrowers more time to repay the loan.

But it’s necessary to note that extensions and rollovers have extra fees, so borrowers must understand the terms and conditions before agreeing. Another way for borrowers to avoid defaulting on a payday loan is to obtain only what they can repay and prioritize making loan payments on time.

Conclusion

Indiana stands out with its sensible approach to payday lending, maintaining a cap of 222% APR. This ensures workers have the means to tackle unforeseen financial obstacles before their upcoming paycheck. Unlike the open-ended rates in Kentucky or the rigid rules of Michigan, Indiana’s method strikes a harmonious chord. It seamlessly marries the needs of consumers with safeguards, appealing to both the industry and its advocates.

Payday loans are a risky financial solution for borrowers with bad credit in Indiana. They are designed to provide quick access to cash for unexpected expenses but have high-interest rates and fees that trap borrowers in a cycle of debt. But borrowers who cannot obtain traditional loans due to poor credit history are still eligible for payday loans from online bad credit direct lenders. Indiana has laws and regulations to protect borrowers from abusive practices by payday lenders. Still, borrowers should know the terms and conditions of the loan to avoid falling into a debt trap.

Frequently Asked Questions

How can I find legitimate online payday loans in Indiana from direct lenders that cater to individuals with bad credit?

Avoid “bad credit payday loans” claims. Legitimate direct lenders in Indiana like Check Into Cash perform credit checks and have income criteria that may be hard to meet with poor credit and explore alternative lenders.

What are the key regulations and requirements governing online payday loans in Indiana, especially when dealing with direct lenders and bad credit situations?

Indiana regulations include limiting APRs to 72%, requiring licensing, prohibiting aggressive collection tactics, allowing payment plans, and banning wage garnishment in most cases – applicable to all direct lenders.

Are there well-established direct lenders in Indiana known for providing payday loans to people with poor credit histories?

Most direct lenders in Indiana perform credit checks and have income requirements that make approval with poor credit unlikely. Some may offer better alternatives for bad credit borrowers.

Can you explain the interest rates and repayment terms associated with online payday loans in Indiana from direct lenders, and how can borrowers make informed decisions?

APRs are capped at 72% but fees still apply. Terms are typically 14-30 days. Reading disclosures fully, comparing lenders, considering alternatives, and budgeting carefully can help inform decisions.

What alternatives exist for residents of Indiana with bad credit who may need short-term financial assistance, aside from payday loans from direct lenders?

Options like the Indiana Community Action Association’s emergency assistance programs, Township Trustees, credit unions, nonprofit credit counseling, payment plans from utility providers, or borrowing from family/friends could help those with bad credit in Indiana.