Payday Loans Kentucky (KY) | Online, No Credit Check & Bad Credit OK Near Me

Borrowers are familiar with the difficulties that arise from financial crises, even those with a stable source of income. PaydayChampion aims to simplify obtaining a Kentucky payday loan near me for bad credit with no credit check by offering the option to apply for quick cash advances through an online application, with funds available immediately after approval.

PaydayChampion loans are specifically designed to assist individuals who face challenges in obtaining traditional financing. Unexpected expenses occur at any time, which is why PaydayChampion offers flexible payment terms to facilitate easy and quick repayment of loans. Borrowers with poor credit scores or no credit history need to be reassured, as PaydayChampion’s lenders still approve their online loan applications.

Navigating the loan process is challenging, so PaydayChampion has created a guide to help Borrowers find the best bad credit loans available. Further information is located on our platform to understand how Reputable Lender PaydayChampion offers Payday Advances for borrowers with bad credit better.

Key Takeaways From PaydayChampion’s Payday Loans With Guaranteed Approval

- PaydayChampion simplifies obtaining a Kentucky payday loan with guaranteed approval by offering the option to apply for cash advances online, with funds available immediately after approval. The process doesn’t require a perfect credit record to get approval.

- PaydayChampion offers flexible payment terms to accommodate quick and easy repayment of loans, taking into account the annual percentage rate to ensure transparent costs.

- PaydayChampion’s lenders still approve borrowers with poor credit scores or no credit history, ensuring that a less-than-perfect credit record doesn’t impede your chances of getting a loan.

- PaydayChampion provides a guide to help Borrowers find the best bad credit loans available, showcasing options tailored for those with a challenged credit history.

- Payday loans are permissible in Kentucky with a maximum of $500, according to the National Conference of States Legislatures (NCSL).

- Payday loans are designed for individuals needing quick financial assistance without a rigorous credit evaluation process. Borrowers with a poor credit history are still eligible for payday loans in Kentucky.

Why Choose Us For Your $100-$500 Payday Loans?

With years of experience serving customers nationwide, we’ve built a reputation as one of the most trusted names in the industry. At PaydayChampion, everyone must have access to affordable short-term loans in KY ranging from $100 to $500. This belief has driven us to create an easy way for anyone to borrow money from their bank account without visiting a brick-and-mortar store.

At PaydayChampion, we are committed to providing reliable financial solutions to needy individuals, and we take pride in our presence across various cities in Kentucky. Whether you’re facing an unexpected expense or seeking a short-term loan, we strive to be there for you when you need it most. Below is a comprehensive list of the major cities where we actively serve customers with our payday loan services. Each city on this list represents a community where we are dedicated to supporting individuals in their financial endeavors, ensuring quick and accessible solutions. Look at the table below to discover the cities where we are ready to assist you with our dependable payday loan options in Kentucky.

| Louisville | Lexington | Bowling Green |

| Owensboro | Covington | Georgetown |

| Richmond | Elizabethtown | Florence |

Are Payday Loans With Instant Approval Legal in Kentucky?

Yes. Payday loans with instant approval are legal in Kentucky for a maximum of $500, according to the National Conference of States Legislatures (NCSL). The maximum loan term is set, and deferred deposit transactions are allowed within the limits.

The Law further specifies that a licensee does not hold more than two deposits from a single customer at any time. There is a 60-day limit on the maximum loan term, beyond which the Borrower is subject to harsh fines.

How Do $200 Online Loans in Kentucky Work?

In Kentucky, obtaining a $200 online payday loan is straightforward. Borrowers must complete a comprehensive online form on the website, including their personal contact information. The form is then reviewed by a credit partner who determines the loan’s eligibility. Upon approval, the Borrowers and the lender enter into an agreement, which is executed through digital means.

The entire process of obtaining a payday loan of $200 or any other desired amount is conducted online, ensuring the privacy and security of the Borrower’s information. The funds are transferred to the Borrower’s bank account within a maximum of one business day after all necessary processes have been completed. Repayment of the loan is automatically deducted from the Borrower’s account when the next payroll deposit is received. Remember that payday loan fees may be associated with this process.

The platform is dedicated to connecting Borrowers with reputable direct lenders who provide high-quality financial services. The Borrower is sometimes eligible for a personal loan with lower interest rates and a flexible repayment plan if the loan application is approved. Personal loans are considered less risky than other loans and have lower interest rates than credit cards or unsecured debt consolidation loans.

Availability of 1-Hour Payday Loans From Online Companies in Kentucky

1-hour payday loans in Kentucky are designed for individuals who require quick financial assistance without having to undergo a rigorous credit evaluation process. Borrowers with poor credit histories still apply for these loans from online companies in Kentucky. The lending institutions only conduct a soft credit check on their personal and financial information rather than a hard credit check. Even a soft credit check can secure better loan options for individuals with less-than-ideal credit records. In conclusion, applying for a payday loan in Kentucky can often involve undergoing a soft credit check to assess the Borrower’s financial background.

Payday loans are ideal for short-term financial needs, and the Borrower needs to remember that they are not relied on for long-term financial assistance. The lender needs to perform a credit check or evaluate their financial situation. With PaydayChampion, Borrowers rest assured that their request for cash loan advances via quick payday loans does not result in harsh credit inquiries.

Payday Loans Approved Immediately Are Available in Kentucky (KY)

Dealing with a constant cash shortage is difficult, but short-term loans approved immediately provide a solution. Payday loans are a commonly utilized financial solution despite their mixed reviews. Cash loans are available in Kentucky and are obtained online with no credit checks or bad credit, such as payday loans. The process is straightforward, and the funds are transferred to the Borrower’s account within one business day. PaydayChampion is dedicated to connecting Borrowers with reputable direct lenders who provide high-quality financial services in consideration of the Borrower’s financial situation.

Below are some statistics about payday loans in Kentucky:

| Statistic | Value |

|---|---|

| Maximum loan amount | $500 |

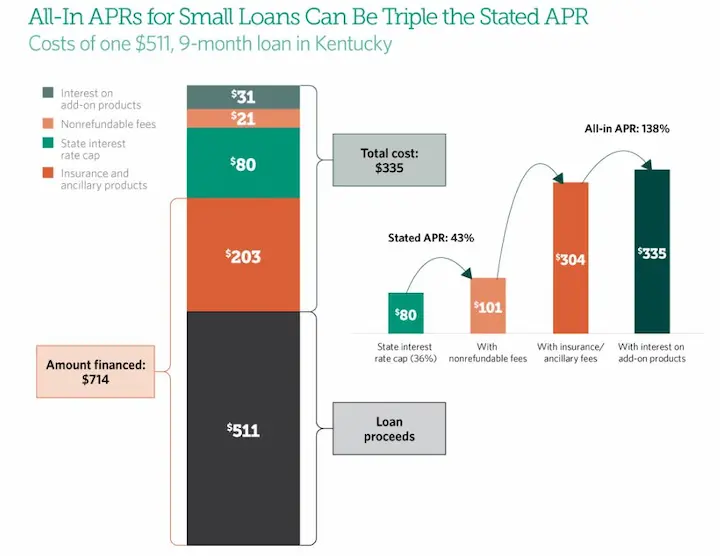

| Maximum APR | 36% |

| Number of payday loan storefronts | 80 |

| Annual payday loan debt per borrower | $1,200 |

| Percentage of borrowers who roll over their loans | 65% |

| Percentage of borrowers who default on their loans | 10% |

| State law on payday loans | Kentucky has a cap on the number of payday loans that a borrower can take out in a year. Borrowers can only take out two payday loans in a 12-month period. |

| State law on interest rates | The maximum APR on payday loans in Kentucky is 36%. |

| Other restrictions | Payday lenders in Kentucky are not allowed to charge fees for late payments or bounced checks. They are also not allowed to garnish wages or take other legal action to collect the debt. |

Reasons for Borrowers to Consider Payday Lenders For Cash Advances in Kentucky

There are various reasons a borrower must turn to a payday lender for a cash advance loan when facing a financial need. PaydayChampion offers assistance and access to a statewide database of lenders.

- Difficulty in Obtaining Bank Loans Borrowers need help securing a loan from a traditional bank, which takes considerable time and sometimes weeks to process. With our statewide database, we can connect borrowers to alternative lenders more efficiently.

- Assistance with Utility Bills-Making timely payments on bills such as rent or utilities proves difficult, and a loan must be necessary. Statistics show that 70% of Americans use cash advances to manage their daily expenses and financial obligations, including outstanding loans.

- Avoiding Burdening Family or Friends Sometimes, borrowing from family or friends is a suitable option. However, it puts pressure on those close relationships and those facing financial hardships. Access to a broader range of lenders through a statewide database can help alleviate this burden.

The Benefits of Getting Small Payday Loans in Kentucky

Listed below are some of the benefits of obtaining a small payday loan in Kentucky with the help of our statewide database:

- Streamlined Application Process Completing lengthy loan applications is time-consuming and confusing. With payday lending transactions, the application process is simple.

- Swift Approval and Direct Transfer of Funds The payday loan provider is committed to promptly processing the Borrower’s payday lending transactions application and transferring the approved funds to their bank account within one business day.

- Clear and Transparent Loan Agreements The payday loan provider strongly emphasizes transparency in all payday lending transactions and contracts. Borrowers have peace of mind knowing that every penny they pay is accurately reflected in the loan agreement.

Other Advantages Of $300 Payday Loans?

These are three reasons why obtaining a $300 payday loan from a lender in Kentucky is beneficial:

- Immediate Availability of Funds

Borrowers receive prompt access to funds by seeking a payday loan in Kentucky. This is because the top lenders in the state have a streamlined payday lending transactions approval process, which results in faster funding than traditional lending institutions.

- Flexible Usage of Funds Once approved for a payday loan, the Borrower utilizes the funds for any purpose. However, it is advised that borrowers, particularly those with a regular income, limit their loan applications to one at a time to avoid potential complications with monthly payments and credit history.

- No Credit Checks A poor credit score is not an obstacle for borrowers to obtain a payday loan in Kentucky. Lenders are primarily concerned with the Borrower’s ability to repay the loan on the due date and only perform a soft search loans credit check.

For individuals facing financial difficulties and limited options, applying for a payday loan through a direct lender might be a viable solution, especially for those with a regular income. The application process is straightforward, and the loan is accessible to individuals with good credit.

Kentucky Legal Payday Locations: Costs & Laws

These are the legal fees borrowers need to pay on a payday loan per the Kentucky laws.

- Finance charges. For loans less than $30, payday lenders do not charge more than 1

- Maximum APR. Maximum Annual Percentage Ratio (APR), $100 loans for 14 Days: 309%

- Acquisition fees. One-tenth of a borrower’s payday loan amount is a legit acquisition fee. The acquisition fee is allowed to be at most $10. If a loan amount exceeds $100,

- Maximum amount. Kentucky payday loans do not have a maximum limit. However, installment loans might be an alternative option for those who need bigger loan amounts.

- Maximum term. The loan term is between 24 hours to 31 days. Simultaneous loans may sometimes be possible, depending on the lender’s policy.

How to Apply For a Kentucky Payday Loan Online?

To secure an online payday loan in Kentucky, Borrowers must first meet certain requirements set by loan laws in the United States. It is illegal to lend money to individuals under the age of 18. Additionally, be aware of any service fees that might be applied alongside the loan amount.

Eligibility Criteria For Cash Advance Loans

Borrowers must be United States citizens and residents of Kentucky to be considered eligible for a cash advance loan. Additionally, having a steady income source and earning at least $1,000 monthly is necessary to ensure the Borrower can repay the loan in monthly installments.

Contact Information and Proof of Steady Income

To obtain loan approval, Borrowers must provide a valid email address and telephone number for easy communication. Failure to provide these details results in the inability to contact the

Borrower and Approve the Loan Request

To verify their steady income, Borrowers must provide proof of income, such as pay stubs or tax returns, to show their ability to repay the loan in monthly installments.

Proof of income is needed to verify employment status. This includes proof of paycheck stubs or tax returns demonstrating a steady income.

What to Do if A Kentucky Payday Loan With Same Day Approval Is Declined?

Although a Borrower takes various steps to ensure the approval of their payday loan application, there is still an instance where the application is declined. The most common reasons for denial on a payday loan with same-day approval include incorrect information provided, insufficient financial information, and inactive accounts. One key piece of information that must be accurate is the Social Security Number.

The Borrower must communicate with their chosen lender to understand why they deny their application. By doing so, the Borrower receives tailored advice and steps to take to increase their chances of approval in the future.

However, following general guidelines, such as ensuring accurate and comprehensive financial information, including a correct Social Security Number, reduces the likelihood of rejection.

Regardless, they are considering alternative options for obtaining funds if a Borrower’s payday loan application is declined.

Conclusion

In the realm of payday lending, Kentucky has crafted a commendable model of consumer protection. Their 200% APR threshold is undeniably more restrained compared to Tennessee, Virginia, West Virginia, and Missouri which have either much higher or unrestricted rates. Kentucky’s method is both empowering and protective, offering individuals a solution for sporadic monetary challenges while also implementing protective measures. While there are whispers of possibly tighter restrictions in the future, many laud the existing regulatory framework.

Borrowers who need funds consider applying for a payday loan. These loans typically offer quick approval and low-interest rates but have higher costs. It is important for Borrowers to fully understand the terms and conditions before taking out a loan, including loan payment schedules and the consequences of a defaulted loan. Long-term financial planning should also be considered, as long-term loans offer better terms for certain situations. paydaychampion.com provides necessary information and assistance to help Borrowers determine the type of loan most suits their needs. Contact us for more details.

Kentucky residents looking for alternative short-term financing options can also consider installment loans. Installment loans allow borrowers to repay the loan amount in multiple scheduled payments over time. To learn more about installment loans and how they work in Kentucky, check out our helpful guide on Installment Loans Kentucky.

Frequently Asked Questions

How do payday loans work in Kentucky, and what are the key regulations surrounding them?

Payday loans in Kentucky have a $500 max loan amount, 60 day minimum term, and APRs capped at 459%. Key regulations include limiting fees, restricting rollovers, and requiring licensing of all payday lenders operating in the state.

What are the eligibility criteria for obtaining a payday loan in Kentucky, and do they vary based on credit history?

Minimum eligibility includes ID, income verification, and a checking account. Bad credit applicants may still qualify but may face higher rates. All borrowers in Kentucky are protected by the same rate and fee limits under law.

What is the maximum loan amount and the typical interest rate for payday loans in Kentucky?

The legal maximum loan amount is $500. Interest rates are capped at 459% APR but most lenders charge around 400% APR. However, additional fees may also apply.

Are there any alternatives to payday loans in Kentucky for people facing financial emergencies or short-term cash needs?

Alternatives like Kentucky’s HANDS program, nonprofits, religious charities, payment plans from utility/medical providers, 401k loans, credit union loans, borrowing from family, credit cards, or paycheck advances may be available to those in need.

What steps can borrowers take to avoid falling into a cycle of debt when using payday loans in Kentucky?

Borrow only what is absolutely needed, have a repayment plan, avoid rollovers, don’t borrow from multiple lenders, look into debt management help, and find ways to supplement income to break the debt cycle.