Payday Loans In Nevada & Las Vegas No Credit Checks And Bad Credit: Accessing $100, $200, $300 Loans Instantly

Are you in dire need of fast cash? Have you been looking for a way to get your hands on $100, $200, or $300 instantly? Payday loans in Nevada are the perfect solution for people who need to cover an unexpected expense or tide them over until their next paycheck arrives. Payday no credit check loans are available online, so you can apply and receive funds from the comfort of your own home.

The simple process means you won’t jump through hoops to access the necessary cash. Don’t wait any longer if you’re looking for a way to get your hands on fast cash with minimal effort. Payday loans in Nevada are the answer. You have all the money you need in your bank account in just a few clicks.

Payday loans provide a quick source of cash when you need it urgently. They offer short-term unsecured loans ranging from $100 to $1,000, designed to be repaid on your next payday. The significant advantage of payday loans is their accessibility since almost anyone qualifies for them regardless of their credit score or history.

Payday loan lenders do not require collateral like banks or traditional moneylenders, and no asset needs to be at risk during borrowing. This makes them particularly useful for people with lower incomes or poor credit scores who do not have access to other forms of credit but still need emergency funds quickly.

SUMMARY

- Payday loans in Nevada provide a quick source of unsecured cash, usually ranging from $100 to $1,000, designed to be repaid on the borrower’s next payday.

- The loans are accessible to almost anyone regardless of their credit score or history and are particularly useful for people with lower incomes or poor credit scores.

- It is necessary to understand the loan terms and repay it on time; otherwise, interest rates and late fees become unmanageable.

- Nevada law restricts lenders from loaning borrowers more than 25% of their monthly gross income, and a table is provided to show the maximum loan amounts based on monthly gross income.

- The statute of limitations on a written contract, like a payday loan in Nevada, is six years, and there are limitations on the fees and interest lenders charge for defaulting on the loan.

- The benefits of applying for a payday loan include quick access to funds, fewer requirements for approval compared with larger loans, and its relative simplicity and speed compared to traditional finance methods.

A Comprehensive Guide To Online Payday Loans in Nevada and Their Benefits

Are you looking for a way to get fast cash? Payday loans in Nevada offer an effective solution and same-day access to funds with no credit check. It’s like having a financial safety net, but how do you know it’s right for you? The comprehensive guide helps you make an informed decision.

You have an unexpected expense and don’t have the means to cover it. Payday loans are a lifesaver in times of unexpected expense. You can apply online or in person; the funds are available the same day with no required credit check. There are things to look at before taking a payday loan in Nevada.

It is necessary to understand the terms of your loan. You must read all the loan details and understand any fees associated with the loan. You must repay them on time. Otherwise, the interest rates and late fees become unmanageable. Understanding your rights as a borrower is necessary. Familiarize yourself with state regulations regarding payday loans to be aware of any available protections.

Payday loans provide quick access to much-needed funds but must not be taken lightly. Educating yourself on your options and understanding all the risks and rewards involved help you decide if a payday loan is right for you.

Payday Loans Near Me In Nevada

Payday loans are short-term cash advances that help consumers in financial need. Such high-interest loans have become popular in Nevada and Las Vegas over the last few years. PaydayChampion’s overview explores the regulations and restrictions associated with payday lending in Nevada and Las Vegas. The maximum loan term in Nevada is 35 days, according to DebtHammer.

| Details | Values |

| Maximum loan term | 35 days |

| Average loan amount | $350 |

| Maximum loan amount | 25% of monthly gross income |

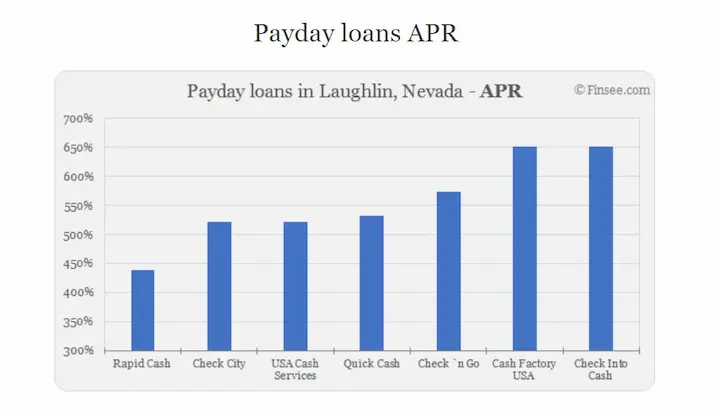

| APR Cap | None, the average is 652% |

| Number of payday lenders in Nevada | 256 |

| Number of payday lenders in Las Vegas | 122 |

| Average 14-day payday loan APR | 652% |

Payday lenders in Nevada offering cash and online payday loans must be licensed by the Financial Institutions Division (FID) of the Department of Business and Industry before offering their services to residents. They must display a valid license at each location where they conduct business and adhere to all applicable laws regarding interest rates, fees, loan terms, repayment plans, Finance Charges, etc. Lenders must provide borrowers with information about the total cost of borrowing before making any loan agreements. There is no limit on how much an individual borrows from a lender. Individuals must not obtain more than one payday advance simultaneously.

Overview Of Instant Payday Loans In Nevada: How to Get Small Loans Immediately

There are minimal legal restrictions on payday lending in Nevada. The only significant limitation in the state is that lenders can’t make a loan to a borrower that exceeds 25% of their gross monthly income. Otherwise, there are no caps on the amount that payday lenders can loan consumers or the interest rates they charge for their services. The annual percentage rates (APRs) regularly reach the high triple digits.

Maximum Loan Amount in Nevada: What You Can Get from Payday Lenders

State law prevents lenders from loaning borrowers more than 25% of their monthly gross income, while Nevada hasn’t any dollar amount restriction on payday loan amounts. For example, suppose a borrower with a monthly gross income of $3,000 applies for a payday loan. In that case, their lender cannot offer them a payday loan with a principal balance over $750. Lenders must verify a borrower’s income by checking their paystubs or W-2 and have them sign a waiver that states the loan does not exceed the allowed amount before they give them the loan, according to DebtHammer.

| Borrower’s Monthly Gross Income | Maximum Loan Amount |

| $1,000 | $250 |

| $2,000 | $500 |

| $3,000 | $750 |

| $4,000 | $1,000 |

The table is useful for borrowers taking a payday loan in Nevada as it gives them an idea of the maximum loan amount they receive based on their monthly gross income. It is helpful for lenders to evaluate their compliance with state law when offering payday loans to borrowers in Nevada.

What Is the Statute of Laws on Same Day Deposit Payday Loans in Nevada?

A statute of laws outlines the period where a creditor initiates legal proceedings to make a borrower pay their outstanding balances. You can use the age of the debt to defend a lawsuit if your payday loan has been delinquent for longer than the statute of limitations in your state. The statute of limitations in Nevada on a written contract, like a payday loan, is six years.

Rates, Fees, and Other Charge Limits for $500 Payday Loans in Nevada

The Nevada payday loan laws don’t include a limit on interest rates during the life of the $500 loan. Lenders can charge whatever borrowers are willing to pay for their payday loans. There are limitations on the fees and interest that lenders charge a borrower for failing to pay their payday loans which include two $25 non-sufficient funds fees and no more than 90 days of 10% interest on the balance after default.

The Maximum Term for a Payday Loan in Nevada: Understanding the Rules and Regulations

Payday loans have a maximum original loan term of 35 days in Nevada. Under no circumstances lenders extend the repayment period more than 90 days from the original origination date through refinances, renewals, or consolidations.

Benefit of No Bank Account Payday Loans in Nevada: How It Works

One major benefit of a payday loan is its relative simplicity and speed compared to traditional bank loans or credit cards. The process involved in obtaining a payday loan is much faster than other forms of finance for people who need access to cash quickly. Fewer requirements are needed for approval than larger loans, making them ideal for people with bad credit scores or limited income sources.

Listed below are the benefits of applying for a payday loan.

- Quick access to funds – The primary advantage of a payday loan is that it provides quick access to cash when needed. Many payday lenders approve and fund loans within a few hours, which is beneficial in emergencies.

- No collateral required – Payday loans do not require collateral to secure the loan, which means you don’t have to put up any assets such as your home or car as security.

- Easy to qualify – Payday lenders generally have minimal requirements for borrowers. Most lenders only require a regular income and a valid bank account, so you still be eligible for a payday loan even if you have poor credit or no credit history.

- Flexible use of funds – Payday loans are used for various purposes, including paying unexpected bills, covering medical expenses, or even funding a vacation. There are no restrictions on using the funds if you repay the loan according to the lender’s terms.

For Nevada residents who need more flexibility in repayment options, installment loans can provide longer terms and structured scheduled payments. Our Installment Loans Nevada guide explores this alternative to traditional payday loans for those looking for extended payment plans. This related resource can supplement the information here with details on installment loan qualifications, benefits, and providers across the state.

What are the Things to Consider When Applying for a Same Day Payday Loan?

A payday loan seems ideal for people who need fast and easy access to money. Payday loans quickly become unmanageable without knowing the high-interest rates and shortened repayment periods.

Applying for a payday loan carries certain risks that must be considered before making such a commitment, like any other form of credit. Here is a list of three components of a payday loan application process that leads to difficulty.

- High-Interest Rates – Payday loans charge higher interest rates than conventional lenders due to the short repayment periods that make it difficult to repay the full amount within the specified time frame without incurring fees or penalties from late payments.

- Short Repayment Periods – Payday loans generally have shorter repayment periods than traditional loans, meaning borrowers find themselves in debt more quickly if they cannot pay off their balance on time, resulting in extended cycles of borrowing and repaying, which only increases the total cost over time.

- Lack Of Regulation – There is less regulation around payday loans, making it easier for lenders to take advantage of unsuspecting borrowers by charging excessive fees or misrepresenting terms and conditions during application processes.

How To Apply For A Guaranteed Approval Payday Loan in NV?

Applying for a payday loan online seems intimidating, especially for people with bad credit. It is necessary to view the challenge as if it were a difficult and slightly daunting mountain at first glance, but one that is conquered through preparation and dedication. Certain steps must be taken to successfully apply for a payday loan online for bad credit.

- Research payday loan lenders. The first step in applying for a payday loan is researching different lenders. Look for licensed and reputable lenders, and read reviews from other customers to know that the lender is trustworthy.

- Check eligibility requirements. Check the eligibility requirements before applying for a payday loan. Most lenders require you to have a steady income, a bank account, and be 18 years old.

- Gather the required documents. You must provide documents such as a government-issued ID, proof of income, and a bank statement to apply for a payday loan.

- Fill out the application. The lender asks for the borrower’s personal information, such as your name, address, and social security number.

What are the Qualifications For Bad Credit Payday Loans? Evaluating Companies and their Offers.

Qualifications vary depending on state regulations and lender policies, including being at least 18 years old, having proof of employment and regular income, and having a valid checking account with direct deposit capability.

Individuals sometimes need extra documents for verification, such as bank statements or pay stubs showing recent deposits into the applicant’s account. Applying online requires no more than 10 minutes, and applicants must know if the loan application is approved after submitting all required documentation.

Listed below are the payday loan qualifications.

- Have a Source of Income – A lender likely requires the borrower to have a steady income to qualify for a payday loan. Your income must come from employment income, retirement benefits, Social Security, disability benefits, or other sources of funds that are consistent and reliable.

- Have Valid Personal Identification – You must provide valid personal identification, such as your driver’s license or government-issued ID, to be approved for a payday loan. Be prepared to provide the required identification when submitting your application for a payday loan.

- Provide proof of address – You must provide proof of address, such as utility bills or mail addressed to you at the same residence where you currently reside, to be approved for payday loans. Lenders like to see proof of residency in your home since it reduces their risk when lending money.

- Establish a Good Payment History From Banks and Other Lenders. A good payment history with banks helps enhance your chances of being approved for a payday loan since lenders view borrowers who manage their finances responsibly as less risky prospects for loan approval.

In the bustling world of financial services, our company has established a strong presence in several key cities across Nevada. As we strive to provide reliable and accessible solutions, we understand the significance of being where our customers are. With a commitment to offering payday loans, we have strategically expanded our reach to the most important cities in the state. This table showcases the primary cities where our company is active, highlighting our dedication to serving the diverse needs of Nevada residents.

| Las Vegas | Henderson | North Las Vegas |

| Reno | Sparks | Carson City |

| Fernley | Mesquite | Elko |

Final Thoughts

Nevada’s recent move to regulate payday lending by incorporating rate limits instead of blanket bans has been seen in a positive light. Pitching the rate at 652% APR, many believe this is a constructive onset, albeit a bit steep. It stands out favorably, particularly when benchmarked against Arizona, Utah, and the unregulated realm of Idaho. The horizon holds potential for Nevada to push these rates to even more accommodating levels. As it stands, these checks and balances act as a shield against exorbitant rates that could eclipse 1,000% APR. They also ensure the continuation of regulated short-term financial solutions, a strategy more conducive than a total halt. For perspective, California has shunned payday lending altogether, while Oregon and Arizona have gentler frameworks than the standard Nevada has set. Taking everything into account, these transformations symbolize a commendable advancement in harmonizing accessibility with consumer interests.

Payday loans in Nevada provide quick access to cash for people needing emergency funds without the need for collateral or a good credit score. Borrowers must know the regulations surrounding payday loans in Nevada, such as maximum loan amounts and fees, and understand their rights and responsibilities as borrowers. Borrowers must make informed decisions and understand the risks involved.

Frequently Asked Questions

What are the regulations and requirements for obtaining payday loans in Nevada, especially in the Las Vegas area?

Nevada caps payday loan amounts at 25% of expected gross monthly income, with maximum loan terms of 35 days. Extended payment plans are available. Lenders must be licensed by the state.

How can I find reputable payday loan lenders in Las Vegas, and what should I consider when choosing one?

Verify state licensing, compare interest rates and terms, read customer reviews. Avoid lenders who push unnecessary products or refinancing.

Are there any specific rules or restrictions for payday loans in Las Vegas that residents should be aware of?

The state limits loans to $2,500 including fees, caps interest at 52% APR, and prohibits rollovers which extend debt. Borrowers cannot have more than one outstanding loan.

What are the typical interest rates and fees associated with payday loans in Nevada, and how can borrowers avoid excessive costs?

State law caps rates at 52% APR. Fees typically range from $15-$20 per $100 borrowed. Avoid lenders charging the maximums.

Are there alternatives to payday loans in Las Vegas for individuals facing financial emergencies or short-term cash needs?

Options include pawn shops, credit union loans, credit counseling agencies, unemployment assistance, interest-free government and nonprofit programs.