Payday Loans Online In Texas From Direct Lenders: Get $100, $200, $300, $500 and $1000 Loans Instantly Even With Bad Credit

Payday loans offer immediate access to funds when an individual needs help to obtain traditional credit from banks or other lenders due to poor credit history. Most common payday loan amounts include $100, $200, $300, and $500 payday loans. They remain popular among working individuals who need quick cash during financial distress. Payday loans have high interest rates, making them accessible but potentially dangerous if not paid back on time.

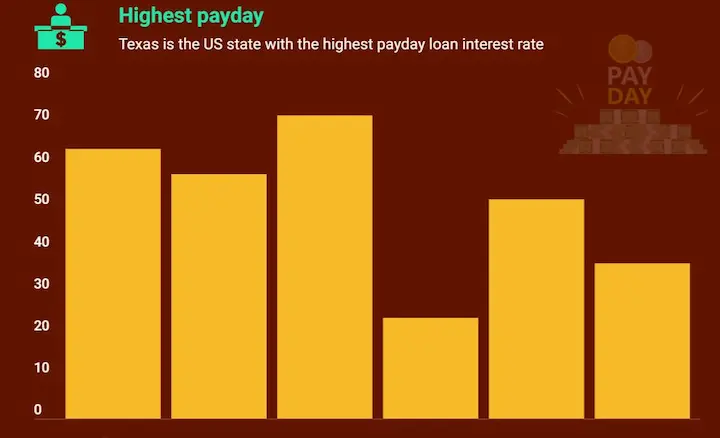

Online loans have become an increasingly popular option for individuals seeking payday loans. Texas has certain laxest laws regarding payday lending, allowing borrowers easy access to such services without worrying about potential legal repercussions. It’s necessary to understand its benefits and risks before signing up for a loan as Texans turn towards this form of borrowing money, especially online loans. This article aims to provide an overview of the factors and helps readers make informed decisions about their borrowing needs.

Why Direct Lenders are the Best for Online Payday Loans in Texas

One cannot overstate the benefits of going for direct lenders when evaluating online payday installment loans in Texas. Efficiency and transparency are two attributes that make direct lenders stand out. The easy access to borrowing and the streamlined repayment process enable clients to appreciate the hassle-free journey. By eliminating middlemen, borrowers enjoy the full benefits without dilutions or unaccounted hidden costs. Such simplicity in the process makes opting for a direct lender the clear choice in navigating the payday loan terrain in Texas.

Direct lenders win points for personalization and customizability of loan products. They work directly with borrowers to understand their financial situation and welcome special requests concerning loan terms. This ability to tailor loan agreements to suit individual borrower needs sets direct lenders apart in the sector – highlighting their commitment to client satisfaction.

Types Of Same Day and No Credit Check Payday Loans Near Me in Texas

In Texas, various online loans are available for those seeking financial assistance. Some of the common options for loans with no credit check and same day approval:

There are many options for payday loans online in Texas, including installment loans and cash advances. The most common loan type in Texas is an installment loan, which offers flexible terms and lower loan interest rates. Cash advances offer quick access to funds but at higher interest rates. Borrowers must carefully review their options and associated risks before choosing a loan type. Doing research ahead of time helps consumers make informed decisions to avoid unexpected fees and high-interest payments.

As a trusted Texas lender, we also offer flexible installment loans to residents across the state. Installment loans allow borrowers to repay over time in manageable fixed payments. This can be a great alternative to a payday loan for some borrowers. Learn more about our installment loan options in Texas by visiting our page on Installment Loans Texas.

Short-Term Loans In Texas With Fast Approval for Emergency Expenses

Short-term loans with fast approval are invaluable for individuals and businesses needing immediate funds when used responsibly. Short-term loans provide fast access to cash without lengthy loan application processes, making them an attractive option for unexpected expenses or times of financial difficulty. Interest rates are higher than banks or credit unions but still lower than many other alternatives. Flexible repayment plans make it easier to manage monthly finances without requiring lump sum payments. Borrowers must assess their circumstances carefully before committing to any loan.

Credit Access Business in Texas: Navigate Through the Payday Lending Statute

Payday lenders, and credit access businesses, offer short-term loans with fast access to cash and minimal paperwork. They are unsecured and have higher interest rates and fees than other loans. Payday loans are usually used by individuals with an insufficient credit history, low monthly income, or who cannot obtain traditional bank loans or credit cards. Long-term use of loans, like a typical payday loan, leads to unsustainable debt levels. Knowing all available options and selecting a lender operating within state regulations is important to avoid potential risks.

Texas Online Payday Loans With Instant Approval

Online payday loans are a quick and convenient solution for short-term financial emergencies, providing immediate relief without the hassle of traditional lenders. They fill the gap between paychecks and help manage unexpected expenses, saving time and stress. The loan offers unparalleled convenience to people needing quick cash with 24/7 availability, minimal paperwork, and fast approval.

Traditional Payday Loans In Texas: Compare the Best Lenders, Rates, and Same Day Deposit Options

Payday loans are a common form of short-term credit that provides an alternative source of funds when traditional banks cannot. Borrowers get small amounts of money for up to 30 days without collateral or a credit check. They carry high-interest rates and fees if not repaid on time, and particular states have regulations limiting the maximum amount borrowed. Researching options and understanding associated costs is necessary before deciding about the loan.

Auto Title Loans in Texas: Get Instant Cash Advance with No Denial

An alternative to payday loans, auto title loans can be a better option for some. Auto title loans are secured short-term loans that use the borrower’s car as collateral, providing higher loan amounts and lower interest rates than traditional payday loans. They are available to borrowers with poor credit history and have longer repayment terms. Potential drawbacks include losing one’s vehicle if payments are not made on time, a higher annual percentage rate (APR) due to extra fees, and a greater risk of repossession. Careful review is advised before committing to this type of loan and exploring Credit Check Loans, which may offer a more secure option with better interest rates.

“No Denial Loans” Get Immediate Approval for Payday Loans with Bad Credit In Texas

Are low credit scores standing in the way of your financial freedom? With PaydayChampion, rise above your credit worries and embrace a stress-free borrowing experience. Our platform avails payday loans online in Texas, bringing financially empowering solutions closer than ever. Bad credit score and need cash quickly? We get it. Our efficient system and expansive network of lenders take the guesswork out of obtaining payday loans. We ensure you don’t experience loan denial due to bad credit scores; it’s all about instant approvals and immediate cash disbursement.

Guaranteed Approval Loans from Direct Lenders Only?

It’s necessary to clearly understand the laws and regulations governing the loan to make informed decisions about loan terms and conditions when applying for payday loans online in Texas. Listed below are the key elements to review.

- Interest Rates & Fees

Interest rates and fees vary from lender to lender but range from 8%-20%, depending on the borrower’s credit score and repayment history. Some online lenders might have additional charges, so compare different options. - Repayment Terms

Lenders usually offer flexible repayment plans with monthly installments over several months or longer. It’s required to review all options with unwanted fees and penalties carefully. Be sure to understand any additional charges that might arise during the repayment period. - Credit Requirements

Most lenders, including online lenders, require a minimum FICO® score of 600 or higher and other financial documents like bank statements and employment verification, depending on the amount borrowed.

It’s fundamental to do due diligence when researching different lending companies. Customers shall look at customer reviews (if available) and check each company has received complaints from consumer protection agencies. Comparing offers side by side, including interest rates, fees, and terms, helps find a loan that best meets your needs while keeping costs low.

Customers confidently decide which instant payday loan works best for them now, providing long-term benefits for future financial endeavors. This can be achieved by doing ample research beforehand into the application process and federal and state laws governing personal and payday loans online in Texas.

As a leading provider of financial solutions, our company has established a strong presence in Texas, offering reliable and accessible payday loan services. We understand that unexpected expenses can arise, and our mission is to support individuals in need with quick and convenient financial assistance. To better assist our customers, we have strategically positioned our services in key cities throughout Texas, ensuring accessibility and convenience for those seeking short-term financial solutions. The following table highlights the most important cities where our company is active, serving as a testament to our commitment to meeting the needs of Texans when it matters most.

| Houston | San Antonio | Dallas |

| Austin | Fort Worth | El Paso |

| Arlington | Corpus Christi | Plano |

| Lubbock | Laredo | Irving |

| Garland | Frisco | McKinney |

Credit Score Requirements for Payday Loans With 1 Hour Approval in Texas

Getting a payday loan online in Texas is complicated, with various lenders having their own regulations and credit score requirements. Follow the steps below to comprehend the requirement.

- Review your entire financial profile. Check your credit history and scores.

- Understand your debt-to-income ratio and outstanding debt.

- Understand the importance of eligibility and financial products.

You make informed decisions when entering into a contract with a lending institution, increase your chances of getting approved for a same-day or payday loan, and secure the best interest rates by following the steps. Additionally, knowing different financial products can help you make better choices.

Maximum Loan Amounts in Texas for Legal Payday Loans Online

Maximum loan amounts are a basic factor when getting a payday loan online in Texas. The amount varies from lender to lender and depends on the state regulations of Texas. Potential borrowers must understand the limits to determine if the loan is right for them in applying for a loan.

The laws regulating payday loans online in Texas limit the maximum loan size between $100 and $1,500, with terms ranging from 7-31 days, depending on the specific lender’s policies. Certain lenders allow consumers to apply for installment loans up to $2,500 or higher based on their creditworthiness. It is significant that borrowers research the options beforehand and examine all fees associated with each type of loan request before making any decisions.

Understanding how much you borrow and being aware of your financial situation helps you make an informed decision about a payday loan online in Texas that suits your needs. Taking into rumination all potential costs associated with borrowing money, including loan payments, helps certify you can repay your debt responsibly while still meeting other financial obligations.

Emergency Cash Advances: Get Fast Approval and Same Day Payday Advance

Emergency advance loans are a popular form of emergency funding for millions of Americans. Borrowers must be informed about the terms and conditions associated with short-term loans to make sound financial decisions. Below is a thorough list of thoughts for borrowers seeking emergency expense advances through quick cash loans.

- Be vigilant of unwanted fees that come along with emergency expense advances. These costs vary from lender to lender but include set-up or processing fees. Actual loan terms should be evaluated properly before committing to any advance loan.

- An instant decision might seem appealing in a dire situation. Still, reviewing other options before getting an emergency loan is always wise, such as asking family members for help or utilizing community resources like food banks.

- Research the regulations governing payday lenders in your state. Particular states have more rigid rules than others regarding maximum interest rates and repayment terms.

- Find trustworthy lenders who abide by applicable laws when counting any advance loan product. This can help you deal with reputable companies and protect yourself from potential fraud or predatory lending practices.

Borrowers make informed decisions about short-term loans by knowing the potential costs and fees, counting alternative sources of income, researching state regulations, and finding trustworthy lenders. The information helps borrowers avoid unnecessary fees, find the best lending options, and avoid predatory lenders. Being informed and mindful of potential scenarios enables people to navigate their finances confidently and responsibly during difficult economic times. Additionally, having complete and accurate loan documents can help secure a well-suited financing option based on their source of income.

Comparison of Legal Status, Interest Rate, and Loan Terms of TX Payday Installment Loans

Payday loans are short-term, high-interest loans that are risky and lead to a cycle of debt. The table below compares the legal status, interest rates, loan terms, and other features of payday loans in the United States, according to UStatesLoans.

| Feature | Description |

|---|---|

| Legal Status | Legal |

| Interest Rate (APR) | Can exceed 400% |

| Maximum Loan Amount | Not Specified (on average $800) |

| Minimum Loan Term | No restriction (no more than three if the City Ordinance was adopted) |

| Maximum Loan Term | 180 days |

| Loan Principal | Varies depending on the loan |

| Number of Rollovers | Four years (from the last payment) |

| Number of Outstanding Loans | Not Specified |

| Cooling-off Period | None |

| Installment | Yes |

| Finance Charges | >$30 => $1 for each $5 |

| [$30 – $100] => 1/10 of the loan amount + $3 /mo (<$35) | |

| [$35 – $70] => $3.50/mo + $4/mo (>$70) | |

| >$100 => $10 + $4/mo for each $100 | |

| Statute of Limitations | 4 years (from the last payment) |

| Database Loan Tracking | No |

Payday loans are legal in many states but have high-interest rates and short terms, with loan amounts averaging around $800. Particular lenders allow rollovers and installments, and finance charges vary based on loan terms. Borrowers shall be alert to the risks and alternatives. A comparison of key features is provided in this table.

Payday Installment Loans: Best Rates, Laws, and Interest Rates in Texas

In the lending world, Texas stands tall with its unique regulations concerning Payday installment loans. The state fully authorizes its use, offering residents another option to manage their financial needs. Remarkably, Texas endorses multiple payments, diverging from traditional lump-sum payday loans. With Payday Installment Loans, borrowers are given ample opportunities to make repayments over a longer duration, which is generally more manageable when dealing with larger figures. Regarding interest rates, the “Wild West” offers an open-ended system with no rate cap, inviting a more competitive scene for lenders.

Texas has set a standard that serves best both the borrower and lender. Their laws provide that payday lenders operate fairly and transparently, offering competitive rates without compromising borrower protection. It’s the reason why Texans feel empowered to meet their financial goals flexibly and affordably, all thanks to the well-regulated lending platform provided by the state.

The Bottom Line For Texas Payday Loans

Change is in the air for payday lending in Texas. Although the state doesn’t have rate caps like Louisiana, New Mexico, Oklahoma, and Arkansas, it’s taking commendable steps by enforcing detailed evaluations of a borrower’s ability to pay back. By doing so, Texas is on a mission to avert possible debt complications. By addressing enforcement shortcomings and fostering a sense of responsibility, the state aims for a more transparent payday lending landscape. And as the journey to amplify consumer protection persists, regulators remain steadfast in their conviction that maintaining access solidifies the value of giving borrowers a choice.

The decision to get a payday loan online in Texas must not be taken lightly. Understanding the types of loans available and any extra fees that apply is obligatory. Study all other options, including emergency expense advances through quick cash loans and alternative debt solutions like credit counseling in signing an agreement.

It is wise to weigh the pros and cons of obtaining a payday loan before diving head first without fully understanding the implications. One must verify they can repay their loan on time or risk falling into a vicious cycle of debt. Think twice before making this financial commitment.

A regular source of income is a crucial aspect to consider while applying for a payday loan. Gradually think if it’s too good to be true, chances are it is when getting a payday loan online in Texas. Doing plenty of research and carefully weighing up your options saves you from getting caught up in a sticky situation. Verify that you have a regular source of income before applying for a payday loan to avoid falling into debt.

Frequently Asked Questions

How can I apply for online payday loans in Texas with bad credit and without undergoing a credit check?

You can apply with Texas payday lenders that offer online approvals for payday loans without performing hard credit inquiries that negatively impact your credit score.

What are the legal regulations and requirements for obtaining online payday loans in Texas, particularly for individuals with poor credit or those seeking no credit check options?

Texas caps payday loan APRs at 660% for loans up to $500 with terms 7-31 days. No minimum credit score is required but criminal interest rates are prohibited.

Are there any recommended reputable online payday loan lenders in Texas known for offering loans to people with bad credit and providing no credit check options?

Some reputable payday lenders in Texas offering loans for bad credit with no hard credit checks.

What are the typical interest rates and repayment terms associated with online payday loans in Texas for borrowers with bad credit?

APRs on Texas payday loans can range from 240-660% for borrowers with bad credit. Repayment terms align with paydays, typically 7-31 days depending on next pay date.

Are there alternative financial resources or assistance programs available to residents of Texas with bad credit or no credit, besides relying on payday loans?

Alternatives to payday loans in Texas include nonprofit credit counseling, credit union loans, paycheck advances from employers, debt management plans, and borrowing from family/friends if possible.