The Prime and Discount Rates are financial rates that significantly impact the market. Each plays a specific role in the economy, affecting different aspects of investments, borrowing, lending, and other economic activities. Understanding how these two rates interact is essential for anyone interested in making informed financial decisions. The article explores the degree of the Prime Rate versus the Discount Rate to help readers understand the topic.

The Prime Rate is known as the “base rate” or “benchmark rate”; large banks set it and indicate overall market interest rates. The higher the prime rate, generally speaking, the more expensive loans become for borrowers, and vice versa when it decreases.

On the other hand, the Discount Rate refers to the interest charged by Federal Reserve Banks on short-term loans made to commercial banks. Central banks use it to influence the money supply and affect economic inflationary pressures. Understanding both rates helps investors make better-informed decisions regarding their portfolios while providing insight into broader macroeconomic trends.

What Is The Prime Rate?

The prime rate is like a lighthouse in the night of financial waters, guiding investors and borrowers to safety. It is a necessary benchmark for many other rates, and thus it has become the most widely used reference rate in finance today.

The prime rate is set by banks and is based on their costs of funds and a markup, usually determined by the Federal Reserve Board’s discount rate decisions. Generally speaking, it serves as a base interest rate used to calculate other forms of borrowing, such as credit cards or mortgages. Banks often use it to set their initial interest rates on deposits and loans. These institutions provide the prime rates as economic conditions chan. Consumers make informed decisions when considering any loan or installment loan product from major lenders by understanding how such an essential tool works.

How Is the Prime Rate Calculated?

The prime rate is a key reference point for lenders and borrowers. It helps to determine the cost of borrowing money and the interest earned on savings accounts or other investments. Knowing how it’s calculated gives you more confidence in managing your finances.

The Federal Reserve sets the target federal funds rate, which helps code benchmarks influencing short-term rates, including the prime rate. The Federal Open Market Committee determines the target rate by economic conditions such as unemployment levels, inflation trends, productivity growth, and consumer spending patterns. The resulting monetary policy affects banks’ funding costs and extends to consumers through changes in loan rates like mortgages, auto loans, and credit cards.

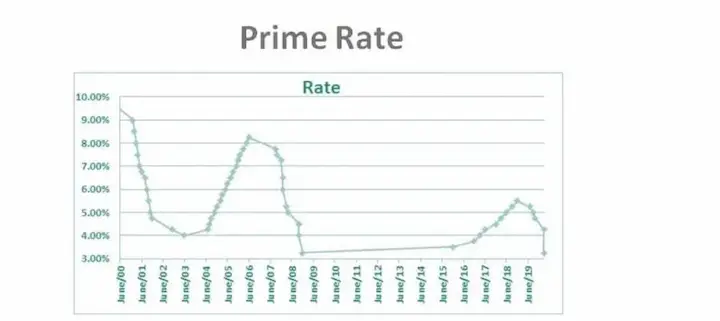

The Prime Rate is calculated by adding 3% to the Fed Funds Rate according to SFGATE. The table shows the Fed Funds and Prime Rates from 1994 to 2020.

| Year | Fed Funds Rate (%) | Prime Rate (%) |

|---|---|---|

| 1994 | 4.25 | 7.25 |

| 2000 | 6.50 | 9.50 |

| 2005 | 4.25 | 7.25 |

| 2010 | 0.00-0.25 | 3.25 |

| 2015 | 0.13 | 3.13 |

| 2020 | 0.09 | 3.09 |

For example 2010, the Fed Funds Rate was 0.00-0.25%, so the Prime Rate was 3.25%. It is observed that the Prime Rate fluctuates based on changes in the Fed Funds Rate, with the highest Prime Rate of 9.50% in 2000 and the lowest Prime Rate of 3.09% in 2020. The average rate during these years can help determine overall trends in the lending market.

TIP: Keep track of any news about changes to the Fed’s target rate so that you know when major shifts occur in lending markets. Prime rates and the average rate affect your decisions regarding taking out a loan or investing money into a savings account!

What Is The Discount Rate?

The discount rate is the interest rate that banks are charged when they borrow funds from a reserve bank. It’s called the primary credit or federal discount rate (FDR). Each Federal Reserve Bank sets the rate and serves as a benchmark for other economic lending rates, such as mortgage and business loan rates.

The prime rate can be influenced indirectly by changes in the discount rate, but it depends on various complex factors related to banking regulations and capital requirements. When setting its discount rate, the Fed considers inflation, economic growth, unemployment, and financial market conditions. Higher discount rates affect long-term borrowing costs because lenders charge more if their money costs increase. On the other hand, lower discount rates tend to reduce borrowing costs since lenders need less return on their loans.

While these terms sound similar and relate to interest rates, they serve different purposes. Private commercial banks determine Prime Rate based on prevailing market conditions, whereas Discount Rate is mandated by central banks such as the Federal Reserve System. Understanding how each work helps provide insight into broader macroeconomic trends across markets and economies.

How Does The Federal Discount Rate Work?

The Federal Reserve sets a discount rate, an interest rate that banks charge when they borrow funds directly from one of the 12 regional Federal Reserve Banks. Federal Discount Rate influences other short-term interest rates and indicates economic health in the United States.

The primary purpose of setting the discount rate is to influence the availability and cost of credit within the economy by controlling the money supply. The Federal Reserve wants to increase the money supply to stimulate economic growth. It is done by decreasing its discount rate. It wishes to reduce inflationary pressures due to excessive demand and raise its discount rate.

TIP: It’s necessary for borrowers who plan on taking out loans or mortgages at some point in their lives to stay informed about these changes in monetary policy since they directly impact their finances.

What Are The Differences Between The Prime Rate And The Discount Rate?

The prime rate and the discount rate are both measures of interest rates. Understanding their differences and similarities is necessary to make informed decisions. There are four key differences between the two to begin with.

- The Federal Reserve sets the discount rate, whereas banks set the prime rate.

- The Fed discounts loans for commercial banks at its discretion through the discount window, while the prime rate follows market conditions more closely.

- The discount rate is only available to depository institutions, while others access prime rate borrowing but at a higher margin.

- The discount rate tends to be lower than the prime rate.

It is noted that these two rates often move together. So does the other when one changes. It means that any change in either affects borrowing costs across all sectors. For example, suppose the Fed decreases or increases the discount rate using the discount window. Lenders tend to decrease or increase their corresponding loan products and mortgages accordingly, significantly impacting individuals’ financial situations. Understanding how these two rates interact provides insight into wider economic trends and potential future outcomes.

What Are The Similarities Between The Prime Rate And The Discount Rate?

The prime rate and the discount rate are like two sides of a coin. On one side, you have the prime rate – an interest rate that banks charge to their most credit-worthy customers. On the other side is the discount rate – which refers to the interest rates charged by Federal Reserve Banks on loans made to commercial banks and other financial institutions. The rates play a significant role in determining how much money flows through our economy, although they come from different sources and serve different purposes.

One similarity is that both affect consumer borrowing costs, including the annual percentage rate. The prime rate affects consumer loan products such as mortgages and auto loans, while the discount rate affects short-term business loans such as those used to purchase large equipment or finance inventory purchases. It means borrowing is more expensive for businesses and individuals when either increases, impacting the annual percentage rate on loans. The prime rate and the discount rate both tend to move together since changes in one often lead to similar changes in the other. Small changes in either cause economic activity to shift substantially over time.

Its similarities demonstrate why lenders, borrowers, and investors must pay attention to what’s happening with these key interest rates, including the annual percentage rate, at any given moment; understanding how they work together helps us better predict future movements in our economy and investment markets.

How The Federal Bank sets both The Prime Rate And The Discount Rate?

It is widely accepted that the primary credit rate and discount rate are closely related, as they are both set by the Federal Reserve Bank. However, there is a difference in how each rate is determined, which significantly impacts the economy. Understanding how these two rates – the prime rate and the primary credit rate – interact with one another help to explain why they have such a large influence on interest rates across the country.

The primary way in which the Federal Reserve sets both the prime rate and the discount rate is through its open market operations. The central bank purchases or sells government securities from member banks to adjust their balance sheets and affect liquidity in the banking system. It affects short-term borrowing costs for commercial banks, influencing what lenders charge customers for loans at various levels of risk. The prime rate reflects higher-quality borrowers, while the discount rate reflects lower-quality borrowers. It means that when the Fed raises either rate, it becomes more expensive for consumers to borrow money. Additionally, the Fed imposes a reserve requirement on banks, ensuring they have enough funds to meet their depositors’ demands. It is necessary to gain insight into how different economic conditions by shaping consumer behavior and financial markets overall by studying how these two rates are affected by changes in monetary policy and reserve requirements.

How Both The Prime Rate And The Discount Rate Are Used As Benchmarks For Other Interest Rates?

The prime rate and the discount rate are like two pillars of a temple, supporting the economy with strength. They help provide financial stability by acting as benchmarks for other interest rates in the market.

Central banks set the prime rate worldwide; more specifically, it is set by the Federal Reserve Bank of America. It represents an economic indicator based on a survey of at least 15 large U.S. banks and acts as a benchmark for setting most other loans and credit card rates. The discount rate, on the other hand, is set by the same institution. However, instead of establishing loan interest rates, the rate determines how much commercial banks pay when they borrow money from the Federal Reserve. It allows them to quickly access funds during times of crisis or low liquidity to prevent any major disruption in their operations.

The two rates greatly influence businesses, consumers, and investors alike. Keeping the key indicators stable through reliable policies enforced by the government guarantees no volatility or instability within different markets worldwide. The two rates keep economies functioning smoothly without facing sudden shocks or disruptions due to monetary policy changes.

How Do Changes In The Prime Rate And The Discount Rate Affect The Economy?

The prime rate and the discount rate are two of the most economic indicators used to measure overall financial stability. The prime rate is a benchmark interest rate set by banks, which lenders use as a reference for setting their rates for lending money, including lines of credit. On the other hand, the discount rate is an interest rate that Federal Reserve Banks charge when they lend funds to member banks on short-term loans. Changes in either or both of these rates can have far-reaching implications across different sectors of the economy.

Changes in the prime rate and discount rate cause fluctuations in borrowing costs from one sector to another, thus affecting investment decisions and spending habits among consumers and businesses alike. Higher borrowing costs usually result in reduced consumer spending and fewer business investments due to increased risk associated with high rates. It leads to slower economic growth if left unchecked for too long. Lower interest rates tend to encourage more borrowing activity, leading to higher consumption and investments – resulting in improved economic conditions over time.

TIP: It’s helpful to think about how changes in the prime rate and discount rate affect borrowers directly, such as small businesses seeking capital or individual consumers looking for credit cards or home loans. Since these groups comprise much of our economy’s infrastructure, people must better prepare when sudden market conditions change by understanding the link between monetary policy instruments like the two rates and real-world outcomes.

The Impact Of Prime Rate And Discount Rate On Borrowers

The prime rate and the discount rate profoundly affect borrowers’ access to credit. The prime rate is a benchmark that banks use when setting the interest rates they charge customers for loans, while the discount rate refers to the interest rate set by central banks when lending money to financial institutions. Individuals and businesses are better equipped to make informed decisions regarding their debt obligations by understanding how changes in both these rates can impact borrowing costs.

Loan repayment conditions become more favorable for borrowers. It becomes more expensive for borrowers as lenders are required to charge higher interest rates on loans when the prime or discount rates increase. Changes in these two variables affect not only the cost of borrowing but also the availability of credit since lenders choose to limit new loan originations due to an unfavorable environment. Fluctuations in these key economic indicators profoundly influence consumer behavior and business operations.

The Impact Of Prime Rate And Discount Rate On Lenders

The impact of prime rates and discount rates on lenders is a topic that has received considerable attention in economic circles. The impact of prime rate and discount rate affects both the cost of capital for banks and their income, depending upon which aspect they are. The prime rate refers to the interest rate banks charge on loans given to customers with high credit ratings. The discount rate applies to the interest rate at which commercial banks borrow money from Federal Reserve Banks. It affects lending costs and profitability – lenders’ profits increase when rates rise while borrowers suffer due to higher loan repayment amounts. However, It benefits borrowers but reduces lender returns substantially when rates fall.

It must be noted that these two rates differ from the federal funds rate. The interest rate at which depository institutions lend balances held at Federal Reserve Banks overnight. A change in prime rate And discount rate influences all other short-term borrowing and saving activities within financial markets, creating a ripple effect throughout the entire economy that impacts lenders and borrowers alike. Understanding how its different rates interact gives an insight into broader macroeconomic trends affecting large and small businesses worldwide. This includes the use of excess reserves within the banking system.

How Do the Prime Rate And Discount Rate Differ From The Federal Funds Rate?

Alluding to the financial climate, prime and discount rates are two of the most integral figures in credit markets. Understanding their effects on lenders is essential for a successful long-term strategy. However, it is good to consider how they differ from the federal funds rate. Specifically, the role that excess reserves play in the relationship between these rates sheds light on their distinct impacts on the economy.

The Federal Reserve generally determines the federal funds rate through open market operations involving buying or selling government securities such as Treasury notes and bonds. It indicates overall economic activity, affecting borrowing costs for banks and other lending institutions like mortgage companies. Individual banks set prime rates and discount rates within their short-term loan programs. The prime rate is used as a benchmark for pricing consumer loans, while the discount rate helps determine interest rates that commercial banks charge each other when making overnight loans. These banks often aim to offer the lowest rate possible to attract more customers and stay competitive.

Its differences suggest that the impact of the three rates is quite distinct depending on an institution’s specific business model. Understanding them thoroughly helps lenders make smarter investment decisions and strategies to achieve desired outcomes over time, such as providing the lowest rate to borrowers.

What Are The Long-Term Effects Of Prime Rate And Discount Rate?

The prime rate and discount rate are two financial tools used to manage interest rates in the economy. But what effect do they have in the long term? Are these changes permanent or merely temporary?

The Federal Reserve sets a target range for each rate that guides banks in setting their rates. The prime or discount rate changes are significant for economic growth, as both rates affect borrowing opportunities and costs for businesses and consumers, including equity lines. An increase in one of these rates causes other related lending rates to rise, altering behavior for borrowers and lenders across the economy. Others suggest it has negative long-term effects, such as reduced consumer spending due to higher borrowing costs for equity lines. At the same time, some argue that increasing these rates is beneficial by encouraging saving. Similarly, decreasing the prime or discount rate results in more people taking out loans, increasing investment opportunities with potentially positive outcomes, and possibly encouraging more usage of equity lines.

The effects of any change in either rate are difficult to predict since they depend heavily on factors, including global conditions and market sentiment. Nevertheless, trends from previous decades indicate that strategic adjustments to both rates can have a meaningful impact on economic activity if done correctly. It is interesting to see how policymakers use them to influence future financial performance.

Exploring The History Of Prime Rate And Discount Rate

Nothing is more complex than the history of the prime and discount rates. Going into the prime rate and discount rate topics, One quickly becomes lost in a maze of financial terminology and centuries’ worth of policy revisions. Understanding how these two rates have evolved is essential for grasping their current economic effects, from the invention of banking to modern-day central banks and monetary policies.

The prime rate has been used since ancient times as a benchmark interest rate that other lending institutions use to set their prices, with roots dating back to medieval England and Europe. However, the discount rate was introduced much later by national governments as an incentive or penalty tool designed to influence economic growth through various fiscal measures such as taxes, public spending, and borrowing costs. The rates remain firmly entrenched today in global macroeconomics. However, they continue to be subject to change depending on factors like inflation levels and economic activity.

Analyzing The Current Prime Rate And Discount Rate Trends

Interesting statistics show that while the prime rate has remained constant at its current value of 3.25% since May 2019, discount rates have risen significantly in recent months. It reflects a trend in which central banks increasingly rely on such monetary policy to manage inflationary pressures and maintain economic stability. Everyone can gain an understanding of how these two necessary financial instruments interact with each other and impact global markets by analyzing current trends in both prime rate and discount rate movements.

It is widely recognized that the primary difference between the prime rate and discount rate lies in their respective uses. On the other hand, the former is used by banks when lending money to their most creditworthy customers; the latter serves as a tool for central banks to control liquidity within a given economy. It is unsurprising that changes in either often have significant implications for global economic conditions.

For instance, if the Federal Reserve decides to lower its benchmark interest rates, it leads to an increase in both consumer spending and investment activity throughout the U.S., thereby providing a much-needed boost to growth prospects in the future. The Fed was instead to raise its target rate, and there likely be a corresponding decrease in borrowing costs across all sectors of society – something which potentially provides some short-term relief from higher prices or stagnant wage growth but results in slower economic expansion over time due to reduced levels of consumption and investment spending.

Any decision made regarding changing either Prime Rate or Discount Rate must be done carefully, as even small changes can have far-reaching consequences for economies worldwide. Investors must remain alert when monitoring developments related to these two influential monetary policy measures. Doing so helps guarantee they are informed about any potential opportunities or risks posed by shifts in either direction before making decisions concerning their portfolios.

Conclusion

The prime rate and discount rate are two financial tools central banks use to regulate economic lending. The prime rate is a benchmark interest rate set by banks for their most creditworthy customers, while the discount rate refers to the cost of borrowing money from a Federal Reserve Bank. The rates determine how much borrowers can access at any given time, which has long-term effects on economic growth.

There has been a significant fluctuation in these rates over time due to factors such as global events or domestic policies. Understanding their differences helps us better understand why certain decisions are made and how they affect our daily lives while both serve necessary functions. Economists, policymakers, lenders, and consumers must stay informed about current trends to assess the potential risks of such a powerful tool.

It makes smarter decisions regarding managing debt or investing funds by recognizing what sets them apart and learning more about each one’s role in our economy.

Frequently Asked Questions

What is the prime rate, and how does it differ from the discount rate?

The prime rate is the benchmark interest rate banks charge favored customers. The discount rate is the rate the Federal Reserve charges banks for loans. Prime follows market rates while the discount is set by the Fed.

How do changes in the prime rate affect the economy, and how is this different from the impact of changes in the discount rate?

Rising prime rates slow borrowing and spending in the economy. Discount rate changes have less direct economic impact, mostly affecting interbank lending.

Can you explain the role of the Federal Reserve in setting the discount rate and how it relates to the prime rate?

The Fed sets the discount rate directly but prime adjusts to it indirectly. Though the rates are linked, the Fed has more control over the discount rate than prime.

What are the typical situations or scenarios where banks use the prime rate, and when do they utilize the discount rate?

Banks use the prime rate for business and consumer loans. The discount rate is for short-term lending between banks and from the Federal Reserve.

How do lenders decide which rate to use when offering loans to consumers or businesses, and what factors influence this decision between prime and discount rates?

Lenders use prime for retail lending based on risk, market rates and profit goals. Discount is for interbank lending and follows the Fed funds rate. The rate choice depends on the type of customer.