Quick Personal Loans Online

Online loans for personal loans might be a practical and quick choice, offering different types of loans for your needs. You may frequently apply, get the money, and pay online through their online application process. You can prequalify with several internet lenders to get an idea of your rate without affecting your credit history.

Loan request amounts range from $1,000 to $10,000, and annual percentage rates for online loans often range from 6 to 36 percent. You can speed up the application procedure by researching lenders and financial institutions to pick one that fits your requirements and credit score, thereby increasing your chances of loan approval and obtaining competitive interest rates.

Main Points

- Online lenders for personal loans can be a quick and practical choice

- Loan amounts range from $1,000 to $10,000, with interest rates of 6-36%

- Prepare documentation, compare loans and prequalify, then apply to speed up the process

- Personal loans can be used for various purposes, but check with the lender. Bad credit loans are one type of loan available.

- Advantages of personal loans include flexibility and affordable rates

- When comparing loan offers, consider origination fees, interest rates, loan terms, and extra costs

- Various factors, including credit score and income, determine interest rates. Bad credit loans often have higher rates.

- The easiest personal loans to obtain are those with modest credit score requirements.

How to Obtain a Personal Loan Quickly?

There are a few actions you may do to speed up the processing of your loan application:

Prepare the Required Documentation.

Gather documents such as proof of income and identity and information on your credit score. Ensure that you understand the Eligibility Criteria for each lender.

Compare Loans and Prequalify.

Before completing a loan agreement, compare multiple loan options, and use prequalification tools to get a sense of your eligibility for different loan offers.

Apply for the Loan.

Once you’ve decided on a lender, submit your application and documentation. Review the loan agreement carefully and understand the terms, interest rates, and payment schedule.

Gather the necessary papers before applying for the short-term loan so the direct lender can quickly confirm your identification, source of income, and other details. Lenders frequently claim that the promptness with which borrowers respond to demands for documents determines their capacity to fund an unsecured loan.

Find Out How Much You Need to Pay.

Use a personal loan calculator to see how your credit score and repayment period affect your monthly payments. Then think about how the projected loan repayments might affect your spending plan. Consider online payday loans and other credit check loan options when comparing rates and terms.

Compare Loans and Prequalify.

Prequalifying for a personal loan gives lenders insight into your creditworthiness and demonstrates your potential borrowing power. Although it won’t harm your credit score, it might help you compare loans without ensuring you get one. To find loans with the lowest rates, looking into several lenders is a good idea, such as utilizing a network of lenders. This can entail comparing your bank, a nearby credit union, and online platform lenders, understanding their minimum credit score requirements and offering flexible repayment terms.

Apply

Depending on your lender, you can apply for a personal loan in person or online, making it convenient for anyone who needs quick access to funds.

While internet lenders provide web-based applications, smaller banks and credit unions may require in-person applications. After completing all the required information, you may expect a judgment within a day. If accepted, you can anticipate getting the money in your bank account in a day or two. A wide variety of financial products can be compared and availed from the convenience of an online platform or through a network of lenders.

What Time Will It Take To Receive a Personal Loan?

PaydayChampion offers a quick, straightforward application process and swift funding for qualified candidates. You will receive a decision immediately after submitting the online application and the required information. Once accepted, most consumers receive their money the following working day.

Can I Obtain a Loan Even With Poor or No Credit?

Flexible repayment options can make it easier to manage your debt and improve your overall access to cash during a financial emergency. You may still qualify for a credit check payday loan even with a poor credit score. It’s also important to be mindful of your budget and make sure you can make the payments on time to avoid further damaging your credit score. It’s also crucial to shop around and compare the offers from various lenders, including those that offer signature loans near me and personal installment loans, before deciding. By researching and being mindful of the terms and conditions, you can find the best option for your financial needs.

What Can I Use a Personal Loan For?

Upon quick approval, you can use a personal loan to cover various expenses, such as medical bills, car repairs, home improvements, wedding expenses, or even consolidate high-interest credit card debts. Ultimately, how you utilize the loan depends on your individual financial needs and goals.

Lenders typically stipulate the purposes for which loans may be utilized, while personal loans may be used for various purposes. They work best for unexpected expenses like house repairs or medical bills.

Personal loans can also be used to pay for expensive purchases like a motorcycle, RV, or a wedding that are not eligible for other financings. Another popular usage is consolidating Bad credit scores card debt into one monthly payment, making it simpler to handle. Check with your Payday loan providers to ensure your intentions align with the lender’s loan alternatives.

The Advantages of Personal Loans

Do you need to make a significant purchase or budget for an emergency expense? Getting a personal loan from PaydayChampion is a smart method to gain control of your financial decisions and the flexibility you need. The following are a few justifications why a PaydayChampion personal loan would be ideal for you:

- Flexible loan amounts: From $1,000 to $5,000 are available as personal loans, subject to proof of monthly income.

- Traditional loans vs. Affordable loans: Although traditional loans may be more widely available, consider Affordable loans as they offer better rates and terms depending on your financial history.

- Loan websites: Use reputable and reliable loan websites to compare different lenders and get transparent information on each one.

- Acceptance Rate: Investigate the lender’s Acceptance Rate to determine the likelihood of your application’s success.

- Financial history: Keep your financial history in mind when applying; a good credit score can lead to better rates.

- Streamlined application process: Look for lenders with a Streamlined application process to save time and prevent potential issues during the application.

At PaydayChampion, we are committed to helping individuals access fast and convenient personal loans when they need them the most. With our user-friendly online platform, we have expanded our services across various states throughout the United States. Whether you’re facing unexpected medical bills, home repairs, or other financial emergencies, our team is dedicated to serving customers nationwide. Below, you’ll find a comprehensive table highlighting all the American states where our company is actively providing quick personal loans online. We take pride in our extensive reach, ensuring that individuals from coast to coast can rely on us for efficient and reliable financial assistance.

| AL / Alabama | AK / Alaska | AZ / Arizona | AR / Arkansas |

| CA / California | CO / Colorado | CT / Connecticut | DE / Delaware |

| DC / District Of Columbia | FL / Florida | GA / Georgia | HI / Hawaii |

| ID / Idaho | IL / Illinois | IN / Indiana | IA / Iowa |

| KS / Kansas | KY / Kentucky | LA / Louisiana | ME / Maine |

| MD / Maryland | MA / Massachusetts | MI / Michigan | MN / Minnesota |

| MS / Mississippi | MO / Missouri | MT / Montana | NE / Nebraska |

| NV / Nevada | NH / New Hampshire | NJ / New Jersey | NM / New Mexico |

| NY / New York | NC / North Carolina | ND / North Dakota | OH / Ohio |

| OK / Oklahoma | OR / Oregon | PA / Pennsylvania | RI / Rhode Island |

| SC / South Carolina | SD / South Dakota | TN / Tennessee | TX / Texas |

| UT / Utah | VT / Vermont | VA / Virginia | WA / Washington |

| WV / West Virginia | WI / Wisconsin | WY / Wyoming |

The Significance of Comparing Loans Before Applying

Finding the lowest interest rate feasible requires comparing loan rates and lenders, which can be difficult. The identical financial profile may result in you receiving a considerably cheaper rate at one lender than another because lenders employ their algorithms to establish interest rates.

When contrasting loan rates and lenders, keep the following things in mind as well:

- Origination fee: A lender will charge an origination cost to handle a new application. Depending on the loan amount, credit score, and loan period, it can range from 1 to 8 percent.

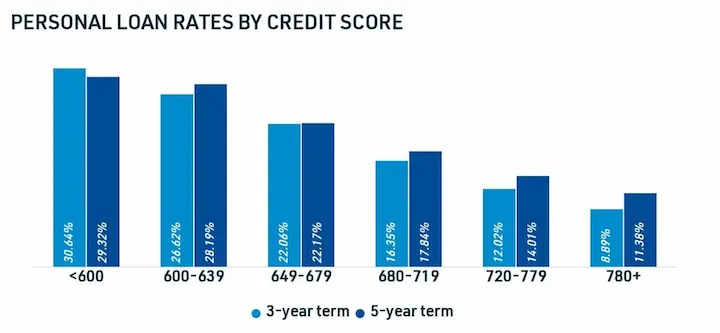

- Interest rate: Interest rates vary per lender and are generally based on your income, credit score, and general financial health. Bad credit borrowers may face higher interest rates.

- Loan term: The time you have to pay back the loan. Terms for personal loans typically range from three to five years. Steady income determines the loan term as well.

- Extra costs: You should be aware of other fees, such as late fines and prepayment penalties, not considered when calculating the APR.

Here are some statistics about comparing loans before applying:

| Statistic | Value |

|---|---|

| Percentage of people who compare loans before taking one out | 70% |

| Most important factors people consider when comparing loans | Interest rate, APR, fees, repayment terms |

| Average time people spend comparing loans | 2 weeks |

| Percentage of people who find a better loan after comparing | 30% |

| Average amount of money saved by finding a better loan | $1,000 |

How Do Lenders Determine Interest Rates?

Each lender’s unique formula determines the interest rate you’ll pay. Credit personal score, debt-to-income ratio, and annual income are the most significant indicators that lenders consider. If your DTI is low and your income is high, you may qualify for significant loan amounts and lower interest rates. However, having a bad credit history can impact the interest rate for bad credit borrowers. Approval direct from loan lenders is affected by these factors.

In addition, some lenders consider your field of study, time spent with your most recent company, work history, and education. For this reason, it’s crucial to shop around and compare rates from several lenders.

What Personal Loans Are Easiest to Obtain?

If you know your ruined credit, you’ll have tremendous success applying for a personal loan through an Internet lender. In contrast to traditional lenders like banks and credit unions, online lenders typically have fewer demanding qualification standards. A personal loan with a modest credit score requirement—which varies based on the lender—is the one that is the simplest to obtain.

However, it’s vital to remember that internet lenders who work with potential borrowers with bad credit frequently demand higher interest rates. Finding a lender who can meet your unique financial demands and conditions should be your priority when applying for a loan, even when you have bad credit. Bad credit instant approval and installment loans, or a no-credit-check loan, might be an option, but consulting a financial advisor is always smart.

Guidelines for Comparing the Most Accessible Personal Loans

When looking for the most accessible personal loans, consider using loan-matching services. They can help you find lenders that offer loans for bad credit, including those with bad credit instant approval options. However, always evaluate the terms carefully and assess whether the loan fits your financial situation.

When evaluating the most straightforward personal loans to obtain, keep the following in mind:

Determine the Amount You Can Comfortably Repay.

When applying for a personal loan, the lender often gives you several repayment options, including cash advances and monthly installments. Choose a payback period based on the monthly payment you can afford to make. Shorter repayment terms often have higher monthly payments and interest rates, while longer repayment terms typically have lower monthly and higher interest rates.

Examine Costs and APRs.

The interest you’ll pay over the loan depends on the interest rate. The interest rate and additional costs, such as a cash advance fee, are combined to form the APR. Never compare interest rates; always compare lender APRs as well.

Decide the Amount You Wish to Borrow

Many lenders impose strict minimum and maximum loan limitations. Knowing whether the amount you need to borrow is within the lender’s parameters is critical before you submit a loan application. Lenders with a Variety of Products might cover your financial needs and help alleviate your financial burdens.

Check Out Their Criteria in Advance.

Before applying for a loan, ensure the lender has a secure platform and meets your borrowing criteria. Review their requirements, terms and conditions, and any other relevant information to ensure you select the best loan for your needs.

Review the quick cash lender’s credit and income standards before filling out loan applications to determine whether you qualify for a high-interest loan. On their websites, some quick cash lenders make their requirements public. If you don’t see it posted, call the customer support number and ask for the high-interest loan prerequisites over the phone.

Frequently Asked Questions

Are there legitimate online lenders that offer quick personal loans for bad credit without conducting a credit check?

Yes, some online lenders offer personal loans without a strict credit check but approval is not guaranteed. They will still assess repayment ability based on income, employment, and other factors. Interest rates will be higher due to the increased risk.

How can I improve my chances of getting approved for a quick personal loan online with bad credit and no credit check?

Your odds improve by providing proof of steady income, long employment history, collateral like a car title, higher income-to-debt ratios, and having a banking relationship. Start with smaller loan requests first.

What are the typical interest rates and fees associated with quick personal loans for bad credit and no credit check?

Expect rates from 30-400% APR but they vary widely. Fees range from 1-10% of the loan amount as an origination or processing fee. Always verify full costs before accepting the loan.

What is the maximum loan amount I can expect to qualify for when applying for a quick personal loan online with bad credit?

Loan amounts typically range from $500-$5000 for bad credit borrowers when applying online. However, approval for larger amounts near $5000 is less likely without good income and other qualifying factors.