Financial decisions are like a minefield, full of danger and offering no guarantees. Choosing the right loan for your needs is challenging, with many available options. Revolving credit and installment credit offer different solutions that have their own set of advantages and disadvantages. Understanding it helps you make an informed decision about which one is best for your situation.

The article dives deeper into revolving credit versus installment credit loans, exploring the features of each option in detail. It contemplates how they differ and when opting for one type is beneficial. Readers must better understand how to select the most suitable choice by examining both sides of this complex issue.

The article aims to equip people with enough knowledge and information to feel confident in making financial decisions in line with what works best for them. Readers must feel empowered by their newfound insight into personal finance management by guiding them to choose between revolving credit and installment loans.

Accessing Funds: Revolving Credit Vs. Installment Loan

Two popular options are revolving credit and installment loans when accessing funds. The two options offer different benefits depending on the individual’s financial situation and needs. Understanding how these loans work is key in deciding which is best for you.

Revolving credit allows borrowing up to a set limit that is used multiple times until the full amount has been spent or paid back. The balance is flexible, as more money is added when payments are made. Revolving credit is a type of credit that does not require collateral, making them easier to obtain but with higher interest rates than other types of loans. Installment loans involve taking out a lump sum all at once and repaying it over a fixed time. They usually have lower interest rates than revolving credit. However, they require some form of collateral, such as personal property or real estate, before approval occurs.

According to CNBC Select, the average interest rate and balance of revolving loans are based on the average credit card APR and the Federal Reserve’s balance. The table below shows the comparison of two different type of credit.

| Loan Type | Average Interest Rate | Average Balance | Payment Frequency | Typical Terms |

|---|---|---|---|---|

| Revolving Loan | 16.61% | $6,194 | Monthly | Ongoing |

| Installment Loan | 5.00% | $22,756 | Monthly | 2-7 years |

Data for the average interest rate and balance of installment loans are based on recent data from LendingTree. Typical loan terms for installment loans are based on common ranges; it varies depending on the lender and loan purpose. Payment frequency is typical for each loan type but varies depending on the lender.

It is good to consider both options carefully when assessing your financing needs so that you make an informed decision about what works best for your current situation.

Repayment Loan Terms: Comparing Revolving Credit And Installment Loans

Comparing revolving credit and installment loans is like a game of chess. Each requires a different strategy for repayment, even though the pieces move on the same board.

Revolving credit allows borrowers to access funds repeatedly in small amounts up to an established limit, with interest paid only on what’s been borrowed and repaid quickly or slowly over time according to the terms of the agreement. Installment loans provide lump sums upfront that is paid back in equal monthly payments, including principal and interest, until the loan is fully repaid.

The credit and installment types of loans must be used responsibly or risk damaging one’s credit score. One factor impacting credit scores is the credit utilization ratio, which refers to the percentage of available credit used. Still, their differences make them suitable for different purposes, such as covering emergency expenses or financing larger purchases. Understanding these distinctions helps prospective borrowers decide which type best suits their financial needs. They can find comfort in knowing they have chosen wisely and belong among those who have made informed decisions about managing their finances with this knowledge, including being mindful of their credit utilization ratio.

Credit Limit: The Difference Between Revolving Credit And Installment Loan

One key factor distinguishing revolving credit from an installment loan is its limit. Revolving credit allows borrowers to access funds up to a certain limit over time; as payments are made on balance due, more money becomes available for borrowing again. Further borrowing only occurs once the lender has approved funding, unlike an installment loan, when all funds have been repaid in full. Some examples of revolving credit include lines of credit and home equity lines of credit (HELOCs).

On the other hand, an installment loan provides a fixed amount of money borrowed at once and requires regular payments until the entire debt has been paid off. There are various installment loans, from personal and mortgage to auto and student loans. Depending on the borrower profile and lender preferences, each type comes with different repayment terms, such as length or interest rate information.

Below is the comparison between the revolving credit and the installment loan.

- Revolving Credit- Accessible funds up to a certain limit over time

- Installment Loan- Fixed sum borrowed at once with regular monthly payments until complete payoff

The biggest difference between the two forms lies in how much you borrow initially versus how much you can borrow over time. Uncovering this distinction helps determine which option fits better when financing a new car. An important factor to consider is the borrower’s credit history.

Credit Score Requirements: Comparing Revolving Credit And Installment Loan

Interestingly, both revolving credit and installment loans require a borrower to have a minimum acceptable credit score. However, the specifics of those requirements vary depending on the lender. Credit history plays a crucial role in determining the approval for either type of loan. Borrowers with lower scores are still approved for either type of loan if they can put up collateral or have a cosigner on their loan application.

The interest rate charged by lenders depends upon the applicant’s credit rating. Borrowers with higher ratings expect lower rates than borrowers who present riskier profiles. Other factors influence the rate offered, such as the amount borrowed and extra fees applied.

You will be able to find an arrangement that works best for your unique financial situation with proper research and an understanding of each option’s pros and cons. It is easier to decide when choosing between revolving credit and installment loan options.

Purpose Of Funds: Understanding The Difference Between Revolving Credit And Installment Loan

Comparing revolving credit and installment loans is like comparing apples to oranges. The purpose of funds for each is quite different, although both are types of borrowing.

Revolving credit is a loan that works best for short-term financing needs or unexpected expenses such as car repairs or medical bills. Revolving credit allows borrowers to access money on an ongoing basis. You can access cash when needed but only pay interest on what has been borrowed. Think of it as a line of credit.

Installment loans offer more predictable payments over a longer period than revolving credit, making them ideal for larger purchases that require more substantial amounts, such as home improvements or debt consolidation. It’s good to note that paying off an installment loan in full before the end date saves you from accumulating extra fees; with revolving credit, there is no set amount due by a certain date since any unpaid balance carries forward month after month until paid off.

Revolving credit and installment loans are the two options that provide unique advantages depending on your financial situation and goals. Understanding their differences helps you make informed decisions about how best to use them for your benefit, considering aspects like your credit report.

Collateral: Exploring The Pros And Cons Of Each Option

Before deciding which best fits your needs, the pros and cons must be considered for revolving credit and installment loans. Revolving credit provides access to funds when needed and benefits those looking for flexible repayment options or low-interest rates. One in three Americans has revolving credit, according to a recent survey. Monitoring your credit report can help you choose between these options, as it represents your creditworthiness and financial health.

The two types of loans have different requirements when it comes to collateral. Revolving credit usually doesn’t require any form of security, while installment loans often do. The main benefit of not having to provide collateral is that you don’t need to own assets such as property or other large items to get approved for the loan. However, it does mean that lenders charge higher interest rates if no collateral is involved due to the increased risk they take on by lending without any guarantee of repaying. On the other hand, offering collateral with an installment loan reduces the interest charged since the lender has some assurance that the money is returned regardless of payments made in full each month.

Borrowers must weigh the flexibility they need when making repayments and the most suitable payment structure. Borrowers make minimum payments on time at regular intervals but can pay more whenever they like with revolving credit. They will only experience late fees if they don’t make timely payments every month. Installment loans offer less flexibility because once the terms are agreed upon during application, borrowers must stick to the predetermined schedule until all installments are paid in full.

Interest Rates: Exploring The Pros And Cons Of Each Option

Understanding the differences between revolving credit and installment loans is a must when not it comes to borrowing money. Undoubtedly, both types of loans have their benefits and drawbacks. One area that makes a big difference in selecting an effective choice is interest rates when exploring the pros and cons of each option.

Revolving credit is a loan with a variable rate that changes depending on market conditions. Interest rates for revolving credit are higher than those associated with installment loan options. Borrowers who opt for revolving credit must be prepared to pay more over time. On the other hand, installment loans often have fixed rates, so borrowers know exactly what they owe monthly during the loan period. Lenders offer different repayment plans for these two lending products; some allow borrowers to pay back over longer periods, while others require payment within shorter terms.

Individuals must consider how much flexibility they need versus how long they’re willing or able to commit to repaying their debt n weighing up choices. Researching various interest rates available from different lenders is necessary to make an informed decision before any agreement. It’s also essential to be aware of their credit utilization rate as it significantly determines their credit score.

Benefits Of Revolving Credit: Flexible Repayment Terms And Access To Low-Interest Rates

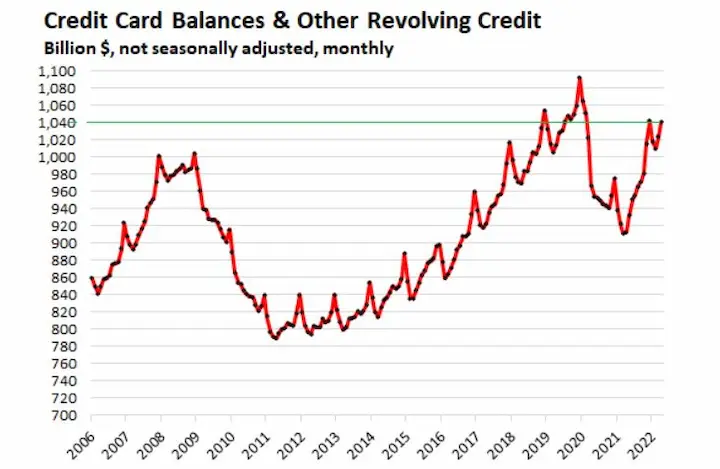

Revolving credit offers borrowers much flexibility on repayment, unlike installment loans. The borrower is given a set amount and must repay it over fixed periods. Revolving credit allows consumers to borrow as much or as little money as they need and repay it at their own pace. Revolving credit flexibility is particularly helpful for those who have unexpected expenses that require quick access to funds. Revolving credit often comes with lower interest rates than other loan products, making them attractive to individuals looking to secure financing quickly and cost-effectively. One example of revolving credit is credit card balances, which allow cardholders to borrow and repay funds continuously.

With flexible repayment options and low-interest rates, many lenders provide more benefits when taking out revolving credit, such as rewards programs or cashback bonuses on purchases made using the line of credit. The incentives help borrowers save money while allowing them to build their credit score if payments are made on time each month. By utilizing these features wisely, borrowers can maximize their savings while improving their financial situation and avoiding accumulating credit card debt.

Certain drawbacks must be considered before deciding whether such a loan product is right for you despite the advantages of revolving credit. For instance, high debt levels become easier to manage due to variable interest rates and a need for more structure regarding how much must be paid back each month if managed responsibly. Having too much available borrowing power leads some people to spend more than they realistically afford, leading them toward potential financial ruin. Therefore, careful consideration must be taken when deciding if revolving credit suits you.

Benefits Of Installment Loans: Predictable Monthly Payments And Fixed Period of Time for Repayment

One of the main benefits of installment loans is the predictability of the monthly payments and a fixed period of time for repayment. This structure allows borrowers to plan their finances around debt repayment and avoid unexpected changes in the amounts due each month.

First and foremost, installment loans offer borrowers a sense of security with their fixed repayment period. It means that the borrower can plan for when the loan must be paid off without worrying about variable interest rates or changes in payment amounts. The loans provide predictable monthly payments allowing individuals to stay on top of their finances and budget accordingly. It is like having a safety net providing peace of mind during uncertain financial times. Additionally, an amortization schedule can be used to track the progress of the loan repayment, further ensuring proper financial planning.

Revolving credit allows users to make purchases up to their limit while paying down balances over multiple months and potentially reducing overall costs associated with borrowing money, unlike installment loans with one large lump sum due at the end of the term. Revolving credit lines are not as structured as installment loans, but they have major benefits, such as access to low-interest rates and flexible repayment terms. For example, customers can take advantage of cashback bonuses or discounts which reduce the cost of borrowing over time depending upon the type of card selected and its rewards program.

Drawbacks Of Revolving Credit: High-Interest Rates And Lack Of Structured Repayment Terms

“Time is money,” as the saying goes, and with revolving credit, it takes longer to pay off debt than installment loans. Revolving credit often carries higher interest rates due to its flexible repayment terms, which is a disadvantage if you do not have a budget plan or cannot stick to one. There are no structured time payments or payment plans when using revolving credit; borrowers must use discipline and restraint to avoid overspending their available funds each month.

It is necessary to consider both benefits and drawbacks of each option when deciding to use revolving credit or an installment loan for large purchases such as a car or home renovation project. The fixed repayment period allows for predictable monthly payments while providing more structure that helps consumers stay on track toward paying off their debts before accumulating more fees from late repayments with an installment loan. However, such loans usually charge higher interest rates than those associated with revolving credit accounts, despite the presence of time payments that offer more structure.

TIP: You must read the fine print in your agreement carefully to understand any potential costs associated with extra fees or balloon payments if you decide to take out a loan for a major purchase like a house remodel or a new car.

Drawbacks Of Installment Loan: Fixed Repayment Period And Higher Interest Rates

Each has certain drawbacks when choosing between an installment loan and revolving credit. Interest rates for such type of loan tend to be higher than those associated with revolving credit loans. The repayment period is fixed, which makes budgeting more difficult if the borrower runs short on funds with an installment loan.

It’s necessary to understand what options are available when evaluating different types of lending products, such as their potential implications on your finances. Knowing about these drawbacks of an installment loan helps you compare them against other forms of debt, such as a revolving credit line, to determine which best meets your needs. Having access to all the facts helps you make a good financial decision. One important aspect to consider during this process is a credit check.

Applying For Revolving Credit: What You Need To Know

Revolving credit is an open-ended line of credit that allows borrowers to make purchases up to a certain limit and pay back the balance over time with interest. Applying for revolving credit is like navigating a minefield. Knowing what type of loan you’re looking for and how much money you need is good for understanding the process. Preparing for a credit check during the application can help ensure a smoother experience.

The benefits of this type of loan are numerous; however, there are some drawbacks too. To apply for revolving credit, consumers must first meet certain criteria, such as having good or excellent credit and providing financial information, including proof of income and assets. Borrowers must be aware that even though they can borrow more money in the future if needed, their monthly payments increase due to higher interest rates than other types of loans like installment loans. One crucial aspect to remember is to pay your bills on time to maintain a good credit score and remain eligible for such loans.

Consumers can approach taking out a revolving credit loan with confidence, knowing they have considered all aspects involved in the application process with all the mentioned tips. It is good to note that while applying for revolving credits often requires less paperwork than other financing types, lenders still pull your credit score, which impacts your overall borrowing power. Potential customers must read the fine print carefully before signing any agreement to guarantee they fully understand all terms associated with their loan, including the importance of paying bills on time.

Applying For Installment Loan: What You Need To Know

Many people seek ways to finance their purchases with an installment loan rather than revolving credit or a mortgage loan. More than 40 million Americans took out installment loans in 2019, according to the Federal Reserve Bank of New York. Applying for an installment loan seems intimidating, but knowing what you need beforehand and being prepared makes it much easier.

Lenders consider several elements when determining if the applicant is eligible for the loan when applying for an installment or mortgage loan.

- Lenders want to know about your income and debt-to-income ratio (DTI). Your DTI indicates how much debt you owe compared to your current annual income, so a high ratio indicates difficulty in making timely payments.

- Second, they’ll look at your credit score, which reveals any past negative payment history; having bad credit means being denied a loan altogether.

- Some lenders require proof of employment, such as pay stubs or tax returns, if applicants wish to qualify for larger amounts of money.

The criteria help guarantee that borrowers take responsibility while taking out loans by showing they can handle their finances responsibly, thus, creating trust between them and the lender. Understanding these factors before starting an application guarantees a smoother process overall and potentially better chances of approval. Aspiring borrowers must research online resources from reputable sources to gain further insight into navigating this life-changing financial decision.

Strategies For Managing Revolving Credit And Installment Loans

Many people find themselves choosing revolving credit and installment loans when it comes to managing debt. The revolving credit and installment types of loans have their benefits and drawbacks. Understanding their differences is key to making an informed decision when taking out a loan or managing existing debt. Strategies for managing revolving credit and installment loans can be found here.

The primary difference between these two types of loans is how they are repaid. Revolving credit involves paying back portions regularly, while installment loans involve repaying fixed amounts each month until the balance has been cleared. Interest rates vary depending on the borrower’s financial situation, type of lender, and repayment term length with both options. Late payments experience paying extra fees or penalties, which must be considered before deciding on a particular loan solution.

Here are some statistics about revolving credit:

| Statistic | Value |

|---|---|

| Total revolving credit outstanding | $11.7 trillion |

| Average credit card debt per household | $6,375 |

| Average credit card APR | 16.18% |

| Revolving credit utilization rate | 34.1% |

| Delinquency rate on revolving credit | 2.5% |

Certain questions come up frequently when it comes to managing revolving credit and installment loans. The article aims to answer those queries to help the reader understand how to manage these financial products.

A key distinction between revolving credit and installment loans is the fact that one offers access to funds for an indefinite time. In contrast, the other requires repayment on specific dates per agreed terms. Revolving credit often has higher fees associated with its use than installment loans. Paying off balances more quickly reduces interest costs when dealing with both types of debt. It is recommended for applicants who have difficulty making payments on their account or multiple accounts at once to consolidate them into a single payment plan.

Appropriate budgeting and understanding borrowing limits are the next steps toward responsible loan product management. Whether revolving credit or installment loan, Understanding the concepts helps create healthier financial habits, which leads to greater success in long-term wealth-building goals.

Conclusion

Revolving credit and installment loans are two different methods of accessing funds with distinct characteristics. Revolving credit offers repayment flexibility and allows borrowers to manage their accounts by setting spending limits. Requires careful consideration when making a decision on which one to use to meet financial objectives.

However, it comes at the expense of higher interest rates compared to an installment loan. On the other hand, an installment loan requires timely payments over a fixed period but offers lower interest rates for those who qualify. Deciding between the two options is like navigating a labyrinth; choices must be carefully evaluated before action. Understanding the differences between them helps you make your way out of the maze and choose the best option accordingly.

Frequently Asked Questions

What is the main difference between a revolving credit and an installment loan, and how do they work?

Revolving credit allows flexible borrowing up to a limit and minimum payments over time. Installment loans provide a fixed amount upfront and require specific scheduled payments until fully repaid.

Which type of credit, revolving or installment, is better for managing day-to-day expenses and building credit?

Revolving credit is better for managing day-to-day expenses because it is flexible, reusable over time, and requires minimum monthly payments. Installment loans provide one lump sum but require fixed repayments, so they are less suited for ongoing expenses.

How does the interest calculation differ between revolving credit and installment loans, and how does it impact the total cost of borrowing?

Revolving credit interest is assessed monthly on the outstanding balance, while installment loans calculate interest upfront for the total loan term. This makes installment loans’ total interest costs more predictable.

What are some common examples of revolving credit and installment loans, and how do they affect one’s financial flexibility?

Common revolving credit includes credit cards and lines of credit. Installment loans include mortgages, auto loans, and personal loans. Revolving credit allows flexible spending, while installment loans have fixed repayment schedules.

What factors should individuals consider when deciding between a revolving credit line and an installment loan for their specific financial needs and goals?

Factors include interest rates, fees, loan amount needed, repayment timeline, flexibility desired in payments, credit impact, and overall costs over time. Personal financial context matters.