Ways to Boost Your Credit Score

Having a good credit score is crucial for achieving financial stability and success. A high credit score helps individuals get approved for loans, save money on interest, qualify for better credit card offers, rent an apartment, and even improve their job prospects. Lenders use credit scores to assess creditworthiness when borrowers apply for loans. A good credit score increases the chance of securing loans with more favorable terms and lower interest rates.

Achieving and maintaining a good credit rating is difficult, but there are easy steps that help boost one’s credit score. The following heading discusses ways to improve one’s credit score and the benefits associated with such an endeavor. Familiarize yourself with different credit scoring models major credit bureaus use to become better equipped to manage your credit. Understanding the role of major credit bureaus and the importance of a diverse credit mix can significantly impact your credit health.

Summary

- A good credit score is important for financial stability and success, helping individuals secure loans, save on interest, qualify for better credit card offers, rent an apartment, and improve job prospects. Information from a credit reporting agency plays a crucial role in determining credit scores.

- Credit scores range from 300 to 850 and are based on information from a consumer’s credit report, including bill payment history, outstanding debt, and credit account applications. Spotting and rectifying a credit report error can help improve your credit score.

- Improving credit scores leads to greater borrowing options and financial control, lower interest rates, potential job opportunities, and psychological well-being. Ensuring you make timely payments is one way to boost your credit score.

- Understanding credit reports (provided by a credit reporting agency) and obtaining a copy of one’s report is essential for understanding how lenders perceive borrowers.

- Strategies to improve credit scores include analyzing credit reports for errors, calculating current credit scores, paying bills on time, reducing credit card balances and utilization ratios, and keeping credit accounts open for a long time.

- Improving credit scores requires patience and dedication, and monitoring progress and making necessary adjustments are important.

What Is A Credit Score?

A credit score numerically represents an individual’s financial health and borrowing capabilities. It is based on the consumer’s credit report information, including their bill payment history, outstanding debt obligations, and how often they apply for new credit accounts. Credit scores range from 300 to 850. This credit score range helps lenders determine the risk of lending money to the individual. Higher scores within the credit score range indicate a lower risk of defaulting on loans or other financial commitments.

Why Is It Important To Improve Your Credit Score?

One of the main reasons for increasing one’s credit score is that it allows individuals to live life with more freedom and flexibility. A strong score helps people gain access to more borrowing options and offers them greater control over their finances.

A higher score is necessary to qualify for certain jobs or professional licenses, as employers often consider them when hiring.

Having a high credit score helps consumers save money in the long run due to lower interest rates on mortgages, car loans, and other forms of debt. The low rates lead to hundreds, if not thousands, of dollars saved throughout the loan repayment period. A healthy credit history has even been linked with improved psychological well-being since it assures any potential financial crisis in the future.

Taking proactive steps to improve credit scores is vital for building credit and achieving long-lasting security and prosperity. There are countless benefits associated with boosting one’s credit score. Maintaining good credit health and striving for an excellent credit score can open up opportunities for lower interest rates and better financial deals.

Understanding Credit Reports

Credit bureaus compile the data from consumer-reporting companies that track consumer spending habits. A credit report contains information about one’s borrowing history, such as accounts opened, existing loans, current debt amounts, delinquent payments, and any negative marks on the account due to late payment histories. Many lenders use these reports, provided by the credit bureau when deciding whether or not to offer an individual a loan or line of credit. The credit files created by these bureaus are essential in this decision-making process.

Obtaining A Copy Of Your Credit Report

Obtaining a copy of a credit report is an essential step in understanding how lenders perceive individuals as borrowers, as it is based on information from the credit bureau. Your credit files can give you a better understanding of your current financial standing. Listed below are three easy steps to help make the process smoother.

Understand Credit Reporting Bureaus

It is essential to be acquainted with the three major credit reporting bureaus: TransUnion, Experian, and Equifax. These entities diligently track consumers’ borrowing activities, compiling this information to create individual credit reports.

Prepare Required Documents

Individuals seeking credit reports must have certain documents ready for submission. These include a valid social security number, government-issued photo identification (like a driver’s license), and any other relevant documentation required by the bureaus.

Submit Paperwork

Once the necessary documents are prepared, individuals can request their credit reports either via mail or online. The request forms are accessible on the official websites of each of the three credit reporting bureaus.

Strategies To Improve Your Credit Score

Improving one’s credit score is a process that requires dedication and patience. It is important to understand that it can only be achieved after some time, and it takes time before any tangible results are visible. However, the process of improving the credit score is relatively easy. It only requires effort and discipline from an individual. Here are helpful strategies to improve one’s credit score:

Analyze the Credit Report For Errors

Analyzing the credit report is a vital step in increasing credit scores. It allows people to identify errors and inaccuracies that negatively affect the value of their score. One reason to analyze the report is to discover opportunities for a credit limit increase.

- Review every line item on the credit report thoroughly. Check any loans and lines of credit and check if any accounts are listed that do not belong to them. Be aware of any credit check that has been performed without consent.

- Check if all reported payments have been accurately recorded by creditors. Positive credit history should be reflected correctly on the report.

- Contact the creditor and the bureau immediately for resolution if discrepancies arise or request a credit limit increase if appropriate. Listed below are the steps for analyzing a credit report:

Borrowers need to evaluate each account’s payment history carefully. Doing so provides valuable insights into which areas need improvement. Look at how much debt is outstanding relative to available credit limits (utilization rate) on each card. A higher utilization rate than recommended causes issues with lenders when applying for new financing opportunities.

Calculate the Current Credit Score

The task of calculating one’s current credit score is a vital step in the process of improving it. The process helps individuals to become aware of their financial standing and work towards raising their overall score.

The calculation requires understanding the various components that make up a credit score, such as payment history, amounts owed, length of credit history, new accounts opened, types of credits used, etc., all of which are weighed differently by each scoring model. It is vital to understand what affects these values so that needed changes are made to improve them.

Pay Bills On Time

Paying bills on time is important in boosting one’s credit score. Borrowers must settle all monthly payments, such as rent, mortgage, and utilities, before the due date. Doing so demonstrates to creditors that an individual has a history of responsible financial decisions and can manage their finances effectively. Paying the bills on time showcases reliability when handling debt obligations.

Settling bills and making timely payments on time allows individuals to avoid late payment fees, harming their credit scores. Keeping track of due dates for each bill and setting up reminders or calendar notifications is strongly encouraged since missing even one payment decreases the overall rating.

Reduce Credit Card Balances and Utilization Ratio

A person’s credit card balances and utilization ratio are vital factors in determining creditworthiness. Reducing credit card debt by lowering one’s outstanding balance is important.

Credit card balances refer to the amount of money a person owes on their credit cards. Borrowers with a high credit card balance indicate that they rely too heavily on credit and may need help to make ends meet. They can positively impact their credit scores by making consistent time payments and keeping balances low.

The credit utilization rate is the ratio of a person’s credit card balance to their credit limit. For example, a person with a $10,00 limit credit card and a balance of $5,000 has a utilization ratio of 50%. A high utilization ratio indicates that a person uses too much of their available credit, which signifies financial distress. According to CNBC, lenders and credit card issuers prefer to see 30% or less utilization ratios.

Paying off credit card balances as quickly as possible is a quick way to reduce credit card balances and utilization ratios. Another strategy is reducing credit card spending by contacting your company to discuss options.

There are plenty of ways to do it. Borrowers are free to create a budget and stick to it, use cash or a debit card instead of a credit card for everyday purchases, or limit credit card use to emergencies only.

Borrowers must consider increasing their credit limit too. Doing so helps reduce their utilization ratio, as long as they don’t increase their spending along with their credit limit. Contacting your credit card company to discuss a credit limit increase may help improve your credit score.

Establish A Positive Payment History

Making timely payments on any debt owed make a drastic difference in improving one’s financial situation. Payment history plays a massive role in determining one’s overall credit score. It accounts for approximately 35% of their total FICO score, according to Experian.

Establishing a positive payment history is like crafting the cornerstone of a strong credit score. Making timely payments on debts helps build a sturdy financial reputation, just as a foundation provides stability and support for an entire structure.

Here are some easy steps to establish a good payment history.

- Pay bills on time – Late payments cause significant damage to the credit report. Set up email or text reminders to avoid missing due dates.

- Automate payments – Borrowers must consider automatic payments. Doing so guarantees that each bill is paid promptly.

- Dispute errors quickly – Mistakes happen, but addressing them immediately saves points in the long run. Investigate immediately and take necessary action to correct inaccurate information on the credit report.

Use Different Types Of Credit Accounts Responsibly

Borrowers must understand the importance of responsibly using different types of credit accounts to improve their credit scores. This includes managing credit card accounts and handling loans carefully, especially for those with bad credit situations. In particular, responsibly maintaining multiple credit card accounts can demonstrate effective credit management and help raise the score over time. A helpful way to think about this is to imagine each account as a separate room in a house, where the way it is used determines its value and contributes to the overall value of the property – in such cases, the credit score.

For instance, having an installment loan account like a mortgage or auto loan indicate responsibility in making long-term commitments with regular monthly bills. On the other hand, revolving accounts like credit cards demonstrate the ability to manage short-term debt effectively, but too much utilization cause issues if not properly managed. Limiting the number of credit inquiries made to prevent negative impacts on the score due to hard credit inquiries from potential creditors is also advisable.

Borrowers must maintain a balanced mix of installment and revolving accounts while avoiding excessive credit applications. Doing so helps to demonstrate financial stability through the responsible use of different credit accounts and increases the likelihood of favorable views from lenders.

Explore Experian Boost To Increase Score Instantly

Experian Boost is an online platform offered by Experian. The program instantly helps users boost their credit scores by tapping into their financial data from banks and other providers. Consumers with excellent credit can connect their accounts with Experian Boost, which adds positive payment history to their existing reports. Positive payments are reflected on the user’s Experian report within two days, increasing its overall value and boosting the user’s score immediately.

Experian Boost provides consumers with a safe and easy way to raise their credit score without additional effort or cost. The system offers personalized insights about how small changes in finances affect a person’s overall creditworthiness over time, including options like a payment plan or debt consolidation loans. Users also benefit from free updates as they pay off debt or make new purchases, allowing them to monitor their spending better while building a healthy credit profile and maintaining excellent credit.

Benefits of Good Credit Scores in Getting Loans

A good credit score offers many benefits when it comes to getting loans. One of the most significant advantages is the potential to receive lower interest rates. The lenders evaluate the credit score to determine the level of risk involved in lending money. A higher credit score generally indicates a lower level of risk, which translates to a lower interest rate on the loan.

| Credit Score | Interest Rate | Loan Amount | Loan Term | Total Interest Paid |

|---|---|---|---|---|

| 760+ | 2.98% | $300,000 | 30 years | $98,316.91 |

| 700-759 | 3.2% | $300,000 | 30 years | $107,782.08 |

| 680-699 | 3.38% | $300,000 | 30 years | $114,876.39 |

| 660-679 | 3.6% | $300,000 | 30 years | $123,580.47 |

| 640-659 | 4.04% | $300,000 | 30 years | $141,142.63 |

| 620-639 | 4.53% | $300,000 | 30 years | $162,969.69 |

The table shows how different credit scores affect the interest rates and total interest paid on a 30-year fixed-rate mortgage with a loan amount of $300,000. The interest rate increases as the credit score decrease, resulting in significantly higher total interest paid over the life of the loan for borrowers with lower credit scores.

For example, a borrower with a credit score of 760 or higher pays a total of $98,316.91 in interest over the life of the loan, while a borrower with a credit score of 620-639 pays a total of $162,969.69 in interest over the same loan term, which is an $80,000 difference. It illustrates the importance of having a good credit score when obtaining a loan and the potential cost savings resulting from a higher credit score.

Conclusion

Having a good credit score is vital for achieving financial stability and success. A high credit score allows individuals to get approved for loans, save on interest, qualify for better credit card offers, rent an apartment, and even improve their job prospects. However, a bad credit score can hinder financial progress and limit opportunities.

Boosting one’s credit score is necessary for building long-lasting security and prosperity. Achieving and maintaining a good credit rating requires dedication and patience. Strategies to improve one’s credit score include:

- Analyzing the credit report for errors.

- Calculating the current credit score.

- Paying bills on time.

- Reducing credit card balances and utilization ratio.

In some cases, individuals with a bad credit score may benefit from seeking professional help, such as credit repair services. These services can assist in disputing errors on the credit report, negotiating with creditors, and providing guidance on improving the overall credit profile. Individuals may accelerate their journey toward a healthier credit score and better financial stability through credit repair services.

Frequently Asked Questions

What are some practical strategies for quickly raising my credit score?

Pay down balances, increase credit limits, become an authorized user on someone else’s card, limit hard inquiries by only applying for needed credit, correct any errors on your report, optimize credit utilization by keeping it below 10%, and sign up for credit monitoring to track your score.

Can you explain the key factors that influence a person’s credit score, and how can I work on improving them?

Payment history, credit utilization, credit history length, new credit accounts, and credit mix are key factors. Improve them by paying bills on time, lowering balances, allowing longer history, minimizing new applications, and using different credit types responsibly.

Are there any common mistakes people make when trying to boost their credit score, and how can I avoid them?

Common mistakes are applying for lots of new credit, closing old accounts, missing payments, maxing out cards, and repeatedly applying for loans. Avoid these by optimizing utilization, paying on time, letting accounts age, monitoring your report, and only applying for needed credit.

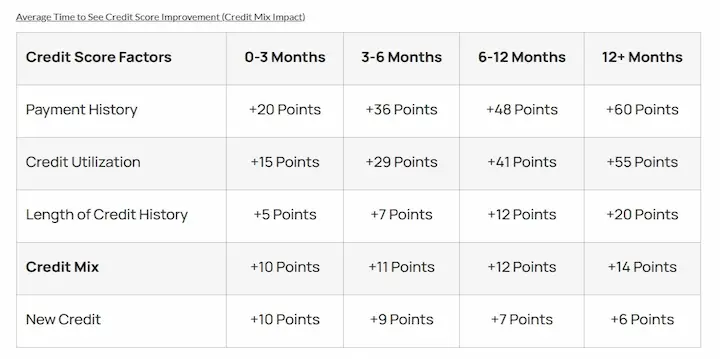

How long does it typically take to see significant improvements in my credit score after implementing these strategies?

It depends on your starting score and credit issues, but most people see at least a small improvement within 1-3 months. More significant increases of 50 points or more may take 6 months to a year of diligently following credit-boosting strategies. Expect slow, steady progress over time.

What are some lesser-known tips or tricks for improving your credit score that many people might not be aware of?

Lesser-known score boosting tips include becoming an authorized user, disputing old debts, optimizing credit mix, asking lenders for lower interest rates, paying down balances before the statement date, and letting old accounts age while minimizing new applications.