What To Know About How Title Lender Loans Work

A title loan company is a lender offering a title loan, a short-term credit secured by the customer’s car. The borrower uses their car, truck, or motorcycle as collateral. In exchange, the lender provides them with a cash advance. Title loan lenders offer title loans to give borrowers quick access to emergency cash. The borrower must give the title loan company their vehicle’s title to get a title loan. The title acts as proof of ownership. The lender then evaluates the vehicle to determine its value. It helps them determine the amount of the loan that the borrower is eligible for. The borrower then uses the loan’s cash to cover urgent financial needs. To qualify for a title loan, the borrower must meet certain requirements. These include being 18 years old and having a valid driver’s license. They must have a clear title to their vehicle, meaning they must own it outright and have no outstanding liens. Besides, the borrower must be able to prove that they can repay the loan.

An example of a title loan is a borrower who needs to pay for urgent car repairs but does not have cash. One option is to take out a title loan using their vehicle as collateral and use the cash from the loan to pay for the repairs. In that case, the online lender holds onto the borrower’s vehicle title until the loan is repaid.

What is a Title Loan?

A title loan is a secured loan where the borrower uses their vehicle as collateral. The online lender repossesses the vehicle if the borrower cannot repay the loan. Title loans are often used by people who need to borrow money. It is an excellent option for people with bad credit. It’s important to carefully consider the terms of a title loan before agreeing to one. Failure to repay the loan results in the loss of the vehicle.

How Do Title Loans Work?

Title loans work by making use of the borrower’s vehicle as collateral. Borrowers must provide the lender with their vehicle’s title to obtain a title loan. Other credit requirements include proof of income and proof of residence. The lender then determines the amount of money to lend a borrower based on the vehicle’s value. Once the borrower agrees to the loan terms, they receive the money. The lender holds onto the vehicle’s title as security. To repay the loan, borrowers must make regular payments to the lender. The payments include interest and fees. The lender releases the collateral once the loan is fully paid. Borrowers who fail to pay the loan risk losing their vehicles. Borrowers must consider the terms of a title loan and ensure they can afford the repayments.

At PaydayChampion, we take pride in our extensive reach and commitment to serving customers across the United States. We understand that financial needs arise in various corners of the country, and we strive to provide accessible solutions. With that in mind, we are pleased to present a comprehensive list of American states where our company is actively operating and offering title loans. Whether you reside in the bustling city streets or the tranquil countryside, our dedicated team is here to assist you in obtaining the financial support you need. Please refer to the table below to see if your state is among those where we proudly extend our services.

| AL (Alabama) | AK (Alaska) | AZ (Arizona) | AR (Arkansas) |

| CA (California) | CO (Colorado) | CT (Connecticut) | DE (Delaware) |

| DC (District Of Columbia) | FL (Florida) | GA (Georgia) | HI (Hawaii) |

| ID (Idaho) | IL (Illinois) | IN (Indiana) | IA (Iowa) |

| KS (Kansas) | KY (Kentucky) | LA (Louisiana) | ME (Maine) |

| MD (Maryland) | MA (Massachusetts) | MI (Michigan) | MN (Minnesota) |

| MS (Mississippi) | MO (Missouri) | MT (Montana) | NE (Nebraska) |

| NV (Nevada) | NH (New Hampshire) | NJ (New Jersey) | NM (New Mexico) |

| NY (New York) | NC (North Carolina) | ND (North Dakota) | OH (Ohio) |

| OK (Oklahoma) | OR (Oregon) | PA (Pennsylvania) | RI (Rhode Island) |

| SC (South Carolina) | SD (South Dakota) | TN (Tennessee) | TX (Texas) |

| UT (Utah) | VT (Vermont) | VA (Virginia) | WA (Washington) |

| WV (West Virginia) | WI (Wisconsin) | WY (Wyoming) |

Can You Get a Title Loan on a Leased Car?

Getting a title loan on a leased car is generally impossible because the borrower does not own the vehicle. Title loans are a type of secured loan. It means the vehicle’s owner uses it as collateral for the loan. To use the vehicle as collateral, they must own it outright. A leased vehicle is owned by the lender of the car, not the borrower. It means that borrowers cannot use the car as collateral for a loan. In such cases, borrowers must explore other options. These include personal loans or unsecured credit.

Can You Get a Title Loan Without a Vehicle Present?

Getting a title loan is generally only possible with the car being present. It is because lenders need to use the vehicle as collateral. The lender needs to assess the vehicle’s value to determine the amount of money they are willing to lend. The lender inspects the vehicle and then approves the loan. They hold onto the vehicle’s title as collateral until the loan is repaid. Borrowers who do not bring their vehicles for inspections risk getting denied. Only a few lenders can provide a loan without the vehicle being present. However, it is rare and is a better option. Borrowers who cannot bring the vehicle to the lender must consider other loan options.

What Are the Requirements for a Title Loan?

- Government-issued IDs

Government-issued ID is an identification issued by a government agency. Common examples include a driver’s license or passport. The ID is important in getting a title loan. It helps the lender verify a borrower’s identity and confirm they are who they say they are. When applying for a title loan, lenders need a government-issued ID as part of the application process. It helps the lender verify the borrower’s identity before lending money. Lenders use it to verify the borrower’s age. It is because most lenders need borrowers to be 18 years old. It is the minimum age for taking out a loan. Besides verifying identity, a government-issued ID provides the lender with other important information. These include a borrower’s address and date of birth. Lenders use the details to determine whether borrowers are eligible. - Original Car Title with your name on it

The original car title with a borrower’s name is a document proving they own the vehicle used as collateral for the loan. It is an essential requirement for a title loan. It allows the lender to hold onto the title as collateral for the loan. During title loan application, the lender needs borrowers to provide it. Another use for the lender to verify the borrower is the vehicle owner. It proves the person has the right to use it as collateral for the loan. The title provides the lender with important information about the vehicle. These include its make, model, and year of manufacture. The details help to determine the vehicle’s value and the amount of money the lender is willing to lend. Before applying for a title loan, borrowers must have this document in good condition. The title must be free of any markings or damage that make it difficult to read or verify. Borrowers need the document to qualify for title loans. - Current Registration of the vehicle

To get a title loan, borrowers must register the vehicle in their name. It is essential because it helps the lender know that a borrower is the car’s legal owner to use it as collateral. Registration records vehicle ownership with the state’s Department of motor vehicles (DMV). It involves filling out some paperwork and paying a fee. By having the car registered in the borrower’s name, they can prove they own it.

Additionally, most states need vehicles registered to be legally driven on public roads. So, if borrowers want to get a title loan and still drive their vehicle, they must ensure it is registered in their name. If they repay the loan on time, they can avoid further complications. - Proof of residency or Utility Bill

You must typically provide residency proof or a utility bill to get a title loan. Proof of residency is a document that shows where a borrower lives. It helps lenders to verify a borrower’s identity and address to process the loan. Examples include a utility bill, bank statement, or lease agreement. It is essential because it helps the lender confirm that the borrower lives at their provided address. A utility bill is a statement from a utility company. It acts as proof of residency because it is a document sent to the home address and provides evidence of where a person lives. An example is a gas, electric, or water company showing how borrowers paid for services over a certain period. - Proofs that you can pay the loan: Payslip

During title loan applications, borrowers must provide proof of income. Proof of income is essential because it helps lenders determine whether borrowers can pay the loan. It shows they are capable of repaying the loan. It includes a payslip, a document showing income, and the amount their employer pays them. A payslip provides evidence of their income and ability to repay the loan. Lenders want to make sure they lend money to borrowers who can repay it. Besides a payslip, lenders use other forms of proof of income, such as tax returns or bank statements. These documents help the lender better understand a borrower’s financial situation. They use it to determine whether a borrower is a good candidate for a title loan. - Proof of Car Insurance

Some lenders need borrowers to provide proof of car insurance when applying for a title loan. It is a document showing a borrower has an active insurance policy for the vehicle used as collateral. Lenders use it because it helps protect their interest in the vehicle. If something happens to the vehicle, such as an accident, the car insurance policy covers the cost of repairs or replacement. The lender is less likely to lose money on the loan if something happens to the vehicle. Additionally, most states require that vehicles be insured to be legally driven on public roads. So, borrowers looking to get a title loan and still be able to drive their vehicle must ensure it is insured. - Car key duplicates that are working

A car key duplicate is an extra copy of a car key. Some lenders need borrowers to provide a duplicate car key when applying for a title loan. The requirement for a duplicate car key is important to the lender. It provides an extra level of security in case the borrower loses the original key or cannot return it for any reason. It protects the lender’s interest in the vehicle and ensures they repossess it if necessary. - Information of valid reference: Names, Phone numbers, and addresses.

To get a title loan, the borrower must provide certain information, including their name, phone number, and address. The information is important for several reasons. First, the lender can verify the borrower’s identity and contact them if necessary. It helps the lender and the borrower by ensuring the loan is made to the correct person. The lender uses it to reach the borrower if there are any issues with the loan. Second, the borrower’s address determines the value of their vehicle. The value of a vehicle varies depending on several factors. These include its location and other factors, such as its condition and mileage.Additionally, it helps to determine the amount of the loan they receive. Third, the borrower’s name and address create a loan agreement, which outlines the terms and conditions of the loan. The agreement is a legally binding document that both parties must sign. The information provided must be accurate and up-to-date.

What Are the Advantages and Disadvantages of a Title Loan?

There are both advantages and disadvantages to taking out a Title Loan.

Some of the advantages:

- Borrowers get the money quickly. In many cases, borrowers receive cash from a title loan within 24 hours.

- It allows borrowers to use the equity in their cars. Suppose a borrower owns their car outright or has significant equity. They are allowed to use it as collateral for a Title Loan.

- It does not require a credit check. Since borrowers use their cars as collateral, lenders do not require a credit check.

- It has lower interest rates. Since the car acts as collateral, the interest rates are lower than other loans.

- Borrowers are allowed to drive the car. Even though the borrower uses the car as collateral, they keep driving it.

Some disadvantages to taking out a Title Loan:

- Borrowers risk losing their cars if they default. Suppose a borrower defaults on the loan; the lender has the right to repossess the car.

- The loan amount is less than the car’s value. Some lenders value the car with a lesser amount. In such a case, borrowers get a lower loan limit than they deserve.

How Long Does It Take To Get a Title Toan?

Borrowers typically get the money they need within 24 hours. The time it takes to get a title loan varies depending on several factors. These include the lender, the borrower’s creditworthiness, and the type of vehicle. The first step in getting a title loan is to fill out an application with the lender. It involves providing personal and financial information and details about the vehicle. The lender reviews the application and determines if the borrower is eligible for the loan. Once approved, the lender provides a loan agreement.

How to Use a Title Loan Calculator?

A title loan calculator is a tool that helps borrowers estimate the cost of a title loan. To use a title loan calculator, borrowers must provide basic information. It includes the loan amount, interest rate, and length. Some calculators ask for additional details like the loan’s fees or charges. To use a title loan calculator, follow these steps:

Find a title loan calculator online. There are many free calculators available on financial websites and lender websites. Enter the loan amount. It is the value of the borrower’s vehicle. But, some lenders allow borrowers to borrow more or less depending on their creditworthiness. Enter the interest charged on the loan. Title loans have high-interest rates. Compare rates from different lenders to find the best deal. Enter the length of the loan. Title loans are short-term loans with repayment periods ranging from a few months to a year. Once done, the calculator provides the total loan estimate. It shows the principal amount and interest fees.

What Is the Average Interest Rate for a Title Loan?

Per the Federal Trade Commission (FTC), a title loan’s average annual percentage rate (APR) is around 300%. However, some go as high as 700%. Suppose a borrower obtains $1,000 for a year at an interest rate of 300%. They end up paying $3,000 in interest and fees on top of the original loan amount. Shop around and compare interest rates from different lenders before borrowing. Some lenders offer lower interest rates to borrowers with good credit.

Here are some statistics about the average interest rate for different amounts of title loans:

| Loan Amount | Average Interest Rate |

|---|---|

| $1,000 | 24% |

| $2,000 | 27% |

| $3,000 | 30% |

| $4,000 | 33% |

| $5,000 | 36% |

What Are the Minimum and Maximum Amounts You Can Borrow With Title Loan?

According to the Federal Trade Commission (FTC), the average loan amount for a title loan is around $100 to $5,000. Borrowers who have cars in excellent condition tend to qualify for higher amounts. However, some lenders allow borrowers to borrow more or less per their situation.

Do Title Loan Amounts Vary on What Kind of Vehicle You Have?

Yes, the amount borrowed with a title loan varies depending on the type of vehicle. Lenders generally consider the vehicle’s value when determining the loan amount. A vehicle with a higher value allows you to borrow more money. When applying for a title loan, the lenders assess the vehicle’s value using various factors. These include the vehicle’s make, model, year, and condition. The lender considers the current market value of similar vehicles to determine their value. It helps the lender determine the maximum loan amount to lend.

Is a Credit Score Required When You Apply for a Title Loan?

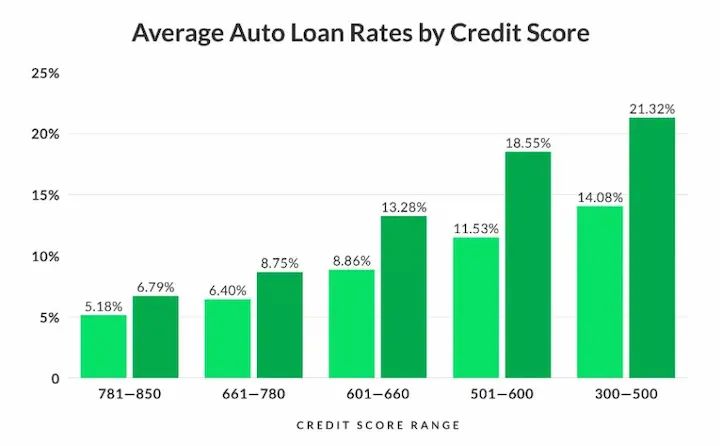

A credit score is required when applying for a title loan. A credit score is a numerical representation of creditworthiness based on information in credit reports. Lenders use it to assess the risk of lending to a borrower. A higher credit score indicates a lower risk of default. During a title loan application, lenders check the credit score to determine if a borrower is eligible for the loan. It lets them know what interest rate to offer. Some lenders need a minimum credit score. Others are more flexible and consider other factors. These include income and the vehicle’s value.

Is There a Difference Between a Title Loan and a Title Pawn?

Yes, there is a difference between a title loan and a title pawn. A title loan is a secured loan where the borrower uses their vehicle’s title as collateral. The lender holds onto the title as security until the loan is repaid. Once repaid, the borrower receives the title back. On the other hand, a title pawn is similar to a title loan in that the borrower uses the vehicle’s title as collateral. However, the borrower receives a cash advance or pawn instead of a loan. The lender holds onto the title until the advance is repaid.

What Is the Difference Between an Auto Loan and a Title Loan?

An auto loan and a title loan are both types of loans that finance the purchase of a vehicle. However, there are some key differences between the two. One major difference is the way the loans are secured. An auto loan is a type of unsecured loan. The lender does not hold onto any collateral as security for the loan.

In contrast, a title loan is a secured loan where the borrower’s vehicle title is used as collateral. Suppose the borrower defaults on the loan. The lender seizes the vehicle and sells it to repay the loan.

Another key difference is the way the loans are processed. Banks and other financial institutions offer auto loans. The application process takes several days to complete. Specialized lenders often offer title loans. The application process is typically much faster. Finally, the terms of the loans vary between the two. Auto loans are offered longer, with up to seven years or more repayment periods, often including monthly payments. Title loans are offered for shorter periods, with 30 days or fewer repayment periods, and may not necessitate monthly payments.

Frequently Asked Questions

What is a title loan, and how does it work?

A title loan uses a car title as collateral for a short-term, high-interest loan. The lender places a lien on the car title in exchange for cash and holds it until repaid. If unpaid, the car can be repossessed and sold.

What are the typical requirements for getting a title loan?

Requirements normally include owning a paid-off or nearly paid-off vehicle, providing car title and keys, government-issued ID, income verification, and passing a vehicle inspection.

Can you explain the risks and benefits of taking out a title loan?

Benefits are fast cash without a credit check. Risks are exorbitantly high interest rates, potential repossession, and cycles of re-borrowing leading to mounting debt. Title loans should be a last resort option.

Are there alternatives to title loans for people in need of quick cash?

Alternatives include payday loans, pawn shop loans, installment loans from credit unions, advances from employers, borrowing from family or friends, credit cards, or government assistance programs.

What happens if I can’t repay a title loan?

If you cannot repay the loan, the lender can repossess your car and sell it to cover your debt. Your credit score may also take a hit. Be very cautious about taking on a title loan and borrow only what you can realistically repay.