What Is a Cash Advance Loan & How Does It Work

A cash advance loan is a small loan that lets borrowers obtain cash against their next paychecks. There are two main cash advance loans payday loans and installment loans. The easiest cash advance loans are tax refund and emergency loans 2023. A tax refund advance cash loan allows borrowers to receive a portion of their anticipated tax refund. They receive it before the Internal Revenue Service (IRS) finishes processing their return. Tax preparation companies or financial institutions offer these loans. They are often advertised as a way to access tax refund money more quickly. They are sometimes called “emergency loans” because they provide a quick source of funds in a financial emergency.

Borrowers usually need proof of income and a valid ID to obtain the loan. They then either visit a storefront location or apply online. The process is typically quick and easy, and borrowers obtain their funds within 24 hours. The upper and lower limits for cash advance loans vary depending on the lender and the specific terms of the loan. Knowing the upper and lower limits is important when taking out cash advance loans.

Some lenders have minimum and maximum loan amounts that they are willing to lend, while others may be more flexible. However, the upper limit of a cash advance loan is $1000, while the lower limit is $500. Payday loan companies typically provide cash advance loans, although some credit card companies offer them. People take out a cash advance loan for a few different reasons. Some people use them for unexpected costs like medical bills and car repairs. Others use them to tide themselves over until their next paycheck arrives, and still, others use them to help meet ends during a tight month.

Many top companies give out cash advances. Some of them include credit unions, banks, and online lenders. Each of these institutions has unique requirements for eligibility, so it is essential to research each before applying. Banks are usually the first place people think of when they need a cash advance. However, banks typically have more stringent requirements for eligibility, such as a good credit score.

Credit unions are another option for cash advances. They often come with more adaptable conditions than banks, but they require a borrower to be a member for some time. Online lenders are a third option for cash advances. They typically contain the easiest conditions to qualify but frequently have the highest interest rates.

Main Points

- Cash advance loans are small loans that allow borrowers to get cash before their next paycheck.

- There are various cash advances, including payday and installment loans, tax refund advances, and emergency loans.

- To obtain a cash advance loan, the borrower generally has to provide proof of income, a valid ID, and information about their occupation on an application.

What is a Cash Advance?

Cash advance loans cover unforeseen costs or wave borrowers until their next paycheck arrives. People traced the cash advance loan history back to the early 1900s when few companies began offering small high-interest loans to workers requiring quick cash. These loans were generally repaid out of the next salary and were regularly used to take care of emergencies or to help the borrower until they received their salary. They became increasingly popular following the great recession as many Americans needed instant money to cover unforeseen expenses. Today, cash advance loans are used by people from all walks of life, ranging from students to small business owners. According to a study by the Federal Reserve, about 12 million Americans use these loans every year. The average loan amount is about $375, and the average borrower pays about $520 in interest and fees.

How Does a Cash Advance Loan Work?

Requesting a cash advance loan starts by providing essential information on the application, such as name, address, age, and occupation. Next, the lender reviews the application to determine if the application loan is eligible for approval and computes the loan application cash limit. Before signing in, an agreement between the lender and the loaner is discussed, especially regarding the interest rates and fees. After signing in with the agreement, the lender releases the cash loan, but some costs are deducted upfront, including interest charges. The loan amount of the applicant would be different from the amount being requested. Depending on the lender’s terms, borrowers make repayments after the next paycheck or as early as the next month.

First, people need steady revenue and a fair credit history to be considered for a cash advance loan. Second, the borrower completes a quick application when obtaining it and provides the requirements. Third, the lender ascertains the details. Fourth, the lender funds the loan once approved.

What is the Upper Limit for Cash Advance?

The maximum cash advance limit in the United States is $500 or $1,000. In Canada, the limit is usually $1,500. A few factors affect the upper limit for cash advances, such as the currency of the country and the policies of the individual bank or credit card company. For instance, some banks have a lower limit for cash advances in foreign countries to protect against currency fluctuations. Credit card companies also set different limits for cash advances depending on the card type. For example, a rewards card has a higher cash advance limit than a basic card.

What is the Lowest Limit for Cash Advance?

The lowest limit for a cash advance in the United States is typically $100, while the lowest limit in Canada is $500. A few factors determine the lowest limit for a cash advance. These factors include the amount of money in the account, the credit score, the interest rate, and the fees associated with the cash advance.

How to Take a Cash Advance Loan?

Borrowers follow the below steps when taking out a cash advance:

- Ensure they need the money and afford to repay the loan. Cash advance loans are typically high-interest, so they’ll want to be sure they repay the loan before taking one out.

- Shop around for the best rates. Not all lenders offer the same rates for cash advance loans, so comparing and finding the best one is important.

- Read the terms and conditions of the loan before signing anything. This way, borrowers know exactly what they agree to, and there won’t be surprises.

- Once borrowers take out the loan, they ensure to repay it soon. The sooner they repay the loan, the less interest they’ll accrue, and the better off they’ll be financially secure.

There are ways to increase the chance of being approved for a cash advance loan: First, ensure a steady income and a good track record. The second is to apply for the loan on a regular business hour. The third is to provide collateral, such as a car or a house, to secure the loan application approval. The last is to pay higher interest rates on loans willingly.

What is the Best Way to Get a Cash Advance?

A credit card is one of the best ways to get a cash advance. Borrowers get the necessary cash without worrying about paying it back immediately. Another great way to get a cash advance is through a payday loan. It is because borrowers get the money they need without collateral.

At PaydayChampion, we are dedicated to providing our valued customers with convenient financial solutions. We understand that unexpected expenses can arise, so we offer a range of cash advance loan options to meet your needs. With a nationwide presence, our services extend across several states in the United States, ensuring that you can access the assistance you require when you need it most. To better assist you, we have compiled a comprehensive table below highlighting all the American states where our company is actively operating. Take a look and find out if we are available in your state so that you can take advantage of our lowest-rate cash advance loans, including payday advances, merchant advances, and installment advances. Trust us to be your reliable partner in financial support.

| AL – Alabama | AK – Alaska | AZ – Arizona | AR – Arkansas |

| CA – California | CO – Colorado | CT – Connecticut | DE – Delaware |

| DC – District Of Columbia | FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana | IA – Iowa |

| KS – Kansas | KY – Kentucky | LA – Louisiana | ME – Maine |

| MD – Maryland | MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana | NE – Nebraska |

| NV – Nevada | NH – New Hampshire | NJ – New Jersey | NM – New Mexico |

| NY – New York | NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania | RI – Rhode Island |

| SC – South Carolina | SD – South Dakota | TN – Tennessee | TX – Texas |

| UT – Utah | VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

How to Get a Cash Advance on a Credit Card?

Several ways to obtain cash advances on a credit card exist. Borrowers obtain them via the following methods.

- Borrowers go to an ATM and obtain the credit cash advance using their credit card.

- Borrowers use a credit card company or bank to request a cash advance.

- Borrowers go to a bank and request a cash advance from their credit card account.

- Some companies transfer funds from their credit cards to the borrowers’ bank accounts.

- People use convenience checks to get a cash advance on a credit card.

- Borrowers use companies like MoneyGram or Western Union to get a cash advance.

Credit cards are only preferable when obtaining a cash advance compared to others. Use Discover It, Citi Double Cash Card, and Cash Back for balance transfers. Chase Slate and Citi Simplicity Card are best for balance transfers. Capital One Venture Rewards Credit Card and Chase Sapphire Preferred Card are best for travel.

How to Get a Cash Advance Loan Online with No Credit Check?

Borrowers needing a cash advance loan but a better credit score find a lender who doesn’t perform a credit check. Here are a few steps to follow:

- Shop around for lenders that offer cash advance loans without a credit check.

- Compare the terms and conditions of the loans to find the best deal.

- Fill out an application form and provide the required documents.

- Wait for the lender to deposit the money into their account.

- Repay the loan on time to avoid any penalties and interest charges.

Does Cash Advance Improve Credit Utilization Ratio?

A cash advance improves a borrower’s credit utilization ratio if their credit card issuer reports the cash advance as a separate transaction from their credit card balance. It is because their credit utilization ratio is calculated as a percentage of their credit card balance and a lower balance results in a lower percentage. A cash advance only improves a borrower’s credit utilization ratio if the credit card issuer reports the cash advance as part of their credit card balance.

Is Non-ATM Transaction an Alternative to Credit Card Cash Advance?

Yes. Borrowers use a debit card to access the money in a checking or savings account. Submit a loan application to the bank. Use some money from an emergency reserve. Borrow money from close relatives or trusted pals.

How to Understand Whether Cash Advances Are for You?

A cash advance is a straightforward and hassle-free method of gaining access to money, but it comes at a high cost. Make sure to have enough available credit on a credit card to cover the cash advance and strategize how to pay back the cash advance as quickly as possible. Remember that the amount of a credit cash advance is often a small proportion of the total credit line and that interest charges begin to accrue as soon as the Transaction is completed.

How to Calculate the Payment Schedule and Amount for Cash Advances?

In an emergency, credit card cash advances are worth the hefty transaction fees and interest rates. Below are ways to reduce a credit card cash advance’s costs.

- Minimize your borrowing: Borrowing what you need is the best way to reduce cash advance expenses. A cash advance is nothing more than a bank loan. The less cash advance you get, the less you have to pay fees and interest. Avoiding taking out a large sum of money would speed up the procedure.

- Immediately repay cash advance: Start paying back the borrowed money as soon as possible for the day to get a cash advance to accrue interest.

Pay the maximum on a $200 cash advance. Repay the money in days rather than weeks. Ignore months. A $1,000 cash advance costs 70 cents daily at 25% APR. Paying it off in a few weeks speeds up the attraction.

What to Know Before Taking a Cash Advance?

Below are the Pros and Cons of cash advances.

Pros

- Gives instant access to unsecured money with no need for collateral.

- Simple to obtain—no underwriting or credit checks are required.

Cons

- Very high fees and APR

- There is no grace period; interest on credit card cash advances starts to accrue immediately.

What are the Cash Advance Terms and Fees?

A cash advance is a credit card loan with a separate APR and charge. Some issuers additionally set a separate credit limit for cash advances.

Cash advances are costly and used for short-term needs since the charge and interest depend on the withdrawal quantity and the payback duration. Lenders limit cash advance withdrawals to cover large expenses.

Cash Advance APR

The cash advance APR is different from the purchase APR. It is disclosed in a credit card agreement or by the issuer.

Cash Advance fee

Credit card issuers charge a fee whenever it makes a cash withdrawal. The fee for a cash advance is a set amount or a percentage of the total amount borrowed.

ATM or Bank Fee

Banks, credit unions, and ATMs imposed cash advance fees apart from credit card companies.

No Grace Period

Transactions involving cash advances often do not have a grace period; hence, cash withdrawals instantly accrue interest charges.

Separate Credit Limit

A percentage of the total credit limit is a separate credit limit for cash advances.

What are the Best Cash Advances with the Lowest Interest Rates?

Banks and other financial institutions offer the best cash advances with the lowest interest rates. These loans usually have higher interest rates than payday loans because they provide more flexible terms. However, these loans do not require collateral and typically allow borrowers to repay them within one month.

Banks charge fees when applying for a cash advance, but most waive this fee using their direct deposit system. The amount borrowed is deposited directly into the client’s bank account. Payday lenders often advertise short-term cash advances at high-interest rates, are regulated by state law, and must adhere to strict lending guidelines. Some states even prohibit payday lenders from charging annual percentage rates (APRs) above 36 percent. Understand all the terms before signing anything if deciding to take out a cash advance. Read the fine print carefully and ask questions if necessary.

How to Compare the Cash Advance Interest Rates?

The loan agreement lists the APR (Annual Percentage Rate). The interest rates vary depending on the type of loan clients’ choose. For example, payday loans typically charge higher interest rates than installment loans.

Listed below is how to compare the cash advance interest rates.

- Payday Loans: These loans are designed specifically for short-term financial needs. They usually offer lower interest rates than other loans but carry high fees. Payday lenders require collateral such as a vehicle title or a bank account.

- Installment Loans: Installment loans are available at banks, credit unions, and online. They generally provide better terms than payday loans because they allow borrowers to repay their debts over an extended period. However, these loans often come with higher interest rates.

- Short-Term Personal Loan: Short-term personal loans are similar to payday loans in that they help borrowers meet immediate financial needs. However, unlike payday loans, short-term personal loans can be repaid once the borrower has paid off the entire debt.

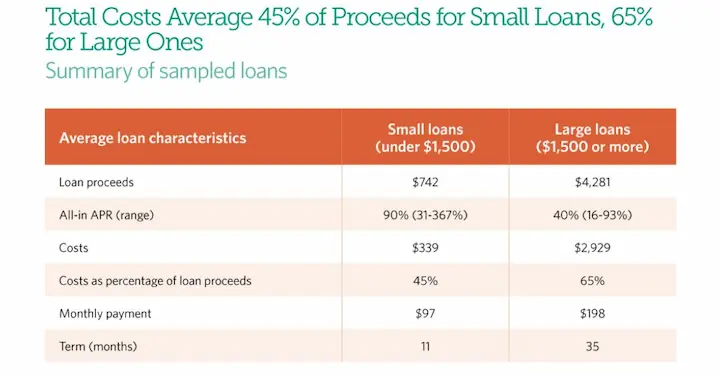

What Is the Average Cost of Cash Advance Loans?

The cost of cash advance loans varies depending on several factors, including loan amount, term length, interest rate, fees, etc. The most common cash advances include payday loans, installment loans, and lines of credit. Payday loans typically carry higher rates than other forms of short-term financing because they offer borrowers more flexibility when paying back their loans. Payday loans usually range between $100-$500 and last up to two weeks. Installment loans are similar to payday loans but are offered at lower rates and often require larger down payments. Installment loans generally range between 00-$5000 and may be paid off over one month or six months. Lines of credit allow consumers to borrow against future earnings. They are available in amounts ranging from $200-$10,000 and are repaid over an extended period (usually 12-24 months). Lines of credit are popular among those who need money quickly. Lenders often extend them without requiring large down payments. This makes it possible for people to get fast access to funds.

What are the Cost Factors of Cash Advance Loans?

The cost factors of cash advance loans include processing fees, interest rates, and other charges. The amount charged depends on the lender and loan terms.

Listed below are the cost factors of cash advance loans.

- Processing Fees: Processing fees are usually between $10 and $20 per Transaction.

- Interest Rates: Most lenders charge an APR (Annual Percentage Rate) ranging from 15% to 30%. Some companies offer lower APRs but require additional documentation such as tax returns, bank statements, etc.

- Other Charges: There might be late payment penalties, application fees, and additional hidden costs.

How Much Does a $1000 Cash Advance Cost?

A $1000 cash advance costs between $100-$300, depending on where a loan applicant live. The cost varies depending on whether an applicant chooses an installment loan or a direct lender. Borrowing up to $1500 for 30 days is allowed if deciding to go with an installment loan. However, interest rates on these loans tend to be higher than those offered by direct lenders. The average APR (Annual Percentage Rate) for a $1000 cash advance is around 300%. That means you’ll be charged an annual rate of 3% to 5%, much higher than most other personal loans. However, some lenders offer low APR cash advances if you’re willing to pay a little extra. For example, a $1000 cash advance with an APR of 10% would only cost borrowers about $110.

How are Payments Processed for Cash Advance Loans?

Payments are processed via ACH (Automated Clearing House), an electronic transfer system banks and other financial institutions use to move funds between accounts. The payment method used is called “Direct Deposit.” Once the application has been approved, the lender automatically deposits the loan proceeds into your bank account. The process takes seconds and usually costs less than $5 per Transaction.

How Payments Are Processed

The lender typically gives a check or access to funds borrowers use immediately when taking out a cash advance loan. The loan amount is based on the applicant’s income and ability to repay the loan. The lender sets up a repayment schedule with payors, outlining when and how much borrowers need to repay. They automatically deduct the payments from a borrower’s bank account on the scheduled due date, so it is necessary to ensure enough money to cover the payment when it is due. The lender charges additional fees if the client needs more money.

Extending the repayment period is necessary if the loan cannot be repaid on time. However, the extension will typically result in additional charges. It is important to understand all of the terms and conditions of the loan before agreeing to anything.

Fees and Charges

There are typically fees and charges associated with cash advance loans. These include application, origination, and late payment fees. Understanding all the fees and charges associated with loans is important before agreeing to anything. The interest rate is also something to be aware of. Cash advance loans often have higher interest rates than traditional loans. The interest rates are based on the loan amount, the loan, the length of the loan, and the credit history. Repayment is needed for the loan plus interest over time.

How to Find Cash Advance Loans Near Me?

Knowing that several options are available is important with cash advance loans. First, look at the budget and see where cutting back is applicable. Next, Start looking into all the different loan programs out there. There are two main categories of these loans: secured and unsecured. Secured loans require collateral to be posted before approving the request. Unsecured loans don’t require collateral. Once you’ve determined which type of loan to apply for, visit an online lender. These lenders usually offer quicker approval times and lower interest rates than traditional banks. The funds are received within 24 hours once approved.

What is the Frequency of Taking a Fast Cash Advance Loan?

The frequency of fast cash advance loans varies depending on several factors, including the amount needed, the type of loan requested, and the borrower’s financial situation. The most common reason people take out fast cash advances is that they need money quickly to cover unexpected expenses such as medical bills, car repairs, or other emergencies. One study found that only 1% of Americans aged 18-24 took out a payday loan within 12 months. However, although fast cash advances are used sparingly among older adults, they’re still an important funding source for many seniors. According to the Consumer Financial Protection Bureau (CFPB), nearly half of all American households headed by someone age 65 or older had at least one outstanding payday loan in 2014.

Why Do Banks Reject Cash Advance Loan Applications?

Banks reject cash advance loan applications to protect their customers from being scammed out of their hard-earned money. The banks don’t want to lose money to people who will never be able to repay them. They know that most people who take out these loans repay more than they borrowed. Borrowers look into other options if there is a need for quick cash, such as payday loans available at local stores like 7-11’s. The government does not regulate these loans, so they charge whatever interest rate they want. However, they usually require collateral (car) and typically only give two to four weeks to repay the loan.

What are the Advantages of Cash Advances?

Cash advances are easy to borrow money when it is needed it most. They offer short-term loans at competitive rates without having to provide collateral. However, they come with certain risks and are used only when other options aren’t available.

These are the advantages of cash advances.

- Short-term loans

- Competitive interest rates

- No collateral required

What Are the Disadvantages of Cash Advance Loans?

Cash advance loans are short-term loans that allow borrowers to borrow small amounts of cash, up to $500, without having to provide collateral. Listed below are some of the disadvantages:

- The interest rates on these loans vary depending on the lender and the amount borrowed.

- The main disadvantage of cash advances is that they carry high fees compared to other forms of borrowing. For example, payday loan lenders typically charge between $15 and $25 per $100 borrowed.

- Most cash advance companies require customers to repay the loan within two weeks.

- Additional charges and late payment penalties are imposed if repayment is not done on time.

- Some cash advance lenders even report your account to consumer reporting agencies like Experian and Equifax.

What are the Types of Cash Advance Loans?

There are four primary types of cash advances: payday loans, installment loans, credit card cash advances, and merchant cash advances. Each option expeditiously delivers cash but operates slightly differently.

Listed below are the four main types of cash advance loans.

- Payday Loans: Payday loans are short-term loans typically repaid on the borrower’s next payday; additional interest is charged if the borrower wishes to extend the loan. Despite the small number of funds borrowed, payday lenders frequently charge exorbitantly high-interest rates, sometimes as high as 400 percent.

- Installment Loans: Installment loans are a form of cash advance in which the funds are repaid in installments over a predetermined period. Common installment loans are auto loans, student loans, and mortgage loans. The borrower pays a portion of the principal plus interest with each installment. Installment loans typically have lower interest rates and flexible terms.

- Credit Card Cash Advances: Cash advances are the most prevalent form. It functions by withdrawing cash from an ATM with a debit card, except the funds come from a credit limit. The borrower must repay the loan with interest.

- Merchant Cash Advance: A merchant cash advance assists businesses or merchants in financing their operations. A business owner typically receives an upfront sum and a percentage of all credit card sales until the initial sum is repaid. These forms of cash advances offer an alternative to conventional small-business loans.

What is Tax Refund Cash Advance Loans?

A tax refund cash advance loan is a short-term loan offered by tax preparation services. Loan funds are received before the IRS processes tax returns and filings. The borrower’s tax refund secures the loan. Typically, only borrowing a portion of the tax refund is granted a loan for the entirety of the tax refund.

Refund advance loans are known as instant refunds, emergency tax refund cash advance loans, and tax refund cash advances. Essentially, borrowing money is repaid by IRS to the financial institution when issued. The remainder of the refund is received directly from the tax preparer or software provider.

What is Cash Advance Installment Loan?

Cash advance installment or personal loans are loans funded in lump sums and paid back over time. Installment loans range from a minimum of $500 to a maximum of $10,000 and are borrowed over 6 to 48 months.

What is the Difference between Cash Advance Loan and Payday Loan?

More similarities than differences exist between payday loans and cash advance services. Both services offer the opportunity to borrow money repaid from the borrower’s next paycheck, promising quick cash in an emergency.

What is a Cash Advance Loan?

A cash advance loan is identical to a payday loan because it enables the borrower to receive a loan to cover expenses until the next paycheck. Some lenders refer to these loans as payday loans, while others refer to them as cash advances, but the loans are structured identically.” The biggest difference is pricing,” Saunders explains, noting that payday loans are notorious for their high APRs. The fees and extra money earned-wage services often ask for, called “tips,” not be ignored.

What is a Payday Loan?

A payday loan is typically a short-term, unsecured loan with high-interest rates. The word “payday” in “payday loan” refers to when a borrower gives the lender a postdated check for their next paycheck, but the lender gives the borrower some of that paycheck right away.

What is the Merchant Cash Advance Loan?

A merchant cash advance (MCA) is not a loan but a cash advance based on a business’s credit card sales deposited in its merchant account. A business owner requests an MCA and has funds deposited into a business checking account within a reasonable amount, sometimes within 24 hours of results. Bankers and other lenders evaluate risk and credit criteria differently than MCA providers. They examine daily credit card receipts to determine whether a company repays the advance on time. Consequently, rates on an MCA are significantly higher than other financing options; therefore, comprehending the terms offered is important to make an informed decision regarding whether or not an MCA is appropriate for needs.

What is Cash Advance Loan Same Day?

From state to state, the availability of instant payday loans varies. The request is to obtain a cash advance loan as soon as possible. A cash advance loan on the same day covers unanticipated expenses such as medical emergencies or unexpected bills.

What is the Most Popular Type of Cash Advance Loan?

The most popular type of cash advance is borrowing on a line of credit through a credit card. Depending on the credit card provider, the money is taken out of a check deposited or cashed at a bank or ATM. Cash advances on credit cards typically carry a rate of interest that is even higher than the rate for regular purchases: Borrowers are asked to pay an average of 24%, which is approximately 9% higher than the average purchase APR. Additionally, interest accrues immediately; there is no grace period.

These cash advances are typically accompanied by a fee, either a flat rate or a percentage of the amount advanced. In addition to different interest rates and balances, credit card cash advances carry different interest rates. The monthly payment is applied to both balances. Federal law authorizes the issuer to request minimum payments to balances with a reduced interest rate if they pay the minimum amount due. The cash advance balance sits for months and accrues interest. Credit card cash advances do not qualify for introductory offers with zero or low interest rates. Additionally, they are quick and simple to acquire.

How to Track and Apply for Cash Advance Loan?

To request a loan, most cash advance loan lenders are required below.

- The applicant is at least 18 years old and above.

- The applicant has an active checking account.

- The applicant provides proof of income.

- The request provides valid identification.

What Are the Advantages of Cash Advances?

Request the funds needed with a cash advance and receive results within 48 hours. Here are the four edges of cash advances.

- They are simple to qualify for: One of the greatest benefits of instant business cash advances is how simple it allows for one. Cash advance lenders do not impose stringent lending criteria on borrowers, in contrast to large banks. Some background checks exist, but these alternative lenders are primarily concerned with the ability to repay the loan.

- Cash is funded fast: Even if the application for a business loan is granted, waiting a long time before getting the funds is possible. The loan request is lengthy and cumbersome to begin with the bank. It is weeks before receiving the payment. In contrast, a business cash advance is nearly instantaneous. One expects the funds to be deposited into personal accounts within a few days, including the loan request and results processes. An instant is precisely needed when cash is required immediately.

- They are highly practical: Visiting a bank and filling out a form in person is unnecessary. Applicants must complete the entire process conveniently from home with a fast business cash advance. Remittances are automatically taken out of the account based on a percentage of the income; applicants don’t have to do anything to perform extensive account monitoring or forecasting. Most alternative lender websites offer customer service lines with significantly more flexible hours. Whether by phone, email, or live chat, obtaining the funding assistance required is as convenient.

- Cash advances are flexible and adaptive: The benefit of quick business cash advances is that they impose almost no restrictions on how the funds are used.

Here are some statistics about cash advance terms and fees:

| Term | Statistic |

|---|---|

| Cash advance fee | Average: 5% of the amount borrowed |

| APR | Average: 24.80% |

| Repayment period | Typical: 30 days |

| Grace period | No grace period |

| Maximum amount | Average: $500 |

What are the Alternatives to a Cash Advance Loan?

Listed below are eight main alternatives to cash advance loans.

- Loan From Relatives or Friends: Consider approaching loved ones for a no-interest or low-interest short-term loan. Yes, asking for a loan be embarrassing and have many emotional strings. It helps maintain a Professional demeanor: Utilize a well-executed written contract that specifies all terms so that both parties know precisely what to expect regarding cost and repayment.

- 401(k) Loan: Most 401(k) administrators permit participants to borrow from accounts. Interest rates and fees depend on the employer and the person in charge of the plan but are usually comparable to personal loans. The loan limit is 50% of the funds up to a maximum of $50,000, and the repayment period is no longer than five years. There are Online No Credit Check Loans, and payments are automatically deducted from the borrower’s paychecks. Remember that when borrowing from 401(k), the money isn’t being invested, so it isn’t earning any money.

- Roth IRA: There is a way to use it as an emergency fund, although it is not highly recommended because the funds are intended for retirement. Since contributions to a Roth IRA are made with after-tax cash, Internal Revenue Service (IRS) laws allow withdrawing funds anytime without incurring a penalty or additional tax responsibility. However, if younger than 5912, only remove what has contributed, even if the account has grown. The contribution earnings are subject to taxes and penalties.

- Bank Personal Loan: For borrowers with good or excellent credit, a personal loan from a bank is less expensive than a cash advance on a credit card. The payoff also occurs faster than minimum credit card payments, reducing the total interest paid.

- Collateral Loan: A collateral loan is any loan tucked by real estate. The credit requirements for collateral loans are usually less strict than those for unsecured loans. For example, the home’s value is used to back up home equity loans and lines of credit. Additionally, some banks offer loans secured by the value of a trust or certificate of deposit (CD).

- Payroll Advance: Many employers offer payroll advances instead of traditional payday loans, which have higher interest rates and cost more money. Payments are deducted automatically from a person’s paycheck. Fees range from 10% to 165%.

- Peer-to-Peer Loan: As it has come to be known, P2P lending is a system in which individuals borrow money from investors rather than banks. There are fewer restrictions on credit, and results rates are increased. The maximum APR for the most expensive loans is approximately 30%, plus a 5% loan fee.

- Payday and Title Loans: A car title loan only is considered a last resort due to its excessive interest rate. Like title loans, payday loans typically charge interest rates in the triple digits, ranging from 300 to 500 percent.

The fees on both types of loans are unaffordable to cash-strapped borrowers, who frequently renew their loans multiple times at a cost that exceeds the original loan amount. Credit card cash advances are likely superior to only these two types of loans, except in states where interest rates on payday and title loan financing are severely capped.

Frequently Asked Questions

What are the key differences between payday loans, merchant cash advances, and installment advances when it comes to interest rates and repayment terms?

Payday loans have very high rates but short 2-4 week repayment terms. Merchant cash advances deduct a percentage of sales daily until repaid. Installment advances are repaid monthly over 6-12 months typically.

How can I find a reputable lender that offers cash advance loans with the lowest interest rates?

Compare rates from multiple lenders like credit unions, online peer-to-peer lenders, payday alternative loan providers, and responsible short-term lenders to find the lowest rates.

What factors should I consider before applying for a cash advance loan to ensure I get the best rate possible?

Only borrow what you can afford to repay, maintain a good credit score, have steady income and low debt-to-income ratio, provide collateral if possible, and build a relationship with the lender over time.

Are there any alternatives to traditional cash advance loans that offer more favorable rates for borrowers?

Alternatives include employer or nonprofit emergency assistance, secured credit cards, 401k loans, payday alternative loans from credit unions, and borrowing from family or friends.

What strategies can I use to effectively manage and repay my cash advance loan to avoid high-interest costs?

Make payments on time, pay more than the minimum when possible, consolidate high-interest loans, create a budget, boost income with extra work, and communicate proactively with the lender if struggling.