A same-day loan is one of the best financial solutions for people short on cash.

Payday Champion provides a platform for borrowers to receive same-day loans from lenders, ensuring their access to cash. Banks and credit unions deny some people with poor credit scores, but we don’t like that. We accept online applications from bad credit borrowers. Poor credit is not a factor with us, and we encourage people with all credit scores to apply if they need quick cash for emergency expenses.

It’s possible to transfer same-day loans through our network of lenders. The loan request process takes just a few minutes. Below we will explain how to get emergency cash loans fast.

What is a Same Day Payday Loan With No Credit Check?

Same-day loans with no credit checks are available only to those who apply before the lenders’ cut-off time. The best time is usually around midday because the lender must do the following:

- Approve the loan amount

- Get the borrower’s approval

- Wire the funds to the customer

Any personal loan authorized or instantly deposited on the same business day is sometimes called a “same-day loan” or cash advance loan. It allows you to borrow cash of up to $1000. Most payday loan lenders provide instant approval and financial assistance. They are simple to apply through an online form even if you have a bad credit rating.

However, a quick payday loan sometimes has a high-interest rate. Always read your loan agreement before signing to avoid surprises when it’s time to repay the loan.

Can I Get a Same-Day Loan Online If I Have Bad Credit?

Yes. People with bad credit can still get a payday loan online if they meet the lender’s eligibility criteria. But those with poor credit scores have fewer options and pay higher interest loan rates. You can submit an online loan form, which will be quickly reviewed.

It’s best to consider credit counseling if you already have too many cash advance loans. We only encourage people who can afford to repay their loans to apply—even though this is difficult during a financial emergency.

Can I get a same-day loan near me with no credit check?

Yes. Payday loan providers only do soft credit checks when you are looking for payday loans “near me.” They do a credit check to determine your creditworthiness and if you can repay the loan. Payday online loans are sometimes called no-credit-check loans because of this. Unlike bank loans, bad credit loans do not involve major credit bureaus.

Lenders also need personal details, such as your name, email address, and social security number, to verify your identity.

Do You Use Direct Lenders for $255 Payday Loans?

Our short-term loans, including $255 payday loans, come from direct lenders, and they have a quick approval process. Our in-house software notifies them of loan requests to make decisions quickly. The loan matching service cuts out third-party lenders. It puts you in touch with reliable lenders only.

Moreover, our quick payday loan process is faster than traditional loans and financial institutions. Moreover, the lenders are transparent about annual percentage rates. They’re obligated to keep your details private as well.

What Are the Eligibility Requirements for a $100 Instant Payday Loan?

You will need the following to qualify for any payday loan, including $100 payday loans:

- Be a US citizen or resident.

- Be over eighteen years old.

- Show Proof of income – This is essential as it provides the lender a source of income to assess your repayment ability.

- Keep an active checking account.

- Social security number

- active email and phone number

Additionally, it’s essential to know the specific requirements for payday loans as they may vary between different lenders and states.

What are the fees on small payday loans?

Small payday loans add interest to the loan’s principal. Most lenders charge fees to cover the administrative costs of processing and administering your loan. These fees may be a flat fee or a percentage of the loan amount.

It’s vital to thoroughly understand the payday loan application form and know all the charges involved before proceeding with the application.

Plan to repay the loan, and Flexible repayments follow the terms as strictly as possible. Specific lenders levy fees that are easy to avoid, such as the charges for missing a loan payment. Some online lenders may charge early repayment fees. Particular lenders may charge fees if you renew your loan after a payment cycle. Avoiding these fees, including late payments, is best because they raise your borrowing costs.

How Can I Apply For 1-hour Approval Loans With Flexible Repayments?

Once you’ve determined that a fast payday loan with 1-hour approval is the best action for your financial situation, you can often submit your application through PaydayChampion and get money the same day. Follow these steps to apply for same-day approval:

- Please fill out the Loan Application Form: Many trustworthy lenders, such as trustworthy payday lenders, provide a short loan application you can submit online whenever it’s most convenient. If you’re interested in a short-term, high-interest loan, have your identification documents ready to make the application process as simple as possible.

- Sign the loan agreement: Once you have decided on the best offer and received your loan funds, you must sign the loan terms. Complete any remaining paperwork, and provide your bank account details.

- Get Your Money: Our network of lenders can directly deposit your cash into your bank account within 24 hours.

Some lenders allow for same-day deposits, depending on their regulations. Meanwhile, others may need 2-3 business days. Ask your lender for a rough timeline as part of the application process.

PaydayChampion strives to provide convenient and reliable financial solutions to needy individuals. With our commitment to serving customers across the United States, we are proud to be active in numerous states, offering our online same-day payday loan services. Whether you require immediate funds to cover unexpected expenses or bridge the gap until your next paycheck, our company is dedicated to assisting you in times of financial urgency. Below, you will find a comprehensive list of the American states where we operate, ensuring that residents in these areas have access to our seamless and efficient loan application process. We are excited to extend our services and support to these regions, helping customers easily navigate their financial challenges.

| AL – Alabama | AK – Alaska | AZ – Arizona | AR – Arkansas |

| CA – California | CO – Colorado | CT – Connecticut | DE – Delaware |

| DC – District Of Columbia | FL – Florida | GA – Georgia | HI – Hawaii |

| ID – Idaho | IL – Illinois | IN – Indiana | IA – Iowa |

| KS – Kansas | KY – Kentucky | LA – Louisiana | ME – Maine |

| MD – Maryland | MA – Massachusetts | MI – Michigan | MN – Minnesota |

| MS – Mississippi | MO – Missouri | MT – Montana | NE – Nebraska |

| NV – Nevada | NH – New Hampshire | NJ – New Jersey | NM – New Mexico |

| NY – New York | NC – North Carolina | ND – North Dakota | OH – Ohio |

| OK – Oklahoma | OR – Oregon | PA – Pennsylvania | RI – Rhode Island |

| SC – South Carolina | SD – South Dakota | TN – Tennessee | TX – Texas |

| UT – Utah | VT – Vermont | VA – Virginia | WA – Washington |

| WV – West Virginia | WI – Wisconsin | WY – Wyoming |

Use Paydaychampions installment loans if you prefer having monthly payments. It’s possible to deposit installment loans on the same day.

Which Type Of Online Loan Can I Get On The Same Day?

You can get a few types of online loans in one business day. You should choose the loan depending on your financial situation. Besides that, consider whether you would like to repay the loan within one month or over many months.

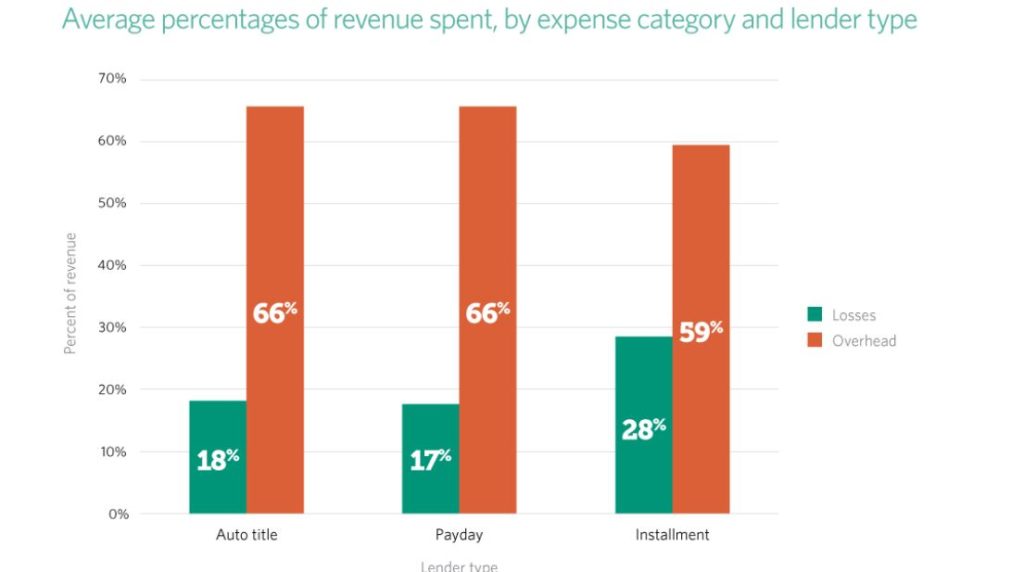

Below are some statistics about the type of loan you can get on the same day:

| Type of Loan | Percentage of Lenders That Offer Same-Day Funding |

|---|---|

| Payday loans | 90% |

| Personal loans | 70% |

| Title loans | 60% |

| Installment loans | 50% |

| Credit cards | 30% |

Payday Loans & Cash Advances For $100, $200, $300, or $500

Individuals seeking online payday loans are far more likely to apply for a loan agreement with immediate approval. Online payday loans or cash advances are short-term credit approved and funded quickly. A payday loan of $100, $200, $300, or $500 up to $1000 is accessible without collateral. Our direct network of lenders can approve you fast, and Paydaychampion specializes in payday loans.

You need to pay back the loan on your next payday. Borrowers often have 31 days to repay the loan in full. The short repayment process makes them ideal solutions for unexpected expenses.

Installment Loans Online

An installment loan online is ideal if you need a more extended period. You use monthly payments to repay the debt. Our installment loan lenders are also ready to quickly deposit cash in your account. The maximum loan term can be up to 60 months. Consider origination fees and monthly payments and whether you can afford them.

The interest on installment loans is smaller than on payday loans. Installment loans have same-day approval, but you must remember to apply early.

Auto Title Loans Online

You can get an online title loan if you own a vehicle with a clear title. Your car serves as the collateral for the loan. You can keep driving while the lender retains your car papers as security. You may borrow up to $30,000 for up to 36 months with a vehicle loan. Title loans enable you to get approval faster and cheaper than unsecured loans. But you may need a vehicle inspection if you need cash on the same day.

What to consider before taking out a loan in California?

Pros – Payday Loans make them popular but have a bad reputation. It’s due to their accessibility, mainly when consumers don’t do enough research beforehand. Access to payday loans in any state, including California, is more manageable because they are often quick and easy to get. It would help if you always carried out the following before applying to ensure that this form of loan is a suitable fit with reasonable interest rates:

- Choose the right loan – Instant payday loans are a particular financial product. Some businesses sell “payday loans” that don’t meet the description. Others need you to provide collateral to secure the loan, putting your property in danger. Before applying, be aware of the terms of your loan and explore various loan websites to find the best option.

- Consider your alternative possibilities – Not every borrower is suitable for payday loans. Consider alternatives like acquiring a second job, utilizing credit cards, or borrowing from friends or relatives if you need a quick infusion of cash to get out of a bind. You may also want to research loan websites for other borrowing options.

- Check the lender’s criteria. The standards for income verification, credit scores, loan amounts, and monthly installment periods vary depending on the lender. Before applying, ensure a lender’s criteria will accommodate your loan demands, including Flexible loan amounts. Keep in mind that lenders sometimes require your banking details. They need your financial history to determine the best repayment terms for your quick payday loan.

Conclusion

Ensure you can afford the monthly payments, and work with a reliable lender that provides flexible repayment options. Same-day payday loans are an excellent option to obtain funds quickly, offering various products tailored to your needs. However, before signing up for a loan, you must understand the terms and circumstances. Paydaychampion is here to assist you in locating the finest same-day payday loan for your specific circumstances. We provide a secure online loan application process and flexible repayment options for varying needs.

Please get in touch with us if you have any further queries regarding same-day payday loans. We are here to assist you in locating the finest loan for your circumstances.

Frequently Asked Questions

How do payday loans with same-day deposit and no credit check work, and what are the typical eligibility requirements?

They assess income, identity, and basic personal details quickly for electronic approval and same-day direct deposit. Eligibility requires a steady income source, valid ID, and an active bank account.

What are the pros and cons of applying for a payday loan online with same-day funding and no credit check compared to traditional loans from banks or credit unions?

Pros are speed and high approval odds. Cons are very high costs and risky debt cycles. Traditional loans have lower rates but slower approvals and may need good credit. Evaluate carefully before choosing.

What precautions should borrowers take when considering online payday loans with same-day approval and no credit check to avoid falling into a debt cycle?

Avoid rollovers, read all terms closely, borrow only what you can repay quickly, use debit card controls to prevent overdrafts, seek lower cost alternatives first, and have a concrete repayment plan.

Are there any alternatives to payday loans for people with poor credit who need fast access to funds, and what should borrowers consider before choosing a payday loan option?

Alternatives like credit union loans, 401k loans, credit card cash advances, payment plans, family loans, crowdfunding, or peer-to-peer lending may provide lower rates for fast funds. Compare all options thoroughly before deciding.