Emergency Loans Online For Bad Credit (No Credit Check) & Same Day Deposit

Emergency Loans for bad credit with same-day deposit and no credit check are the perfect solution for those who need a cash advance but can’t wait until their next payday. Direct lenders of emergency Loans provide borrowers with quick access to funds without a soft credit check process or any other requirements that come with traditional loans. In emergency situations, these loans can be a lifesaver.

Emergency loan alternatives like Personal loan lenders such as PaydayChampion offer these online payday loans for immediate, urgent, and unexpected expenses, making them ideal for addressing an urgent expense.

Bad credit will only affect the loan decision. Lenders need to check applicants’ credit history, increasing approval chances.

Here’s what you need to know about emergency online loans and what differentiates them from traditional secured loans.

What Are Emergency Cash Loans With A Bad Credit Score?

Emergency cash loans with a bad credit score from PaydayChampion are short-term, unsecured personal loans you can apply for when you need money. We offer these loans to help borrowers meet financial obligations and deal with paperwork with minimal hassle. As an emergency lender, we understand that financial difficulties can arise unexpectedly, and we strive to be there for our clients when they need us most.

PaydayChampion can provide fast, flexible loan agreements to help with any financial situation. Our company offers same-day funding for individuals with emergency expenses and flexible repayment options tailored to suit the needs of each borrower. Whether that’s paying for your medical expenses, your child’s college fees, or funding a business venture, we have plenty of urgent cash options available to suit every borrower.

We only have a minimum credit score requirement for these types of loans.

What Should I Consider Before Taking A Loan Through Payday Loan Direct Lenders Near Me?

Emergency loans from direct lenders near me have become a convenient way to get cash when needed. However, if you are considering taking out a payday loan, there are several things that you should consider before applying for this loan type. Remember the importance of finding an emergency lender that offers flexible repayment options and can support you through any financial difficulties that may arise during the repayment process.

- Is it a genuine emergency? – It’s important to consider whether you need an urgent loan at all or if it can wait until the end of the month. Taking out a credit card cash advance is sometimes better for your situation. For example, a credit card cash advance is better if you only need a few hundred dollars and want to avoid paying interest on your urgent loan. Alternatively, you might consider looking into credit unions for financial assistance if you have a regular income.

- Eligibility for emergency personal loans – You need to meet the minimum age requirement of your state and be a permanent resident with a steady monthly income to qualify for this loan. The age requirement for a mortgage varies from state to state, but it’s usually between 18 and 21 years old. Remember that some credit unions might have different eligibility requirements and can offer various financial assistance to those with a regular income.

- Answer all information honestly – The lenders check information for accuracy. They only accept loan applications if they find discrepancies in your application. The lender wants to be sure you are telling the truth about your steady income, assets, and liabilities. Moreover, honesty can improve your chances of securing financial assistance from credit unions as they often prioritize supporting individuals and communities with a reliable regular income.

What Are Some Uses For PaydayChampion’s Best Emergency Loans For Unemployed Borrowers?

The best emergency loans for unemployed borrowers are a great way to get cash fast when emergency expenses occur. It’s a solution for your short-term financial needs. One common reason for an emergency loan is a loan request due to unforeseen circumstances. To give you an idea, here are some examples of when you might need an emergency loan:

- Unexpected bills: Sometimes, bills may arise that you were not prepared for, causing a financial strain.

- A one-time fix. An emergency loan provides the cash you need until you get back on your feet. Use the borrowed money to pay for car repairs or medical bills.

- Short-term solution. An emergency loan could help you catch up and avoid missing payments on your loan balances or utility bills. It’s a short-term solution to immediate cash flow problems. Emergency quick loans are generally small, but they make all the difference when you’re in a bind.

- The last resort. An emergency loan has quick funding to provide you with the cash you need to cover a gap in your finances. Licensed lenders make decision within minutes, ensuring a speedy solution. Remember that it’s not always the best option, but it tides you over until you find a more permanent solution with a decision within minutes too.

Can I Get Cash Now On Same Day Payday Loans Through PaydayChampion?

Yes, it is now possible to receive same-day payday loans from PaydayChampion if you submit a loan application in the morning, ideally before 11:30 A.M. The approval process is fast, and the lender often transfers money within a few minutes hours during business days, provided your loan application is approved.

Emergency loans are available online and in-store. Online applications only need minimal documentation, and the process is simple: You only need to answer a set of questions. The online platform offers a simple application process which makes it easier for you. There’s no need to wait for days because the decision is almost instant. But some lenders require you to wait 2 or 3 three business days for your loan approval.

Can I Immediately Apply For A Fast Loan Advance Through PaydayChampion?

Yes, applying for a loan through PaydayChampion is possible even with bad credit. The simple application process ensures that your credit score is not the only factor considered during the loan approval process. Individuals with bad credit can immediately apply for emergency cash loans through PaydayChampion in the US. While lenders and other financial organizations typically check credit scores, they may be more concerned with your ability to repay the loan rather than your credit score.

Loan companies require proof of source of income, like pay slips, IRS filings, and bank statements. They may also request information regarding any existing debts, such as education debt, auto loan obligations, or medical bills, which can affect your loan payments.

To have a successful application, you should have been employed for at least four months and be able to make loan payments on time. Ensure that the details in your form are accurate and up-to-date, including your source of income, as this will help speed up the process.

Will Emergency Personal Loans With No Job Impact My Credit?

Yes, applying for an emergency personal loan with no job can impact your credit score. It could only negatively impact your credit rating if you fail to fully repay the loan on time. However, taking out an emergency payday loan and paying it back on time will help your credit score.

But it’s possible to recover from this situation quickly. The best thing to do is check your credit score before applying for a loan to avoid surprises later. You only need to pay off the loan soon and make all the missed payments. Considering the loan term is essential for making a sound financial decision.

You should also ask the loan provider if they report to credit bureaus and inquire about the loan term provided.

What are The Interest Rates On PaydayChampion’s Bad Credit Loan For Veterans?

Payday loans for veterans sometimes cost 450% annual interest (APR) or more. Other fees for bad credit loans for veterans range from $45 to $35 to borrow $100. These additional charges for a fortnight result in interest rates from 380 to 790% annual percentage rate or APR. Remember the associated loan terms when making a financial decision regarding the loan.

Bad credit loans are sometimes expensive because borrowers pay for convenience. Lenders transfer the money in less than 24 hours. They can also offer more flexibility than traditional lenders. For example, you can use your bad credit loan to pay rent or fix a broken car, with flexible terms compared to traditional lenders.

These short-term loans are usually repayable within 30 days. The short repayment period makes them a good solution for people who need money quickly. However, there are better ways to build credit than this type of loan because they can also be expensive.

How Can I Apply for Legit Urgent Loans through PaydayChampion?

Fill out the loan application, which takes up just one page when applying for legit urgent loans through PaydayChampion. You may apply from your computer, tablet, or smartphone.

Your online lender will contact you personally to discuss the range of loan options, loan conditions, borrowing possibilities, and payment schedule. You will receive a prompt reply in a couple of minutes. If accepted, the loan proceeds or cash will often arrive in your bank account within 24 hours.

How Much Can I Borrow From PaydayChampion’s Quick Loans With Guaranteed Approval?

PaydayChampion offers fast and secure quick loans wth guaranteed approval of up to $1,000 in emergencies. Application is simple and can be completed online in minutes, with loan decisions being made immediately.

The amount you borrow is based on your income, financial profile, and the lender’s criteria, such as poor credit score. You may receive the money within two business days if you meet the requirements. There are fees involved with PaydayChampion loans, so make sure to read through their terms and conditions carefully before applying.

At PaydayChampion, the maximum loan amounts range from:

- $100 to $1000 for payday loans

- $500-$5000 for installment loans

- $500-$30000 for title loans, but this depends on the value of your vehicle.

What Makes PaydayChampion Loans For Emergency Money Different?

PaydayChampion loans for emergency money differ from other financial institutions because we provide short-term loan contracts to help you through a financial emergency. We understand these situations can be stressful, so we are here to help you find the best solution with flexible payment options.

Aside from that, here are other reasons why we are different:

- Our range of cash loans includes instant payday advances, flexible installment plans, and auto title loans.

- We aim to provide you with fast cash, even on the same day. Improve your credit score – our loans won’t require hard credit checks and are ideal for those with bad credit.

How To Choose Urgent Cash Loans From PaydayChampion?

Choosing the right urgent cash loan for your situation can be challenging. Luckily, PaydayChampion can help make this process easier by allowing you to easily compare loan options and find the one best suited to your needs.

As an online lender, they offer competitive rates and flexible repayment terms to fit your budget. In addition, their excellent customer service is top-notch, offering assistance throughout the application process from start to finish. With PaydayChampion, you can rest assured that you are getting the best possible loan for your specific situation and have peace of mind knowing that help is just a call or click away, all while enjoying their competitive rates.

What Are The Different Types Of Emergency Cash Advance?

Three emergency cash advance loans are available for consumers who need money fast:

- Payday loans: are short-term loans typically lasting between 2 weeks and one month. People use this when they run out of money and need to borrow some quick cash.

- Installment loans: These long-term financial solutions are paid back over several months. They are typically for larger purchases that require more money upfront.

- Home equity lines of credit: This type of loan allows borrowers to tap into the equity they have built up in their homes. This option is ideal for those with a large amount of equity in their home and who want to use it to finance other expenses.

Here are some statistics about emergency loans:

| Stat | Value |

|---|---|

| Number of emergency loans taken out in 2022 | 10 million |

| The average interest rate on an emergency loan | $500 |

| Average interest rate on an emergency loan | 300% |

| Percentage of emergency loans that are repaid | 60% |

| Percentage of emergency loans that default | 40% |

What Are The Alternatives To PaydayChampion’s Emergency Payday Loans?

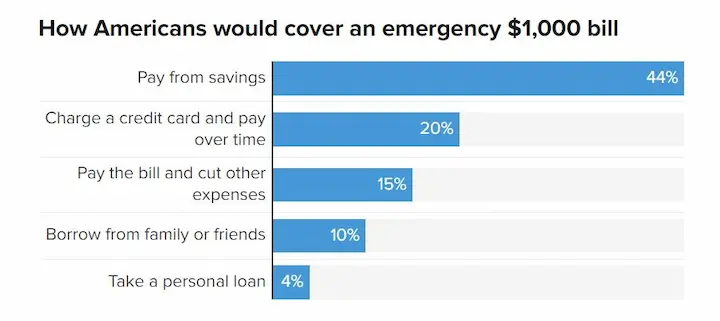

Here are some other options to help deal with a financial crisis if you’re not eligible for an emergency payday loan:

Credit Cards

If you have a credit card with a good limit, you can use it for small emergencies. Remember that if the balance is not paid in full at the end of the month, you will be charged interest on what is left over. Some credit card companies offer special promotions or low-interest rates to attract new customers.

Equity Loans

Equity loans can be another alternative to emergency loans, allowing you to borrow money against the value of your home or other valuable assets. This option is generally suitable for people who own their property or have significant equity in it.

Debt Consolidation Loan

A debt consolidation loan can be a good alternative for individuals struggling with multiple debts. By consolidating your debts into one manageable payment, this type of loan aims to help you achieve a better financial situation and alleviate the stress of multiple repayments.

Personal Loans

Like credit cards, personal loans can carry several hidden costs. However, unlike credit card rates (usually fixed), the interest rate on a personal loan is often variable. It may change depending on how policies and economic factors influence market conditions. It’s essential to choose reputable lenders to ensure that your loan funds are obtained fairly and securely.

Peer-To-Peer Lending Platforms

Online peer-to-peer lenders connect borrowers with investors who want to lend money. This type of loan offers flexible repayment periods and competitive interest rates. It’s best suited to those looking for smaller sums of cash than traditional bank loans. With this method, there is a higher chance of dealing with reputable lenders who can quickly disburse your loan funds.

Loans From Friends And Family

This option works well if you know someone willing to lend you money. You’ll need permission first and ensure you’re borrowing only a little before asking for assistance. Although these loans may not involve reputable lenders, they require a proper agreement so both parties understand the terms and proper use of the loan funds.

What are the Repayment Terms for Emergency Loans With 24 Hour Deposit?

Repayment terms for emergency loans with a 24-hour deposit vary based on the type of loan, the amount borrowed, and other factors. Generally, terms are more flexible than traditional bank loans, with repayment due in full within a few months up to a few years.

The repayment may consist of monthly payments or a lump sum upon expiration of the agreement. Depending on the agreement, interest rates can be either fixed or variable, and lenders balance risk with higher rates for those with weak credit profiles. Making regular payments on an emergency loan is an important part of improving credit scores, so borrowers should research their options carefully and prioritize paying off their loans on time.

What Are The Qualification Requirements For PaydayChampion’s Legit Emergency Loans?

To qualify for our legit Emergency Loans, you need to meet the following criteria:

- Be 18 years of age or older.

- Have a valid photo ID such as a Driver’s license.

- Have an active bank account with at least six months of history.

You must also provide proof of steady employment with an income of at least $1,000 per month and live in one of the states where Paydaychampion provides financial services.

At PaydayChampion, we understand that financial emergencies can arise unexpectedly, leaving individuals with limited options. That’s why we proudly offer our services across multiple states in the United States, providing accessible emergency loans online for individuals with bad credit. We are committed to assisting those in need during challenging times, offering a simple and efficient application process that can be completed from the comfort of your home. Our nationwide presence allows us to extend our support to individuals in various regions, offering a lifeline when traditional lending institutions may turn them away. Below is a comprehensive table showcasing all the American states where our company is actively serving, empowering individuals to navigate financial difficulties confidently.

| AL / Alabama | AK / Alaska | AZ / Arizona | AR / Arkansas |

| CA / California | CO / Colorado | CT / Connecticut | DE / Delaware |

| DC / District Of Columbia | FL / Florida | GA / Georgia | HI / Hawaii |

| ID / Idaho | IL / Illinois | IN / Indiana | IA / Iowa |

| KS / Kansas | KY / Kentucky | LA / Louisiana | ME / Maine |

| MD / Maryland | MA / Massachusetts | MI / Michigan | MN / Minnesota |

| MS / Mississippi | MO / Missouri | MT / Montana | NE / Nebraska |

| NV / Nevada | NH / New Hampshire | NJ / New Jersey | NM / New Mexico |

| NY / New York | NC / North Carolina | ND / North Dakota | OH / Ohio |

| OK / Oklahoma | OR / Oregon | PA / Pennsylvania | RI / Rhode Island |

| SC / South Carolina | SD / South Dakota | TN / Tennessee | TX / Texas |

| UT / Utah | VT / Vermont | VA / Virginia | WA / Washington |

| WV / West Virginia | WI / Wisconsin | WY / Wyoming |

Finally, applicants must agree to comply with our anti-fraud policies. We will take all necessary steps to protect our customers from fraud or identity theft threats.

Final Thoughts

Emergency loans are lifesavers as long as you use them wisely. They can be a nightmare when you do not take the time to go through the terms and conditions of the loan. With emergency funds, you will enjoy the high approval rate and no credit check, but you should also take note of the short repayment term and high-interest rate incurred. Doing this prevents you from getting into more trouble than you initially had before taking the unsecured loan.

Moreover, increasing your financial literacy and understanding the dangers of the cycle of debt can help you make informed decisions and potentially avoid falling into a cycle of debt caused by emergency loans. Contact us if you have more questions about emergency loans.

Frequently Asked Questions

How can I obtain emergency loans online with bad credit, and what is the fastest way to access immediate cash during a financial crisis?

Applying through online lenders that offer urgent loans for bad credit can provide funds via direct deposit quickly, usually within one business day if approved.

What are the eligibility criteria for emergency loans, and how quickly can applicants with bad credit typically receive the needed cash?

Minimum requirements are income and ID verification. With bad credit, loan funds may be deposited within 1 business day after approval.

What should borrowers consider in terms of fees, interest rates, and repayment terms when seeking immediate cash loans online with bad credit during an emergency?

Expect interest rates of 25% or more along with origination fees. Emergency loan repayment terms are short, often set at 2 years or less. Carefully review total costs.

Are there any specific state or federal regulations that govern emergency loans for bad credit, and what steps should borrowers take to avoid potential scams while seeking financial assistance online in urgent situations?

Regulations include interest rate caps and TILA rules. Vet lenders thoroughly, confirm licensing, read reviews, check contact info, and avoid advanced fees when seeking urgent online loans.