The cost of living rises, wages remain stagnant, and more Americans rely on consumer credit to stay afloat. Understanding how consumer credit works become necessary for all individuals who seek financial freedom as indebtedness continues to rise.

Consumer credit is a line of credit loan that people use to purchase items or services to repay the loan gradually over time. It is used for short-term borrowings, such as covering an unexpected expense or purchasing a car. Consumer credit comes in various forms, such as credit cards, personal loans, and payday loans. Consumer borrowing entails risk as repayment depends on borrowers’ ability to fulfill their financial obligation. Lenders evaluate an individual’s financial history before lending them money.

SUMMARY

- Consumer credit is a financial agreement between a lender and the borrower where the borrower receives immediate access to cash or goods with repayment due over time.

- The consumer credit market encompasses all forms of borrowing from banks, non-bank lenders, retail stores, and other sources, including traditional loans and newer products such as buy now/pay later services, peer-to-peer lending platforms, online installment prepaid cards, and cryptocurrency-backed loans.

- The types of consumer credit include credit cards, installment loans, revolving credit, business loans, payday loans, home equity loans, and auto title loans.

- Benefits of using consumer credit include credit building and convenience and enabling people to purchase items they cannot afford upfront without taking on too much debt.

- Consumer credit comes with risks, including high-interest rates, fees, and penalties for missed or late payments, leading to a debt cycle and financial hardship.

- Borrowers must exercise caution, understand the loan terms and conditions, and develop a repayment plan to make timely payments and avoid accumulating more debt.

What Is Consumer Credit?

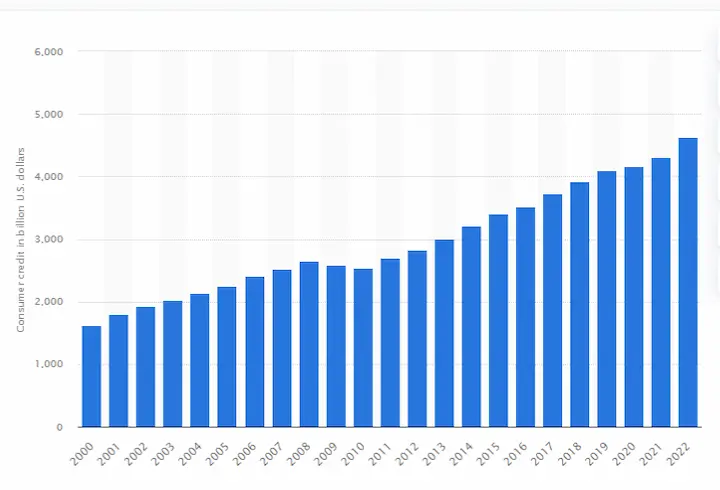

Consumer credit is a financial agreement between a lender and the borrower in which the borrower receives immediate access to cash or goods with repayment due over time. Consumer credit has grown significantly since the turn of the millennium, driven by technological innovations that have made it easier for individuals to borrow money and lenders to assess risk more accurately.

The consumer credit market encompasses all forms of borrowing from banks, non-bank lenders such as payday loan companies, retail stores, and other sources. It includes traditional loans and newer products such as buy now/pay later services, peer-to-peer lending platforms, online installment loans, prepaid cards, and cryptocurrency-backed loans. Consumer credit enables people to purchase items they cannot afford upfront without taking on too much.

How Consumer Credit Works?

Consumer credit allows individuals to borrow money from a lender like a bank or a loan company. The borrower is responsible for repaying the debt with interest over an agreed-upon period. Borrowers must provide proof of income and employment to be approved. The amount of credit depends on several factors, including credit history, income level, employment status, and debt load.

What are the Types Of Consumer Credit?

Consumer credit is a type of financing designed for individuals to purchase goods and services today and pay for them over time. Consumer credit features include lines of credit such as personal loans, credit cards, mortgage loans, and other installment loans. The lines of credit have varying repayment terms and credit limits based on the borrower’s financial history and ability to repay debt. When applying for consumer credit, lenders look at an individual’s income and assets to determine the approved amount. Certain consumer credits must be secured with collateral such as real estate or currency.

Listed below are the types of consumer credit.

- Credit Cards

Credit cards are credit instruments that allow people to make purchases without paying cash upfront. A credit card issuer issues a credit card to borrowers, and individuals get billed by the card issuer for the total amount charged plus interest and other fees when individuals use their cards to make purchases. - Installment Loans

Installment loans are traditional long-term loans that require steady payments over an extended period, such as mortgages, car loans, and student loans. The borrower receives an upfront lump-sum payment to purchase an asset and then promises to pay regular installments for a predefined length of time at a fixed or variable interest rate. - Revolving Credit

Revolving credit is an unsecured loan that allows individuals and businesses to borrow money with no required end date and repay it in multiple smaller increments over time with varying interest rates and minimum payments required depending on the lender agreement terms. It includes lines of credit, home equity lines of credit (HELOCs), and certain store-branded and rental cards. - Business Loans

Business loans are financing designed for business owners who need immediate access to capital to fund new projects or expand operations. Businesses can apply for term or revolving business loans through banks, online lenders, alternative financial institutions, or microloan programs offered by nonprofit organizations and foundations like Kiva Microloans. - Payday Loans

Payday loans are short-term personal loans, usually less than a few hundred dollars, whose purpose is to cover emergency expenses due before your next paycheck arrives during financially difficult times when available money is tight until things get better again soon enough in due time. - Home Equity Loans

Home Equity Loans have secured debt against the equity built into real estate properties that use the borrowed property’s value as collateral for an agreed loan amount between the parties with terms such as repayment lengths and variable interests.

What are the Benefits Of Using Consumer Credit?

Consumer credit has become a popular way to finance purchases and manage cash flow. Understanding the benefits of using consumer credit is necessary to make an informed decision when deciding if it is right for you.

Listed below are the benefits of using consumer credit.

- Credit Building

The benefit of using consumer credit is building and improving one’s credit score. By responsibly paying back loans and other debts, consumers can show lenders they are reliable and worthy of more credit. The improved credit score helps access better loan terms, such as lower interest rates or new loan types. - Convenience

Consumer credit makes it easy to finance purchases online or in person without dealing with cash or checks in an era where almost everyone pays their bills electronically. It provides financial flexibility by allowing consumers to make payments over time instead of all at once. - Accessibility

Most banks and other lenders offer consumer credit options for customers to easily access funds for large purchases without necessarily having the money upfront. Credit lines often are used when needed, helping customers finance investments like houses or cars without feeling overwhelmed by looming debt payments (as long as they are paid off on time). - Reward Opportunities

Many creditors offer rewards programs for their cards, such as point systems with accumulating bonus points from spending redeemed for discounts on future purchases or even cash-back bonuses at certain retail outlets. - Payment Protection

Other Lenders offer payment protection to cardholders if unexpected life events, such as job loss or illness, hinder their ability to pay off their debts on time. Payment protection spares off the burdens of accruing late fees and provides relief in difficult times when saving is not an option but paying off a bill is still necessary.

How to Build A Credit History?

Building a credit history is a necessary step in becoming financially responsible. Staying afloat by accessing lending services or consumer credit has become increasingly challenging. Establishing and maintaining good credit is invaluable to building a strong financial foundation and enhancing one’s ability to secure loans for larger purchases such as cars, a home, etc.

Listed below are the ways how to build a credit history.

- Open a Checking Account

Opening a checking account is the first step to building your credit history because it proves you can manage your finances responsibly and handle monthly payments and bank fees. - Apply for a Secured Credit Card

A secured credit card is perfect for building up your credit score while still having access to funds if needed. A secure card requires you to put down an upfront deposit as collateral, has lower limits than regular cards, and carries higher interest rates. - Get a Co-Signer on Your Loan

Another way to improve your credit score is by asking someone with established credit, such as a family member or friend, if they are willing to co-sign on your loan application to have better chances of getting approved and having favorable terms. - Pay Off Existing Debt

Work towards paying off debt as soon as possible for creditors or lenders to see that you’re capable of managing money responsibly, which builds trust in their eyes that you can handle larger amounts of loans or lines of credit without defaulting on payments. - Monitor Your Credit Report Regularly

It’s necessary to keep track of how your financial decisions impact your overall credit rating by regularly monitoring all three reports from Equifax, Experian, and TransUnion —no more than once every four months— to stay up-to-date with any changes that occur there due to spelling errors or fraudulent activities taking place without your consent or knowledge.

Consumer Credit vs. Business Credit

Consumer and business credit are two financial products that serve different needs. Consumer credit is designed primarily for personal use, while business credit helps companies fund their operations and grow. Consumer and business credit share similarities, such as needing a good credit score and a reliable source of repayment. Business credit offers more lenient terms and higher repayment amounts. It provides access to many types of capital not available with consumer credit, such as venture capital, private equity, and debt financing. The decision must be based on the funding you require for your circumstance.

Consumer Credit

Consumer Credit consists of loans issued by lenders to individuals for personal use. Consumer credit loans are secured against collateral, such as a home, car, or unsecured. Consumer credit takes different forms, such as credit cards, payday loans, and lines of credit. Consumer credit is regulated by federal laws to protect borrowers from unscrupulous lending practices. Consumer Credit comes with various features, including interest rates and repayment lengths which vary depending on the type of loan and the borrower’s credit score. Lenders require borrowers to provide documents such as bank statements or proof of income to approve them for consumer credit.

Business Credit

Business Credit has several features that make securing financing easier for business owners. Its features include building credit using vendors and lenders, improving repayment history with longer payment terms, using real-time credit information to track current liabilities and credits, purchasing supplies without prepayment, and supporting strategic financial decisions. Business Credit provides access to various loan options and lines of credit tailored to businesses’ needs while allowing them the flexibility to adjust their credit profile over time to maximize success.

What Is the Interest Rate of Consumer Credit?

The consumer credit interest rate increased by 7.8 percent, with revolving and nonrevolving credit increasing by 14.8 percent and 5.6 percent, respectively, according to federalreserve.gov in 2022. During the fourth quarter, consumer credit increased at a seasonally adjusted annual rate of 6.5 percent, while in December, it increased at 2.9 percent.

| Type of Consumer Credit | Interest Rate Increase (%) in 2022 | Q4 Seasonally Adjusted Annual Rate of Increase (%) | Increase in December (%) |

| Revolving Credit | 14.8 | 6.5 | 2.9 |

| Nonrevolving Credit | 5.6 | 6.5 | 2.9 |

| Total Consumer Credit | 7.8 | 6.5 | 2.9 |

The table provides a clear overview of the different scenarios related to consumer credit in 2022, allowing us to compare and contrast the different types of credit and periods.

Emergency Funding Options With Consumer Credit

Access to reliable emergency funding options is a lifesaver for many individuals. Consumer credit has become an increasingly popular option for providing much-needed assistance in times of need. Consumer credit offers unprecedented security and assurance that no other financing option matches. Consumer credit allows users to secure timely funds without waiting days or weeks for approval from traditional lenders like banks or private loan companies.

By leveraging the latest technologies, consumers can get fast application approvals and receive the money within minutes after submitting all required documents online. It means they don’t have to worry about waiting around while their applications are processed and knowing that help arrives quickly if needed. Consumer credit allows borrowers to pay off debts over long periods, giving them more financial breathing room during tough economic times.

Consumer credit as an emergency funding source has made it easier than ever for those in difficult situations due to unforeseen circumstances such as medical emergencies, job loss, or any other unexpected expense. The peace of mind provided by consumer credit cannot be understated. It allows individuals facing dire straits to take control back into their own hands and regain a semblance of stability in even the most trying times.

Conclusion

Consumer credit has become increasingly necessary as more people rely on it to make purchases, manage their cash flow, and build credit. There are different types of consumer credit, including credit cards, installment loans, and revolving credit, each with varying repayment terms and credit limits. While consumer credit offers benefits such as building credit and convenience, it is dangerous if not managed responsibly. Understanding how consumer credit works and exercising caution when borrowing is necessary to avoid excessive debt and maintain financial freedom. Consumers must carefully weigh the risks and benefits of using consumer credit and seek professional advice to make informed decisions that align with their financial goals.

Frequently Asked Questions

What is consumer credit, and how is it defined in the financial world?

Consumer credit is any type of loan or credit extended to an individual, not a business, to finance personal expenses and purchases. It includes credit cards, personal loans, auto loans, student loans, mortgages, and other non-business borrowing. It allows individuals to make purchases they otherwise could not afford upfront.

What are the different types of consumer credit available to individuals, and how do they differ from one another?

Common types of consumer credit include credit cards, personal installment loans, auto loans, student loans, mortgages, home equity loans, payday loans, and revolving lines of credit. They differ by loan amount, interest rate, fees, repayment schedule, collateral, and intended use. Credit cards offer ongoing reusable credit; installment loans provide fixed amounts for specific uses.

How can responsible use of consumer credit benefit an individual’s financial situation and credit score?

Using credit responsibly by making on-time payments, keeping balances low, and having a mix of credit types will help build a strong credit history. Good credit scores open doors to lower loan rates, higher limits, and better financial opportunities. Credit, when managed well, provides convenience, allows you to meet goals, and enhances your financial profile.

What are some common pitfalls to avoid when using consumer credit, and how can one manage credit effectively?

Common pitfalls include late payments, maxing out cards, opening too many new accounts, and missing payments. To manage credit effectively, pay on time, keep utilization below 30%, monitor credit regularly, don’t overextend yourself on how much you can realistically repay, and aim to use credit as a financial tool rather than a supplement for income.

Can you provide examples of specific situations where consumer credit can be advantageous, such as buying a home or financing education?

Consumer credit allows people to make major purchases like buying a home with a mortgage, financing higher education through student loans, covering emergency expenses with credit cards, taking out an auto loan to buy a reliable vehicle for work, or consolidating debt into a personal loan with lower interest.