The credit utilization ratio is calculated by dividing the amount of credit being utilized by the total amount of credit available. Lenders use it to assess a borrower’s creditworthiness; it is often represented as a percentage.

A lower credit utilization ratio implies that a borrower is utilizing less available credit, often seen as an indication of prudent credit use. Conversely, a high credit usage ratio suggests that a borrower uses credit beyond the means and is more prone to make late payments or default.

1. Gather and Add All the Revolving Credit Balances.

The best way to total up revolving credit amounts is to compile all credit card statements or go into an online account and examine balances. Calculate the total outstanding revolving credit amount by adding the balances on all credit cards.

Credit card providers disclose the statement balance, minimum payment, and current balance. Thus, issuer balances must be verified.

2. Add All the Credit Limits.

To add all credit limits, collect the credit card bills or go into an online account. The total credit limit is the sum of all the credit limitations. Credit limits fluctuate, so use each account’s current credit limit when determining the credit utilization ratio.

3. Divide the total Balance by the Total Credit Limit.

Divide the entire revolving credit debt by the credit limit to obtain the credit usage ratio.

Divide $5,000 by $10,000 if the total revolving credit debt is $5,000 and the credit limit is $10,000.

4. Multiply by 100 to see the Credit Utilization Ratio as a Percentage.

Multiply the decimal credit utilization ratio by 100 to get a percentage. Multiply it by 100 to get 50% if the credit utilization ratio is 0.5. Credit usage is 50%. Keep credit use percentage below 30% for good credit. Low credit usage ratios reflect low-risk borrowers.

What is Credit Utilization Ratio?

The credit utilization ratio is the quantity of credit utilized compared to the total available. Creditworthiness is assessed by lenders using it as a percentage. A lower credit utilization ratio indicates responsible credit use. On the other hand, a high credit usage ratio suggests that a borrower is overextended and more likely to skip payments or default.

Why is there a Need to Calculate the Credit Utilization Ratio?

Calculating a borrower’s credit usage ratio is crucial for assessing creditworthiness, loan repayment, and credit management. Lenders and credit bureaus evaluate a borrower’s credit usage ratio to gauge the confidence in the borrower’s capacity to repay loans. A low credit utilization ratio indicates prudent borrowing practices and is associated with a higher credit score. On the other hand, a high credit usage ratio negatively impacts scores and suggests an increase in late payments or defaults. Furthermore, the credit utilization ratio is a major feature in credit scoring models.

What is Considered a Good Credit Utilization Rate?

Credit usage below 30% is considered good. It indicates that the borrower uses less than 30 percent of the available credit. For a borrower with a $10,000 credit limit, a desirable credit utilization rate using less than $3,000 of that credit since this shows prudent use of the available credit.

The credit score increase if having a low credit usage rate since this demonstrates that borrowers are managing their credit responsibly and are not taking on more debt. A low credit utilization rate is another thing that lenders look for since it shows that the borrower is less likely to fail on the loans or skip payments.

Is Calculating Credit Utilization Necessary?

Yes, calculating the credit utilization ratio is necessary for proper credit management. It is one of the most important elements considered by credit scoring algorithms and relied upon by lenders and credit bureaus when determining the creditworthiness and capacity to repay loans. Maintaining a low credit usage rate is one way to raise your credit score and become a more desirable borrower.

Does Credit Utilization Affect Credit Score?

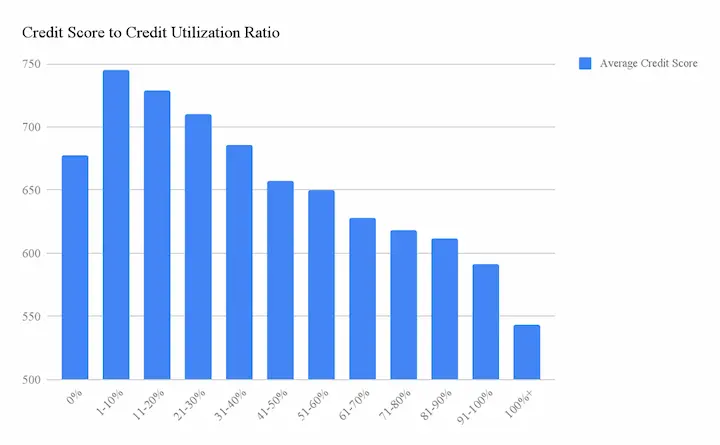

Yes, credit utilization does affect credit scores. Credit usage is one of the most important criteria that credit scoring algorithms consider when calculating credit scores. Credit scoring algorithms examine the credit utilization ratio of the credit limit.

A high credit usage rate reduces credit scores since it indicates that borrowing too much and are thus more likely to skip payments or default on loans. A high credit usage rate tells credit scoring models that they are spending more than affordable and find it difficult to pay off their obligations.

How Does the Credit Utilization Work?

Credit utilization measures how much of the total available credit is utilized. As a rule of thumb, it is represented as a percentage and is arrived at by dividing the amount of used credit by the total amount of available credit. The credit usage is 50% if the debt is $500 and the credit limit is $1,000. When calculating the Credit score, lenders and credit bureaus consider credit usage. The optimal credit usage rate is below 30%.

One of the best ways to improve credit scores is to lower the credit usage ratio. It is feasible to improve the credit score even with a history of large balances and late payments. Making regular, on-time payments quickly reduces or eliminates outstanding debt., The credit utilization ratio and the score must improve to pay off debt.

How to Lower Down the Credit Utilization Ratio?

Reducing the credit usage ratio is accomplished in several ways:

- Reduce credit card debt by paying off the amounts you already have. It frees up more of the available credit and reduces credit utilization.

- Ask the credit card company for a higher credit limit if it needs more financial flexibility. Since the credit usage ratio goes down, have more accessible credit.

- Maintaining a low credit usage ratio is accomplished in several ways: by spreading balances throughout many credit cards.

- It’s best to keep the older credit accounts active to avoid a rise in credit usage percentage.

- Try to avoid making any new credit applications if possible since doing so results in a hard inquiry being added to a credit report, which hurts the score.

Reducing credit use is a process that calls for patience and perseverance. Check credit reports often and challenge any inaccuracies to protect your credit score.

Is a 70% Credit Utilization Rate Bad?

Yes, a credit utilization rate of 70 percent or above is considered excessive and detrimental to a person’s credit score. It is because creditors and credit bureaus consider high credit usage to indicate that a person has overextended themselves financially and is at a greater risk of defaulting on payments. Maintain a credit utilization rate of 30 percent or below if one values a high credit score.

What Happens if I Used more than the Credit Limit of My Credit Card?

Over-limit use occurs when a credit card is used over its predetermined credit limit. In addition to potentially damaging credit scores, the credit card company imposes an over-limit fee on individuals. Borrowers risk terminating an account or raising the interest rate if they repeatedly make charges exceeding the credit limit. Make timely payments and never exceed the credit limit to prevent this.

Is Lower Credit Utilization Ratio Good?

Yes, having a low credit usage ratio is often seen as beneficial to a credit score. Credit utilization refers to how much of one’s available credit is used. Get this ratio by dividing the total credit card balances by the sum of available credit. One favorable indicator of responsible credit use is a low utilization ratio.

A lower credit usage ratio improves credit scores, but it’s not the sole one. The credit score is based not only on payment history and total debt amount. Further, different credit scoring models use different cutoffs for credit use; for instance, 10% is the cutoff for certain models. Thus, it is prudent to investigate the specifics of the credit scoring methodology used by the financial institution to which people apply.

Frequently Asked Questions

What is a credit utilization ratio, and why is it important for my credit score?

The credit utilization ratio is the amount of credit you’re using compared to your total available credit. It’s important because high utilization can negatively impact your credit score by making it seem like you’re over-reliant on credit.

How do I calculate my credit utilization ratio, and what factors should I consider when determining it?

Add up your credit card balances and divide by your total credit limits. Generally aim for a ratio below 30%. Consider keeping individual cards below 10% utilization. Don’t obsess monthly but monitor periodically.

What is the ideal credit utilization ratio to maintain for a healthy credit score, and how can I work to improve it if it’s too high?

Experts recommend keeping your utilization ratio below 30%, with lower than 10% being ideal. If it’s too high, pay down balances, request credit limit increases, open a new account, or consolidate debt onto a lower balance card.

Does the credit utilization ratio vary between credit cards and other types of credit accounts, and how do I calculate it for each?

Yes, utilization ratios can vary. For credit cards, compare balances to the card’s limit. For installment loans, compare balance to original loan amount. Don’t stress over perfectly optimizing each account. Focus on the total picture.

Are there any tips or strategies for managing my credit utilization ratio effectively to optimize my credit score?

Helpful strategies include making extra payments before billing cycles end, asking issuers for higher limits, opening an installment loan and keeping the balance low, avoiding maxing any card out completely, and splitting charges between multiple cards.