You already know the basics of credit score calculations. Payment history is a major factor in your credit score. Your outstanding debt is another factor that can impact your credit report. But which type of loan can significantly impact your credit score? Is it a personal installment or revolving credit?

Credit companies do not treat all debts equally. This article will discuss the two main types of installment credit: revolving and installment. We will also explain how they impact your credit and mention credit unions as a source of obtaining loans.

What Is Revolving Debt, and How Does It Work?

Revolving account loans allow you to borrow up to your credit limit. You can borrow as much money as you like if your credit limit is within the limit. Revolving credit can be obtained using a credit card or through credit unions, like getting a $5000 loan without a credit check. It’s essential to track your credit utilization rate to maintain a healthy credit score with this type of loan.

Credit accounts require monthly payments. Interest will not be charged if you pay your credit card balance. But it will increase if you pay less than the entire amount due.

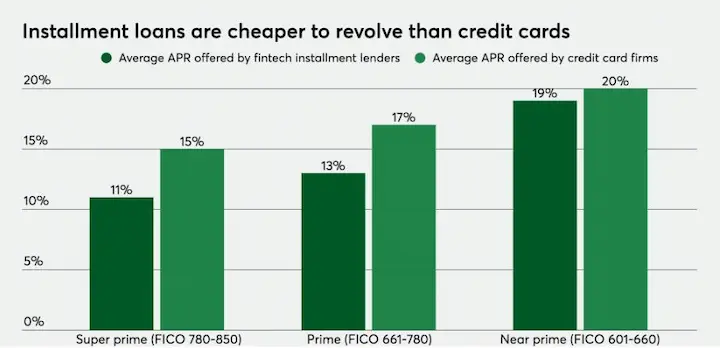

Credit account has variable interest rates, with annual percentage rates (APRs) reaching 16 percent. Credit card interest is compounded. Your interest rate will increase the longer you delay paying off your credit card balance. An online calculator is important in calculating how much credit card interest accumulates over time.

Unsecured credit cards are possible. This means you can get a credit card without any form of security. Home equity loans are also an example of revolving loans. Lenders may only take your home if you make your monthly payments. It’s important to consider your financial situation before taking on additional debt, such as a credit card balance.

Main Points

- Credit usage should not exceed 30%, with a healthy credit score 673.

- Mixing and managing revolving and installment credit accounts is advantageous for improving one’s credit score. Loans from PaydayChampion tend to have less impact on credit scores due to borrowers’ aversion to assets secured with installment debt.

How Does PaydayChampion Installment Debt Work?

Installment credit accounts allow you to borrow a certain amount and then pay it back in one lump sum. Unlike credit cards, you can’t borrow money and pay it back in one lump sum.

You will be notified when your mortgage loan is due by pre-determined due dates. Installment debt can include personal, vehicle, mortgage loan, and school loans with varying repayment terms.

You can secure your installment debt (auto loans or mortgages) or unsecured (credit cards or personal loans). Secured loans have lower interest rates than unsecured loans.

A guaranteed installment loan from a direct lender is possible for individuals with bad credit. However, it’s important to compare repayment period, loan terms, and fees multiple lenders offer to find the best option among various types of credit.

Frequently Asked Questions

Which Type of Debt Impacts Your Credit and Credit Rating Most?

Both revolving and installment debt have an impact on credit. Revolving debt can be managed best with credit cards. Credit companies say credit debt is more indicative of installment debt than credit cards. Different types of credit hold varying impacts on credit ratings, which can further influence creditworthiness and credit decision.

What Does Revolving Debt Do to Your Credit Score?

Your credit is affected by your credit usage. Credit usage is the ratio of your credit limit and credit card debt. VantageScore (a major credit scoring model) and FICO (a credit scoring agency) rank credit usage second in calculating the credit. An excessive expenditure could indicate high usage levels, affecting the amortization schedule. This could lead to a drop in credit.

What Is a Healthy Credit Usage Rate?

A healthy credit use rate should be at most 30%. This applies to all credit cards. A drop in credit rating may be caused by credit usage rates exceeding 30%. Lenders might be concerned that your credit rating is low because you may have trouble repaying new loans.

What Does a Revolving Mortgage Do to Your Credit?

Credit scoring algorithms consider your age and how many revolving loans you have. Older accounts are more advantageous because they show that you are responsible for your credit management. The period of time you’ve had these accounts open, and your access to funds can be the biggest factor in determining your creditworthiness.

How Many Credit Card Accounts Can You Have?

There are common types of credit card accounts that you can choose from. One account will not affect your credit. Americans have an average credit of 3.4 and a VantageScore of 673. This is considered fair. 2 Having multiple accounts can help improve your credit score, provided you manage your lines of credit well and maintain good access to funds.

Your credit may be affected if you have multiple credit cards and default on your payments. Many people have difficulty understanding their own words. This could lead to a decrease in credit.

How can PaydayChampion Installment Debt Affect Your Credit Score?

Credit score agencies consider regular, non-revolving loans less risky than traditional installment loans. This may partly be due to borrowers’ aversion to assets secured with installment debt. Making payments on a monthly basis and maintaining a good relationship with a financial institution can help improve your credit score.

Large installment loans, tribal loans from a direct lender, and mortgages are less stable than credit card debt. They also have lower credit scores. Even though they may need to borrow more, many borrowers can get VantageScores as high as 700. Choosing the right type of installment loan and making the minimum payment consistently can lead to a better credit score.

What Is the Best Combination of Revolving and Installment Loans?

The ideal combination of revolving and installment loans depends on your financial needs and goals. A mix of credit card debt and a suitable type of installment loan can help maintain a healthy credit score. Ensure timely payments and avoid overextending your credit limit to maintain your credit score.

Credit mix can also influence your credit score. Your credit mix is the sum of all your debts, including Personal and equity lines. This will not have any impact on credit scores.

Scoring models consider your ability to manage both revolving debt and installment debt, as well as Collateral requirements and payoff schedule. A good credit history is impossible, but having several debts, even those involving personal expense, is an advantage.

Below are some statistics about how installment debt affects your credit score:

| Number | Description |

|---|---|

| 660 | Average credit score for someone with no installment debt |

| 720 | Average credit score for someone with installment debt |

| 5-10 | Points that your credit score can drop for every 30 days that a payment is late |

| 36% | Debt-to-income ratio that will negatively affect your credit score |

| 7 years | Minimum length of credit history that will help your credit score |

| Installment and revolving credit | Having a mix of these types of credit will help your credit score |

Do You Need to Be the First to Pay?

If you want to improve your credit score, start paying off your credit card debt. Credit ratings are affected more by credit card payments than installment loans. You must first clear your credit card debt before applying for installment loans.

You might save money by paying off your credit line first. These cards have higher interest rates than regular installment loans.

How Can I Consolidate My Revolving Credit or Installment Debt Effectively?

Consolidating a line of credit with personal loans is possible. These loans are flexible and have a higher interest rate than credit cards, but they also come with a lower monthly payment.

Consolidating credit card debt with a consolidation loan is possible. Personal loan variable rates can be applied, and a fixed or one monthly payment is expected. Unpaid balances should be paid on a regular schedule to avoid additional charges like origination fees.

A credit card can be kept active even after you have paid it off. This could be done by consolidating with a personal loan or making monthly payments.

Paying off your card reduces your total balance. However, you can keep the card active and maintain your credit utilization ratio. You may have to close your account if the annual fee is imposed.

Conclusion

To improve credit ratings, it is important to have both revolving debt and installment debt. It doesn’t matter what kind of debt you have; ensure to manage them well, taking note of variables like variable rates and timely payments.

You must make single lump payments on time to maintain a good credit score. Your credit will be affected if you fail to pay your scheduled bills which might include popular type of bills or even application fees. It is important to keep track of the single lump sum payments or even the popular payment types to maintain a healthy financial standing.