What Is Credit Score & How Does Your Credit Score Is Calculated

A credit score is a number that ranges from 300 to 850, indicating a consumer’s reliability as a borrower. The loans are all examined by the total amount of debt an individual has, how long the credit has been extended, the types of credit used, and how well it has paid back. A credit score indicates the capacity to repay loans to lenders. A credit score is a three-digit summary of an individual’s credit history. It’s compiled based on information collected from creditors and collated in the Credit Information Report, or CIR. People with excellent credit typically receive reduced interest rates. In the long run, paying less interest on debt save substantial funds.

The importance of credit score varies from person to person. Some people use a credit score to determine eligibility for loans or mortgages; others use credit scores to determine eligibility to get insurance discounts or receive free stuff. Credit scores also influence decisions about employment, education, and housing.

The credit score affects whether or not a borrower gets a loan and how much interest to pay.

Additionally, prospective employers use it to determine dependability. Service providers and utility companies review it to determine if a deposit is required. The length of time payments were late, the total amount past due, and the frequency with which payments were missed are the primary factors considered by most credit scoring models.

Main Points

Credit Score Range

Credit scores typically range from 300 to 850. Lenders use these scores as a tool to assess an individual’s creditworthiness, which is crucial when deciding whether to approve a loan application and at what interest rate.

Determining Factors

Credit scores are calculated based on various factors. These include the total amount of debt, the length of credit history, the types of credit used, repayment history, and the timeliness of payments. Each factor plays a significant role in determining an individual’s overall credit score.

High Credit Score

Having a high credit score is vital for various reasons. Not only does it help in securing loans with favorable interest rates, but it is also considered by various service providers and employers when determining eligibility for services, goods, or employment opportunities.

What is a Credit Score?

A credit score scale ranging from 300 to 850 identifies a consumer’s creditworthiness. A person’s credit records are checked to determine a credit score. Credit score evaluation considers the overall amount of debt, the number of open accounts, and the individual’s repayment records. Financial organizations use credit ratings to know the likelihood that borrowers would punctually repay obligations incurred.

The earliest kinds of credit reporting emerged in the United States in the early 19th century, when commercial lenders assessed the risk associated with lending to various prospective business clients. The Fair Isaac Corporation, now known as FICO, developed the credit score model, which financial institutions utilize. There are a lot of techniques to increase one’s credit score, including timely loan repayment and low debt levels.

What Is the Importance of Credit Scores?

The importance of credit scores relies on reasons. First, it determines whether it qualifies for a mortgage and car loan. Second, it influences what kind of insurance rates to receive. Third, it affects how much to pay for utilities like electricity and gas. Fourth, it impacts the ability to open new lines of credit, such as credit cards and store cards. Fifth, it affects employment opportunities. Sixth, it has implications for finances. Lastly, a credit score helps determine eligibility for government programs such as food stamps and Medicaid.

How Does Credit Score Work?

Listed below is the step-by-step guide on how credit score works.

- The first step is to open up a free account at Experian. Experian asks for basic information such as name, address, phone number, and email. Next, Experian runs a security check on identity using Social Security Administration and Department of Motor Vehicles records.

- Creditors look for information on credit history that indicates a likelihood of default, such as unpaid debts, litigation, and bankruptcies.

- A credit score is affected by payment history. Credit score drops if the borrower carries a load for six months or if payments are late. In addition to credit score, lenders evaluate income, work status, the creditworthiness of parents, and age when evaluating whether to approve a loan.

- Credit score systems vary from lender to lender but generally consist of three basic components: payment history, credit utilization percentage, and total debt. Each part is granted a different weight depending on the lender. The algorithm then considers all three aspects when assessing whether or not it is authorized. However, if the borrower has poor credit, banks normally evaluate only one factor — payment history — when determining whether a borrower is likely to default on a loan. Other variables, such as income, employment, and assets, are considered.

What Factors Affect Credit Scores?

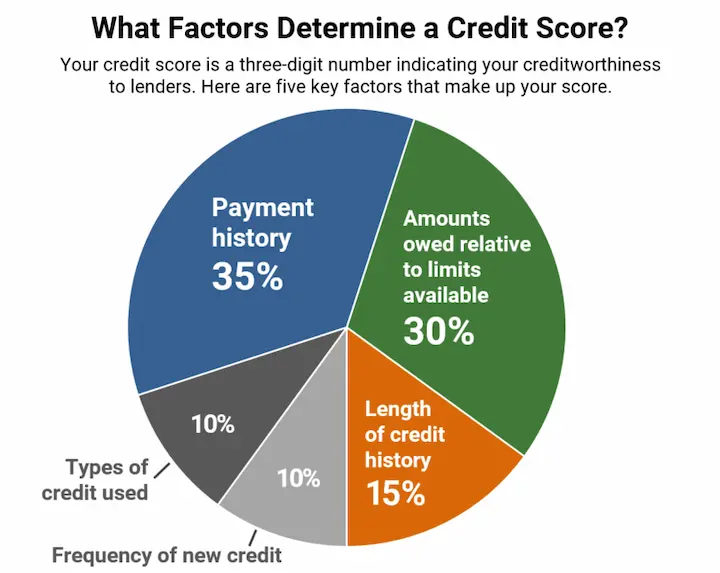

Payment history mostly affects credit score, the amount of debt owed, the time spent using credit, new or recent credit, and the categories used. Each factor has a varied weighting in the score. Listed below are the factors that affect credit scores.

- Payment History: Payment history indicates the frequency of making on-time payments. Payment history is the most significant factor in determining a credit score.

- Debts Owe: The amount presently owed is the outstanding debt. The lower the due loan balance, the greater the credit score.

- Duration of Credit Report: A credit report determines how long had credit accounts. A longer credit history is advantageous to credit score. Maintaining a high credit score requires the responsible use of an established line of credit.

- New Credit Request: New credit request.

- Credit Types Use: The credit score improves using extra credit responsibly, such as installment and revolving loans. However, having several types of credit is optional for a good score.

Below are some statistics about factors that affect credit scores:

| Factor | Weight |

|---|---|

| Payment history | 35% |

| Amount owed | 30% |

| Length of credit history | 15% |

| New credit | 10% |

| Inquiries | 10% |

How Are Credit Scores Determined?

The following factors determine credit scores. First, the payment history, as reflected on the credit report, is often the most influential factor in calculating a credit score. The score algorithms incorporate on-time payments, late payments, and public records within the category. Second, The amounts owed, or credit utilization, is important for assessing credit scores after payment history. The credit score category shows the amount owe on loans and the number of accounts outstanding. The third is the duration of the Credit Record; when evaluating credit history, credit scoring algorithms consider the age of the oldest account, the newest version, and the average age of all funds. Lastly, Credit reports are constantly analyzed to determine a credit score. A credit score is established when someone examines a credit report instead of being updated at regular intervals.

What Metric Is Used to Determine a Credit Score?

The metric used to determine a credit score is credit utilization. The credit utilization ratio is the proportion of a borrower’s total available credit currently being utilized. Credit reporting companies use the credit utilization ratio to establish a borrower’s credit score. Borrower enhances credit score by reducing the credit use ratio and attempting to increase credit score.

What Is a Good Credit Score?

On a scale ranging from 300 to 850, a credit score of 700 or more is typically considered good. A score of 800 or above in the same range is considered outstanding. The majority of consumers have credit ratings between 600 and 750. The average FICO® Score in the United States rose by four points to 714 in 2021. Higher scores increase creditors’ confidence to repay future loans as promised. However, creditors establish standards for a good or negative credit score when evaluating applicants for loans and credit cards.

What Is a Bad Credit Score?

FICO scores range from 300 to 850, and debtors with 579 or below are typically regarded as having poor credit. Experian estimates that 62% of consumers with credit scores of 579 or lower are likely to default on loans in the future. Fair scores range between 580 and 669 points. These borrowers are significantly less likely to go seriously late on loans, making a safer bet than individuals with poor credit scores. However, even borrowers within a bad credit range are subject to higher interest rates or need help acquiring loans compared to those with credit scores closer to 850.

How to Improve a Credit Score?

Consider these to improve your credit score.

- Examine credit history. There are three possible approaches for examining credit histories: 1) a personal recommendation from someone, 2) public records such as court filings, judgments, liens, tax liens, bankruptcies, foreclosures, etc., 3) credit reporting organizations such as Equifax, Experian, and TransUnion.

- Manage bill payments. Establishing a monthly bill management system is essential to developing good financial habits. Make and save a list of monthly costs in separate tabs. Track internet, phone, cable TV, power, water, gas, taxes, and other monthly bills on the first tab. Track non-recurring expenses like auto repairs, health insurance, and dentist visits on another account. Finally, save for future purchases and vacations on a third tab.

- Utilize at most 30% of available credit. The maximum utilization rate is at most 30%, not surpassing 30% of the credit limit when applying for new cards. Refrain from incurring further debt if you already have a substantial debt. Instead, utilize and successfully manage existing credit cards responsibly.

- Limit the number of credit requests. The simplest way to limit the number of credit requests is to use a budgeting tool like Mint.com to record all purchases meticulously. Being conscious of spending habits allows for limiting outlays.

- Fill out a thin credit report. To complete a thin credit report, visit AnnualCreditReport.com and click “Check Credit Report.” Thin credit report requests are issued to all three major credit reporting agencies – Experian, Equifax, and TransUnion – and return information regarding any bad entries on file.

- Maintain former accounts and address delinquencies. Call the lender immediately if the loan payments are overdue. The first step is to request a payment extension by calling the creditor. Next, determine why you are asking for additional time. Negotiate a lower interest rate or an extended repayment period. Finally, determine whether the debt is still affordable.

- Consider consolidating debt. Determine if it is needed to consolidate all of the bills into one loan or if considering debt consolidation. Consolidating debts into one loan saves money in interest payments and reduces monthly payment amounts. However, consolidating debts into one large loan have less flexibility when making changes to the budget.

- Using credit monitoring, check progress. Credit monitoring is used to help keep track of how much debt owes, what types of loans have, and whether one is making payments on time. Using credit monitoring leads to missed deadlines for loan payments, late fees, and other consequences.

How Can I Maintain a Good Credit Score?

Listed below are the ways to maintain a good credit score.

- First, control credit. Keep tabs on expenditures. Keeping track of debt and credit card transactions and using ATM cards and cheques is necessary. Viewing transactions online to monitor current balances, verify deposits and other activities, and promptly report any potential discrepancies is important. Stay within the credit limit on credit cards and lines of credit. Ensure it stays within credit limits, as it negatively affects credit scores. Set up various alerts (such as email and text messages) and other services to recall upcoming payments and appropriately manage credit usage. Have a reserve fund. Maintain a 15% emergency cushion of available credit. Or, even better, keep three to six months’ living expenses in a liquid, interest-bearing account. Setting up periodic transfers into a savings account through a bank is one approach to simplify emergency fund savings. Pay all debts. Always make at least the minimum payment on time each month—lower loan charges by paying more than the minimum monthly payment or, ideally, the full balance.

- Second, make on-time payments. Put bills in a single location to avoid losing or forgetting them. Please keep track of outstanding invoices and remember to pay them. Contact the lender to see if the payment due date is adjusted. Pay attention to the due dates for prices. Send payment by mail, or plan a Bill Pay online payment at least one week before the due date. Consider configuring account alerts to inform of low account balances to avoid late penalties and overdrafts.

Enroll in automatic payments. Automatic payments from a checking account are a straightforward and handy method for monthly payments. Ensure sufficient funds for the payment when drafted by scheduling it according to the payment plan.

Maintain accurate contact information. Remember to complete the change of address form on the statement or amend it online if relocating to guarantee that account is sent to the new address.

- Third, maintain contact with creditors. Immediately contact the lenders if behind on payments. Most creditors are prepared to establish alternate payment arrangements, especially if directly advised of the circumstances.

How to Check Your Credit Score?

Listed below is the step-by-step guide on how to check your credit score.

- First, go to AnnualCreditReport.com and request a copy of the credit report from the three major credit agencies: Equifax®, Experian®, and TransUnion®.

- Second, request a copy of the credit report once every 60 days if there is an error in the account.

- Third, each credit reporting agency provides a copy of the credit report, which is carefully evaluated as each is inaccurate or includes inconsistent data.

- Fourth, submit a complaint when observing an error in consumer reports.

How to Fix a Bad Credit Score?

Below is the step-by-step guide on fixing a bad credit score.

- First, review the credit report and rating. The first step is to examine and verify the correctness of the credit report to enhance a low credit score. Then, access free weekly credit reports from all three bureaus during the pandemic. Equifax offers up to six free credit reports through 2026.

- Second, dispute any errors. Be required to provide proof stating the inaccurate details (such as confirmation of paid bills on time were reported late). The credit bureau must conclude its examination within 30 days. The Fair Credit Reporting Act gives an additional 15 days for any dispute that cannot be settled within the specified time frame.

- Third, get bill payments under control. Payment history greatly influences credit score, accounting for 35% of the score. Pay bills on time to raise your credit score. One way to track payment deadlines is to set up automatic payments for existing accounts. Always make a monthly payment, which always is completed on time. Paying the minimum amount required helps avoid late fines and even greater interest charges.

- Fourth, establish a goal of less than 30 percent credit usage. To calculate the credit utilization ratio, divide the total debt amount by the available credit amount. Therefore, if having $3,000 in full credit with a credit card and loan debt of $800, the credit utilization rate is 26.67% ($800 divided by $3,000)—the higher the utilization ratio, the lower the credit score.

- Fifth, restrict new credit inquiries. A credit inquiry is performed when requesting the credit or increasing the credit limit; a credit inquiry is conducted. There are two varieties of questions: soft inquiries and harsh inquiries. A soft search does not impact the credit score. It is achieved when evaluating credit, authorizing an employer to examine credit, credit card companies looking for preapproval status offers, and financial institutions with transacting conduct credit checks.

- Sixth, Avoid canceling outdated credit card accounts. Canceling outdated credit cards further reduces credit scores. The length of credit history contributes to 15% of the credit score; the longer it is, the better. Instead, shred the old cards to avoid the temptation to reuse them. Refrain from influencing whether the card issuer closes the card; after a specific time of inactivity, the issuer closes the account.

- Seventh, Consider a balance transfer credit card. Balance transfer credit cards offer promotional APRs of 0% for 12 to 24 months. A balance transfer credit card allows for consolidating high-interest credit card debt onto a single card, consolidating payments, and reducing interest charges—a clear obligation within the introductory time before requesting a balance transfer card.

- Lastly, request a secured credit card. Rebuilding credit takes time, but a secured credit card help improve a low credit score. A secured credit card functions identically to a standard credit card, except that the credit limit depends on a security deposit or the amount deposited into a connected account, such as a savings account.

Which Scoring System Are Financial Firms Using?

Financial firms use the FICO scoring system when determining a person’s credit score to determine how well the borrower pays back the loans, the types of loans, how long the borrower has credit, and how much debt. FICO Scores are determined using various credit information from the credit report. FICO scoring system information is categorized into five groups: payment history (35%), amounts owing (30%), credit history length (15%), new credit (10%), and credit mix (10%).

What Are the Main Credit Bureaus?

Equifax, Experian, and TransUnion are the main credit bureaus. These lead the market for collecting, analyzing, and disseminating information about credit market users.

- Equifax: It has been in business for more than 100 years and is one of the oldest consumer reporting agencies in the world. Equifax provides information about US consumers to banks and other companies and gives consumers access to personal data through a mobile app called “MyEquifax.” Equifax’s credit score is from 280 to 850.

- Experian: The biggest difference between Experian and other credit reporting agencies is that Experian offers all consumers free credit reports once per year, while other agencies charge monthly fees. Experian provides better customer service and is less likely to give inaccurate information. Additionally, Experian offers 24/7 live chat support, phone lines, email forms, and web forms via its website. Experian’s credit score is from 330 to 830.

- TransUnion: Offers a free credit score based on information collected from government agencies, banks, retailers, and other creditors. TransUnion data is updated daily and allows for real-time monitoring of credit standing. TransUnion’s credit score is from 501 to 990.

Is Credit Score More Important Than Credit Report?

While having a bad credit rating and poor credit history prevent someone from obtaining a loan, having one set of information showing a negative payment history doesn’t necessarily mean they won’t qualify. A credit score and credit report better predict whether you’ll be able to repay a loan. According to Experian, one’s credit score has much more impact on how much they’ll be able to borrow in the future and what kind of loans be available to them. On the other hand, having a clean credit report won’t directly affect how much funds someone else lends to them.

Frequently Asked Questions

What is a credit score, and how is it defined?

A credit score is a three-digit number calculated from a person’s credit history that represents their creditworthiness. It’s a snapshot of how likely someone is to repay debts based on past borrowing behavior. Scores typically range from 300-850. Higher scores represent lower credit risk.

Why is a good credit score important, and how does it impact financial decisions?

Good credit scores allow access to better loan terms, lower interest rates, higher limits, and more favorable lending decisions. Individuals with higher scores are viewed as lower risk and more reliable. A good score saves money over the long run and provides more options in times of emergency or need.

How do credit bureaus calculate credit scores, and what factors influence them?

Credit bureaus use complex mathematical algorithms to calculate scores based on the components of someone’s credit history. The main factors are payment history, amounts owed, length of credit history, new credit accounts, and credit mix. Each area is weighted differently based on predictive value.

What steps can individuals take to improve their credit scores?

Key steps to improve credit scores include paying all bills on time, keeping balances low on credit cards and loans, limiting hard inquiries on credit reports, correcting any errors in the credit history, and maintaining current accounts while also having a good mix of credit types. Time and good habits are essential.

Can you explain the relationship between credit utilization and credit scores, and how can it be managed effectively?

Credit utilization is the percentage of available credit being used. High utilization lowers scores. Keeping this below 30%, and optimally below 10%, can raise scores. Avoid maxing cards, spread debt across cards, pay down balances, and ask for higher limits. Proper utilization management demonstrates lower risk.