What Is an Installment Loan & What Is The Application Process

An installment loan is when the borrower gets a fixed amount from a lender and repays it in regular installments, usually monthly, over a specified period. The repayment term for installment loans varies from a few months to several years.

Personal installment loans consolidate debt, pay for unexpected expenses, or make large purchases. Examples of installment loans include personal loans, auto loans, student loans, and mortgages. Car loans are used to purchase a vehicle, while student loans are used to finance education expenses. Mortgages are used to finance the purchase of a home.

Alternatives to installment loans include payday loans, credit card cash advances, and lines of credit. Its options have much higher interest rates and fees than installment loans, leading to a debt cycle for the borrower.

Another alternative to installment loans is a secured loan, where the borrower pledges collateral, like a car or home, to secure the loan. Secured loans have lower interest rates than unsecured loans, but there is a risk of losing the pledged collateral if the borrower cannot repay the loan.

What is an Installment Loan?

An installment loan is when a borrower receives a fixed amount from a lender and agrees to pay it back in regular, predetermined payments or installments over a set period. Each installment payment includes a portion of the principal borrowed with interest and fees.

Installment loans are secured or unsecured. Common examples of installment loans include personal loans, auto loans, student loans, and mortgages. Installment loans are used for large purchases, consolidating debt, or financing unexpected expenses.

The repayment terms of an installment loan vary depending on the lender and the borrower’s creditworthiness. Repayment periods range from a few months to several years, with longer repayment terms resulting in lower monthly payments but higher interest rates.

How Does An Installment Loan Work?

An installment loan gives a borrower a fixed amount of money to be repaid in regular, predetermined payments or installments. Borrowers and lenders agree to a set repayment schedule, which includes the amount of each installment, the frequency of payments, and the total repayment period.

A borrower’s income, work position, and credit history are only a few of the factors that lenders take when approving borrowers for installment loans. Lenders evaluate a borrower’s credit history and other financial data to decide on providing loans and their interest rate.

- The borrower applies for an installment loan in person or online and provides information about their income, employment, and credit history.

- The lender reviews the borrower’s application and creditworthiness to determine their eligibility for the loan. A loan offer includes the loan amount, interest rate, fees, and repayment conditions if the lender authorizes the borrower.

- The lender gives the borrower a lump amount or pays the vendor or creditor immediately if they accept the loan offer.

- The borrower agrees to make regular, predetermined payments or monthly installments until the loan is fully repaid. Each installment payment includes a portion of the principal borrowed with interest and fees.

- The loan is completely repaid when the borrower makes all due installments.

What Are The Installment Loans Examples?

Examples of installment loans include mortgages, car loans, personal loans, and student loans. Borrowers must make regular payments over a set period, with the interest rate and repayment terms determined at the time of the loan agreement with its types of loans. Check their financial situation before obtaining an installment loan, as they are responsible for repaying the full loan amount with interest over the loan term.

Personal Installment Loans

Personal installment loans in Virginia are unsecured loans that provide the borrower with a lump sum. They must repay the loan in equal monthly installments over a set period. They have fixed interest rates determined by the borrower’s credit score, income, and other factors.

Personal installment loans are versatile and are useful for various purposes like home improvements, medical expenses, or debt consolidation. Banks, credit unions, and online lenders offer them, and applicants need to provide documentation, like proof of income and identification, to apply.

Payday Loans

Payday Loans are short-term lending with repayment scheduled for the borrower’s next paycheck. They are helpful in emergencies or when other financing options are unavailable. Payday loans are more flexible than traditional bank loans, allowing borrowers to choose their loan amount and repayment plan. They are unsecured loans between one and a thousand dollars that people borrow to deal with financial emergencies or make ends meet between payments. Payday loans spiral into a never-ending circle of debt.

Title Loans

A title loan is a type of secured loan that provides quick access to cash for borrowers who own a vehicle outright. Its loan allows borrowers to use their vehicle as collateral in exchange for a loan. The lender places a lien on the vehicle’s title, meaning they have the legal right to repossess the vehicle if the borrower fails to repay the loan. Title loans are helpful for individuals who need quick access to cash.

Student Loans

Student loans are financial aid provided to students to help them pay for their college or university education. Its loans cover tuition fees, room and board, textbooks, and other educational expenses. Students only have to begin repaying their loans after they graduate or leave school, unlike other types of loans, and repayment plans vary depending on the type of loan. Borrowers must check the amount of money they borrow and explore other financial aid options before obtaining a loan, as the repayment of student loans significantly impacts their financial situation after graduation.

Mortgage Loans

A mortgage loan is a popular loan used to finance a real estate purchase. The borrower uses the purchased property as collateral and pays back the loan over a period with fixed or adjustable interest rates. Borrowers need a good credit score, a stable income source, and a down payment to qualify for a mortgage loan. Mortgage loans are useful for purchasing primary residences, vacation homes, and investment properties. They are used to refinance an existing mortgage for better interest rates or lower monthly payments.

What Are The Installment Loan Alternatives?

The installment loan alternatives include home equity loans, personal lines of credit, credit card cash advances, peer-to-peer lending platforms, and credit unions. Home equity loans allow homeowners to borrow money against their home equity, while personal lines of credit are pre-approved credit limits that borrowers access as needed.

Credit card cash advances provide short-term loans for unexpected expenses, and peer-to-peer lending platforms connect borrowers with individual investors. Credit unions are non-profit financial institutions that offer various financial services and lower interest rates on loans and credit cards.

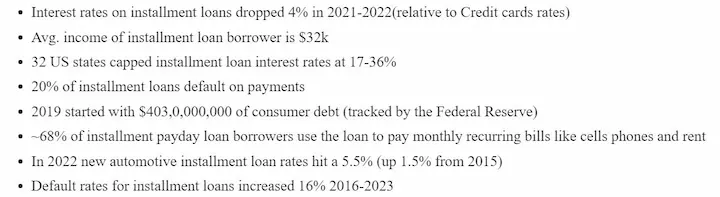

Below are some statistics about installment loan alternatives:

| Alternative | Interest Rate | Fees | Repayment Term |

|---|---|---|---|

| Credit card | Typically 12-24% | Variable | Varies |

| Line of credit | Typically 10-18% | Variable | Varies |

| Personal loan | Typically 6-36% | Fixed | 1-7 years |

| Borrowing from friends or family | Varies | Varies | Varies |

Home Equity Loans

A home equity loan is a secured loan that lets homeowners borrow money against the equity in their home, which is the difference between the home’s market value and the outstanding mortgage balance. They are ideal for financing home improvements or other large expenses and have fixed interest rates and repayment terms ranging from 5 to 30 years. Borrowers must weigh the risks and benefits before obtaining a home equity loan, including the potential for foreclosure if they default on payments.

Personal Lines Of Credit

A personal line of credit loan allows borrowers to access a pre-approved credit limit as needed. It’s similar to a credit card in that the borrower borrows up to a certain amount and only pays interest on the amount borrowed. The lender determines the credit limit based on the borrower’s creditworthiness, and the borrower uses the funds for any purpose.

The borrower only pays interest on the amount borrowed and draws on the line of credit as needed, making it a useful financial tool for unexpected expenses or emergencies. Personal lines of credit are unsecured loans, meaning they don’t require collateral but a good credit score and stable income to qualify.

Credit Card Cash Advance

A credit card cash advance is a short-term loan that borrowers obtain at an ATM or bank using their credit card. The amount that applicants borrow depends on the credit limit of the card and the available cash advance limit. Credit card cash advances are accessible. They are useful for various purposes, like covering unexpected expenses or emergencies.

Peer-to-peer Lending Platforms

Peer-to-peer lending platforms provide an alternative option for online borrowers seeking installment loans by connecting them with individual investors lending money. Its platforms offer competitive interest rates and flexible repayment terms, which make them popular among borrowers.

Borrowers must provide information about their income, employment, and credit history to apply for a loan on a peer-to-peer lending platform. The platform uses its information to assess their creditworthiness and assigns them a credit rating.

Credit Unions

Credit unions are member-owned and non-profit financial institutions that offer various financial services, like savings accounts, checking accounts, and credit cards. They are smaller than traditional banks and focus on serving communities or groups of people.

Credit unions offer lower interest rates on loans and credit cards because their primary goal is to provide financial services to their members rather than generate profits. They are cooperative financial institutions that provide access to loans that borrowers repay in installments over a while.

Where To Apply For Installment Loans?

There are several places where borrowers apply for installment loans, including banks, credit unions, online lenders, and peer-to-peer lending platforms. Traditional banks and credit unions offer installment loans with competitive interest rates and favorable repayment terms, but they require a good credit score and stricter eligibility requirements. Online lenders and peer-to-peer lending platforms are more accessible to borrowers with lower credit scores or less established credit histories.

Our company proudly provides installment loans to individuals across the United States, offering financial solutions tailored to our customer’s diverse needs. We understand that unexpected expenses can arise anytime, and our commitment is to make the loan application process convenient and accessible. With a nationwide presence, we have established operations in several American states to ensure that residents have access to our reliable and transparent installment loan services. Below is a comprehensive table highlighting the states our company is actively serving, bringing flexible borrowing options closer to you.

| AL (Alabama) | AK (Alaska) | AZ (Arizona) | AR (Arkansas) |

| CA (California) | CO (Colorado) | CT (Connecticut) | DE (Delaware) |

| DC (District Of Columbia) | FL (Florida) | GA (Georgia) | HI (Hawaii) |

| ID (Idaho) | IL (Illinois) | IN (Indiana) | IA (Iowa) |

| KS (Kansas) | KY (Kentucky) | LA (Louisiana) | ME (Maine) |

| MD (Maryland) | MA (Massachusetts) | MI (Michigan) | MN (Minnesota) |

| MS (Mississippi) | MO (Missouri) | MT (Montana) | NE (Nebraska) |

| NV (Nevada) | NH (New Hampshire) | NJ (New Jersey) | NM (New Mexico) |

| NY (New York) | NC (North Carolina) | ND (North Dakota) | OH (Ohio) |

| OK (Oklahoma) | OR (Oregon) | PA (Pennsylvania) | RI (Rhode Island) |

| SC (South Carolina) | SD (South Dakota) | TN (Tennessee) | TX (Texas) |

| UT (Utah) | VT (Vermont) | VA (Virginia) | WA (Washington) |

| WV (West Virginia) | WI (Wisconsin) | WY (Wyoming) |

What Are The Requirements To Qualify For Installment Loans?

The qualifications for an installment loan vary depending on the lender and the type of loan. There are criteria that most lenders take when evaluating a borrower’s eligibility for an installment loan. Listed below are the requirement to qualify for Installment Loans.

- Lenders require a minimum credit score to qualify for an installment loan. A higher credit score improves the chances of being approved and receiving a lower interest rate.

- Borrowers must have a steady income to demonstrate their ability to repay the loan. Other lenders require a minimum income level to qualify.

- Lenders evaluate the borrower’s debt-to-income ratio, which is the amount of debt they have compared to their income. A lower debt-to-income ratio indicates a borrower is more likely to repay the loan.

- Borrowers must have a stable job or a reliable source of income to qualify for an installment loan.

- Borrowers must be at least 18 years old and legally resident of the country where they apply for the loan.

How Does an Installment Loan Affect Credit?

The table provides a clear and concise overview of how installment loans affect credit scores, according to Bankrate. The table summarizes the impact of installment loans on credit scores in different scenarios, according to Bankrate. It includes five scenarios and their impact on credit scores: on-time payments, missed payments, paying the loan in full, paying off the loan early, and closing accounts.

The table highlights that making on-time payments has a positive impact on credit scores, while missed payments have a negative impact. It indicates that paying the loan in full has a positive impact on credit score, paying off the loan early has a minimal impact, and closed accounts in good standing have a positive impact on credit score.

| Scenario | Impact on Credit Score | Explanation |

| On-time payments | Positive | Making on-time payments boost their credit score. Payment history makes up 35% of your score. Being on time with their monthly payments helps their credit. |

| Missed payments | Negative | Being late or having missed payments negatively impacts their score. |

| Paying the loan in full | Positive | Paying it off on time and in full bumps their score. |

| Paying off the loan early | Minimal impact | It won’t greatly impact overpaying it off on the agreed-upon schedule. |

| Loan checked the closed account | Positive | Loan accounts are terminated after all payments have been made. Accounts closed in good standing remain on a person’s credit report for 10 years after closure. |

Is Getting an Installment Loan Raise Borrowers’ Credit Score?

Yes, getting an installment loan potentially raises a borrower’s credit score, but it is not a guaranteed outcome. A borrower who gets an installment loan, like a vehicle or personal loan, receives a predetermined sum of money with interest repaid over time. Borrowers who pay their bills on time and in full show financial responsibility to credit reporting agencies.

It positively impacts their credit score. The borrower misses payments or defaults on the loan, which hurts their credit score. Obtaining a new loan temporarily lowers a borrower’s credit score as it increases their overall debt load. Check their ability to repay an installment loan before applying. Make all their payments on time to prevent negatively impacting their credit score.

Frequently Asked Questions

What is an installment loan, and how does it differ from other types of loans?

An installment loan is repaid with fixed monthly payments over a set period. It differs from revolving debt like credit cards and differs from single payment loans like payday loans.

Can you provide examples of common installment loans, and explain how they work?

Examples include mortgages, auto loans, and personal loans. You borrow a lump sum, then repay it in equal monthly installments with interest over a fixed term like 5 years. This structure helps with budgeting.

What are the advantages and disadvantages of taking out an installment loan?

Advantages are predictable payments, lower rates than payday loans, can improve credit when repaid on time. Disadvantages are borrowing costs with interest, restrictive terms, collateral often required.

Are there alternative borrowing options to installment loans for individuals with varying credit profiles?

Yes, alternatives include payday loans, credit cards, 401k loans, home equity loans, pawning assets, borrowing from friends/family, credit-builder loans, or employer advances.

What factors should borrowers consider when choosing between different types of installment loans?

Loan amount needed, interest rates, monthly payments, loan term length, fees, early repayment penalties, credit impact, and eligibility requirements.