Cash Loans Wired in 1 Hour: How Does It Work

Emergency loans like cash loans wired in 1 hour are a practical option. They are an alternative financial service where you can obtain quick cash to deal with emergencies and unanticipated bills or to get you through a difficult time, often provided by an online lender. Compared to conventional loans, they offer a more accessible solution for those needing funds.

Although they can be secured, cash loans often have short repayment periods and are unsecured. Since they typically involve an advance of a portion of your upcoming paycheck, they are also known as “cash advance loans” or “payday loans.” The loan’s term will frequently coincide with your payday schedule and repayment period.

There are numerous types of cash loans. Due to their swift approval and funding, cash loans are also known as “fast cash loans,” “immediate cash loans with no credit check,” “speedy cash loans,” “1-hour loan direct deposit loans in minutes,” or “instant cash loans.” Whatever name you give them, quick cash loans all provide complete comfort.

Main Points

1-Hour Loan Cash Loans

1-hour cash loans wired in 1-hour offer a quick financial solution for dealing with emergencies and unexpected bills. These loans provide immediate access to cash, aiding individuals in urgent need of financial assistance.

Eligibility Criteria

To be eligible for these rapid cash loans, applicants must fulfill certain requirements. These include possessing a valid national ID, providing proof of income, having a working email address, and meeting the minimum age restrictions set by the lender.

Consider Interest Rates

It’s important to note that the interest rates for 1-hour cash loans can be relatively high due to their short-term nature. Therefore, individuals should also consider alternative loan options, such as installment loans or title loans, which may offer more favorable terms and rates.

Cash Loans Wired in 1 Hour: What Are the Eligibility Criteria, and What Are They?

Short-term borrowing from a direct lender is a cash loan in 1 hour. Upon official approval, the agreed-upon amount is transferred to the borrower’s bank account. The entire process is simple, quick, and secure because there are often fewer needs for verification than for other cash loans, such as credit check loans and installment loans.

Due to their high APRs and quick repayment schedules, one-hour personal loans are only used in dire circumstances. In other words, they are excellent at filling in unexpected expenses or cash shortfalls, compared to credit check loans and installment loans that might take longer to process.

How to Apply for Cash Loans Wired in 1 Hour

You now have some reasonable expectations for this repayable loan because you know that guaranteed one-hour loan approval is different from reality. You must follow a few easy steps to submit your online loan request form and have cash loans transmitted to you in 1 hour on the same day:

1. Finish the Loan Application Online Process.

There is a brief online form where you must enter some personal data. The documents requested must also be gathered and attached. This process is designed to be accessible to individuals with a poor credit history and bad credit borrowers.

2. Await the Outcome.

We need a few minutes to handle your loan application request. Following a thorough review, we will let you know the decision.

3. Gather your Papers.

Upon approval, you will receive a notification to submit documents that verify your identity and address. These documents can include a driver’s license or passport for identification purposes and proof of residence like a utility bill or bank statement.

We proudly present a comprehensive table showcasing the American states where our company actively offers a unique financial solution: cash loans wired in 1 hour, with absolutely no credit check required. Our mission is to provide accessible and efficient financial services to needy individuals, ensuring that urgent financial obligations can be met swiftly and conveniently. With our commitment to serving customers across the United States, we have expanded our operations to numerous states, allowing individuals from various regions to benefit from our hassle-free loan process. Please refer to the table below to discover if our services are available in your state and take the first step toward resolving your immediate financial needs.

| AL / Alabama | AK / Alaska | AZ / Arizona |

| AR / Arkansas | CA / California | CO / Colorado |

| CT / Connecticut | DE / Delaware | DC / District Of Columbia |

| FL / Florida | GA / Georgia | HI / Hawaii |

| ID / Idaho | IL / Illinois | IN / Indiana |

| IA / Iowa | KS / Kansas | KY / Kentucky |

| LA / Louisiana | ME / Maine | MD / Maryland |

| MA / Massachusetts | MI / Michigan | MN / Minnesota |

| MS / Mississippi | MO / Missouri | MT / Montana |

| NE / Nebraska | NV / Nevada | NH / New Hampshire |

| NJ / New Jersey | NM / New Mexico | NY / New York |

| NC / North Carolina | ND / North Dakota | OH / Ohio |

| OK / Oklahoma | OR / Oregon | PA / Pennsylvania |

| RI / Rhode Island | SC / South Carolina | SD / South Dakota |

| TN / Tennessee | TX / Texas | UT / Utah |

| VT / Vermont | VA / Virginia | WA / Washington |

| WV / West Virginia | WI / Wisconsin | WY / Wyoming |

To Qualify for Short-Term Loans Wired in 1 Hour, What Qualifications Must One Meet?

Understanding the prerequisites before applying for the 1-hour instant loans with no credit check service is essential. These are the eligibility requirements, including for those with a poor credit history and bad credit borrowers:

- A working email address.

- Minimum age restrictions (18 years or older).

- A current bank account.

- A valid national ID with a residential address.

- Evidence of monthly income.

How Much Do Online Loans Cost?

Despite being very simple, 1-hour payday loans can be very pricey. For every $100 you borrow, a payday lender may charge you 15% to 20% in fees. As a result, the annual percentage rate (APR) for a payday loan could range from 391 to 521 percent. Your loan agreement will contain specific information on the interest rate and loan terms.

Additionally, several jurisdictions have imposed restrictions on the highest APR and lowest and maximum loan amounts that payday lenders and other financial institutions may charge. These restrictions are in place to deter unscrupulous lending practices by online payday loan providers and to make monthly payments more manageable for borrowers. These loan options tend to have a higher cost compared to a traditional bank loan.

Consider other loan options, including installment, personal, and title loans, if payday loans are too pricey. These are handled in a single business day, just like loan online, and the lending company is not required to run a bad credit score check.

Can I Obtain a 1-Hour Payday Loan Without Work?

Yes, applying for a 1-hour loan online directly from a lender is feasible without proof of work. Complete our online application form for a payday(steady income) loan that accepts unemployment benefits, and we’ll locate numerous payday lenders eager to handle your loan request immediately. Remember to provide your bank account details for a smooth transaction.

So long as you have other sources of income, such as Social Security payments, unemployment benefits, pension funds, etc., you can still acquire a loan from a direct lender, even if you’re unemployed.

Can I Get Instant Approval on Cash Loans Wired in 1 Hour?

Yes, you can obtain an instant payday loan decision within 1-hour. You only need to provide the most basic information about yourself to get instant approval for same-day payday loans from direct lenders online. Unlike traditional loans, these payday loans are more accessible, even with poor credit score.

With no complicated processes, the loan will be granted in less than an hour and sent to your bank account. The loan contract is usually simple and easy to understand.

You can pay back the loan with your subsequent paycheck. However, your rights are safeguarded if you turn out to be unable to repay the loan. Therefore, if you default on a loan or have late payments, your creditors cannot file a criminal complaint against you.

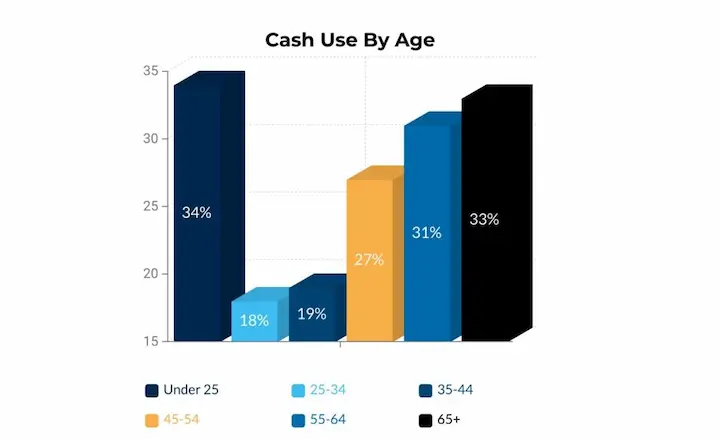

Below are some statistics about cash loans wired in 1 hour:

| Statistic | Value |

|---|---|

| Average loan amount | $500 |

| Average interest rate | 391% |

| Average repayment period | 14 days |

| Average fee | $15 |

| Maximum loan amount | $1,000 |

What Are the Main Characteristics of Loan Products Wired in 1 Hour?

You should know the main characteristics of the ideal loans wired in 1 hour before considering borrowing. Knowing this will make it easier to decide if this loan request is the best way to handle your issue. Essential details are as follows:

Quick Disbursement of Online Cash Loans

The funds should appear on your debit card within an hour after a quick payday loan direct lender approves your loan amount. You can now make urgent payments thanks to this.

No Faxes

Loan websites that require no or no faxing are processed quickly and without difficulty by conventional lenders. Anyone in need of assistance financially can get them. Your documentation must be in an electronic format for no-fax loans. It implies that to submit your application. You can be familiar with fax machines.

No Credit Check

Some quick loan lenders, like PaydayChampion, don’t thoroughly analyze your credit before granting your request. They still consider your credit history, cash flow, and financial status before choosing. These lenders prefer to carry out a soft credit check instead of the hard checks performed by a credit bureau. This way, they can offer Unsecured loans even to people with less-than-perfect credit scores.

Instant Decision

Things move quickly when it comes to 1-hour direct deposit payday advances. Within an hour, a lender makes a final determination after reviewing the supporting documentation in the request form and conducting a soft credit check.

Experienced borrowers frequently have their petitions accepted within a matter of minutes. Be aware that the lender, Viva Payday, could send money to a borrower’s bank account within a business day, greatly helping their financial situation. It’s important to note that major credit bureaus tend to keep track of loan history, so choosing a reputable lender like Viva Payday can be beneficial.

Frequently Asked Questions

How can I apply for a cash loan with a direct lender that offers a 1-hour wire transfer and no credit check?

To obtain such a cash loan, research and compare direct lender options online, focusing on lenders that advertise fast approvals and wire transfers with minimal eligibility criteria. Carefully review all terms and ensure you understand the costs before applying.

What are the typical eligibility requirements for obtaining a cash loan from a direct lender with no credit check and a fast wire transfer?

Typical eligibility is being 18+ years old, having a regular income source, and a valid checking account for fast wire transfers. Some lenders may require proof of income. Credit checks are usually not required.

Are there any specific interest rates or fees I should be aware of when considering a cash loan from a direct lender with these features?

Yes, interest rates are often quite high, sometimes over 400% APR. There are also origination fees up to 10% of the loan amount. Ensure you understand the full costs before borrowing.

What are the advantages and disadvantages of choosing a direct lender for cash loans with no credit check compared to traditional lending options?

Advantages are speed and high approval rates. Disadvantages are very high costs and aggressive collection practices. Traditional loans have lower costs but stricter eligibility and longer timelines.

Are there any alternative financing options or tips for individuals who may not qualify for traditional loans but need quick access to cash through direct lenders?

Alternatives include secured credit cards, credit-builder loans, and borrowing from friends/family. Tips include budgeting, cutting expenses, negotiating bills, and avoiding high-cost loans if possible.