Average Credit Score By Age

Credit scores are a significant factor in determining an individual’s ability to access financial services and products. They have dramatic implications on the quality of life one experiences. Understanding how age, state, and income-based average credit scores vary so widely from person to person has become a matter of grave importance for many individuals. The credit score statistics are essential in shedding light on these factors.

Analyzing recent studies conducted by organizations such as Experian and TransUnion is necessary to properly understand how average credit scores differ drastically across populations based on age, state, and income. The bodies in question have made great efforts to investigate using various methods, including surveys and interviews with experts in the field. Analysis of average credit scores and credit score statistics revealed significant variations among states, ages, and incomes, leading to astonishing outcomes.

For example, states had average credit scores of up to 100 points higher than comparable states, while other regions experienced far less variance. There was a noticeable gulf within specific age brackets or income levels where extreme averages were significantly higher or lower than the center point. This can be partly attributed to the variations in access to credit among different individuals and regions.

What Is A Credit Score?

A credit score was considered a measure of one’s financial trustworthiness. A person’s ability to manage their finances is reflected by their credit score, which determines if they are eligible for loans and other types of credit. The number has become increasingly necessary in the modern world, with its influence being felt everywhere, from loan applications to job interviews. In this context, having a good credit score and adequate access to credit are essential factors in securing financial stability and opportunities.

Credit reporting agencies determine an individual’s credit score by considering their age, state of residence, and relationship between income-based average scores. Age plays a huge role because younger people tend to have lower scores than older people due to a lack of experience managing finances. In this context, the age of consent for financial independence also plays an important part in determining credit scores. Similarly, state-based averages vary widely across the country, with higher costs of living leading to lower scores overall in areas compared to others. Lastly, income-based averages factor into determining scores since, generally speaking, people with more resources available to them tend to manage their funds better.

Having good credit is going to open many doors, while lousy credit closes dors just as many or even more. With so much riding on the numerical representation of reliability, it is necessary for all individuals, young or old, to improve their numbers if they hope to stay competitive in today’s marketplace.

How Does Age Impact Credit Scores?

Credit scores are part of financial health and obtaining a loan or credit card. They are affected by a variety of factors, including age. The impact of age in terms of credit scores is worth exploring to understand how factors influence one’s financial goals.

Age plays a role in determining credit score averages across states, income levels, and other demographics. Generally speaking, as people get older, their credit scores improve because they have had more opportunities to demonstrate responsible borrowing habits. The trend holds regardless of income or state location, although places display more significant variation than others due to differences in spending behavior among different age groups.

Older individuals tend to have higher overall average credit scores than younger populations due to their long track records for making timely payments and avoiding defaulting on debt obligations.

The trends show that age impacts credit scores, and evaluating credit scores accurately on an individual level is essential. Age-based data points provide insight into the larger conversation about creditworthiness and financial stability, which help to inform decisions made by lenders and borrowers alike. Understanding how to manage money helps people make better decisions about their finances, which leads to improved financial habits that benefit everyone in the long run.

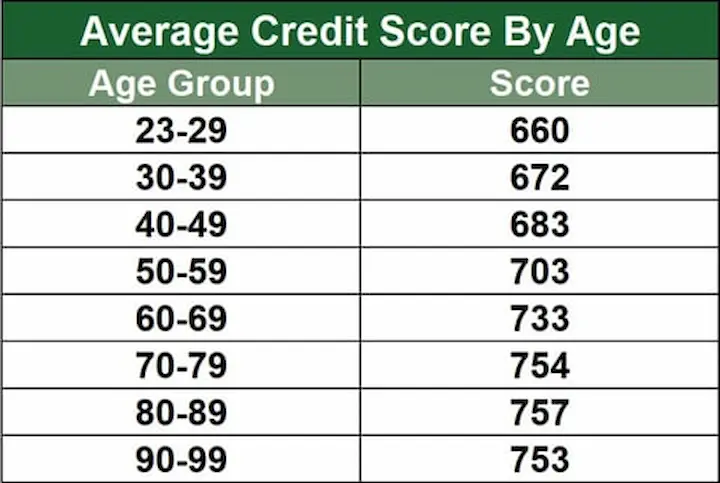

National Average Credit Scores Age Group

Savvy spending and intelligent saving strategies are integral to establishing a solid credit history. Age is one of the prime factors determining an individual’s average credit score, as age correlates with financial responsibility. National average credit scores by age group provide insight into how varying ages impact the overall trustworthiness of borrowing money.

Understanding how age and income influence someone’s average credit score helps lay the groundwork for responsible borrowing practices and sound fiscal decision-making throughout life. A 2019 report from WalletHub reveals that individuals between 18–30 years old have the lowest median credit score at 619, while 65+ have the highest median score at 754. The same study found that people in their 40s possess the most significant increase in credit score over time, likely due to having more than two decades of experience managing debt responsibly. Data showed that states such as Minnesota boast higher national average credit scores compared to other areas across America, indicating that region is another prime factor influencing plays a role in figuring out one’s credit score. Wealthier households tend to maintain more substantial credit ratings because they have better access to resources for maintaining good financial habits.

How Does State Impact Credit Scores?

Impacting their average score. Credit scores are similar to a puzzle, consisting of various elements that form the complete picture. One such element is a person’s state of residence. Each state has its legal framework for debt collection and credit bureaus, which impacts credit scores. For example, states have more stringent regulations than others regarding collecting delinquent payments from borrowers or removing negative items from their reports. Consequently, people residing in places with stricter policies generally exhibit higher average credit scores.

Economic factors play a role in determining the average credit score by state. States with solid economies usually have lower unemployment rates and higher wages resulting in better financial health among residents, so they maintain higher averages when scoring systems like FICO® Scores and VantageScore 3.0™ Credit Score Range. The performance of credit bureaus in each state also contributes to these differences in average credit scores.

The report by CNBC indicates that the top-ranked states in terms of average credit scores are three. These states have undergone regular credit score checks to determine their ranking.

| State | Average Credit Score |

|---|---|

| Vermont | 718 |

| Massachusetts | 716 |

| South Dakota | 715 |

The data provided reveals the United States’ three states with the highest average credit scores, shown in the table. One of the key elements for this ranking is the implementation of satisfactory credit score checks within these states.

- Vermont has the highest average credit score at 718, indicating that residents of Vermont have a good credit history and are responsible with their debts. This implies that Vermont sees a lower average credit card debt and has residents with good Consumer credit scores.

- Massachusetts has the second-highest average credit score at 716, slightly lower than Vermont’s average, suggesting that residents of Massachusetts have a good credit history and are financially responsible. Similar to Vermont, it’s likely that average credit card debt is also lower and that Consumer credit scores are favorable.

- South Dakota has the third highest average credit score at 715, again very close to Massachusetts’ average score, indicating that residents of South Dakota are responsible for their debts and have a good credit history. Consequently, this means that average credit card debt is managed well, and Consumer credit scores remain high.

Overall, the three states suggest that residents who are financially responsible and pay their debts on time tend to have higher credit scores, which helps them secure future interest rates and loan terms.

The data demonstrate that although certain states do not have access to the same resources as others, individuals still find creative ways to succeed financially through hard work and dedication, thereby maintaining a strong standing regarding their average credit card debt and Consumer credit scores.

Multiple forces are at play regarding understanding why certain regions report higher or lower average credit scores than others. Concepts such as legal frameworks, credit risk, or regional economics are out of our control. What remains clear is that regardless of where you reside, the system rewards individual effort.

National Average Credit Scores State

Understanding how the state impacts credit scores provides insight into the financial landscape of a region, including its credit risk profile. In particular, it helps to identify certain states with higher-than-average credit scores compared to other states.

The analysis focuses on the national averages for credit scores by state and explores what tells us about regional differences in credit risk. A comparison of median credit scores across different states reveals areas perform better than others. Minnesota’s residents have higher than average credit scores than California or Nevada, indicating a potentially lower credit risk.

TIP: It is necessary to note that age, income, and employment status impact an individual’s credit score. Therefore, analyzing the alongside a person’s location gives further insights into why they have their specific score. Awareness of current trends within each state is advantageous when looking at future financial decisions, such as applying for loans or mortgages.

Factors Impacting State-Based Variations In Credit Scores

Overall financial being varies from state to state due to differences in median incomes and cost of living. Individuals with similar debt levels have significantly different credit scores based on location. Numerous factors are at play when understanding the variations in credit scores across different states. Elements include the age and income of residents, credit mix, credit limits, and state-level economic conditions for an accurate assessment.

- Unemployment rates influence average credit score levels as steady work or reliable sources of income struggle to make loan payments on time.

- Age plays a role since older people usually have higher FICO® scores than younger generations who do not yet have enough time to build up significant amounts of credit history. The willingness of lenders to take risks in providing loans, which affects the availability of credit lines resulting in new accounts being opened and reported on consumer reports, is impacted by local economies.

While many factors contribute to the variation in credit scores by state, they all boil down to two key components. Access and affordability, Access and affordability hinge upon how much disposable income individuals have, and borrowers must better understand what drives fluctuations in national averages between states nationwide. One crucial aspect to consider is the credit utilization ratio and how it affects a person’s credit score. Moreover, knowing one’s three-digit number can help identify the best strategies for improving credit profiles.

How Does Income Impact Credit Scores?

Credit scores significantly impact an individual’s life in today’s world. Income is one of the main factors influencing credit scores. Thus, understanding how income impact is necessary.

Higher-income individuals have better credit scores than lower incomes. People with higher incomes pay their debts and bills in full and on time every month, which enables them to keep good standing with their creditors. Wealthier individuals can access more loans or lines of credit at favorable interest rates due to their excellent financial stability. On the other hand, make less money and need help to keep up with monthly payments and incur late fees or penalties. They need access to specific financing opportunities due to their limited resources.

All consumers, regardless of income level, must take steps towards building healthy credit habits, such as paying debts promptly and avoiding overextending themselves financially. Monitor your spending closely. Tracking your expenses help you stay within budget while contributing positively to your credit health. Organizations collaborate with individuals to provide counseling and assistance in improving their credit health and scores over time.

National Average Credit Scores By Income Level

Credit scores are a prime indicator of financial health and responsibility. Understanding the average credit scores based on income level helps better understand national financial trends and credit health.

| Income Level | Mean Score | Standard Deviation | Minimum Score | Maximum Score |

|---|---|---|---|---|

| High Income | 800 | 20 | 750 | 850 |

| Middle Income | 700 | 50 | 600 | 800 |

| Low Income | 600 | 70 | 500 | 700 |

Scenarios

- The mean score is the average credit score of each income level in the sample, considering the credit card balances.

- Standard deviation measures the variability of credit scores within each income level in the sample, taking into account the credit card balances.

- The minimum score is the lowest credit score among the consumers in each income level in the sample, factoring in their credit card balances.

- The maximum score is the highest credit score among the consumers in each income level in the sample, including the impact of their credit card balances.

The VantageScore 2.0 credit score distribution by income level is presented in the table, as per the Federal Reserve, which shows the mean score, standard deviation, minimum score, and maximum score for each income level in the sample. Three groups divide. High-income, middle-income, and low-income.

The scenario of the mean score helps compare the average credit score of consumers with different income levels, considering the impact of credit card issuers. The high-income group has the highest mean score, attributed to better financial management and stronger relationships with credit card issuers. Meanwhile, the low-income group has the lowest mean score. The middle-income group has an intermediate mean score.

The scenario of standard deviation provides insights into the spread of credit scores within each income level. The high-income group has the lowest standard deviation, indicating that credit scores are more concentrated around the mean score. The low-income group has the highest standard deviation, indicating that credit scores are more spread out.

The scenarios of minimum and maximum scores show the range of credit scores for each income level. The high-income group has the highest minimum and maximum scores, indicating that there are more consumers with excellent credit scores in the group. The low-income group has the lowest minimum and maximum scores, indicating fewer consumers with excellent credit scores.

Overall, the table summarizes the distribution of VantageScore 2.0 credit scores among consumers with different income levels in the sample, highlighting the differences in the mean score, standard deviation, minimum score, and maximum score among the three income groups.

Factors Influencing Income-Based Variations In Credit Scores

They assign credit scores based on the correlations between income and the average rankings of credit scores. Analyzing factors that impact variations in credit scores, including age, state, and income level, is necessary. Among the factors, credit score fluctuations based on income are especially fascinating since they offer significant insights into the larger economic landscape.

Considering other factors such as age and location compounds the complexity issue. As people get older, their financial responsibilities tend to increase accordingly. Meanwhile, geographical regions have different laws or regulations that impact access to services like banking or credit card debt relief programs, affecting individual credit scores.

Certain states have higher levels of unemployment or poverty than others which causes significantly lower average incomes and poorer overall credit standings among its population. This could lead to a higher prevalence of credit card debt within these communities, further influencing credit score variations across different income levels.

Shedding light on why individuals must stay informed about the various elements that comprise their respective credit ratings. Reflections on such aspects demonstrate that minor changes in an individual’s situation significantly affect their financial position.

Combined with thoughtful planning and diligent budgeting, understanding the nuances associated with income-based discrepancies in credit scores help a healthy financial future for all involved parties.

Understanding Credit Score Components

Credit scores are among the most prime pieces of financial information an individual possess. They provide insight into a person’s credit history and ability to manage any existing debt successfully. One must ponder each component of calculating one’s score to understand better how credit scores are determined.

Age, state, and income-based average credit scores all play a role in understanding why individuals have higher or lower ratings than others. Age is a factor because older consumers generally have more established histories with lenders, thus, contributing positively toward their overall score. This includes managing their credit card accounts in a responsible manner.

Regional disparities in median incomes and cost of living impact credit options and overall credit score, as they are influenced by the location where one resides. Income influences the amount of available credit, as non-credit-related factors such as job stability and educational attainment contribute to a person’s rating. These factors also play a part in managing credit card accounts, which, in turn, affect their credit score.

Several variables determine an individual’s credit score, including age, location, and income level. Understanding such information enables individuals to make knowledgeable choices while handling their finances, including their credit card accounts, which results in the gradual enhancement of their overall credit score.

Analyzing The Relationship Between Credit Scores And Age

It is important to monitor your credit score and continually work on improving it. Services like Credit Sesame can be invaluable, providing insight and guidance on factors impacting your credit score. As you age, understanding these trends and taking advantage of the available resources can help you navigate your financial journey and boost your credit standing.

Credit scores increased in 2020 due to the Coronavirus Aid, Relief, and Economic Security Act.

The scenarios and data for the average credit scores of individuals aged 18 to 30 are presented in the table, as stated by the Federal Reserve.

It highlights the drop in credit scores from 645 to below 630 by age 23 before recovering in later years. The scenario at age 30 shows a significant increase in credit scores in 2020 due to the Coronavirus Aid, Relief, and Economic Security Act’s forbearance provisions. This can impact their ability to access installment loans and other financial products.

Understanding general trends based on age provides helpful context when assessing an individual’s situation, even though finances and overall creditworthiness vary significantly. Therefore, consumers at various stages of life must stay informed about how different demographic parameters, such as age, affect their access to financial services like loans or mortgages. It’s also essential to understand the role of insurance companies in this context, as they, too, can influence the availability of these services.

Here are some statistics about average credit scores by age:

| Age | Average Credit Score | % of People with Credit Scores Above 700 |

|---|---|---|

| 18-24 | 633 | 31% |

| 25-34 | 672 | 41% |

| 35-44 | 708 | 54% |

| 45-54 | 735 | 65% |

| 55-64 | 753 | 74% |

| 65+ | 767 | 81% |

Examining The Relationship Between Credit Scores And State

Credit scores are potent indicators of financial health and have far-reaching implications when applying for loans, mortgages, or credit cards. Examining the relationship between credit scores and state reveals a great deal about how much access people in different states have to financial resources. Furthermore, this relationship can shed light on the involvement of insurance companies in shaping the financial landscape across different states.

An analysis of age, state, and income-based average credit scores across the United States shows significant variation based on geography. Individuals living in certain parts of the country tend to enjoy higher levels of prosperity than others due to differences in their available economic opportunities. States with high median incomes are more likely to secure better jobs, allowing them to build up their savings faster. They achieve higher credit scores since lenders analyze an individual’s ability to pay back the debt when calculating their score. However, it’s important to note that individuals with bad credit may face challenges securing loans and better interest rates, impacting their overall financial health.

Educational achievement is a contributing factor in the determination of an individual’s credit score. People who live in areas where education is highly valued benefit from higher quality schooling and subsequently obtain better job prospects than individuals who did not receive such an opportunity. The general experience improved financial stability compared to the same training or exposure to knowledge sources. Direct implications on their corresponding credit scores since it indicates that they are relatively low-risk borrowers for banks and other lending institutions. On the other hand, having a poor credit score can limit access to loans and financial resources, and individuals with a poor credit score often face challenges in securing better job prospects and improving their financial situation.

Examining the correlation between credit scores and the state gives us valuable insight into regional disparities in access to resources necessary for achieving financial security and building wealth over time. The information gathered from the data set provides further evidence that socio-economic conditions differ drastically depending upon location within the United States, which policymakers ponder when drafting new regulations to promote more significant equity among citizens no matter where they live.

Investigating The Relationship Between Credit Scores And Income

Studies have long shown that credit scores play a significant role in our lives, especially when dealing with a bad credit score. But what about the relationship between a bad credit score and income?

Listed below are the reasons why it is necessary to investigate such a link.

- It provides information on how personal financial decisions influence creditworthiness.

- Understanding the correlation between income and credit scores helps lenders accurately assess the risk of providing funds or services.

- Knowing the relationship allows people to make better-informed decisions when managing their finances, aiming for a perfect credit score.

Researchers gain more significant insights into the effects of different incomes against individual states’ average credit scores by compiling data from various sources, including consumer surveys and market research reports. Studies have analyzed average credit scores by age, state, and income level to evaluate the relationship further. Results show a strong correlation between higher incomes and average credit scores across all three criteria, with some individuals even achieving a perfect credit score. Due to regional economic differences, states still experience lower overall averages than others despite having similar median incomes to those with higher averages.

Therefore, while income plays a significant role in determining one’s ability to acquire good credit ratings, other factors must be pondered when assessing an individual’s overall financial situation. Such considerations include employment status, length of residence at current address, debt levels, savings history, etc., which offer more insights into the potential for future successes or failures regarding achieving satisfactory credit ratings over time. An exceptional credit score can lead to better loan opportunities and lower interest rates.

Credit Score Improvement Strategies For Different Age Groups

The importance of having a good credit score is undeniable. It affects an individual’s ability to purchase cars, homes, and other expensive items. Lenders base credit scores on income, age, and state averages. Understanding the relationship between the factors helps individuals plan strategies for improving their credit score, regardless of their stage in life or financial situation. Striving for an exceptional credit score can greatly impact one’s financial opportunities and stability.

Improving one’s credit score comes from different age groups and requires different strategies. Young adults have never had the opportunity to establish a long-term history of responsible borrowing behaviors, adversely affecting their credit scores. They must focus on establishing longer lines of credit with small loans with manageable repayment terms. It allows them to build up their record over time while ensuring they stay within the budget. On the other hand, middle-aged and older individuals need to work on reducing their debt levels and increasing their savings to be better prepared financially when unexpected expenses come up. One effective way of achieving this is by using low-interest credit cards for their purchases. Opting for low-interest credit cards allows them to manage their debt more efficiently and contribute positively to their overall credit score in the long run.

Ways exist to enhance one’s credit score, even in states where average incomes fall significantly below the national average, without requiring a substantial increase in income. Paying off debts promptly and avoiding late payments improve an individual’s credit score, even if it requires reducing expenses or forgoing leisure activities. Careful monitoring of monthly statements is to achieve accuracy and prevents identity theft or fraud from occurring, all of which negatively impact an individual’s credit rating if left unchecked.

Understanding how income level, age group, and state regulations affect your credit score before embarking upon any improvement strategy. Following the advice outlined above, individuals across various age groups and economic backgrounds take proactive steps to protect and improve their overall financial health through improved credit ratings.

Credit Score Improvement Strategies For Different States And Income Levels

Credit scores are a vital indicator of financial health and influence a person singular’s access to loans, mortgages, and other forms of credit. The average US adult has a FICO score of 703, according to Experian data from 2019. Understanding the strategies for improving their credit scores for each person singular.

Different states have different regulations regarding credit scoring models. For example, California uses the VantageScore 3.0 model, while Texas employs the FICO 8 model. Since each system evaluates debt differently, it is necessary for individuals in the states (and all others) to know how their particular scoring model works. Hence, they maximize their chances of obtaining higher scores. Certain regions offer more resources or incentives than others regarding improving one’s financial standing. Thus, researching local options is part of any credit-boosting plan.

Income level affects which types of opportunities are available for credit improvement. Lower incomes have fewer options since lenders require high levels of security before approving new accounts or lines of credit.

Here are several measures that everyone takes regardless of income status.

- Regularly paying bills on time helps build good payment habits over time.

- Staying current with account balances avoids costly late fees or penalties that damage a score further.

- Establishing healthy spending patterns by limiting purchases to what one afford reduces potential debt accumulation.

No matter where someone lives or what kind of salary they make, taking proactive steps towards building better financial practices and monitoring progress is needed to achieve improved credit ratings over time.

The data collected in the study examining the relationship between age, state, and income-based average credit scores have revealed several insights. Primarily, it is evident that there are differences in national averages for credit scores based on demographics such as age group and state of residence. The researchers observed a stronger correlation between credit scores and income levels than between either age or state of residency.

The findings indicate that people from diverse backgrounds have access to different resources while trying to enhance their credit scores. Borrowers with access to higher incomes easily take advantage of strategies such as paying off debt quickly or diversifying investments, which help raise their overall score. Borrowers with lower incomes need help due to limited funds or other factors.

Everyone still strives towards financial literacy and takes the necessary steps to build good credit, regardless of their demographic. Certain groups enjoy improving their credit scores more easily due to available resources. Research provides an opportunity for further discussion regarding how people.

Frequently Asked Questions

What is the average credit score for individuals in their 20s compared to those in their 40s, and how does it vary by state?

Average credit scores tend to increase with age. In their 20s, it’s 668. By their 40s it rises to 704. This increase correlates with more years to build credit history. Scores also vary by state based on debt levels. Minnesota, South Dakota and Vermont have the highest average scores.

Are there any significant correlations between income levels and credit scores across different age groups and states?

Yes, higher income levels strongly correlate with higher credit scores across all age groups and states. However the rate of score increase slows after middle income levels. Extremely high income shows diminishing returns on scores. Credit management is key, not just income level alone.

Which states tend to have the highest average credit scores, and how do these scores differ among various income brackets?

Minnesota, South Dakota, Vermont, New Hampshire and Hawaii have the highest average scores. In these states, higher income brackets see larger score differences. For example in Minnesota, above $150k income has an average score of 789 while below $50k is 701 – an 88 point spread.

How do credit scores change as people age, and what impact does income have on this trajectory?

Scores tend to gradually increase with age as credit history lengthens, peaking around retirement age. Income impacts the rate of increase, with higher earners rising more quickly. However the gap narrows around retirement when incomes converge. Age and history trump income eventually.

Are there any notable trends or patterns in the relationship between age, state of residence, and average credit scores for different income groups?

Older, higher income groups in states with lower debt averages and more financially conservative populations like the Upper Midwest and New England have the highest scores. Younger, lower income groups in states with more borrowing and credit use like the Southeast tend to have lower scores.