Credit: What It Is and Why You Need It

A credit is an economic instrument representing a loan extended to an organization, individual, or government in anticipation that it will be repaid later, usually with interest. A credit is used to finance capital expenditures or cover operational costs. Credits are important to the financial system because they allow businesses and people to borrow money to finance their activities. Credits are essential for lenders because they provide a way to earn income from their money. Features to look for in credit include the amount of the credit, the interest rate, the repayment period, and the collateral. Your credit utilization rate and credit worthiness play an essential role in making financial decisions. Understanding these factors can help you make better borrowing choices and improve your financial health.

There are two types of credit: secured credit card and unsecured. Secured credit is when the borrower pledges an asset as collateral. Unsecured credit is when the borrowers don’t pledge any assets for the loan. The interest rate for a secured credit card is usually lower than an unsecured credit because the lender has less risk. There are a few things needed to apply for a secured credit card. The first is identification in the form of a driver’s license, state ID, or passport. Borrowers need proof of income, such as a pay stub, tax return, or bank statement. Finally, they need a good credit history to be approved for a secured credit card.

Individuals with all the required information apply for a secured credit card online, over the phone, or in person. The process is generally the same regardless of how people apply. They must provide their income, personal information, and credit history. Once they submit their application, the lender reviews the information and decides. Borrowers receive a credit limit and terms of use if approved.

Main Points

- Credit works when the borrower agrees to repay their debt with interest within a certain period.

- Credit applications require proof of identity, income, good credit history, and possibly a cosigner and citizenship status.

- To apply for credit, borrowers must gather financial details and complete an application, which is then reviewed by the lender and approved or denied based on credit scoring models and credit risk assessment.

What is Credit?

Credit is described as a contract between a borrower and a lender. Credit is an agreement between borrowers and lenders where lenders provide money or other assets to the borrowers in exchange for future loan repayment, usually with interest. Credit is a key component of the modern economy, and most businesses and individuals use it in one form or another. Lenders assess the credit risk of borrowers through various credit scoring models before granting a loan or credit line.

Credit is important for several reasons. One reason is that it is one of the main ways lenders determine whether to lend money to people and companies. Major credit bureaus play a significant role in this decision-making process. Credit is important for individuals, as it helps them to finance big-ticket items such as a car or a house. It helps individuals to manage their finances more effectively by allowing them to spread the cost of purchases over time. Finally, credit is important because it is one of the main ways companies and individuals keep track of their monetary commitments. A well-balanced credit mix is crucial to maintaining a healthy credit profile.

The history of credit is quite long and complicated. Early forms of credit were used in ancient civilizations, and credit has evolved. The first known use of credit was in Mesopotamia, around 1750 BC. At that time, people used credit to buy services and goods from others. Credit financed trade and business transactions. The concept of credit spread to other parts of the world, and different cultures developed their forms of credit.

The next step in the history of credit was the development of banking. Banks allowed people to deposit money and then borrow it when needed. This system gave people a way to store their money safely and to borrow money when they needed it. The last major step in credit history was the development of credit cards. Credit cards allow people to borrow money from a bank and then use that money to buy goods and services. This system allowed people to borrow money without carrying large amounts of cash.

How Does Credit Work?

Credit works when the debtor agrees to repay the debt per the terms of the credit agreement, which include interest, within a certain period. The creditor requires collateral, such as property, to secure the debt. The borrower then uses the money to buy what they need and pays the lender interest over time. The interest is the cost of borrowing the money and is usually a percentage of the total loan. Various types of loans are available depending on the borrower’s needs and financial situation. The outstanding balance represents the amount still owed on the debt after a specific period, and repayment schedules are usually designed to cover both principal and interest.

The lender risks the borrower not repaying the debt, so the interest rate is generally higher than the rate on a savings account. The borrower pays the interest along with the borrowed money so that the lender makes a profit. Credit is a convenient way to get and pay cash back over time. It helps to buy a car, a house, or pay for college. But borrowers have to be careful with credit. Borrowers who don’t repay their debt risk their credit score going down, and it is harder to borrow money in the future. Regularly checking annual credit reports can help borrowers to stay informed about their credit standing.

What Are the Requirements Needed When Applying for Credit?

The following are the requirements needed when applying for credit:

- One important factor is the borrower’s credit score model, which lenders use to determine the borrower’s creditworthiness.

- Lenders also consider credit inquiries made by the borrower, as too many inquiries in a short period can negatively impact their credit score.

- Identification: Borrowers must provide proof of identity. This is a driver’s license, passport, or utility bill with their name and address.

- Proof of Income: Borrowers need to show proof of income by providing either a paycheck stub or bank statement showing their earnings.

- Credit history: Borrowers must have a good credit history. This means they have made all of their credit card payments and late payments on time and have not had any major credit problems.

- Cosigner: Borrowers must have a cosigner if they still need to meet the requirements. This is someone who agrees to be responsible for the debt if the borrower cannot pay it back.

- Citizen: Borrowers must be s citizens of the country they are applying.

Credit requirements are important because they help people who borrow money repay their debts. Lenders use credit requirements to assess borrowers’ creditworthiness and determine whether they will likely default on their loans. Credit requirements help protect lenders from losses if borrowers cannot repay their debt.

How Do I Apply for Credit?

There are a few steps to follow when obtaining credit. First, undergo a credit check to determine your creditworthiness. This is an important step as it helps lenders assess your financial stability and ability to repay your debt.

- Gather the required financial details. They comprise debts, income, and credit history. Borrowers must deliver identification details, such as Social Security number (SSN) and date of birth. Most applications request the borrower’s address, contact, and name. They must provide their SSN, date of birth, and employment details. One crucial factor to remember is the credit utilization ratio, which significantly determines your credit score.

- Once they have their details, borrowers must complete a credit application. This is done online, over the phone, or in person. Borrowers are likely to be asked to sign a credit agreement. This agreement outlines the credit terms, including the monthly payments, interest rate, and fees or penalties.

- Once they submit their application, the lender reviews the details and makes the final decision, considering factors like the credit utilization ratio. The borrower gets an interest rate and a credit limit if approved. The borrower then starts using their credit as they need it. Remember to keep your Social Security number and other sensitive information secure throughout the process.

Borrowers who are newbies to the world of credit find applying for credit daunting. However, it is quite simple. First, they must choose the credit type they want to apply for. There are many types of credit, such as business loans, personal loans, and credit card applications. Second, the borrower needs to find a lender. They do this by searching online or asking family and friends for recommendations. Once the borrower identifies the lender, they must fill out an application. After applying, the lender reviews the credit card applications and determines whether or not the borrower is approved for credit. The borrower gets a credit limit once authorized and begins using their credit card accounts.

Who Qualifies for Credit?

Lenders look at several factors to determine whether borrowers qualify for credit.

Age: most lenders only extend credit to adults 18 or older. Some lenders require that applicants be 21 years of age or older. In general, minors (those under 18) are not eligible for credit.

Gender: Lenders are more interested in an applicant’s credit history and employment status than their gender. However, sometimes, some lenders are more likely to offer credit to female borrowers who are married or have children, as they perceive these women to be more responsible than their unmarried or childless counterparts.

Status: To qualify for the credit, an individual must have a good to excellent credit score and a history of making time payments. Other factors, such as income, employment history, and debts, are considered when determining whether or not an individual qualifies for credit.

Income: Borrowers need a regular income to qualify for a mortgage loan or credit card. This income comes from employment, self-employment, government benefits, or other sources, but it must be reliable and consistent with meeting the lender’s requirements. The most important factor in income is the borrower’s ability to make repayments on time and in full, so they must ensure they understand the repayment terms before applying for any credit. Building credit is essential for borrowers looking to apply for a mortgage loan.

How Long Does It Take for Credit to Be Approved?

It takes a few days or weeks for the credit to be approved. The time frame is usually determined by how quickly the credit bureau and the lender process the borrower’s application and verify their information. Borrowers hoping to get approval for a mortgage loan must be patient and understand that the process takes a little time. However, they can do a few things to speed up the process.

First, they must complete the application and provide all the required information. This helps to avoid any delays in processing. Secondly, they must check their types of credit scores and credit reports ahead of time to ensure no errors delay their approval. If they find any mistakes, dispute them immediately with the nationwide credit bureaus. Lastly, they must try to apply for credit with a lender they have a good relationship.

What are the Different Types of Credit?

People divide credit into three categories: open-end, revolving, and installment. Open-end credit allows the borrower to make charges up to a predetermined cap. The borrower is free to make payments against the limit as frequently as they desire, but they must pay the full monthly costs. Typically, this kind of credit is utilized for items like types of credit cards.

Revolving credit allows the borrower to make small, frequent payments to a certain maximum. The borrower repays the credit against the limit as frequently as they wish; the lender sets the limit. Lines of credit and credit cards are typical examples of this credit.

Installment credit is where borrowers must pay back the loan in several installments. The lender sets the borrower’s payment deadlines and each payment’s amount. Loans and mortgages are typical uses for this kind of credit.

The primary difference between installment, open-end, and revolving credit is how the debt is repaid. While installment credit is paid back monthly, revolving credit is repaid with interest over an extended period. Open-end credit is paid back over time interest-free. The importance of having a variety of credit kinds is attributed to a few factors. It first aids borrowers in establishing a solid credit history. Various credit types demonstrate a borrower’s maturity and ability to handle additional forms of debt. They have a better probability of receiving loan approval as a result.

Additionally, various credit products assist borrowers in obtaining a cheaper interest rate or annual percentage rate. Lenders frequently see borrowers with a variety of credit kinds as less dangerous. Therefore, they offer these customers a reduced interest rate.

It’s also essential to maintain a positive relationship with credit reporting companies. Having a good credit history on file with these companies can influence your overall credit score, which can further impact your interest rates and other financial opportunities.

What is the Most Common Type of Credit?

Revolving credit is any credit where the amount owed changes over time. For example, if taking out a loan for $1,000, then making monthly payments until the balance is paid off, this is a revolving line of credit. Banks and other lending institutions often offer revolving credit lines. One common form of revolving credit is credit card debt. The term “revolving” refers to increasing debt when paying it down. The opposite would be a fixed-rate loan, where the interest rate stays the same regardless of how much money is owed on the loan.

During the application process for a revolving credit card, borrowers agree to pay a certain percentage of credit for each purchase back in cash within a specific period (usually 30 days). This way, they don’t need to worry about paying the full amount due every month because they’ll always have some money left over. Borrowers sometimes use the leftover funds to pay off the rest they owe. This specific period is known as the grace period where borrowers will not be charged any interest on their purchases if they pay the balance in full within that time frame.

There’s no limit on how much someone spends during a credit usage revolving credit card period. However, most cards have annual spending limits so that they won’t exceed the budget. As soon as borrowers exceed their credit limit, they won’t continue making purchases with their cards. The bank charges fees for exceeding the credit limit. In addition, they report the account activity to one or more credit bureaus. This affects the ability to get approved for new credit. Borrowers require credit cards, permitting them to borrow money to make purchases with this sort of credit. Credit usage is vital in how borrowers use the credit card to make purchases. After purchasing, they must reimburse the credit card company for their funds.

What are the Credit Instruments?

The four types of credit instruments are loans, lines of credit, bonds, and equity.

Loans:

Loans are the most common type of credit instrument. A loan is when a lender gives a borrower a certain of cash and agrees to pay the lender back over time with interest. The interest is the cost of borrowing the money.

Lines of credit:

Lines of credit are similar to loans, but they work differently. With a line of credit, the borrower can access a specified amount of cash, but they only have to pay back what they use. They only have to pay interest on the money they use.

Bonds:

Issued by governments and corporations to provide money. Bonds are issued when the company has surplus cash and wants to invest it into something else. Investors buy bonds expecting them to return a profit after a specified period.

Equity:

Equity is when a borrower gives the lender an ownership stake in the borrower’s business. In exchange for the money, the lender gets a percentage of the business. The lender makes money if the business does well, but if the company does poorly, the lender lose money.

There are a few differences between these types of credit. A loan is a debt that must be repaid with interest. A line of credit is a loan used up and repaid multiple times. A bond is a debt that pays periodic interest payments and must be repaid at maturity. Equity is an investment in a company that represents ownership. For example, a home equity line of credit is a loan secured by the home’s equity. A company issues a bond to raise money for expansion. Equity is in the form of shares of stock.

Below is a table of statistics on credit instruments:

| Stat | Value |

|---|---|

| Total amount of credit outstanding | $147 trillion |

| Consumer credit | $90 trillion |

| Business credit | $57 trillion |

| Average credit card interest rate | 16.1% |

| Average mortgage interest rate | 5.2% |

| Average student loan interest rate | 5.8% |

| Number of people with credit card debt | 150 million |

| Average credit card debt per person | $6,375 |

| Number of people with mortgage debt | 40 million |

| Average mortgage debt per person | $200,000 |

| Number of people with student loan debt | 45 million |

| Average student loan debt per person | $30,000 |

What Does Having Good Credit Imply?

Having good credit implies that an individual has a favorable credit range and consistently demonstrates responsible credit behavior. Various Credit Scores Factors, such as payment history, utilization rate, and length of credit history, determine this. Maintaining a high credit score can lead to better borrowing opportunities and lower interest rates on loans or lines of credit.

A good credit score implies that an individual is a reliable borrower. Lenders have confidence that these individuals repay their debts on time and in full. This, in turn, means that they are a low-risk borrower, which is good news for lenders. A good credit score implies that a borrower is financially stable. This means they have a steady income and don’t have too much debt. Lenders like to see this because these borrowers are less likely to default on their loans. Lastly, a good credit score implies an individual is a smart borrower. They know how to use credit wisely and don’t overextend themselves.

What is Considered a Good Credit?

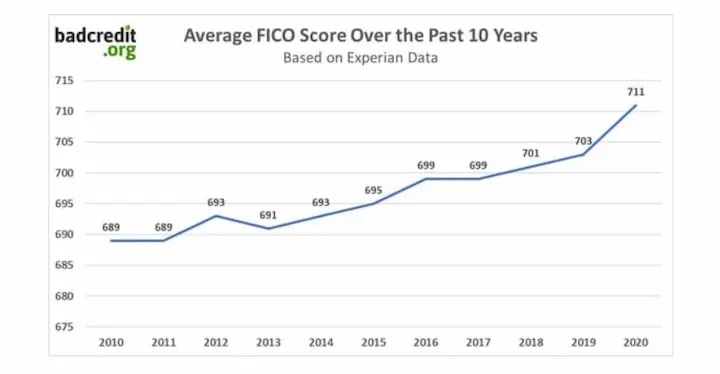

Good credit includes all three major credit scores — FICO® Score 830, VantageScore 3.0, and Experian® 740 — based on information collected by the three largest consumer reporting agencies: Equifax, TransUnion, and Experian. These scores range from 300 to 850. In general, a score above 700 is considered excellent score. A credit score service like Credit Karma can help you monitor your credit score and provide insights on improving it.

There are a few things that help improve credit scores. One is to make all payments on time. This includes not only credit card and loan payments but utility bills and rent. Another is to keep credit card balances low. This means using less than 30% of the available credit on each card. Additionally, having good credit habits and monitoring your current debt can significantly impact your credit score. Also, avoid opening new credit accounts too frequently, which signifies financial instability, and strive for perfect credit scores.

What is Considered Bad Credit?

Bad credit refers to a FICO score that is below 630. This is deemed poor credit and is a scenario where it is challenging to qualify for credit cards or loans. A person with bad credit is charged higher rates on loans. Having bad credit is a very frustrating thing for many people. Getting approved for loans or other financing types is difficult, making it feel like someone’s life has been turned upside down. However, there are ways to improve credit scores to qualify for better rates on future loans. Here are some things to consider when looking at bad credit:

Can I Buy a Product With Credit?

Yes. People buy a lot of different products with credit. For example, they buy a car, a house, or even a boat with credit. They often buy smaller things like furniture or television with credit. Additionally, credit can be used for a major purchase such as a house or a car, which requires a higher amount of credit.

Can I Apply for Credit if I Don’t Have Any Income?

Yes. Anyone with no income can still apply for credit. Most lenders consider other factors when determining whether or not to approve credit applications, such as employment history, credit history, and debt-to-income ratio. People with a strong credit history and a low debt-to-income ratio still qualify for credit, even if they don’t have any income.

There are many limitations of credit. One is that it is hard to obtain it with bad credit. Another is that it is expensive, with high-interest rates and fees. Additionally, if anyone doesn’t use credit wisely, it leads to debt problems. Finally, a credit limit is typically fairly low. Hence, there is no need to use other forms of financing for large purchases, such as another major purchase that exceeds the credit limit.

What Is the Difference Between Interest and Credit?

Interest is a charge for borrowing money. It’s called interest because it’s paid on mortgages or car loans. The interest rate depends on how much a person borrows and when they make payments. Borrowers are charged more interest than a variable-rate mortgage if they have an auto loan with a fixed-rate mortgage. Interest is calculated by dividing the total cost of a loan by the number of months borrowed the money. So if someone took out a $10,000 loan for two years, they’d pay 2% per year.

On the other hand, credit offers allow individuals to borrow money over time and pay it back, usually with interest. This can be in the form of credit cards, personal loans, or other forms of financing. Unlike interest, credit is a broader term encompassing the entire process of obtaining and repaying borrowed funds, including the interest charged.

Credit is an arrangement in which a lender provides a borrower with money for a specific purpose. The primary difference between interest and credit is that interest is paid by the borrower to the lender, while credit is simply the use of borrowed funds. Interest is paid to the lender as compensation for using their money, while credit is simply the act of borrowing funds. Interest is typically a percentage of the total loan amount, while credit does or does not incur interest charges. The borrower pays interest while the lender or a third party extends credit. One aspect of managing credit is considering a credit limit increase to access more funds.

What Is the Difference Between Credit and Credit Score?

Credit is a type of loan that allows consumers to borrow money from a financial institution and make purchases without immediately paying. Credit scores are numerical representations of an individual’s creditworthiness. Lenders use them to determine whether or not to extend credit to a borrower and at what interest rate. Managing credit wisely may involve requesting a credit limit increase from the lender, which requires maintaining a good payment history and credit utilization rate. Another helpful tool is subscribing to a credit monitoring service that assists in tracking one’s credit activity and keeps the individual informed of any changes affecting their credit score.

Credit scores are based on credit reports, which credit bureaus compile from information supplied by creditors. Credit reports include the type and number of accounts owned, payment history, and derogatory information, such as bankruptcies or foreclosures. Credit scores are calculated using this information and other factors, such as the length of credit history and current level of debt.

Credit Sesame offers a variety of tools and resources to help consumers better understand their credit scores and overall financial health. Using Credit Sesame, individuals can access their credit scores, receive personalized advice, and track their progress.

The main difference between credit and credit scores is that credit is a loan used to make purchases. In contrast, credit scores are numerical representations of an individual’s credit-worthy. Most lenders use credit scores to determine whether or not to extend credit to a borrower and at what interest rate.

Frequently Asked Questions

What is a credit score, and how does it impact my financial life?

A credit score is a number calculated from your credit history that lenders use to assess your creditworthiness. Higher scores typically mean better access to credit products and lower interest rates.

What are the key factors that affect my credit score, and how can I improve it?

Payment history, credit utilization, credit mix, and history length are key factors. Improving scores involves making on-time payments, lowering balances, having diverse credit types, and building history over time.

How does credit utilization work, and why is it important for managing credit?

Utilization is the ratio of balances to limits. High utilization hurts scores, so keeping balances low relative to limits helps credit health.

What are the different types of credit accounts available, and how do they differ from each other?

Major credit types are credit cards, retail accounts, installment loans, mortgages, and revolving lines. They differ by repayment structure, duration, collateral, and impact on credit scores.

Can you explain the concept of credit reports and how to obtain and review them for accuracy?

Credit reports compile your payment history, accounts, inquiries and other data from bureaus. Review annually for errors that could negatively impact your scores.