Credit is money borrowed from a financial institution such as a bank or credit union. Credit is money borrowed from a lender for a specified purpose. The borrower must repay the loan with interest at regular intervals. The lender charges late payment penalties if the borrower fails to do so. A type of credit card is a consumer debt in which the borrower agrees to pay a set amount each month for a set time. A borrower can obtain auto loans for a personal loan to purchase a new vehicle if planning to buy one.

Credit cards are important for all purchases, such as groceries, gas, utilities, etc. Using debit cards is the best alternative if a person needs a credit card. Debit cards allow borrowers to spend money from checking accounts, which means the borrower cannot overdraw the account. However, using a credit card lets the borrower borrow against future earnings. On the other hand, if a borrower plans to take out a home equity line of credit, they will only be able to borrow up to 50% of the value of the current residence.

The eight types of credit are revolving credit, trade credit, consumer credit, installment loans, service credit, bank credit, mutual credit, and available credit. Additionally, various types of credit cards cater to different needs and preferences. Continue reading, and let us learn more about the different types of credit.

One major concern when using credit cards is credit card debt, which occurs when a cardholder owes money to the credit card issuer. If the balance is paid on time, the debt can grow and positively impact one’s credit score.

1. Revolving Credit

Revolving credit is money borrowed from a financial institution for which payment must be made at least monthly. The term “revolving” refers to the borrower’s right to borrow additional amounts up to the total amount outstanding. Revolving credit is known as a “line of credit.” Revolving credit is the best form for two reasons: 1) It has no fixed term and won’t worry about how long it can keep up payments. 2) It doesn’t require collateral, so it will only lose the borrower’s home if it falls behind on payments. Revolving credit has advantages such as no fixed payments, low minimum payment requirements, and lower rates. The disadvantages of revolving credit include higher fees, less flexibility, and higher risk.

The borrower must know these risks to use revolving credit for personal reasons. An example of revolving credit is when someone uses a credit card for purchases and then pays off the balance each month. This means the borrower doesn’t need to worry about how much money is owed since the borrower can always pay back the money borrowed amount. Clients must only borrow what they can afford to pay back the entire amount immediately if they use a credit card to finance a purchase. Consider refinancing debt into a lower-rate loan if the borrower has trouble repaying the full amount. Revolving credit has no fixed term. The length of time depends on the amount borrowed, the interest rate charged, and whether payments are made regularly.

2. Trade Credit

Trade credit is a form of financing used for purchasing goods from suppliers. The supplier gives the buyer a line of credit limit, allowing the buyer to buy items later. Large corporations usually offer trade credit financing to ensure the next payment from the customers is received. Trade credit differs from other forms of credit because it allows businesses to borrow money for inventory purchases, equipment, and supplies. Trade credit form of borrowing is often used when a company needs immediate funds to purchase goods and cannot wait until it receives the credit limit of the next customer payment.

The advantage of trade credit is that it allows companies to buy inventory quickly, which helps lenders avoid waiting for customer payment. However, trade credit has disadvantages, such as high-interest rates and late fees. A common example of trade credit is buying a car, which requires financing through a dealership. The dealer offers a lower price than the manufacturer, who collects payment after delivery. Trade credit usually takes about 30 days to pay off. During this time, businesses face the challenge of credit risk associated with non-payment or late payment by customers.

3. Consumer Credit

Consumer credit is money borrowed from a lender for personal use. The borrower agrees to repay the loan plus interest at some future date. A typical example is when someone buys a car using a loan from a dealership. Consumer credit differs from other types of credit because consumers do not need collateral for loans. Lenders only need proof of income and assets, meaning a person can borrow money regardless of how much debt is already owed. Consumer credit has some advantages, such as allowing consumers to purchase items they cannot afford and giving access to loans at lower rates when they have a good credit report. One way to assess borrowers’ creditworthiness is by checking their credit reports.

The disadvantages of consumer credit include high-interest rates and the possibility of losing money due to default. The process of obtaining consumer credit begins when a person applies for a loan from a lender. After receiving approval, the borrower signs a contract agreeing to repay the money borrowed plus any fees associated with the loan. The lender charges a penalty or late payment fee if the borrower fails to repay the loan. The average time consumers pay off consumer debt varies depending on the amount owed.

4. Installment Credit

Installment credit is when a person borrows money for a specific period. The loan is paid back in installments, usually monthly payments. Installment credit financing allows borrowers to spread monthly payments over several months, making budgeting easier, meaning borrowers must repay the entire amount. Installment credit differs from other forms of credit because it requires payments for a fixed period, meaning borrowers must repay the loan at regular intervals, usually monthly.

The advantage of installment credit is that it allows consumers to borrow money quickly, which is useful when a person needs immediate funds. However, the disadvantage is that borrowers cannot use these loans to finance purchases such as cars or furniture since those items typically require longer terms. The process of installment credit is when a person borrows money from a financial institution for a specific period and loan type, including personal loans such as car loans, home mortgages, student loans, etc. Installment credit allows borrowers to repay the loan at a set rate of interest per month.

5. Service Credit

Service credit is a form of financing for small businesses involving a specific loan type. The customer pays a monthly fee to use the business’s equipment, such as computers, printers, copiers, fax machines, etc. The money owed depends on how much the company uses the equipment and its cash flow. The company owes nothing if the company has no debt. The company is charged $10 per month if it owes $100,000; customers purchase new equipment anytime, and the company only needs to pay back what is used. Service Credit offers flexible payment options for customers who need to pay off debts quickly, including installment plans that allow customers to spread out payments over several months instead of one large lump sum. Another benefit of using service credit is that customers do not worry about late fees. The advantage of using service credit is that it doesn’t require paperwork. However, the disadvantage is that the amount spent per transaction can be at most $50, and some stores refuse to accept it. The process of installment credit starts when a borrower applies for a loan from a lender.

After completing the application form, the lender sends a pre-qualification letter stating how much money the lender thinks the borrower can borrow. The borrower signs the contract, agreeing to repay the full amount plus any fees if approved. Once the borrower signs the agreement, the lender sends the first payment, which usually comes from the borrower’s checking account, and continues making payments until the balance has been paid. Service credits usually pay off after 30 days. However, some businesses extend the payment period up to 60 days. It is important to note that the major credit bureaus play a significant role in monitoring and reporting credit activities.

6. Bank Credit

Bank credit is a type of loan or credit facility provided by banks to individuals or businesses. This form of credit is highly regulated and monitored by the major credit bureaus to ensure responsible borrowing and lending behavior.

A bank credit is money lent to someone with no collateral for repayment. The lender takes possession of the borrower’s property as security for the mortgage loan. The lender repossesses the property and sells it at auction to recover the loss if the borrower fails to repay the debt. Bank credit differs from other forms of credit because banks lend money based on collateral, meaning lenders do not need to know anything about the borrower, such as income or assets.

The main advantage of using bank credit is that it does not require collateral. Lenders only require proof of ownership of something valuable, like a home or car. However, the disadvantage is that banks charge high-interest rates. Another problem is that some banks only give a loan if the borrower can pass the credit check and prove they can repay it. The average time to pay off bank credit is about two years. Avoid using credit cards for purchases since credit carries high fees and interest rates. Instead, use debit card transactions when shopping.

7. Mutual Credit

Mutual credit is when two parties agree to trade something for each other, such as money, goods, or anything else. The concept of mutual credit was first introduced by Adam Smith, who wrote “The Wealth of Nations.” Adam Smith described how barter systems exchanged goods and services between individuals.

Mutual credit differs from other forms of credit, like business credit cards, because it allows members to borrow money against future earnings, which means that when a person borrows money from a lender, the lender doesn’t know how much a borrower earns in the future. This makes it important for individuals to seek financial advice to stay informed about these lending options.

However, lenders do know how much the borrower made in the past. With mutual credit, both parties agree to share information about income and expenses. The lender then uses the data to determine whether the borrower can repay the loan. The lender will only lend more money if the borrower can repay the loan. Mutual credit takes about two weeks to pay off. The payment amount depends on the loan balance and the length of the term.

8. Open Credit

A borrower must first determine whether to qualify for one if wanted to apply for a loan. Open credit means the borrower does not need to be approved for a loan, including loans from banks, credit unions, and other financial institutions. Open credit allows borrowers to borrow money for any purpose, such as buying a car, a home improvement project, or college tuition. One option to consider is secured credit cards which can help establish good financial habits and credit scores.

Open credit is when a borrower doesn’t need to ask for permission from anyone to borrow money. The main advantage of having access to credit is that the borrower can access funds immediately without waiting for approval. However, available credit has risks, such as higher interest rates and fees. Therefore, it’s important to be mindful of your credit utilization ratio to maintain a healthy credit score while taking advantage of open credit options.

The disadvantages of open credit are higher rates and fees. The time it takes to pay off open credit depends on several factors, such as the total amount owed, the number of missed payments, and the length of time between each charge. The borrower must be able to pay off the debt in about three months if able to keep up with all expenses. It takes longer if the borrower fails to make one or two time payments.

What is credit?

A credit card issued by a financial institution allows customers to spend money at any store that accepts MasterCard or Visa. The customer pays for items upfront using the customer’s credit card and then receives a receipt from the merchant detailing how much was paid for each item. The information is kept on file until the bill is paid off. The customer is notified via phone, text, or email if the balance exceeds the charge. Paying your bills on time is essential to avoid penalties and maintain a good credit score.

Credit cards work like cash or checks for everyday purchases. The merchant pays for the goods or service using a “credit card number,” which includes information such as the name of the company issuing it, the amount, and the date it expires. The data is stored in the bank’s database that issued the card and is used to verify who owns the account. The merchant transfers money from the borrower’s checking account to the one owned by the credit card company. The merchant sends a confirmation email to both parties when the transaction is complete. The customer gets charged at the end of each month and either repay the entire balance or pays off only what he owes.

With credit card limits playing a vital role, knowing how much credit one can use before reaching the limit is essential.

What is the most common type of credit?

The most common type of credit is revolving credit, which includes lines of credit such as credit cards, car loans, personal loans, mortgages, etc. Revolving credit is typically used for short-term purchases of big-ticket items like cars, houses, boats, etc. It’s important to understand how these types of loans work before applying. Revolving credit works well when a person needs money immediately and plans to repay the loan quickly. However, revolving credit has high-interest rates and high minimum payments.

Here are some statistics about different types of credit:

| Type of Credit | Interest Rate Range |

|---|---|

| Credit cards | 15% – 25% |

| Personal loans | 6% – 36% |

| Mortgages | 3% – 5% |

| Student loans | 5% – 7% |

What are the benefits of having various credit types?

Listed below are the benefits of having various credit types.

- Rewards Programs and Rewards Credit Card. One of the biggest reasons people use credit cards is to earn rewards points. These points can be redeemed for cash back, travel credits, gift cards, merchandise discounts, and even free flights! Many credit cards have various reward programs that give borrowers extra incentives to purchase with a card. Rewards credit card options are popular for providing exceptional benefits.

- No Annual Fee. Many credit cards don’t charge annual fees, meaning they will only automatically renew if a borrower pays it. Consider signing up for a no-fee credit card to save money without paying additional charges.

- Cash Back and Cash Back Credit Cards. Cashback is a benefit of many credit cards, including cashback credit cards. When a borrower purchases using a card, the borrower receives a percentage of those purchases back in cash. Most cards offer 1% – 5% cashback depending on the investment.

- Low-Interest Rates. Consider taking advantage of low introductory APR offers if a borrower wants to avoid high-interest rates. Many credit cards offer 0% APR for a certain amount of time after opening an account.

- Travel Benefits. Some credit cards allow borrowers to redeem points for airline miles or hotel stays. Others let borrowers book travel directly through the website. Still, others provide special deals for airfare or hotels.

- Free Checks. Credit cards often come with a complimentary checking account. These accounts usually carry lower monthly fees than traditional bank accounts and offer direct deposit options and online bill payment services.

How to Determine the Different Types of Credit

First, consider how much money is needed to determine the different types of credit. The borrower must know how much money to borrow from banks or other financial institutions. Second, what loan term is preferred, either a fixed or variable rate? Understanding the loan terms helps lenders determine whether to offer a better deal. Lenders usually give borrowers longer loan terms when confident about repayment. Credit mix also plays a crucial role when determining credit types. Ask the credit lender which loan term lender like to provide if wanting to apply for a credit loan. The information helps borrowers decide whether to accept the offer.

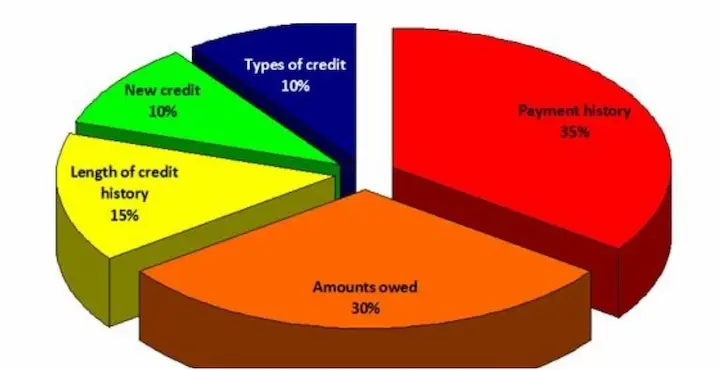

How Different Credit Types Impact Credit Scores?

Different types of credit can impact credit scores in various ways, depending on the credit scoring model used. Each credit scoring model may weigh credit factors differently, such as payment history, credit utilization, loan types, and the overall credit mix. By having a diverse credit mix, borrowers can increase their credit scores, making them more attractive to potential lenders.

Credit types impact credit scores; the credit bureaus report the payment history if the borrower uses any revolving debt, such as balance transfer credit cards. Lenders look at the borrower’s credit history, including any credit inquiries, to determine how likely the borrower is to repay the borrowed money when applying for a loan. Credit score affects whether a person qualifies for certain insurance policies.

Frequently Asked Questions

How does a revolving credit line differ from an installment loan, and what are the advantages and disadvantages of each?

Revolving credit allows flexible borrowing up to a limit and minimum monthly payments like credit cards. Installment loans provide a lump sum upfront and require fixed monthly payments until fully paid off like mortgages.

What are the key differences between secured and unsecured credit, and when might one be more beneficial than the other?

Secured credit is backed by collateral like property that can be seized if you default. Unsecured has no collateral, higher rates, but easier approval. Secured credit has lower rates but risk of losing assets.

Can you explain the concept of open-end credit versus closed-end credit and provide examples of each?

Open-end credit allows reuse of available funds like credit cards. Closed-end has a one-time fixed amount repayment like auto loans.

What are the main distinctions between personal lines of credit and credit cards, and how do they impact your financial flexibility and credit score?

Personal lines of credit have variable usage and rates and require monthly minimum payments. Credit cards offer fixed rates and grace periods but have late fees and may hurt your score with high utilization.