Payday loans have become a popular financial solution for individuals who need quick cash. Short-term, high-interest payday loan online options help people cover emergency expenses until their next paycheck arrives. Austin Payday Loans in Austin, Texas, have gained popularity due to the city’s growing population and rising cost of living.

Payday loans have significant risks that sometimes lead borrowers into a cycle of debt despite their convenience. The interest rates on online loan options are as high as 400%, making it difficult for borrowers to pay them off in time. The loan process involves a simple loan application, but poor credit history might increase the rates.

Various lenders use aggressive tactics to collect payments from borrowers, further exacerbating their financial situation. PaydayChampion explores the world of payday loans in Austin, Texas, and provides information on navigating such a complex industry while avoiding predatory lending practices.

Understanding Payday Loans And How They Work

Austin Payday Loans are an increasingly popular type of short-term loan that people turn to to cover unexpected expenses. Such loans provide access to quick cash with a fast loan process and minimal requirements compared to traditional bank loans. But the convenience comes at a high price as payday lenders charge exorbitant interest rates, usually exceeding 400 percent annual percentage rate (APR). The average APR of a $300 payday loan online in Texas is 664%, according to MoneyTransfers.com.

| Information | Value |

|---|---|

| Average APR of a $300 payday loan online in Texas | 664% |

| Number of payday loan online lenders in the US (California) | 2,451 |

| Percentage of Americans aged 25-29 who have taken out an Austin Payday Loans | 9% |

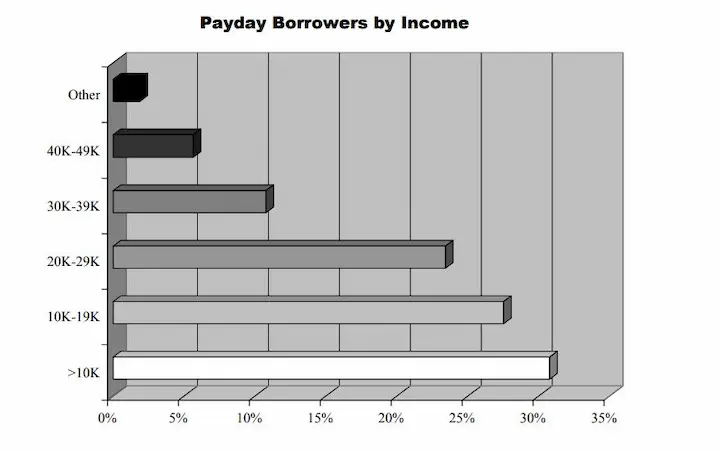

| Percentage of American households with incomes $15,000-$25,000 who are online loan borrowers | 11% |

| Percentage of payday loan borrowers in the US who are White Americans | 55% |

| Average time spent in debt by an American who gets an online loan | 5 months/year |

Austin Payday Loans statistics

Borrowers pay significantly more than they borrowed due to Austin Payday Loan Companies. Repayment terms for such loans are quite strict, with most requiring full payment on the borrower’s next payday and proof of income.

The borrowing limits vary depending on the direct lenders and state regulations but range from $100 to $1,000. A credit score is not usually a factor when obtaining a payday loan, especially with Austin TX lenders. Failing to repay the loan on time negatively impacts one’s credit score.

Payday lenders offer loan rollovers where borrowers extend their repayment period by paying extra fees. But such a practice quickly leads to a cycle of debt and financial ruin if not managed properly.

Pros And Cons Of Online Payday Loans In Austin

Payday loans in Austin Texas offer fast access to funds for people who need them, as the requirements for obtaining a loan are usually low. They have high-interest rates, resulting in a large debt for people who use them. Obtaining payday loans results in a potential debt cycle, where the individual cannot repay the loan and must borrow more to cover them.

Pros: Fast Access To Funds

Quick access to funds is one of Austin’s primary advantages of online payday loans. The online application process for such loans takes only a few minutes, and borrowers receive their funds within a few hours or even minutes after approval. Such a quick turnaround time makes payday loans an attractive option for individuals who need cash urgently.

Repayment terms for payday loans are flexible, with lenders offering various options based on the borrower’s circumstances. Interest rates for such loans tend to be high due to the increased risk involved. Loan limits vary depending on income level and credit check results.

Low Requirements

Another advantage of payday loans in Austin is the low requirements for approval. Unlike traditional loans that require extensive credit checks and documentation, payday lenders offer easy applications with minimal paperwork and no credit check, making them accessible options for those seeking funds from direct lenders in Austin TX.

It makes the loans accessible to individuals with poor credit or limited financial history, even for those with a bad credit score. Borrowers apply for small amounts, which allows them to avoid taking on large debts they cannot afford to repay, especially when dealing with unexpected bills or medical bills.

Repayment terms are flexible, allowing borrowers to repay their loans longer if they face financial hardship. Loan payments can be adjusted to accommodate the borrowers’ needs. Potential borrowers must carefully review all factors before obtaining a payday loan, as interest rates tend to be high.

Eligibility Requirements For Payday Loans

You must meet certain income requirements to be eligible for a payday loan. It involves a steady income stream from employment or other sources, such as government benefits. The lender reviews the borrower’s credit score requirements when assessing eligibility. But unlike traditional lenders, payday lenders are willing to lend instant money to people with poor credit scores.

- Employment status verification is another key factor in determining eligibility for a payday loan. Borrowers need proof of their current job and length of employment at that company.

- There are age restrictions on who applies for such loans. Most borrowers must be 18 years or older to qualify.

- Lastly, payday lenders limit the amount borrowed based on the borrower’s income level and ability to repay the loan within a set timeframe, considering any financial hardship they may face.

Overall, meeting the eligibility requirements for a payday loan requires carefully reviewing one’s financial situation and willingness to meet certain criteria established by the lender. Such loans offer quick access to cash in times of need. Still, borrowers must fully understand the terms and conditions before agreeing to any loan agreement.

Finding The Best Payday Loan Lenders In Austin

A few argue that there are better options than payday loans for financial assistance due to their high-interest rates and short repayment terms. However, a payday loan can be a lifesaver in emergencies where one needs instant money.

Choosing the right lender from whom to borrow is necessary if you find yourself in such a situation in Austin. When searching for the best payday loan lenders in Austin, several factors are worth evaluating, especially if you need quick money or have a bad credit history.

- First, pay attention to the maximum loan amount each lender offers, as it determines if they meet your borrowing needs, and consider lenders that offer payday advances.

- Secondly, compare interest rates across different lenders to get favorable rates that won’t leave you struggling with debt later. Also, assess the chances for approval and the benefits of payday loans each lender provides.

- Evaluate the convenient application form and each lender’s process when applying for an urgent loan online. Assess the repayment terms each lender offers and if they align with your ability to repay comfortably.

- Review customer reviews of each lender before settling on one. Positive reviews indicate quality service, while negative ones signal red flags about a particular lender’s operations.

Finding trustworthy payday loan lenders in Austin requires carefully reviewing various factors such as loan amounts, interest rates, repayment terms, application processes, and customer reviews. Taking time to research such aspects when looking for financial help during emergencies enables borrowers to avoid falling into debt traps created by unscrupulous lenders who seek to exploit vulnerable individuals seeking credit facilities.

Alternatives To Payday Loans For Financial Assistance

- Financial advisors guide and advise individuals when researching alternative options to payday loans.

- Credit unions are an attractive option to individuals needing short-term financial assistance due to their ability to offer lower rates and fewer fees.

- Budgeting tools are available to assist individuals in evaluating their financial situation and developing a plan to pay off any debt incurred from payday loans.

- Online and community-based resources provide extra assistance in understanding the various options for payday loans.

Financial Advisors

Seeking advice from a financial advisor is an effective alternative to avoid the high-interest rates and fees associated with payday loans, particularly if you have concerns about your bad credit history or need guidance on the most suitable urgent loan online options.

Financial advisors specialize in helping individuals manage their finances through budget planning, debt management, investment strategies, retirement planning, and tax preparation. They provide expert guidance to help people develop long-term financial goals and create personalized plans that enable them to achieve them, even on a tight business day schedule.

The primary benefit of consulting with a financial advisor is accessing their expertise on managing money effectively. For example, they help you establish realistic budgets based on your income and expenses while providing tips for cutting unnecessary costs, all within the constraints of a regular business day.

They assist you in developing a comprehensive debt management plan that prioritizes paying off high-interest debts before tackling other lower-interest debts. Overall, working with a financial advisor helps you make informed decisions about your finances while achieving greater financial stability in the long run without payday loans or other short-term borrowings, ensuring that every business day counts toward your financial success.

Credit Unions

Another alternative to payday loans is credit unions. Credit unions are not-for-profit financial institutions that offer various services, including savings accounts, checking accounts, and loans at lower interest rates than traditional banks, making them an attractive choice for managing your money during a normal business day.

Several credit unions in Austin are available for residents, with varying membership requirements. The benefits of joining a credit union in Austin include lower fees and interest rates on loans than traditional banks, ensuring that each business day spent managing your money leads to greater financial stability.

The drawbacks include limited access to ATMs or physical branches, depending on the credit union. Most credit unions have strict membership requirements, such as being affiliated with certain organizations or living in specific areas, which might impact your daily business day convenience.

Joining a credit union provides advantages over traditional banks by offering personalized customer service and community-focused banking options without high-interest payday loans, making them more reliable for handling your finances on any business day.

Staying Safe And Avoiding Scams With Payday Loans

Warning signs abound when it comes to payday loans. Borrowers must watch out for red flags that indicate a lender is not legitimate or that the loan terms are unfavorable.

These warning signs include lenders who do not require credit checks, have unclear repayment options, ask for upfront fees or pressure borrowers to obtain more money than they need.

Researching lenders is essential to avoid scams and stay safe while applying for a payday loan. It means looking up reviews online, checking with the Better Business Bureau, and verifying that the lender is licensed in your state. One way to improve your chances of approval is to submit an accurate application form through a secure online form.

Understanding loan terms and repayment options before signing agreements helps prevent unexpected fees or penalties. Borrowers should also seek lenders that offer quick approvals and an instant lending decision to save a considerable period of time. Identifying legitimate lenders and being proactive about research and due diligence enables borrowers to navigate the world of payday loans with greater confidence and security.

Conclusion

Payday loans seem like a quick fix for people in financial need, but you must understand their potential risks and drawbacks. They provide immediate relief, but high-interest rates and fees quickly accumulate, leading borrowers into a cycle of debt. You must carefully review your options before seeking out a payday loan. You must research reputable lenders in Austin and confirm that you meet all eligibility requirements if you decide to pursue such an avenue for financial assistance. Be sure to look for lenders offering an instant decision option, which can improve your overall experience with payday loans.

Frequently Asked Questions

How can I apply for payday loans in Austin online with instant funding?

To apply for payday loans in Austin with instant funding, search for online direct lenders. Complete their online application providing personal information, employment details, and bank account access. If approved, funds can be deposited same-day.

What are the eligibility requirements for getting an online payday loan in Austin?

Typical eligibility includes being a Texas resident, over 18 with a valid ID, employed or receiving fixed income, a checking account in your name, and providing personal contact information. Lenders may also verify income before approving an Austin payday loan online.

What are the pros and cons of using online payday loan services in Austin for instant funding?

Pros are quick access to cash and convenient online applications. Cons are very high fees and interest rates over 100% APR, short repayment terms increasing financial strain, and potential debt cycles. Borrowers should have a repayment plan and explore alternatives before taking an online payday loan.

What is the typical interest rate and repayment terms for online payday loans in Austin?

Online payday loans in Austin carry interest rates ranging from 200% – 700% APR typically. Repayment terms are usually 5-30 days or the borrower’s next pay date. Loans under $500 must be payable in four installments under Texas law.