We’ve all been in a situation when we needed money right away. Even those with steady jobs can find themselves in need of quick cash. With PaydayChampion’s fast approval and straightforward personal loan request application, getting an online payday cash advance in Colorado has never been easier. We’re here to help Colorado residents get the cash they need when they need it most.

Online Payday Loans Are Legal in Colorado (CO)

Colorado payday loans for bad credit and with no hard credit checks have become popular recently and are legal for anyone who meets the eligibility requirements. Despite the varied opinions, installment loans may still be an excellent way to manage your finances. Sticking to your budget is a challenge if you’re short on cash. State laws govern short-term alternative loans in Colorado. You can find the rules in Colorado Payday Loan Regulations, which relate to payday loans.

How Do Payday Advance Loans Near Me With Same Day Deposit Work?

Online payday advance loans near me with same-day deposits are a quick and easy solution to get the money you need when you need it most. The borrower applies for a loan term, and if accepted, the direct lenders earn from the borrower’s monthly payments. There are finance charges if the borrower exceeds the amount on their pay stub. The yearly percentage rate varies from lender to loan, but it is 400% on average.

Coloradans looking for additional options beyond payday loans may want to consider installment loans. Installment loans allow you to borrow a larger amount and repay it over several scheduled payments. To learn more about the benefits of installment loans and how they work, check out our guide on Installment Loans Colorado.

5 Reasons To Get A $100 Payday Loan With No Denial In Colorado

There are a variety of reasons why you need to get a $100 payday loan with no denial in Colorado. PaydayChampion may assist you in these situations.

- Your bank turned you down for a loan. It is difficult to safeguard oneself from financial ruin. Obtaining a bank loan or topping up your home loan can be complicated. It may take up to a year to persuade a lender. Getting a short-term loan to pay rent or a mortgage is considerably more convenient. Unsecured loans often have instant approvals.

- Rent, electricity bills, and other expenses are difficult to pay. 70% of Americans use small financial advances for daily expenditures and different needs. Rent, food, and electricity bills are among these costs. These borrowers are always short on cash and need to borrow money to cover their expenses.

- You need to pay off your credit card debt. Credit card firms use various techniques to collect debts and make payments. They contact debtors several times a day. Sometimes, they harass them and threaten to take legal action for missed payments. Late and overdue monthly payments can lead to legal action and garnishment. It affects your credit score too. A low credit score can affect your ability to get a loan, rent an apartment, or buy a car.

Benefits of PaydayChampion’s Small Personal Loans With Instant Approval

Using PaydayChampion’s small personal loans with instant approval is a great way to get extra cash in your pocket. It’s one of the best options if you don’t have any other options. Payday loans are quick, easy, and convenient for people who need money fast.

To give you an idea, here are the benefits of convenient payday loan options by PaydayChampion:

Best Application Forms That Are Easy to Fill Out & Help With Guaranteed Approval

Large lenders need help getting loans approved. Spending too much time filling out complex loan applications is not a good idea. It takes 2 minutes to complete our best loan application forms that are easy to fill out and help you increase your chances of guaranteed approval.

Online Applications For Low Credit Emergency Loans

You don’t need to look for the “best lender near me” to get extra funds. You can apply for Colorado payday loans online from anywhere in the USA. You only need a smartphone or computer connected to the internet to send an application. It involves simple online applications when you need emergency loans for low credit. Lenders often send the money to your account after approving your loan application. There’s no need to check bank account details or statements for a minimum loan term.

Direct Lenders Only Provide Clear Agreements On Payday Installment Loans

Our direct lenders offer clear agreements on your payday installment loans. We are transparent about our fees. You will know what you are paying for or being charged with. Our direct lender loan agreements include all important information, such as the interest rates, repayment period, and penalties in case of late payments.

You can be assured that your interest rates will be fair and affordable. We do not charge prepayment penalties or any other hidden fees.

Colorado Payday Loans For $200 With No Money Down: What Are The Benefits?

Borrowers can access cash for $200 with no money down. But aside from that, here are other benefits of $200 payday loans:

- Cash will be readily accessible – Traditional loans take days before the lender approves and give you money. Colorado online payday loan and cash advance loans are faster than conventional lenders. The loan transaction takes less than 24 hours. After the direct lender loan approval, you can expect the borrowed money to appear in your active checking account.

- You may spend money on anything – You are free to spend the money you get on whatever you choose. Moreover, you can apply for another longer-term payday loan even if you still need to pay off your first one. But it’s not advisable to take out several online loans at once. Doing this makes the initial loan payment procedure more difficult.

- Credit ratings are unnecessary – You’re still eligible for a Colorado payday loan even if you have a bad credit score. Direct loan lenders only check your credit record or history to see your ability to repay the quick cash loan. They check your proof of income to ensure you can afford instant payday loans’ monthly or automatic payments.

Colorado Payday Loan Laws And Costs For $300 & $500 Payday Loans

You may expect these payday loan regulations and costs if you apply for a Colorado online loan for $300 & $500.

- Finance costs: Payday lenders can’t charge you more than $1 for every $5 borrowed if your loan amount is less than $30.

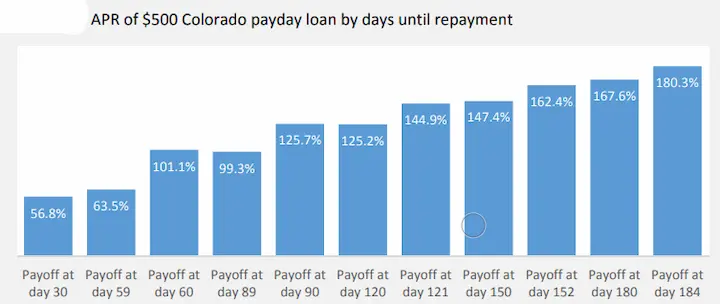

- The highest possible APR: The maximum annual percentage rate is 309% for 14-day 0 loans.

- Purchase costs: A legitimate acquisition charge is a tenth of the total loan amount if the cash advance exceeds $100. The acquisition fee can be at most $10 If your loan is for more than $100.

- Maximum time limit. Payday loans in Colorado (CO) may last from one to 31 calendar days.

How Do I Apply For A Colorado Payday Loan Immediately?

The process of getting a payday loan in Colorado immediately depends on the lender. Each payday lender has their application process. Some require you to visit their store to complete the application in person; others allow you to apply online.

Regardless of the loan application method, the lender processes every document quickly. They will contact you shortly after they have approved your application.

A cash advance from online personal and title loans may also be helpful and handy in an emergency. These types of loans are sometimes the only solution to your financial difficulties. However, applying for several loans without an outstanding loan is not a good idea. Doing this may put your finances in jeopardy. It’s best to consider applying for another loan from a credit union.

Bad credit loans are also available from some lenders. They are the ideal solutions for emergency cash situations.

What Are The Requirements For Payday Loans From PaydayChampion Loan Company?

Payday or personal loans from PaydaChampion loan company are a quick and easy way to access funds for a financial emergency. However, before applying for a payday loan, it is important to understand the requirements set by payday loan providers and financial institutions.

The basic requirements for a payday loan include having an active bank account, a steady income, and a good borrowing history. Additionally, you must provide proof of time payments, such as bills or rent, and be prepared to have the loan funds deposited into your account the day after approval.

It’s crucial to remember that these specifications may change based on the individual financial institution or payday loan provider.

How To Get Your Payday Loan Online With Poor Credit Score?

Payday loans online aren’t like credit check loans. Lenders aren’t too concerned with your credit history. They look at your capacity to repay the debt.

But be sure to contact the right lender to guarantee your chances of getting a payday loan with a poor credit score.

Welcome to our comprehensive guide on “Payday Loans Colorado”! As a leading provider of financial services, our company is actively serving numerous cities across the beautiful state of Colorado. To help you navigate our extensive coverage, we have compiled a table featuring the most important cities where our services are available. Whether you need short-term financial assistance or looking for reliable options for payday loans, this table will provide you with a quick overview of the cities where our company operates. Take a closer look at the table below to discover the cities where our dedicated team is ready to assist you in meeting your financial needs.

| Denver | Colorado Springs | Aurora |

| Fort Collins | Lakewood | Thornton |

| Arvada | Pueblo | Westminster |

| Greeley | Centennial | Boulder |

| Longmont | Castle Rock | Loveland |

Get your payday loan here at PaydayChampion. We always do our best to help you get the payday loan you need. We’ve vetted our lenders and only recommend those that offer fair rates and reasonable fees.

You can trust us if you need a payday loan with bad credit.

Conclusion

In Colorado, there’s an open door for payday lending, but with the safeguard of a 200% APR cap, courtesy of its forward-thinking reform laws. This stands in contrast to the laissez-faire stances of states such as Wyoming, Kansas, and Utah. Even so, there’s a lingering challenge with some online lenders bypassing these regulations, charging inflated rates. Advocacy groups are rallying for stricter measures and a reduction in rate thresholds. Yet, many in the industry see the existing regulations as harmonizing the needs of borrowers and the lending sector.

Payday loans in Colorado (CO) are ideal for people who need quick access to cash. To get a payday loan, you must meet the basic requirements of lenders and financial institutions. Additionally, if you have bad credit, you can still qualify for a payday loan with the right lender. PaydayChampion makes finding the best lenders with reasonable rates and fees easy.

If you have more questions, don’t hesitate to contact us. We are always here to help you.

Frequently Asked Questions

How can I apply for payday loans online in Colorado, and what is the typical process for obtaining these loans?

The online payday loan application process in Colorado involves submitting personal information, employment details, and bank account info to licensed lenders. Approval decisions are based on income verification and the ability to repay. Funds may be deposited within one business day.

What are the regulations and laws specific to payday loans in Colorado, including maximum loan amounts and interest rates?

Colorado laws cap payday loan amounts at $500 with a minimum 6-month term and a maximum 45% annual interest rate. Additional fees are restricted to 20% of the first $300 loaned plus 7.5% of any amounts above $300.

What are some alternatives to payday loans for Colorado residents who may be facing financial emergencies?

Alternatives to payday loans in Colorado include pawn loans, installment loans, credit union personal loans, debt management plans, emergency assistance programs, credit counseling services, 401k loans, and borrowing from friends/family when facing financial hardship.

How can borrowers in Colorado ensure they are making informed financial decisions when considering payday loans to meet short-term financial needs?

Colorado borrowers should compare options, understand state lending laws, read terms closely, borrow only essential amounts conservatively, have a realistic repayment plan, and use payday loans as a last resort for unavoidable short-term needs.